Capital Gains Tax and Income Tax are both methods by which governments generate revenue, but they target different types of income. Income tax is levied on the regular income of an individual or entity, which includes wages, salaries, and interest income. The rate often depends on the amount of income earned, with higher income brackets typically taxed at higher rates in progressive tax systems. This tax ensures that those who earn more pay a fair share towards public expenditure. On the other hand, capital gains tax is charged on the profit realized from the sale of an asset which has appreciated in value over time. Notably, it's not the entire sale amount but only the gain or profit that's taxed. While income tax is a recurrent annual expense for most working individuals, capital gains tax is event-driven, arising only when an asset is sold at a profit.

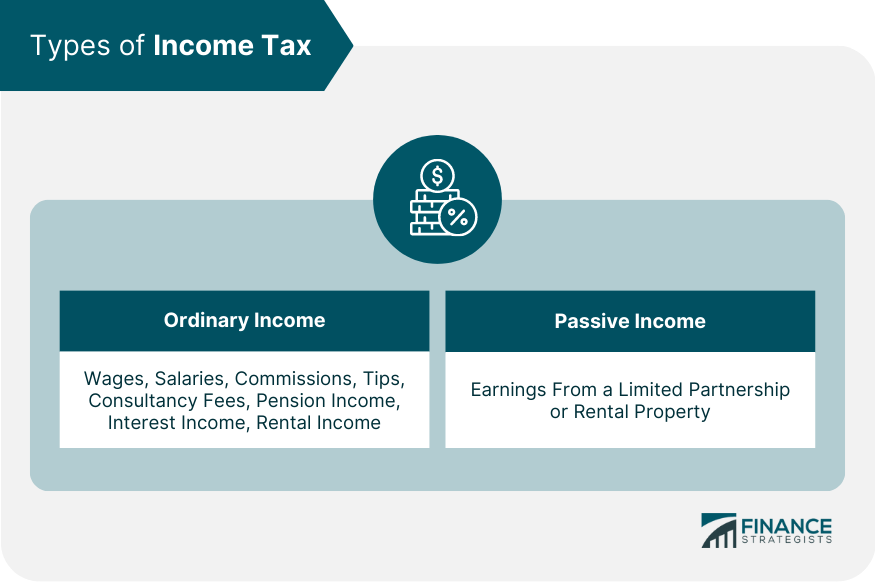

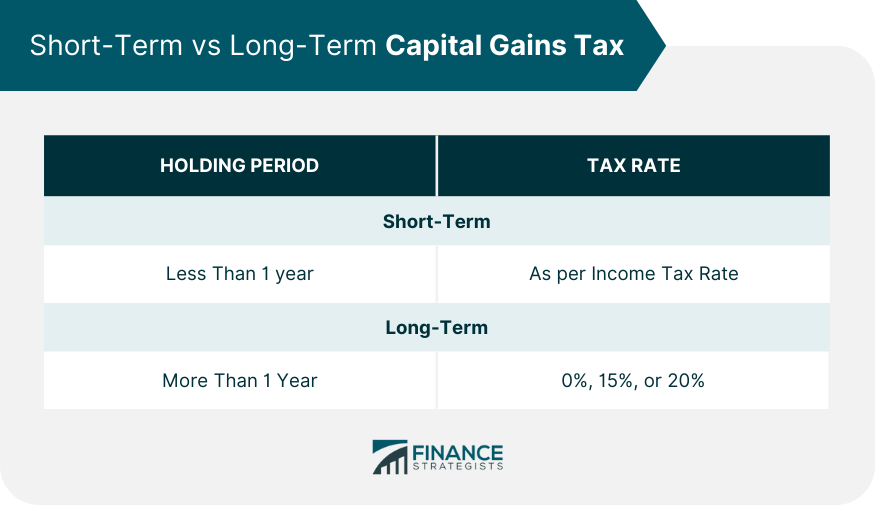

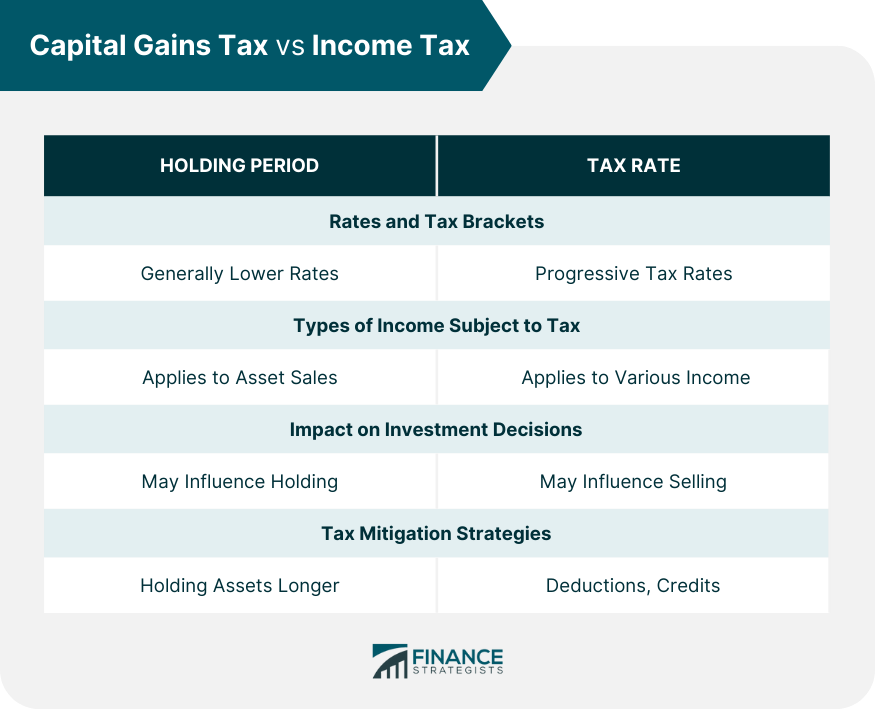

Income tax is a financial charge that governments impose on individuals or entities based on their respective income or profits. Generally, it's the revenue authorities of each country that administer these taxes. Tax revenue serves to fund public services, infrastructure, and government operations. For instance, the tax you pay could help build roads, schools, and other public facilities, contributing to overall societal development. There are different types of income that can be subject to tax, such as: This encompasses wages, salaries, commissions, tips, consultancy fees, pension income, interest income, and rental income, among other things. Ordinary income is the most common type of income and forms the basis for most people's livelihood. Passive income is money earned from ventures in which the person isn't actively involved. Examples include earnings from a limited partnership or rental property. Passive income, though requiring little active involvement, is an essential aspect of wealth building and financial security. Income tax calculation depends on an individual's income bracket, which determines the tax rate applied. The more you earn, the higher your tax bracket. For example, in the United States, tax brackets ranged from 12% to 37%. Different countries have different tax brackets, and some even use a flat tax system where the same percentage applies to everyone, regardless of income. Understanding income tax is vital to your financial planning, as it can impact your net income, savings, and lifestyle. It's a crucial factor to consider when planning for retirement, investments, and estate distribution. A good grasp of income tax can help one optimize savings and plan future expenditure more wisely. Capital gains tax is levied on the profit realized from the sale of a non-inventory asset, such as stocks, bonds, precious metals, real estate, and properties. This tax is only triggered when the asset is sold, not while it's held. Understanding this concept can influence one's decision on when or if to sell an asset. Capital gains tax can be classified as either short-term or long-term. In the U.S., for example, if you hold an asset for one year or less before selling it, it's considered a short-term capital gain. The profit from such a sale is typically taxed as ordinary income. This rule underscores the benefits of patience in investing. On the other hand, long-term capital gains come from selling assets held for more than a year. These gains are generally taxed at a lower rate to encourage long-term investments, aiding economic growth. Investors are hence incentivized to hold onto their assets for longer periods. The calculation of capital gains tax starts with determining your "basis" in an asset—usually the amount you paid for it. The tax is then levied on the difference between your selling price and the basis. Certain improvements and investments can adjust the basis and potentially lower the tax liability, adding a layer of complexity to the calculation. Just as income tax plays a role in personal finance, capital gains tax significantly impacts investment strategies. A firm understanding of these taxes can help investors make wise decisions about when and how to buy or sell assets, aiding in the optimization of post-tax returns. In the long run, these strategies can make a significant difference to one's investment portfolio. While both taxes depend on the taxpayer's income, the rates and brackets differ. As previously mentioned, income tax rates range significantly. Conversely, long-term capital gains tax rates are often substantially lower. As of 2024, these rates were 0%, 15%, or 20% in the U.S., depending on the individual's income. Being aware of these rates can help individuals make informed decisions about their assets. Income tax applies to wages, salaries, and other forms of income, whereas capital gains tax only applies when you sell an asset for profit. The form of tax can significantly influence financial decisions, particularly when it comes to investments. With careful planning, it's possible to balance different income streams for a more favorable tax outcome. The type of tax can impact the decision to hold or sell an asset. If a high income tax rate applies, an investor might prefer to hold onto assets to benefit from the lower capital gains tax rate. Understanding these taxes is crucial for strategic investment planning. Every investor, big or small, can benefit from this knowledge to maximize their returns. Several strategies can reduce the amount of tax paid. For income tax, deductions and credits can lower tax obligations. For capital gains tax, strategies can include holding onto assets longer to qualify for long-term rates or offsetting gains with investment losses, known as tax-loss harvesting. Utilizing these strategies can lead to significant savings, making a substantial difference in your overall financial health. Understanding your tax bracket can help plan income and investments more effectively. For example, if you're near the top of your tax bracket, it might be beneficial to defer additional income to the next year to avoid pushing into a higher bracket. Doing so could result in considerable tax savings and help achieve your financial goals more quickly. Proper asset allocation isn't just about risk and return; it's also about tax efficiency. For instance, tax-efficient investments like index funds or ETFs can be held in taxable accounts, while investments that generate higher taxes could be held in tax-advantaged accounts. By considering the tax implications of each asset class, one can better manage their investment portfolio for maximum returns and minimal tax liabilities. Certain retirement accounts, like a 401(k) or an IRA, offer tax advantages. Contributions may be tax-deductible, and investments grow tax-free until withdrawal. Understanding how these accounts work can greatly enhance your tax planning. The earlier you start investing in these accounts, the more you can take advantage of compounding interest and potential tax deductions. Tax-loss harvesting involves selling securities at a loss to offset a capital gains tax liability. This strategy can be a valuable tool for reducing your current tax bill, but it's essential to be aware of rules like the IRS's "wash-sale" rule, which disallows a deduction if the same or substantially identical security is purchased within 30 days before or after the sale. However, when done correctly, tax-loss harvesting can turn investment losses into opportunities. Understanding the intricacies between Capital Gains Tax and Income Tax is crucial for individuals and entities alike. While both serve as revenue-generating mechanisms for governments, they target varied income types and can influence financial and investment strategies differently. Income tax, levied on regular earnings such as wages and interest income, impacts one's annual financial planning. In contrast, capital gains tax is event-specific, and applied only to the profits realized from asset sales. The differentiation in tax rates and brackets for each can significantly influence investment decisions. Strategic considerations like tax-loss harvesting or optimizing asset allocation with a tax perspective can lead to more favorable financial outcomes. Ultimately, whether one is an investor or simply planning for retirement, a comprehensive grasp of these tax types is pivotal for financial optimization. For those seeking further clarity or assistance, considering professional tax planning services is a wise step towards achieving financial goals efficiently.Capital Gains Tax vs Income Tax: Overview

Definition and Explanation of Income Tax

What Is Income Tax?

Types of Income Tax

Ordinary Income

Passive Income

How Is Income Tax Calculated?

Implications of Income Tax on Financial Planning

Definition and Explanation of Capital Gains Tax

What Is Capital Gains Tax?

Short-Term vs Long-Term Capital Gains Tax

How Is Capital Gains Tax Calculated?

Implications of Capital Gains Tax on Investment Strategies

Capital Gains Tax vs Income Tax: Key Differences and Similarities

Rates and Tax Brackets

Types of Income Subject to Each Tax

Impact on Investment Decisions

Tax Mitigation Strategies for Each Category

Tax Planning Strategies

Leverage Tax Brackets

Asset Allocation

Use of Retirement Accounts

Tax-Loss Harvesting

Bottom Line

Capital Gains Tax vs Income Tax FAQs

The main difference lies in their applicability. Income tax applies to the earnings from work or passive income, while capital gains tax is charged on profits from the sale of non-inventory assets.

Capital gains tax significantly impacts investment strategies as understanding these taxes can help investors make informed decisions about when and how to buy or sell assets.

Income tax affects financial planning as it impacts net income, savings, and lifestyle. It's an important factor in planning for retirement, investments, and estate distribution.

For income tax, deductions and credits can lower tax obligations. For capital gains tax, strategies can include holding onto assets longer to qualify for long-term rates or offsetting gains with investment losses.

Knowing your tax bracket can help you plan your income and investments more effectively. It can help you decide whether to defer income to the next year to avoid entering a higher bracket.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.