Capital gains and ordinary income represent two distinct types of income subject to different tax treatments. Ordinary income includes wages, salaries, and interest earned on a savings account, typically taxed according to progressive tax rates. On the other hand, capital gains refer to the increase in value of an investment or real estate that is realized when the asset is sold. This gain can be short-term (held for one year or less) or long-term (held for more than one year). The taxation on capital gains is generally lower, especially for long-term gains, encouraging longer-term investments. This differential treatment is based on the belief that lower tax rates on capital gains provide an incentive for individuals and businesses to invest, driving economic growth. Capital gains describes the profit realized from the sale of an investment or property. If you sell an asset for more than you initially paid for it, the financial gain from that transaction is your capital gain. These can result from various investments, including real estate, stocks, and bonds. The reason why capital gains are so important in the realm of tax planning is due to their unique tax treatment. Compared to ordinary income, capital gains are typically taxed at a lower rate, making them a critical area to understand for savvy investors and tax planners alike. This special tax treatment can offer strategic opportunities for reducing your overall tax liability. Diving deeper into the workings of capital gains, we see that there are two main types: short-term and long-term. Short-term capital gains are profits from the sale of an asset that was held for one year or less. The tax rate for these gains is typically the same as for ordinary income, scaling up based on your overall income level. Thus, strategic timing of asset sales can influence the amount of tax you owe. Long-term capital gains come from assets held for more than one year. The tax rates here are generally lower than for ordinary income, often significantly so, depending on the asset and how long it was held. This provides a tax incentive for holding onto investments for longer periods, rewarding patient and forward-thinking investors. Understanding these types of capital gains is crucial because different tax rates apply to each, which can influence your investment strategies. By strategically planning the timing of asset sales, you may be able to influence whether your gains are considered short-term or long-term. The tax rates for capital gains vary based on your income level and how long you've held the asset. Long-term capital gains rates range from 0% to 20%, depending on the taxpayer's income. Short-term capital gains, however, are taxed as ordinary income. It's worth noting that some higher-income taxpayers may also be subject to an additional Net Investment Income Tax. Capital gains can arise from various sources, but the most common are the sale of real estate and the sale of stocks and bonds. Whenever these assets appreciate in value and are sold for a profit, capital gains tax applies. The extent of these taxes can vary based on factors such as the type of asset and the length of time it was held. Ordinary income refers to the income earned from providing services or the sale of goods. It includes wages, salaries, tips, commissions, bonuses, and other types of compensation from employment. It also encompasses interest from savings accounts and bonds, dividends from stocks, and rental income. Like capital gains, ordinary income plays a significant role in tax planning. It constitutes the bulk of income for most people, and understanding how it's taxed is critical for effective tax planning. As your ordinary income forms the basis for your income tax, managing and planning around this can greatly affect your financial landscape. There are many types of ordinary income, each with its own considerations when it comes to taxation. This is the income you earn from your job or career. It includes hourly wages, salaries, tips, and bonuses. This type of income is typically subject to the highest tax rates. Therefore, it's essential to understand the various deductions and credits available to potentially reduce your tax burden. Interest earned from savings accounts, bonds, and other investments, as well as dividends from stocks, are also considered ordinary income. However, qualified dividends may be taxed at the more favorable capital gains tax rate. This nuance in tax treatment adds an extra layer of consideration when planning your investment strategy. Income from renting out property is also counted as ordinary income. However, there are often associated expenses that can be deducted, potentially reducing the overall tax liability. Consequently, effective tax planning for rental income involves a keen understanding of deductible expenses. The tax rates for ordinary income vary depending on your total income and filing status. Federal income tax rates range from 10% to 37%. These progressive tax rates mean that higher levels of income are taxed at higher rates, making income reduction strategies a significant part of tax planning. When dealing with ordinary income, there are various tax deductions and credits available that can reduce your overall tax liability. These range from the standard deduction to itemized deductions for things like mortgage interest and charitable donations, as well as tax credits for education, child care, and more. Understanding these deductions and credits and how to maximize them is key to effective tax planning. The most obvious difference between capital gains and ordinary income lies in how they're taxed. Ordinary income is taxed at your regular income tax rate, while long-term capital gains are usually taxed at a lower rate. This difference can make a substantial impact on your after-tax income, particularly for high-income individuals or those with significant investments. This is why tax-efficient investing, which considers the tax implications of various investment types, can be so beneficial. The difference in tax treatment also has significant implications for your investment strategies. Investments that produce capital gains might be more appealing due to the potentially lower tax rate. However, it's essential to consider other factors like risk level and investment horizon. Balancing the potential tax advantages of capital gains with these other considerations is a critical part of sound investment planning. When planning for retirement, the type of income you anticipate receiving can shape your approach. For example, a retiree living off long-term capital gains may have a lower tax bill compared to someone drawing from a pension or IRA, which is taxed as ordinary income. This highlights the importance of considering tax implications when planning for retirement income sources. Given the lower tax rate on long-term capital gains, it often makes sense to hold onto investments for at least a year before selling. This can be a particularly effective strategy for assets that have appreciated significantly in a short period. Choosing the right accounts for your investments can also make a big difference. Tax-efficient investments might be better placed in taxable accounts, while those generating high levels of ordinary income might be better suited to tax-deferred or tax-free accounts. This strategy, known as asset location, can make a significant difference in your after-tax returns. Another effective tax planning strategy involves using capital losses to offset capital gains. If your capital losses exceed your capital gains, you can use the loss to offset up to $3,000 of other income. In addition, you can carry over unused capital losses to future years. This strategy, known as tax-loss harvesting, can be particularly beneficial during market downturns. Placing investments that generate ordinary income in tax-deferred accounts like IRAs or 401(k)s can help minimize current tax liability. Over time, this strategy can result in significant tax savings. These accounts allow your investments to grow tax-free until you withdraw the funds, typically during retirement when you might be in a lower tax bracket. Maximizing your tax deductions and credits can also help reduce your ordinary income tax liability. This includes making the most of above-the-line deductions like contributions to Health Savings Accounts (HSAs), as well as itemized deductions and tax credits. Another strategy to consider is income splitting. This can involve shifting income from a high-income family member to one in a lower tax bracket, potentially reducing the overall tax liability for the family. Common methods of income splitting include gifts, loans, and the use of family trusts. Understanding the distinctions between capital gains and ordinary income, and their respective tax treatments, is vital for successful financial planning. Both represent significant sources of income but are taxed differently, which can significantly impact your total tax liability. Capital gains, particularly long-term, are typically taxed at a lower rate, incentivizing investment. Ordinary income, on the other hand, includes wages, interest, and rental income, and is subject to progressive tax rates. This differentiation offers strategic opportunities to optimize one's tax planning. Astute planning can help ensure assets are held long enough to qualify for the lower tax rate, use capital losses to offset gains, and make the most of tax-deferred accounts and income-splitting strategies. A deep understanding of these factors, coupled with careful planning, can lead to significant savings and a more secure financial future.Capital Gains vs Ordinary Income: Overview

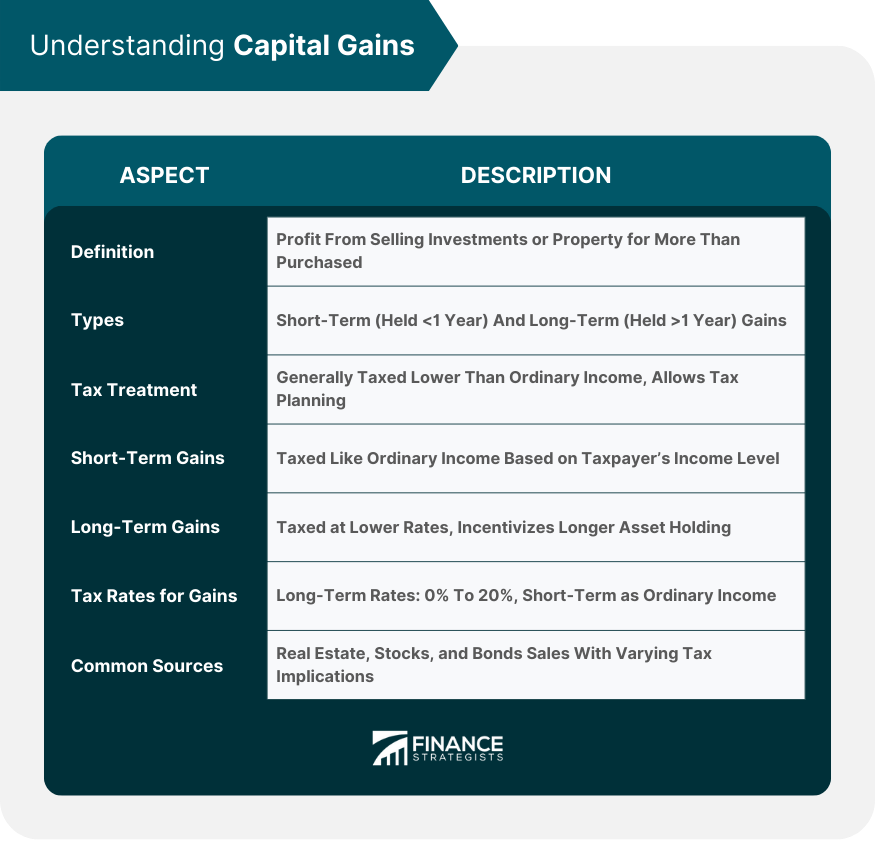

What Are Capital Gains?

How Capital Gains Work

Short-Term Capital Gains

Long-Term Capital Gains

Tax Rates for Capital Gains

Common Sources of Capital Gains

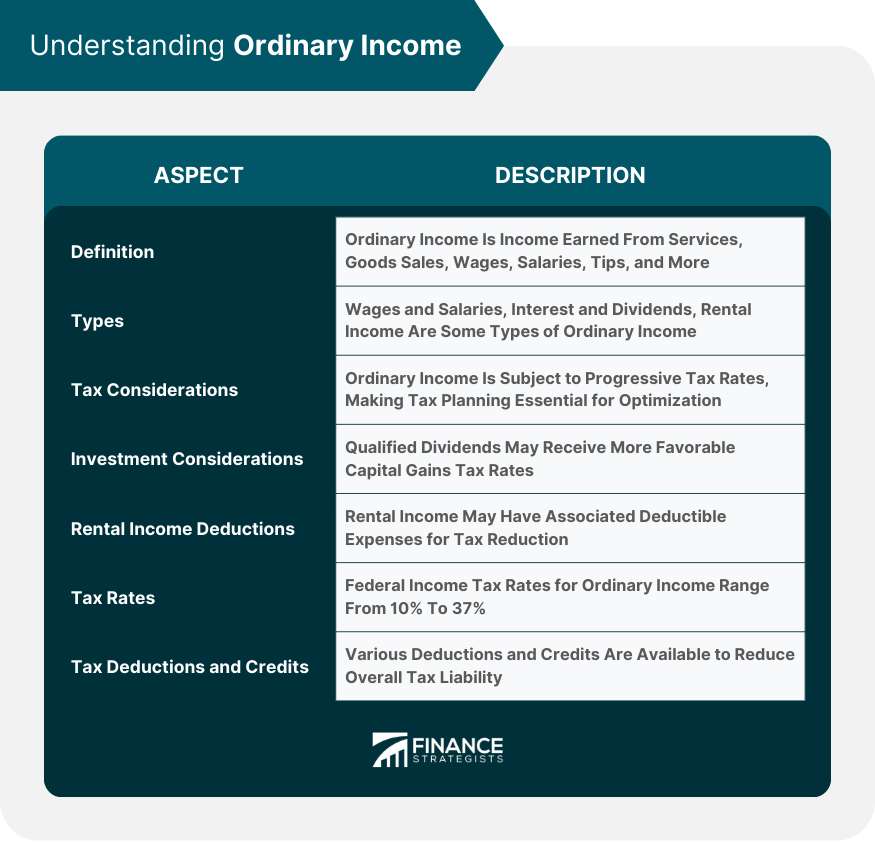

What Is Ordinary Income?

How Ordinary Income Works

Wages and Salaries

Interest and Dividends

Rental Income

Tax Rates for Ordinary Income

Tax Deductions and Credits

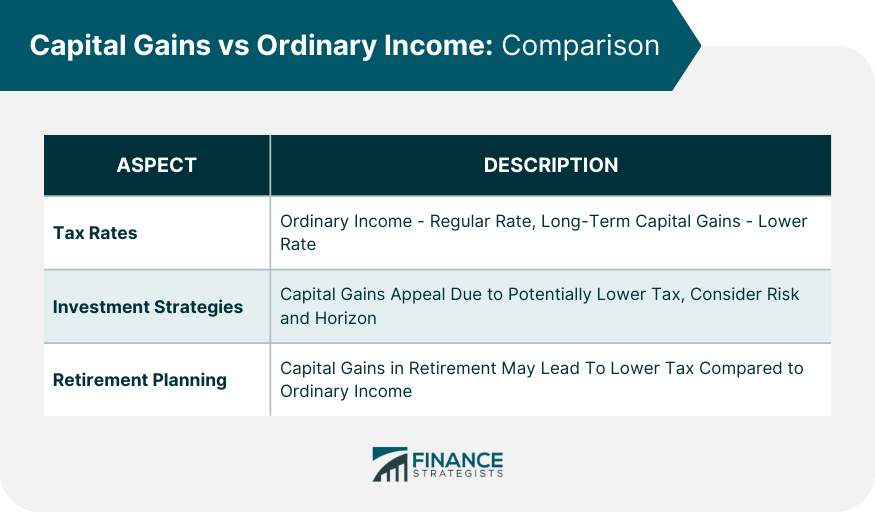

Capital Gains vs Ordinary Income: Comparison

Differences in Tax Rates

Impact on Investment Strategies

Influence on Retirement Planning

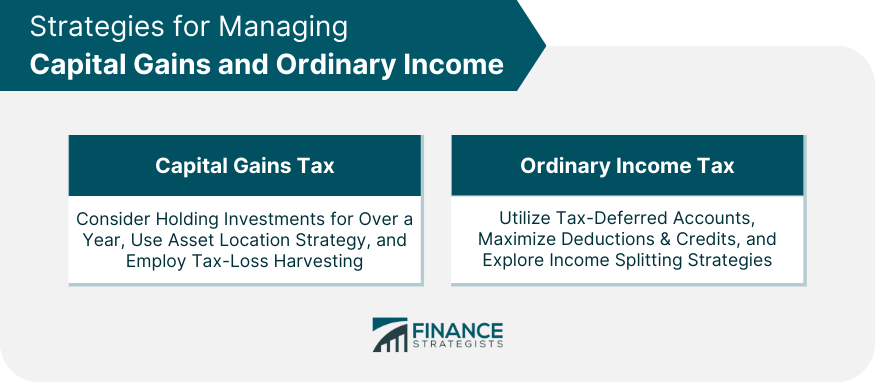

Strategies for Managing Capital Gains and Ordinary Income

Tax Planning Strategies for Capital Gains

Consider Holding Period

Utilize Asset Location Strategy

Use Capital Losses to Offset Capital Gains

Tax Planning Strategies for Ordinary Income

Make Use of Tax-Deferred Accounts

Maximize Deductions and Credits

Implement Income Splitting Strategies

Bottom Line

Capital Gains vs Ordinary Income FAQs

Capital gains refer to profits from the sale of investments or property, while ordinary income includes wages, tips, interest, dividends, and rental income.

Capital gains are usually taxed at lower rates than ordinary income. Long-term capital gains can range from 0% to 20%, while ordinary income rates vary from 10% to 37%.

The main differences lie in their tax treatment and impact on investment strategies. Capital gains are typically taxed at lower rates, affecting investment and retirement planning.

Strategies include holding onto investments for at least a year, using tax-deferred accounts, maximizing tax deductions and credits, and using capital losses to offset gains.

The type of income you anticipate during retirement can shape your planning. Income from long-term capital gains may result in lower taxes compared to ordinary income sources.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.