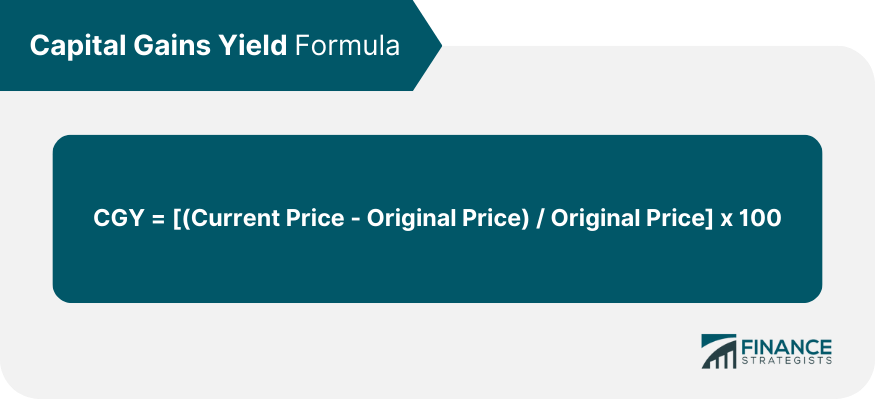

Capital gains yield (CGY) is a measure that financial analysts use to evaluate the performance of an investment based on its appreciation in value. This metric specifically looks at the price increase of a security (like a stock or a bond), but it does not consider dividends or interest earned. The yield is usually expressed as a percentage. The purpose of calculating the capital gains yield is to provide an indicator of the potential return on an investment based purely on its appreciation in price. This is important because it gives investors a way to compare the performance of different investments, and to evaluate whether an investment is likely to meet their return expectations based purely on price appreciation. Calculating Capital Gains Yield (CGY) is a straightforward process that allows investors to measure the percentage increase in the value of an investment based on its price appreciation. This metric provides valuable insights into an investment's performance, particularly in terms of capital growth, without considering any income generated from dividends or interest. To calculate Capital Gains Yield, follow these steps: 1. Identify the Original Price (Purchase Price): Determine the price at which you initially purchased the asset or investment. 2. Find the Current Price (Selling Price): Determine the current market price of the asset. This could be the price at which you plan to sell the investment or its current market value. 3. Calculate the Change in Price: Subtract the original price from the current price. The result represents the total price appreciation or capital gain. 4. Divide by the Original Price: Divide the price appreciation by the original price. 5. Multiply by 100: Multiply the result by 100 to express the capital gains yield as a percentage. The formula for calculating CGY can be represented as: Consider this example: Suppose you purchased a stock for $50, and its current market value is $70. To calculate the CGY: CGY = [(70 - 50) / 50] x 100 CGY = (20 / 50) x 100 CGY = 0.4 x 100 CGY = 40% In this scenario, the Capital Gains Yield would be 40%, indicating that the investment has appreciated by 40% since its purchase. Investors can apply CGY to compare the performance of different investments over specific time frames. It helps them gauge which assets have generated higher or lower returns relative to their original purchase prices. By comparing CGYs, investors can make informed decisions about portfolio composition, decide whether to hold onto profitable investments, sell underperforming ones, or allocate more funds to assets showing strong CGY. Capital gains yield (CGY) is a valuable metric in investment analysis as it enables investors to evaluate and compare the performance of different investments. By calculating CGY for two or more investments over a specific time frame, investors can gauge which assets have generated higher or lower returns relative to their original prices. For instance, if an investor wants to compare the performance of two stocks, they can calculate the CGY for each stock based on the change in their prices over a specific period. A positive CGY indicates a gain in value, while a negative CGY indicates a loss. By comparing the CGYs, investors can make informed decisions about their portfolio composition, deciding whether to hold onto profitable investments, sell underperforming ones, or increase their position in assets showing strong CGY. Capital gains yield (CGY) serves as a direct indicator of the potential returns an investor can expect from an investment based solely on price appreciation. For investors focused on capital growth and looking to maximize their profits through price appreciation, CGY offers a straightforward measure of how much their investment has gained in value over a specific period. Unlike other metrics that consider dividends or interest income, CGY focuses solely on the change in the asset's price. This makes it especially valuable for investors who prioritize long-term capital appreciation and are less concerned with immediate income. Capital gains yield (CGY) not only offers insights into individual investments but also provides valuable information about the overall market performance. When CGY is high across a wide range of assets, it indicates a bullish market where many investments are experiencing significant price appreciation. Conversely, low CGY values suggest a bearish market with limited price growth. By analyzing CGY trends, investors can gauge the overall health of the market, identify potential opportunities or risks, and make informed decisions on their investment strategies based on broader market conditions. In volatile markets, capital gains yield (CGY) may become misleading due to its focus on price changes. It can indicate a positive yield even when an investment is performing poorly overall. The fluctuating prices in volatile markets can lead to distorted CGY values, potentially misinforming investors about an investment's true performance. Therefore, it's essential for investors to consider other metrics and factors alongside CGY to gain a more comprehensive understanding of an investment's viability and risk in such unpredictable market conditions. Capital gains yield (CGY) has limitations in its applicability to certain types of investments. It is most relevant for investments that experience price appreciation over time. However, for investments like bonds or certificates of deposit, where the primary return is from interest payments rather than capital appreciation, CGY does not provide a meaningful measure of return. In such cases, investors should consider other metrics, such as yield to maturity or interest income, to assess the performance and suitability of these investment types. Here are some key ways in which capital gains yield can influence tax liabilities: Taxation of capital gains occurs when a taxable event takes place. A taxable event could be selling an appreciated asset, exchanging it for another asset, or receiving dividends or capital gains distributions in a taxable investment account. Capital gains are typically categorized as either short-term or long-term, depending on the holding period of the investment. Short-term capital gains apply to assets held for one year or less, while long-term capital gains apply to assets held for more than one year. Long-term capital gains are often taxed at lower rates than short-term gains, incentivizing investors to hold their assets for a longer period. The tax rates applied to capital gains vary depending on an individual's tax bracket and the type of asset being sold. In many countries, including the United States, the tax rates for long-term capital gains are generally more favorable than the rates for short-term gains. Lower tax rates on long-term gains can result in higher after-tax returns. Investors can use tax-loss harvesting to offset capital gains. By selling investments that have experienced losses, investors can use those losses to reduce their taxable income and, in turn, minimize their overall tax liabilities. This strategy can be particularly beneficial during years with substantial capital gains, as losses can help offset the tax burden. In some jurisdictions, there may be an additional Net Investment Income Tax (NIIT) that applies to certain high-income individuals. The NIIT is a 3.8% tax on net investment income, which includes capital gains, for taxpayers whose income exceeds certain thresholds. When an individual inherits an asset, the cost basis of that asset is "stepped up" to its fair market value at the time of the original owner's death. This step-up in basis can reduce or eliminate capital gains tax if the asset is later sold by the heir at its inherited value. Utilize tax-advantaged retirement accounts like IRAs and 401(k)s to shelter investments from immediate capital gains tax. These accounts allow capital gains to grow tax-free until withdrawal during retirement, reducing current tax liabilities. Consider holding onto investments for more than one year to qualify for long-term capital gains tax rates, which are often lower than short-term rates. Longer holding periods can result in significant tax savings and increased after-tax returns. Offset capital gains by strategically selling losing investments to realize capital losses. These losses can be used to reduce taxable income, thereby minimizing overall tax liabilities and increasing post-tax returns. Optimize the location of investments across taxable and tax-advantaged accounts. Place tax-efficient investments (e.g., index funds) in taxable accounts, while holding tax-inefficient assets (e.g., high-yield bonds) in tax-advantaged accounts. Focus on investments that offer qualified dividends, which may be taxed at a lower rate than ordinary dividends. This can enhance post-tax returns, especially for investors in higher tax brackets. Consider investing in tax-free municipal bonds, as the interest income from these bonds is often exempt from federal and sometimes state income taxes, providing higher after-tax returns. Inherit investments to benefit from the "stepped-up" cost basis. When an asset is inherited, its cost basis is adjusted to the market value at the time of the original owner's death, potentially reducing capital gains tax upon selling. Contribute appreciated securities to charity instead of cash to avoid capital gains tax. Charitable donations can be deducted from taxable income, further reducing tax liabilities. If you're in retirement, consider a systematic withdrawal plan that strategically withdraws funds from various investment accounts to minimize taxable income and preserve capital gains. By implementing these strategies and incorporating capital gains yield analysis into your investment decision-making, you can optimize your after-tax returns, effectively grow your wealth, and achieve your financial objectives. Remember that tax laws can be complex and subject to change, so staying informed and seeking professional advice is essential for effective tax planning. Capital gains yield (CGY) is a financial metric used to evaluate the performance of an investment based on its appreciation in value. This measure does not consider dividends or interest earned, focusing solely on price increases. Calculating CGY is straightforward, and its application in investment analysis is instrumental in comparing the performance of different assets. CGY also offers insights into overall market performance. However, it can be misleading in volatile markets and is not applicable to all types of investments. Importantly, CGY plays a crucial role in tax planning, influencing tax liabilities based on several factors such as taxable events, holding periods, tax rates, and strategies for offsetting gains with losses. A range of strategies can be deployed to maximize post-tax returns, including tax-advantaged accounts, long-term holding, tax-loss harvesting, and strategic asset location. Professional advice is crucial as tax laws can be complex and subject to change.What Is Capital Gains Yield?

How Capital Gains Yield Works

Calculating Capital Gains Yield

Applying Capital Gains Yield in Investment Analysis

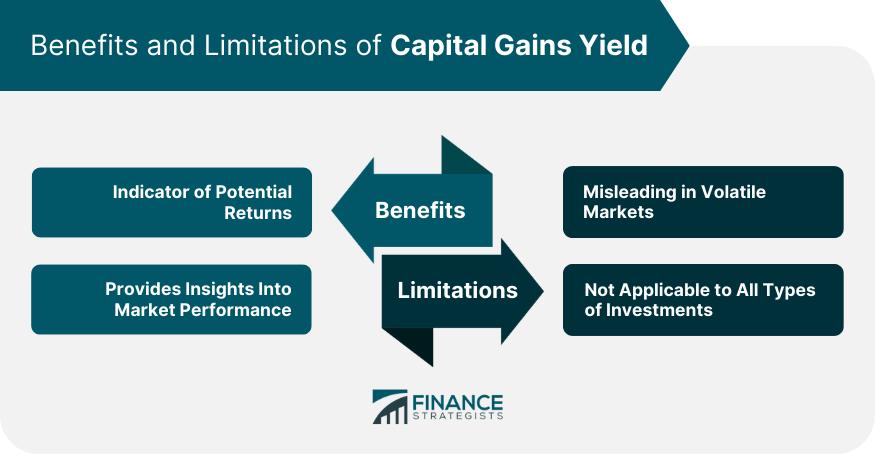

Benefits of Capital Gains Yield

Indicator of Potential Returns

Provides Insights Into Market Performance

Limitations of Capital Gains Yield

Misleading in Volatile Markets

Not Applicable to All Types of Investments

Capital Gains Yield in Tax Planning

Influence on Tax Liabilities

Taxable Events

Short-Term vs Long-Term Capital Gains

Tax Rates

Offsetting Gains With Losses

Net Investment Income Tax (NIIT)

Step-up in Basis for Inherited Assets

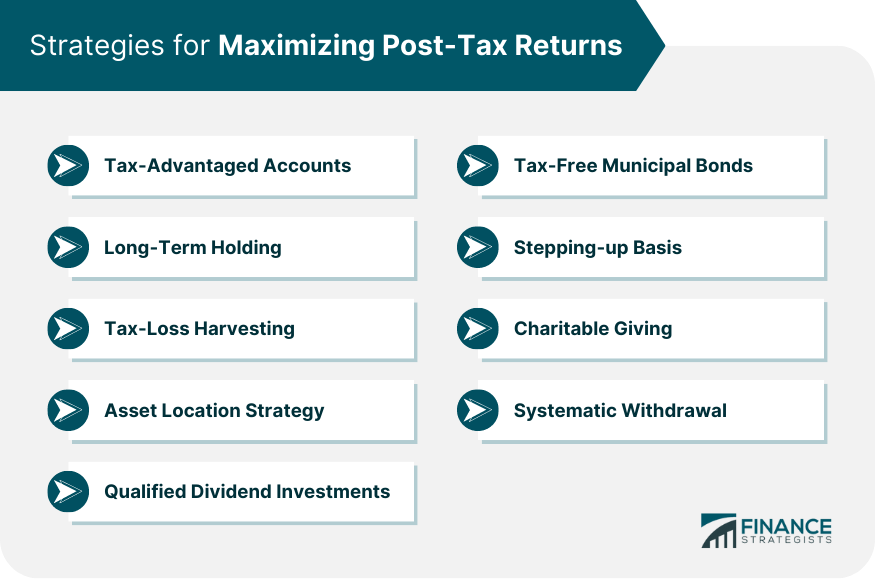

Strategies for Maximizing Post-Tax Returns

Tax-Advantaged Accounts

Long-Term Holding

Tax-Loss Harvesting

Asset Location Strategy

Qualified Dividend Investments

Tax-Free Municipal Bonds

Stepping-up Basis

Charitable Giving

Systematic Withdrawal

Conclusion

Capital Gains Yield FAQs

Capital gains yield (CGY) is a measure used to evaluate an investment's performance based on its appreciation in value over time, expressed as a percentage.

To calculate capital gains yield, subtract the original purchase price from the current selling price, divide the result by the original price, and multiply by 100 to express it as a percentage.

Capital gains yield provides a direct indicator of potential returns from an investment based solely on price appreciation. It allows investors to assess an investment's capital growth potential and compare different investment opportunities.

No, capital gains yield focuses solely on the change in an asset's price and does not take into account any income generated from dividends or interest.

Investors can use capital gains yield to compare the performance of different investments over a specific time frame. By calculating CGY for various assets, they can identify which ones have generated higher or lower returns relative to their original purchase prices and make informed decisions about portfolio composition.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.