Capital loss carryover refers to the provision that allows investors to apply net capital losses, which are losses exceeding capital gains, from one tax year to subsequent years. This mechanism aims to offset potential capital gains or even ordinary income in those future years. The primary purpose of this financial tool is to mitigate the impact of a particularly bad investment year, ensuring that investors don't bear the brunt of their losses all at once. Instead, they can spread out the financial repercussions over multiple years, providing some relief in terms of tax obligations. By leveraging the capital loss carryover, investors can strategize their asset sales and purchases to optimize tax benefits. It serves as a testament to the tax system's recognition of the volatility of markets and investments, offering a buffer against unforeseen financial downturns. It's crucial to remember that there are conditions attached. First, capital losses must first offset the same type of gain. For instance, if you have a short-term loss, it must first offset any short-term gains. Also, there's a yearly limit to how much loss can be deducted from ordinary income, which, as of 2022, stands at $3,000 for individuals and $1,500 for married individuals filing separately. Before carrying over any loss, one must first ascertain the total capital loss for the year. This is done by subtracting the total capital gains from the total capital losses. Once the amount is determined, the next step is to subtract your total capital losses from your total capital gains. If the resulting figure is negative, you have a net capital loss. However, if the loss exceeds the annual limit of deduction against other income, the excess can be carried over to the next tax year. Short-term and long-term capital losses are determined by the period an asset was held. If it's held for one year or less, it's short-term. Anything over a year is long-term. Each type is first applied against gains of the same nature. Timing is pivotal. The end-of-year sales can be used strategically to realize losses and offset them against gains. But it's also essential to avoid the "wash-sale" rule, where selling an investment at a loss and repurchasing a similar one within 30 days disallows the loss claim. The IRS offers individuals the ability to move forward with their capital losses for an indefinite period until fully utilized. However, this seeming simplicity is underpinned by a myriad of guidelines provided by the IRS. Navigating these rules can be challenging, and it's essential to familiarize oneself with these details to ensure accurate application and to derive the maximum potential benefits. While capital loss carryover is a boon for many, it's not without its bounds. The most salient limitation is the annual cap on how much can be deducted against regular income. Furthermore, it's imperative that taxpayers distinguish and correctly apply rules related to short-term versus long-term losses, ensuring a seamless process. The IRS enforces its guidelines with stringent penalties for those who stray. Not adhering to the prescribed regulations can lead to a spectrum of consequences. From monetary penalties that can strain one's finances to exhaustive audits that demand time and documentation, it underscores the importance of due diligence and meticulous compliance. Capital loss carryover shines in instances like stock market declines or property sales at a loss. These unfavorable outcomes become more manageable as the losses offset future gains or ordinary income. Moreover, for those who dabble in various investments, such as bonds, stocks, or real estate, this mechanism acts as a safety net, reducing the sting of poor financial decisions or unforeseen market changes. Utilizing capital loss carryover is a game-changer for taxpayers, particularly those with expansive portfolios. This approach not only mitigates the immediate tax implications of a loss but, when strategically applied, can lead to significant tax savings in years when substantial gains are realized. Over time, this can have a profound effect on an individual's financial health and investment returns. Strategizing asset sales and acquisitions is crucial for maximizing capital loss carryover benefits. Keeping abreast of market trends and potential tax changes can position an investor favorably. Furthermore, a proactive approach, combined with expert insights from tax professionals, can amplify the advantages, ensuring one’s investment and taxation strategy remains both agile and efficient in the long run. The IRS requires taxpayers to report capital gains and losses on Schedule D of Form 1040. This form is crucial as it delineates both short-term and long-term gains and losses, aiding in accurate carryover calculations. Start by listing all capital asset transactions, segregating them based on the holding period. Once all gains and losses are summarized, compute the net gain or loss and transfer this to the main tax form. If there's a net loss, it's this figure that may be eligible for carryover. Maintaining precise records ensures that you can substantiate your claims if ever questioned by the IRS. This includes purchase and sales receipts, brokerage statements, and any other pertinent documentation. Capital loss carryover provides a strategic avenue for investors to offset future capital gains or ordinary income, softening the financial blow from a poor investment year. By setting specific conditions, like the differentiation between short-term and long-term losses, and annual deduction limits, the system seeks balance and fairness. The effective application depends on understanding the nuances, like the pivotal role of timing in realizing losses and the potential pitfalls of non-compliance. With the IRS's detailed guidelines and the indispensable Schedule D for accurate reporting, taxpayers can navigate this facet of financial planning more confidently. The real power of capital loss carryover lies in its potential to strategically shape tax obligations over time, underlining the importance of foresight, planning, and impeccable record-keeping in the realm of investments and taxation.Definition of Capital Loss Carryover

Conditions for Applying a Capital Loss Carryover

How to Calculate Capital Loss Carryover

Determining the Amount of Capital Loss

Calculation Methods and Steps for Capital Loss Carryover

Understanding Short-Term vs Long-Term Capital Losses

Importance of Timing in Capital Loss and Capital Loss Carryover

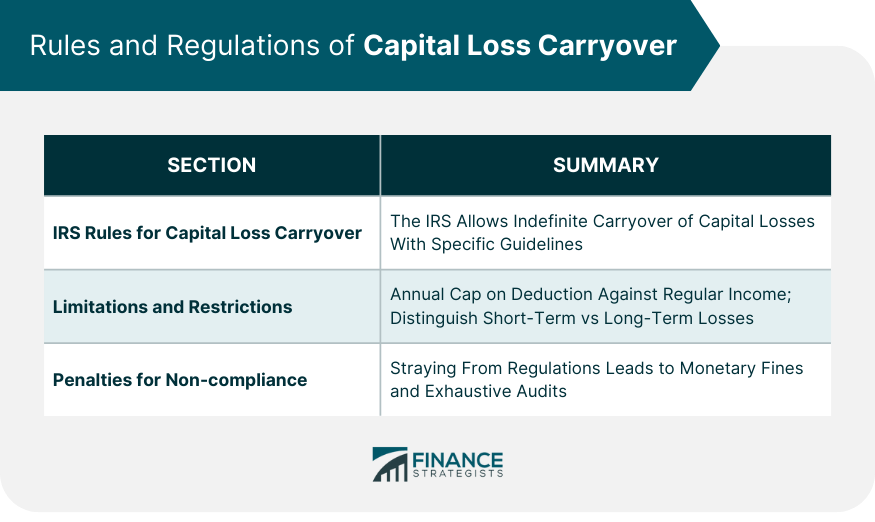

Rules and Regulations of Capital Loss Carryover

IRS Rules for Capital Loss Carryover

Limitations and Restrictions of Capital Loss Carryover

Penalties for Non-compliance With Capital Loss Carryover Regulations

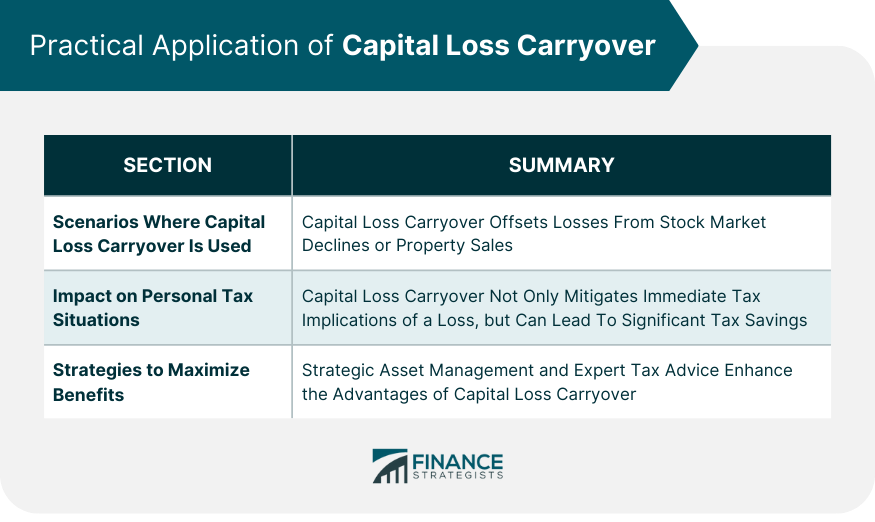

Practical Application of Capital Loss Carryover

Scenarios Where Capital Loss Carryover Can Be Used

Impact on Personal Tax Situations

Strategies to Maximize Benefits of Capital Loss Carryover

Documenting and Reporting Capital Loss Carryover

Role of Schedule D in Reporting Capital Loss Carryover

How to Fill Out Schedule D for Capital Loss Carryover

Importance of Accurate Record Keeping

Bottom Line

Capital Loss Carryover FAQs

Capital loss carryover allows investors to apply net capital losses from one tax year to subsequent years, offsetting potential capital gains or ordinary income in those years. It serves as a financial tool to reduce potential tax obligations in the future.

The distinction lies in the holding period of the asset. If an asset is held for one year or less before selling, it's considered a short-term loss. If it's held for more than a year, it's deemed a long-term loss.

Yes, there's an annual limit on how much capital loss can be deducted against ordinary income. As of 2022, the limit is $3,000 for individuals and $1,500 for married individuals filing separately. Any loss beyond this can be carried over to subsequent years.

You should report capital gains and losses on Schedule D of Form 1040. This form breaks down both short-term and long-term gains and losses, helping calculate net figures and potential carryovers.

Non-compliance can result in penalties from the IRS. This can range from monetary fines to potential audits, depending on the nature and extent of the non-compliance. Always ensure accuracy and adherence to IRS guidelines.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.