Capital gains refer to the increase in value of an investment or real estate over the time it's owned, realized upon selling the asset at a higher price than the purchase price. The difference between the sale and purchase prices represents the capital gain. Capital gains are typically classified as short-term (held for one year or less) or long-term (held for more than one year), with tax implications varying between jurisdictions. Long-term capital gains are derived from assets that are held for more than one year before they are sold.

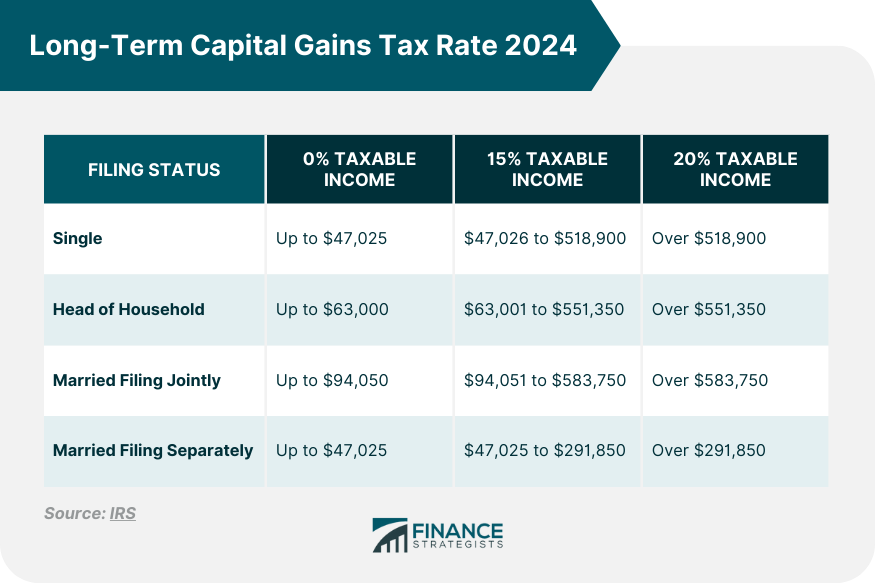

Long-term capital gains are taxed at 0%, 15%, or 20%, according to graduated income thresholds. The tax rate for most taxpayers who report long-term capital gains is 15% or lower. In determining the holding period - the duration for which you possessed an asset before selling it - the date of sale is included, but not the purchase date. Take for instance, if an asset was procured on February 1, 2024, the commencement of your holding period would be from February 2, 2024. Consequently, the completion of one year of ownership would be recognized on February 1, 2025. Governmental decisions on tax rates are often reactions to broader economic conditions. A booming economy might witness stable or decreased tax rates, while recessionary conditions could prompt hikes to address fiscal deficits. Policy-makers use tax rates as a lever, either promoting investments during robust economic phases or garnering revenue during downturns. Inflation reduces purchasing power. However, its effect on capital gains is nuanced. As asset values increase with inflation, without proper adjustments, investors might pay taxes on "phantom gains." Some countries index capital gains for inflation, ensuring taxes are on real gains and not inflationary ones. Without such indexing, the real value of an investor's gain could be eroded, leading to unfair taxation. Therefore, understanding inflation's interplay with capital gains becomes pivotal. Favorable long-term capital gains rates incentivize longer holding periods. This promotes stability in financial markets, reduces speculative trading, and aligns with many financial goals like retirement planning or buying a home. Such incentives foster a healthier investment environment, channeling funds into productive, long-term ventures, thereby bolstering economic growth. Lower tax rates can amplify the returns on retirement accounts or long-term savings plans, making it easier for individuals to achieve their financial milestones. Over an extended period, even a slight reduction in tax rates can compound into significant savings, ensuring a more comfortable retirement or achieving other financial objectives sooner. By strategically selling investments that have declined in value, investors can offset the gains realized on other investments. This process, known as tax loss harvesting, can significantly reduce tax liabilities in a given year. It's a proactive approach, requiring regular portfolio reviews. When executed correctly, it can transform losses into advantageous tax maneuvers. Accounts like IRAs or 401(k)s offer tax advantages. Growth within these accounts is often tax-deferred, allowing investments to compound more efficiently over time. Maximizing contributions to these accounts and understanding their withdrawal rules can position an investor for optimized tax savings, particularly in the retirement phase. Transferring assets as gifts or inheritances can sometimes offer tax advantages, especially if recipients are in lower tax brackets or if assets receive a stepped-up basis upon inheritance. Such transfers can be a win-win, benefiting both the giver and the receiver. Proper planning ensures that assets transition smoothly, minimizing tax implications. It's essential to stay updated with any amendments, new exemptions, or deductions introduced during 2024-2025 that pertain to capital gains. These changes can provide new opportunities or challenges for tax planning. A proactive approach, such as subscribing to tax news updates or consulting with a tax professional, ensures that you stay ahead of such changes. Sometimes, specific deductions or exemptions related to capital gains might be introduced, modified, or repealed. These can directly influence the effective tax rate an individual might face on their long-term capital gains. For instance, a newly introduced deduction could significantly reduce taxable income, potentially moving an investor to a lower tax bracket. Being aware of such shifts can make a monumental difference in tax liabilities. Understanding long-term capital gains tax rates and their implications can significantly impact one's financial situation. The graduated income thresholds and the tax rates for the years 2024-2024 indicate that strategic planning can result in substantial tax savings. The economic conditions, federal policies, inflation, and policy changes or updates all influence these tax rates. Using tax strategies such as tax loss harvesting, tax-advantaged accounts, and gifting or inheritance strategies can also help in minimizing long-term capital gains tax. Nonetheless, the complexities involved require thorough understanding and timely updates. Engaging professional tax planning services can greatly assist in navigating these complexities, helping you maximize your returns and align with your financial objectives. For the most accurate and strategic approach, don't hesitate to seek expert advice. Overview of Long-Term Capital Gains

Long-Term Capital Gains Tax Rate 2024-2025

Factors Influencing Long-Term Capital Gains Tax Rate

Economic Conditions and Federal Policies

Inflation's Role

Benefits of Favorable Long-Term Capital Gains Tax Rates

Encourages Long-Term Investments

Amplifies Retirement and Savings

Methods to Minimize Long-Term Capital Gains Tax

Tax Loss Harvesting

Utilizing Tax-Advantaged Accounts

Applying Gifting or Inheritance Strategies

Special Considerations for Long-Term Capital Gains Tax Rate

Policy Changes or Updates

Changes in Exemptions or Deductions

Bottom Line

Long-Term Capital Gains Tax Rate FAQs

The tax rate varies based on income brackets, with rates ranging from 0% to 20% or more.

Short-term gains are from assets held for a year or less, while long-term gains are from assets held for more than a year.

Economic conditions influence tax policies; a strong economy might lead to stable or reduced rates, while a recession could prompt increases.

They encourage long-term investments, promote market stability, and positively impact retirement and savings.

Yes, strategies include tax loss harvesting, utilizing tax-advantaged accounts, and gifting or inheritance strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.