Net capital gain is a financial term that refers to the profit from the sale of an asset, such as stocks or real estate. It's calculated by subtracting the cost basis, or the original purchase price, plus any associated costs of acquisition or improvement from the sale price of the asset. This concept forms a key part of your investment returns and can significantly influence your long-term financial goals. As such, being well-versed in net capital gains can be a significant advantage in effective financial planning and wealth management. The significance of net capital gain goes beyond just reflecting your profit. It plays an important role in your tax liability and personal wealth accumulation. Understanding and managing your net capital gains can have significant impacts on your financial health and investment strategy. In fact, strategic management of net capital gains can lead to potentially higher after-tax returns on your investments. The calculation of net capital gains starts with the cost basis. This is the original value of an asset for tax purposes, usually the purchase price, adjusted for stock splits, dividends, and return of capital distributions. This value is then used to determine the capital gain, which is the difference between the asset's cost basis and the price the asset is sold at. Additionally, understanding the cost basis is crucial when calculating potential capital gains on a sale and can help you make informed decisions about when and how to sell an asset. There's a significant distinction between short-term and long-term capital gains. If you hold an asset for a year or less before you sell it, any profit is considered a short-term capital gain. If you hold the asset for more than a year before selling, any profit is a long-term capital gain. This distinction is crucial because short-term and long-term capital gains are taxed at different rates. Properly categorizing your gains is a critical part of accurately computing your tax liability. Net capital gain is computed by subtracting the total capital losses from the total capital gains. However, there's a twist. You must first differentiate short-term gains/losses from long-term gains/losses. This is due to the differing tax treatments. Once you've separated them, you subtract short-term losses from short-term gains and long-term losses from long-term gains. The final figure after offsetting gains against losses is your net capital gain. Regular monitoring and tracking of your capital gains and losses can help optimize your overall financial strategy. Keeping accurate and detailed records is critical when calculating net capital gains. You'll need to keep track of when you purchased an asset, the price you paid, any improvements you made (in the case of property), and when and how much you sold it for. Keeping good records can make the process of calculating your capital gains much simpler and more accurate. Additionally, having precise records is essential for tax purposes, not only to ensure you're paying the correct amount but also to provide documentation in case of an audit. Short-term capital gains are taxed as ordinary income. This means they're subject to the same tax rates as your regular income, such as salary or business income. Depending on your tax bracket, the tax rate on short-term capital gains could be quite high, reaching up to 37% in 2024. For this reason, many investors strategize to hold their investments longer to shift potential gains into the long-term category. In contrast, long-term capital gains benefit from a more favorable tax rate. They are taxed at rates of 0%, 15%, or 20%, depending on your overall taxable income. For most taxpayers, the rate is typically 15%. This is a key reason financial advisors often recommend holding assets for at least a year and a day whenever possible. The tax savings can be substantial, making it an important consideration in investment strategies. As mentioned above, the tax rate applied to your capital gains depends on whether it's a short-term or long-term gain and on your taxable income. However, these rates are subject to changes and adjustments, which is why it's crucial to stay informed about current tax laws. Also, understanding your marginal tax rate and the thresholds for each tax bracket can help guide your investment decisions and tax planning strategies. Net capital gain plays a significant role in your overall tax liability. A year where you realize significant capital gains—say, from selling a property or a large number of stocks—can lead to a substantial tax bill. On the flip side, a year in which you realize capital losses could potentially reduce your tax liability by offsetting other gains. Hence, strategic timing of the sale of your assets can impact not just your net capital gain, but also your overall tax bill. Tax-loss harvesting is a strategy that involves selling securities at a loss to offset a capital gains tax liability. This strategy is typically used to limit the recognition of short-term capital gains, which are generally taxed at a higher rate than long-term gains. By strategically realizing losses, investors can effectively lower their taxable income and reduce their tax liability, providing them with more funds for future investments. Holding an asset for more than a year before selling can often significantly reduce the tax burden due to the difference in tax rates between short-term and long-term gains. Therefore, if feasible and in line with your investment strategy, it might be advantageous to hold assets for at least a year and a day. The longer holding period might also align better with long-term investment goals, serving dual purposes in your overall financial strategy. Giving assets as gifts or as part of an inheritance can also play a role in managing net capital gains. The recipient of a gift inherits the giver's cost basis, potentially leading to lower capital gains when the asset is later sold. Inherited assets, on the other hand, receive a "step-up" in basis, meaning the cost basis is reset to the asset's value at the date of the original owner's death, which can significantly reduce capital gains. These strategies, when planned carefully, can lead to substantial tax savings while also aiding in efficient wealth transfer. Asset location is a tax-efficient investing strategy that involves deciding which investments to hold in taxable versus tax-advantaged accounts. For example, holding assets that generate high levels of taxable income or short-term capital gains in tax-advantaged accounts can minimize your overall tax liability. Implementing an effective asset location strategy can potentially boost your after-tax returns and contribute to your overall financial goals. Intentionally realizing capital gains can be a strategy for funding retirement. This approach is especially effective if you expect to be in a lower tax bracket in retirement, as the capital gains could be taxed at a lower rate. By planning the realization of capital gains strategically, retirees can generate income in a tax-efficient manner, allowing them to enjoy their retirement years with fewer financial concerns. Day traders make frequent trades and typically hold assets for less than a day. As a result, their gains are usually classified as short-term capital gains, which are taxed at a higher rate than long-term capital gains. Day traders need to be aware of the potential tax implications of their activity and should consider these tax implications when evaluating the profitability of their trades. It's also important for them to keep detailed records of all transactions to accurately calculate their net capital gain at the end of the year. Even though day trading offers the allure of quick profits, the significant tax implications mean that it's not always the most tax-efficient investment strategy. Real estate often appreciates over time, which can lead to substantial capital gains when the property is sold. However, there are specific tax provisions related to real estate that can help to reduce the capital gains tax. For example, the IRS provides a home sale exclusion that allows individuals to exclude up to $250,000 (or $500,000 for married couples filing jointly) of gain on the sale of a home, as long as certain conditions are met. This can be a significant tax advantage for homeowners. Additionally, real estate investors can use strategies like a 1031 exchange to defer capital gains taxes by reinvesting proceeds from a sale into a similar type of property. When an individual inherits an asset, such as stocks or real estate, they usually receive a step-up in basis, meaning the cost basis of the asset becomes its fair market value at the time of the original owner's death. This step-up in basis can significantly reduce the inheritor's capital gains when they eventually sell the asset. Therefore, the potential tax savings from a step-up in basis can make inheriting assets a desirable route for wealth transfer. However, inheriting assets comes with its own set of complex tax rules and potential complications, so it's important to consult with a tax advisor or financial planner to navigate these situations. For individuals in retirement, the strategic realization of capital gains can be a valuable income strategy. Since long-term capital gains are generally taxed at lower rates than ordinary income, retirees can potentially lower their tax bill by relying more on capital gains for income rather than withdrawals from retirement accounts that may be subject to ordinary income tax rates. However, the timing of the sale of assets must be carefully managed to ensure the gain remains in the long-term category and that the income does not push the individual into a higher tax bracket. One common misconception is that all capital gains are taxed at the same rate. In reality, short-term and long-term capital gains are taxed differently. Short-term capital gains are taxed as ordinary income, while long-term capital gains have their own tax rates. Additionally, the rate applied to long-term capital gains is not fixed but depends on your taxable income. This means your capital gains tax rate can change from year to year, and it's essential to stay informed about current tax laws and how they might affect you. Another misunderstanding is that capital gains and dividend income are the same thing. While both are types of investment income, they're treated differently for tax purposes. Dividends are payments made by a corporation to its shareholders, and they can be qualified or nonqualified. Qualified dividends are taxed at the long-term capital gains tax rates, while nonqualified dividends are taxed as ordinary income. On the other hand, capital gains arise from the sale of an asset for a profit. It's crucial to understand the difference between these types of income to accurately calculate your tax liability. There's often confusion about the offset of capital gains with capital losses. While it's true that capital losses can offset capital gains, reducing your overall tax liability, there are limits. For example, if your capital losses exceed your capital gains, you can use the loss to offset up to $3,000 of other income. After that, additional losses can be carried forward to future years. However, many people mistakenly believe that all losses can be deducted from their income in the year they are incurred. It's essential to understand these nuances to accurately calculate and report your net capital gain. Net capital gain is the profit realized from the sale of an asset, such as stocks or real estate, after subtracting the cost basis or the initial investment amount. More than just a reflection of profit, it plays a pivotal role in determining tax liability and shaping personal wealth. Understanding the difference between short-term and long-term capital gains is essential due to the disparate tax treatments each receives. Moreover, keeping meticulous records of these transactions is non-negotiable, ensuring accuracy for tax purposes and safeguarding against potential audits. It's also vital for investors to remain abreast of the ever-evolving tax laws. By strategically managing these capital gains and losses, individuals can unlock significant tax savings. Implementing strategies like tax-loss harvesting, holding period optimization, and astute asset location can augment these advantages further. What Is Net Capital Gain?

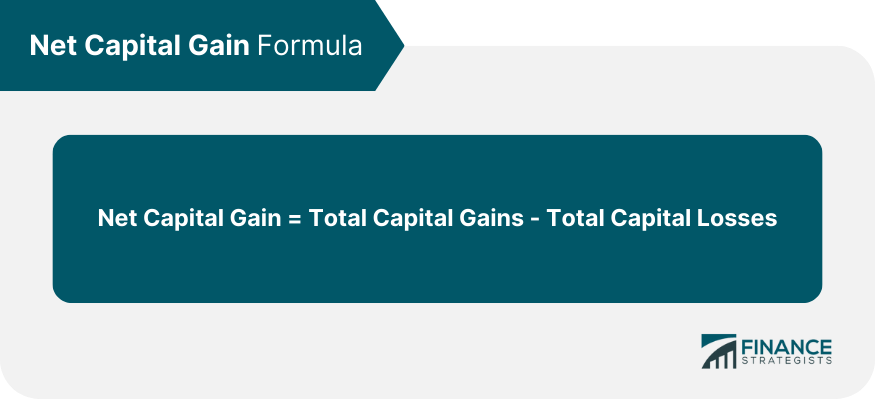

Computation of Net Capital Gain

Role of Cost Basis

Understanding Short-Term vs Long-Term Capital Gains

Calculating Net Capital Gain

Importance of Keeping Accurate Records

Tax Implications of Net Capital Gain

Short-Term Capital Gains Tax

Long-Term Capital Gains Tax

Tax Brackets and Rates for Capital Gains

Impact on Tax Liability

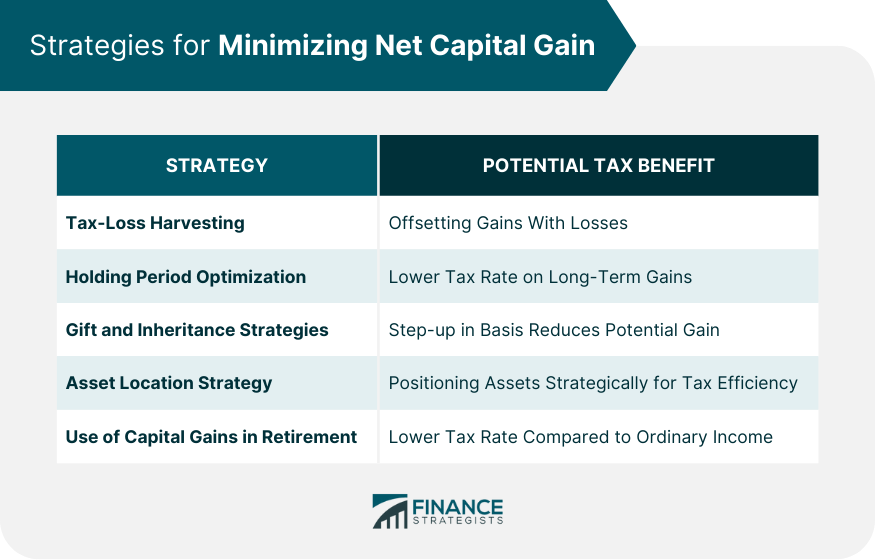

Strategies for Minimizing Net Capital Gain

Tax-Loss Harvesting

Holding Period Optimization

Gift and Inheritance Strategies

Asset Location Strategy

Use of Capital Gains to Fund Retirement

Real-World Examples and Scenarios of Net Capital Gain

Day Trading

Real Estate

Inheritance

Retirement

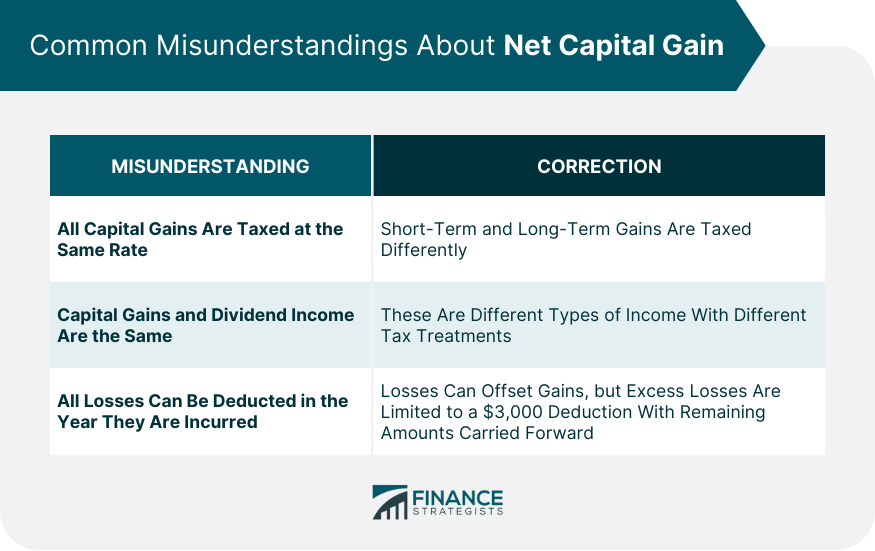

Common Misunderstandings About Net Capital Gain

All Capital Gains Are Taxed at the Same Rate

Capital Gains and Dividend Income Are the Same

All Losses Can Be Deducted in the Year They Are Incurred

Final Thoughts

Net Capital Gain FAQs

A net capital gain is the profit from the sale of an asset, such as stocks or real estate, after subtracting the original purchase price and associated costs.

Net capital gain is calculated by subtracting the total capital losses from the total capital gains, differentiating between short-term and long-term gains/losses due to differing tax treatments.

Short-term capital gains are taxed as ordinary income, while long-term capital gains are taxed at rates of 0%, 15%, or 20%, depending on your overall taxable income.

Strategies include tax-loss harvesting, holding period optimization, gift and inheritance strategies, asset location strategy, and using capital gains to fund retirement.

Misunderstandings often revolve around capital gains tax rates, confusion between capital gains and dividend income, and misconceptions about net loss offsets.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.