What Is the Over-55 Home Sale Exemption?

The over-55 home sale exemption was a tax law that provided homeowners over age 55 with a one-time capital gains exclusion. Individuals who met the requirements could exclude up to $125,000 of capital gains on the sale of their personal residences.

The exemption was intended to stimulate the real estate market and reward homeowners for the purchase and subsequent sale of their homes. It was replaced by other exclusions for everyone who profited from selling their principal residences regardless of age.

The exemption was repealed in 1997 and replaced with a more beneficial rule, now allowing homeowners of any age to exclude up to $250,000 in gain ($500,000 for married couples filing jointly) from the sale of their primary residence, given they meet specific conditions.

The modification of this rule expanded the tax benefit to a broader demographic, no longer exclusively favoring seniors.

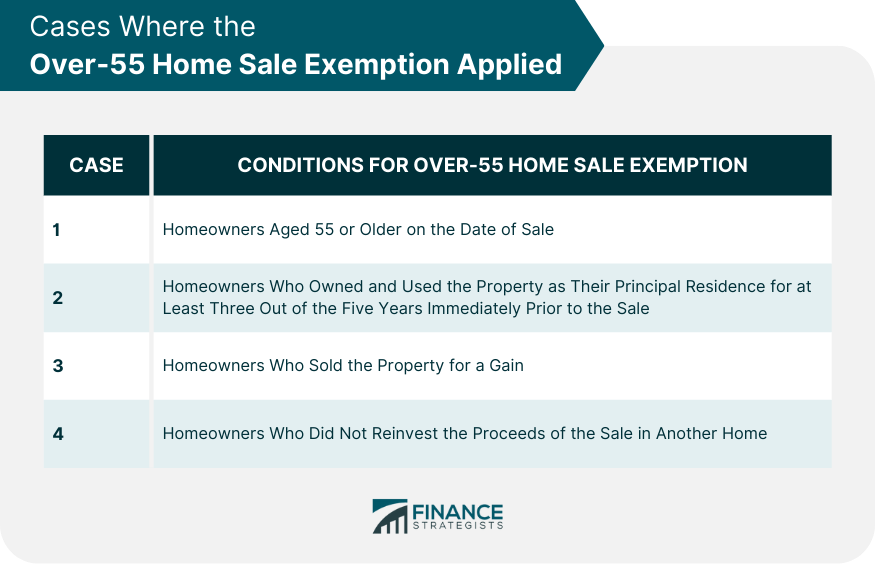

Cases Where the Over-55 Home Sale Exemption Applied

The over-55 home sale exemption applied in a number of cases, including:

Homeowners who were 55 years old or older on the date of the sale

Homeowners who had owned and used the property as their principal residence for at least three out of the five years immediately prior to the sale

Homeowners who sold the property for a gain

Homeowners who did not reinvest the proceeds of the sale in another home

There were some exceptions to the over-55 home sale exemption. For example, the exemption did not apply to homeowners who had previously claimed the exemption on the sale of another home.

Additionally, the exemption did not apply to homeowners who sold their homes to their children or grandchildren.

Here are some specific examples of cases where the over-55 home sale exemption applied:

A 60-year-old homeowner who had lived in his home for 10 years sold the home for a $100,000 gain. He could exclude the entire $100,000 gain from his taxable income.

A 57-year-old homeowner who had lived in her home for 7 years sold the home for a $50,000 gain. She could exclude $50,000 of the gain from her taxable income.

A 55-year-old homeowner who had lived in her home for 2 years sold the home for a $25,000 gain. She could not exclude any of the gains from her taxable income.

Benefits and Implications of the Over-55 Home Sale Exemption

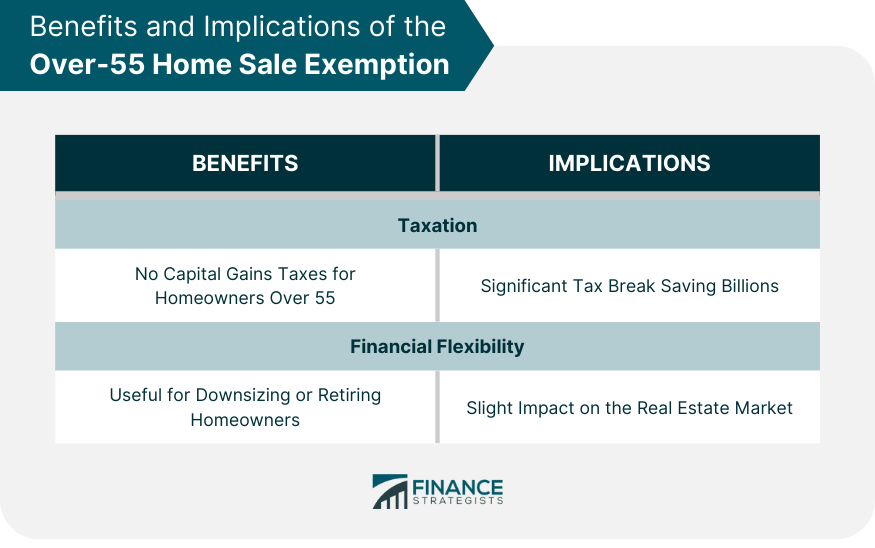

Benefits

Tax Break for Homeowners Over 55

The over-55 home sale exemption allowed homeowners to sell their homes without having to pay capital gains taxes on the profit they made.

This could be a significant amount of money, especially for homeowners who had lived in their homes for many years and seen their property values appreciate.

Helpful for Downsizing or Retiring

The over-55 home sale exemption was particularly beneficial for homeowners who were downsizing or retiring. These homeowners may have had a large amount of equity in their homes, but they may not have needed as much money as they had in the past.

The over-55 home sale exemption allowed them to sell their homes and keep more of the proceeds.

Implications

Significant Tax Break

The over-55 home sale exemption was a significant tax break for homeowners over the age of 55. It is estimated that the exemption saved taxpayers billions of dollars over the years.

Slight Impact on the Real Estate Market

The over-55 home sale exemption may have had a small impact on the real estate market. Some economists believe that the exemption encouraged homeowners to sell their homes, which may have led to a slight decrease in home prices.

Understanding the Current Home Sale Tax Exclusion

Eligibility Criteria for the Current Home Sale Tax Exclusion

To qualify for the home sale tax exclusion, you must meet the following requirements:

You must have owned and used the home as your primary residence for at least two of the five years leading up to the sale.

You must not have excluded any gain on the sale of another home within the past two years.

You must not have converted the home to rental property before the sale.

If you meet all of the requirements, you can exclude the gain on the sale of your home by filing Form 2119 with your federal income tax return.

Single vs Married Filing: Differences in Exclusion Amounts

For single taxpayers, the maximum amount of gain that can be excluded from income is $250,000. For married taxpayers filing jointly, this amount doubles to $500,000, provided both spouses meet the use test, and at least one spouse meets the ownership test.

This differentiation between single and joint filers highlights the potential benefits of marital status in tax planning strategies and underscores the importance of understanding these nuances.

Exceptions and Special Circumstances

The home sale tax exclusion is a valuable tax break that can save homeowners a significant amount of money. If you are considering selling your home, you should talk to your tax advisor to see if you qualify for the exclusion.

Here are some additional things to keep in mind about the home sale tax exclusion:

The exclusion is applied to the net gain on the sale of your home. This means that you will need to subtract the cost basis of your home and any selling expenses from the sale price to determine your net gain.

The exclusion is only available for the sale of your primary residence. If you sell a vacation home or investment property, you will not be able to exclude any gain on the sale.

The exclusion is only available once every two years. If you sell your home and exclude the gain, you will not be able to exclude any gain on the sale of another home for two years.

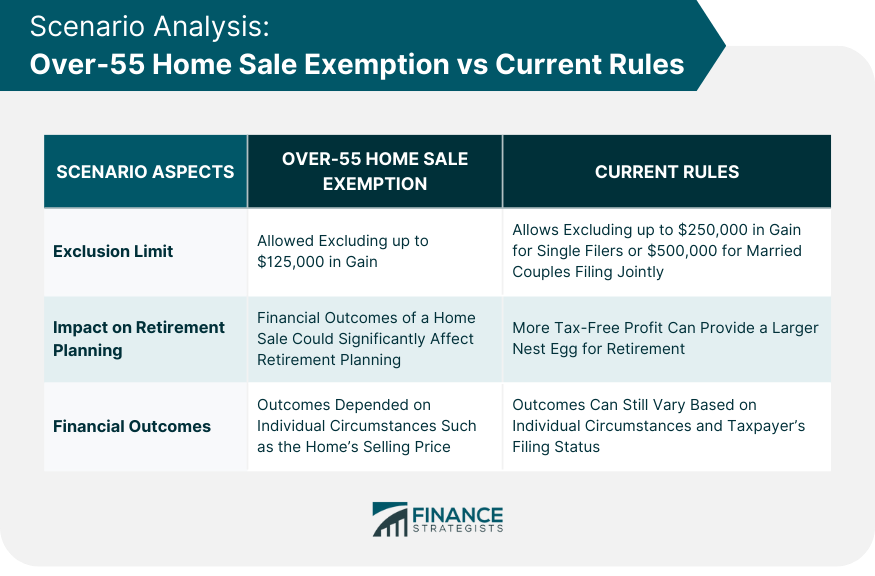

Scenario Analysis: Over-55 Home Sale Exemption vs Current Rules

Comparative Analysis Through Example Scenarios

Imagine a senior couple who sold their long-time family home. Under the old over-55 rule, they would have been able to exclude $125,000 of their gain from taxation.

Under the current law, they could potentially exclude up to $500,000 of the gain, a significant increase.

This comparison provides a stark illustration of how tax laws have evolved and can influence individuals' financial outcomes.

Impact on Retirement Planning and Asset Management for Seniors

The difference in potential tax savings between the two rules can significantly impact seniors' retirement planning and asset management strategies. The current rule allows for more tax-free profit, which can provide a larger nest egg for retirement.

Therefore, understanding these rules can potentially influence seniors' decisions about when and how to sell their homes to optimize financial benefits.

Discussion on Potential Financial Outcomes

While the current law generally allows for larger exclusions, it's essential to note that not all seniors will necessarily benefit more from the current rule. The outcomes can vary based on individual circumstances, such as the home's selling price and the taxpayer's filing status.

Thus, it is crucial to consider personalized financial circumstances and seek advice when navigating these tax laws.

Tax Strategies for Seniors Selling Their Homes

Home Sale Tax Exclusion

As mentioned earlier, homeowners can exclude up to $250,000 of capital gains on the sale of their primary residence.

This means that if you sell your home for a profit of $250,000 or less, you will not have to pay any capital gains taxes on that profit. The exclusion is doubled to $500,000 for married couples filing jointly.

Rollover Into a New Home

If you are selling your home to downsize or move to a different area, you may be able to roll over the proceeds into the purchase of a new home. This can help you avoid paying capital gains taxes on the sale of your old home.

1031 Exchange

A 1031 exchange is a tax-deferred exchange of real estate. This means that if you sell your home and reinvest the proceeds into another piece of real estate, you can defer paying capital gains taxes on the sale of your old home.

Reinvest in Rental Property

If you are not planning to downsize or move to a different area, you may want to consider reinvesting the proceeds from the sale of your home into rental property. This can provide you with a steady stream of income in retirement.

Talk to Your Tax Advisor

It is important to talk to your tax advisor to discuss the specific tax implications of selling your home. Your advisor can help you determine which tax strategies are best for you and your individual circumstances.

Final Thoughts

The Over-55 Home Sale Exemption, a former tax law that was significant in providing tax breaks for homeowners above 55, paved the way for the current home sale tax exclusion, a much more inclusive rule.

Today, homeowners of any age can enjoy tax exemptions on capital gains from the sale of their primary residences, providing the opportunity for larger tax-free profits and impacting retirement and asset management strategies for many individuals.

However, the beneficial outcome of these laws isn't always uniform, as it depends on personalized financial circumstances, home selling price, and filing status.

Therefore, thorough knowledge of these exclusions, aided by expert advice, is critical to optimize the benefits.

Over-55 Home Sale Exemption FAQs

It was a tax law that allowed homeowners over 55 to exclude up to $125,000 of capital gains from the sale of their homes.

It was replaced in 1997 by a rule allowing homeowners of any age to exclude up to $250,000 in gain ($500,000 for married couples) from the sale of their primary residence.

It allowed homeowners over 55 to avoid capital gains taxes on the sale of their homes, aiding in downsizing or retirement plans.

Ownership and usage of the home as the primary residence for at least two of the five years leading up to the sale, among other conditions.

Options include home sale tax exclusion, rollovers into new homes, 1031 exchange, and reinvestment in rental properties, guided by a tax advisor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.