Understanding Capital Gains

Capital gains are the profits that investors earn from the sale of assets or investments when their value increases over time. These assets could range from stocks and bonds to real estate and even precious art pieces.

It's crucial to distinguish between short-term and long-term capital gains, as each is treated differently for tax purposes.

Short-term capital gains arise from assets held for less than a year, while long-term gains relate to assets held for more than a year.

The taxation of capital gains is a crucial aspect of investment planning. Depending on the investor's income bracket and the asset's holding period, different tax rates apply.

Notably, short-term capital gains are generally taxed at a higher rate than long-term gains.

Understanding these tax implications can help investors formulate strategies to manage and potentially minimize their tax liabilities.

Comprehensive Overview of Registered Retirement Savings Plan (RRSP)

Definition of RRSP

A Registered Retirement Savings Plan (RRSP) is a Canadian retirement savings plan. Established in 1957, RRSPs serve to incentivize retirement savings among employees by offering them tax benefits.

Compliance with the rules laid down by the Canadian Income Tax Act is mandatory to reap the benefits of an RRSP.

Contributions made to this plan are deductible from your taxable income, thereby lowering your overall tax liability.

Benefits and Importance of RRSPs

RRSPs come with notable tax advantages, the most significant being the reduction in taxable income due to the contributions made. This effectively decreases the amount of income tax payable.

Additionally, the growth of the investments within an RRSP is tax-deferred until withdrawal. This allows your savings to compound over time, accelerating your retirement savings growth.

Eligibility and Contribution Rules of RRSPs

Contributing to an RRSP is not restricted; anyone earning an income, possessing a social insurance number, and having filed a tax return can contribute.

However, contribution limits do apply. As of 2024, this limit stands at 18% of the earned income reported on the previous year's tax return, subject to a maximum limit set annually by the government. The annual RRSP limit for 2024 is $31,560 ($32,490 in 2025).

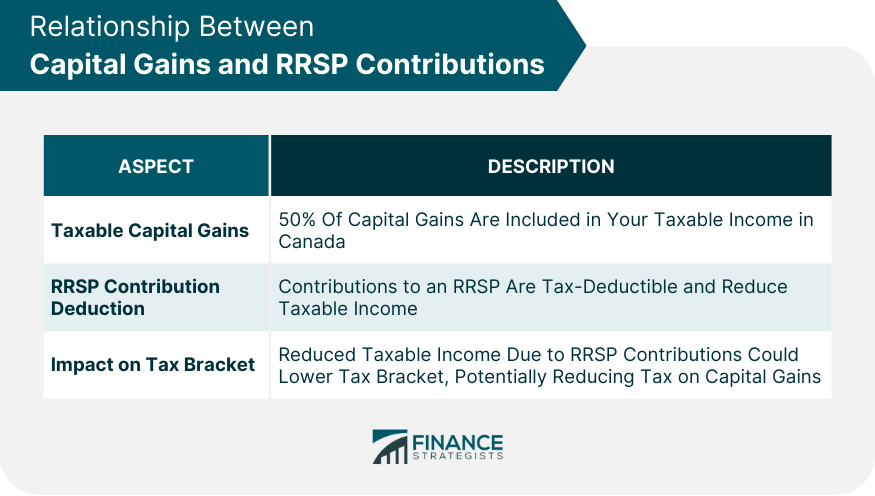

Relationship Between Capital Gains and RRSP Contributions

Immediate Impacts of Capital Gains on RRSP Contributions

Capital gains can have a direct impact on your RRSP contributions.

Notably, the income realized from capital gains can be contributed to your RRSP, which may reduce your taxable income.

However, remember that only 50% of your capital gains are included in your taxable income in Canada, making strategic planning around this crucial.

Strategy to Use Capital Gains for RRSP Contributions

Capital gains can be a significant source of funds for RRSP contributions.

By reinvesting these gains into your RRSP, you can reduce your taxable income and increase your retirement savings simultaneously.

However, to maximize this strategy's benefits, you should be fully aware of your RRSP contribution limits.

Maximizing RRSP Contributions to Offset Capital Gains

Exploring the RRSP Contribution Limit

Understanding your RRSP contribution limit is key to maximizing its tax benefits. This limit is calculated as 18% of your income from the previous year, up to a maximum limit set annually by the government.

Note that any unused contribution room from the past can be carried forward, allowing for potentially larger RRSP contributions in future years.

Impact of RRSP Contributions on Taxable Income and Capital Gains

RRSP contributions have the potential to significantly lower your taxable income, as they are tax-deductible. In the context of capital gains, the reduced taxable income could lower your income tax bracket, thereby potentially reducing the tax on your capital gains.

Practical Examples and Case Studies

Let's delve into a practical scenario. If you have $10,000 in capital gains from selling an investment, only $5,000 will be added to your taxable income for the year. If you're in the 30% tax bracket, you'd owe $1,500 in taxes on the capital gain.

But if you contribute the full $10,000 to your RRSP, you could save $3,000 on your taxes (30% of $10,000), thus offsetting the tax on the capital gain and generating additional savings.

Advanced RRSP Strategies for Capital Gain Management

RRSP vs Tax-Free Savings Accounts (TFSAs)

Both RRSPs and Tax-Free Savings Accounts (TFSAs) offer their own tax advantages. It's crucial to understand these differences when deciding where to invest your capital gains.

With RRSPs, contributions are tax-deductible, but withdrawals are taxed. In contrast, TFSA contributions are made with after-tax dollars, but withdrawals, including capital gains, are tax-free.

Role of Income Splitting With RRSPs to Manage Capital Gains

Income splitting is a technique where a higher-income spouse contributes to the RRSP of the lower-income spouse. By reducing the couple's overall tax liability, this method offers an efficient way to manage capital gains.

Consequences of Withdrawing From RRSPs

Tax Implications Upon Withdrawal

Withdrawals from your RRSP in retirement are taxed as income. Therefore, it's important to strategically plan these withdrawals. Unplanned large withdrawals could potentially push you into a higher tax bracket.

Effect on Capital Gains

Withdrawals from your RRSP can also impact your capital gains tax. If the RRSP withdrawals increase your income to a point where you shift into a higher tax bracket, you could end up paying more taxes on your capital gains.

Best Practices and Common Mistakes to Avoid on Capital Gains and RRSP Contribution

Mistake to Avoid

Misunderstanding How Capital Gains and RRSP Contributions Interact

People often misconceive that RRSP contributions directly reduce the tax on capital gains.

However, RRSP contributions only reduce your taxable income, not the tax on capital gains directly.

It can indirectly affect your tax on capital gains by lowering your taxable income, which might potentially place you in a lower tax bracket, leading to less tax payable on your capital gains.

Best Practices

Consider Personal Tax Situation When Making Investment Decisions

Always take into account your personal tax situation when making decisions about investments. This will allow you to optimize for the least amount of tax liability based on your individual circumstances.

Be Aware of RRSP Contribution Limit

Knowing your RRSP contribution limit is essential to avoid penalties associated with over-contributing. You are allowed to contribute a certain amount each year to your RRSP, any amount contributed over this limit may attract penalties.

Consider Income Splitting

If it's an option for you, consider income splitting with your spouse. This can reduce your overall tax liability by lowering your taxable income, potentially placing you in a lower tax bracket.

Bottom Line

Understanding the relationship between capital gains and RRSP contributions is crucial to optimizing tax liabilities and fostering retirement savings growth.

Capital gains serve as a significant source of funds for RRSP contributions, offering an opportunity to reduce taxable income and build a robust retirement corpus.

It's important to be aware of your RRSP contribution limits, use advanced strategies like income splitting, and understand the different tax benefits between RRSPs and TFSAs.

Furthermore, it is essential to realize the impact of RRSP withdrawals on your tax bracket and capital gains.

Misconceptions about RRSP contributions and capital gains can lead to strategic missteps, therefore, staying informed and making mindful investment decisions is critical.

Lastly, be sure to enlist the aid of a tax planning professional to ensure optimal capital gains management and RRSP contribution strategy for your unique situation. Secure your financial future today by seeking expert tax planning services.

Relationship Between Capital Gains and RRSP Contributions FAQs

Capital gains can be contributed to an RRSP, which may reduce your taxable income. However, only 50% of capital gains are taxable in Canada.

RRSP contributions are tax-deductible and can lower your taxable income, potentially reducing the tax on your capital gains if it brings you down a tax bracket.

Withdrawals from an RRSP are taxed as income, and could potentially push you into a higher tax bracket, affecting your tax on capital gains.

Yes, both RRSPs and TFSAs offer unique tax advantages that can be utilized for managing capital gains, depending on your personal tax situation.

A common mistake is misunderstanding how capital gains and RRSP contributions interact. It's crucial to remember that RRSP contributions lower taxable income, but do not directly reduce tax on capital gains.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.