Capital gains tax is a levy imposed on the profit realized from the sale of a non-inventory asset that has appreciated in value, such as stocks, bonds, precious metals, real estate, and businesses. The tax is calculated on the difference between the asset's selling price and its original purchase price, minus any associated costs. Capital gains tax rates may vary based on factors such as the investor's income level, the type of asset, and the holding period. Typically, long-term investments held for over a year are subject to lower tax rates. This is to incentivize long-term investing and economic growth. However, short-term gains are often taxed as regular income. It's also worth noting that some jurisdictions offer exemptions, deductions, or credits to reduce capital gains tax.

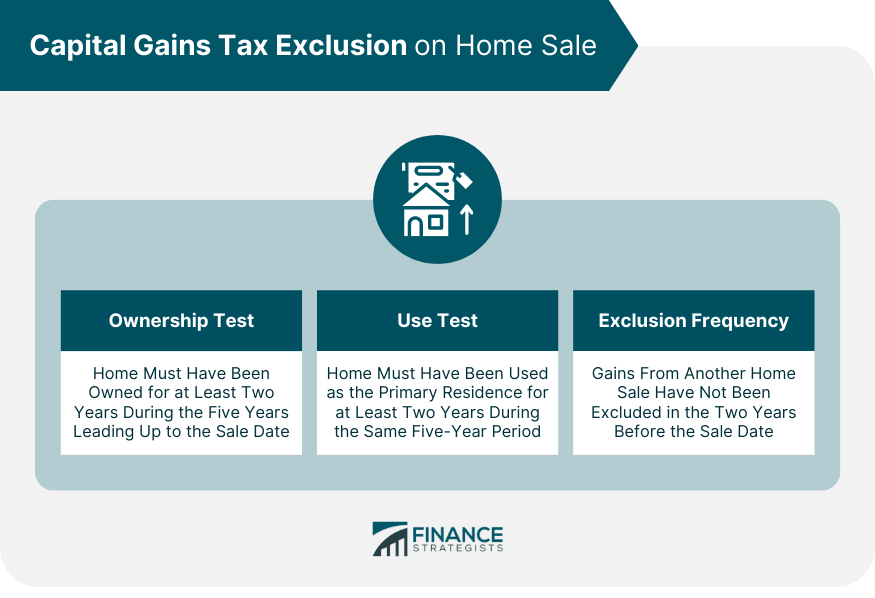

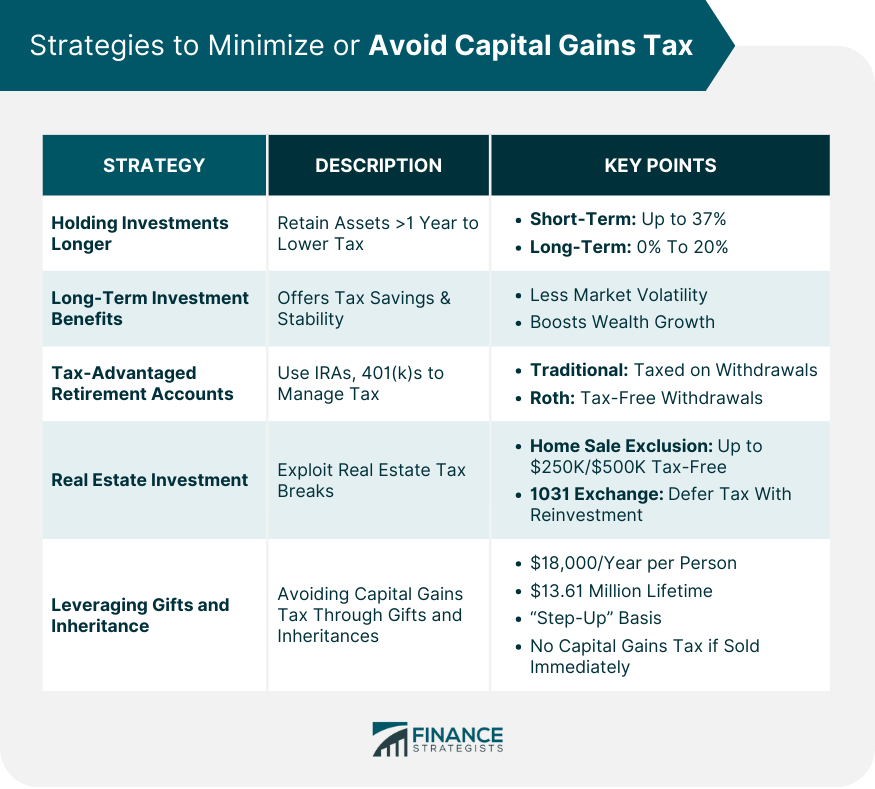

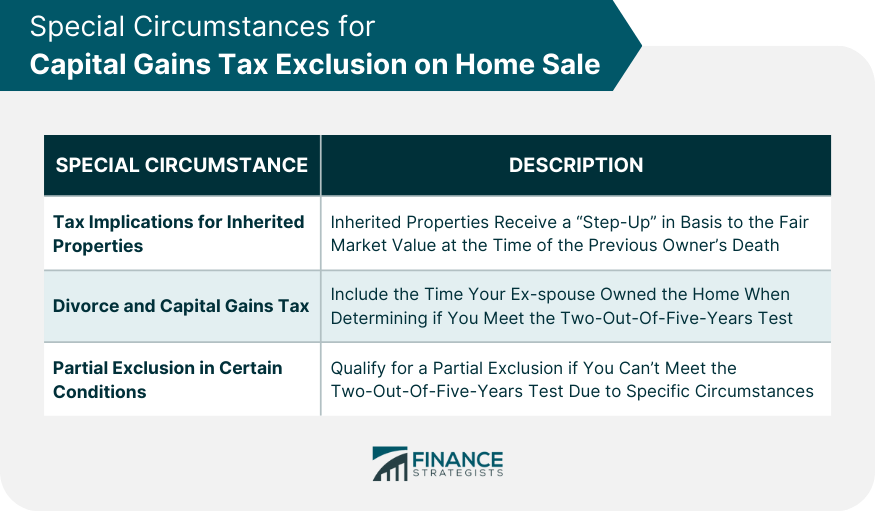

The primary residence exclusion, officially known as Section 121 of the Internal Revenue Code, is a U.S. tax provision that allows homeowners to exclude up to a certain amount of the gain they realize from the sale of their primary residence from their taxable income. This potentially saves a significant amount in capital gains tax. An individual homeowner can exclude up to $250,000 in gain, while married couples filing jointly can exclude up to $500,000. The IRS stipulates three primary qualifying conditions that homeowners must meet to take advantage of the capital gains tax exclusion. These conditions include the ownership test, the use test, and the exclusion frequency rule. The first qualifying condition for the capital gains tax exclusion is the ownership test. Under this test, the homeowner must have owned the home for at least two years during the five years leading up to the sale date. This doesn't necessarily mean two continuous years, but rather a total of two years within the specified five-year period. The ownership test was designed to encourage long-term home ownership and discourage speculative property trading. However, it's important to note that the IRS provides certain exceptions to the ownership test for special circumstances, such as death, divorce, or disaster. The use test is the second qualifying condition for the capital gains tax exclusion. According to this test, the home must have been used as the primary residence for at least two years during the same five-year period leading up to the sale date. This means that the homeowner must have actually lived in the house as their main home for at least two years. Just like the ownership test, the use test doesn't require the two years to be continuous. For example, a homeowner could live in the house for one year, rent it out for three years, and then move back in for another year, and still satisfy the use test. Again, there are certain exceptions that the IRS provides for special situations, like changes in health, employment, or unforeseen circumstances. The third qualifying condition for the capital gains tax exclusion is related to the frequency of exclusion. Under this rule, homeowners cannot exclude gains from the sale of another home during the two years before the sale date of the current home. This means that the capital gains tax exclusion is not available to homeowners who frequently buy and sell homes. This rule is designed to limit the use of the exclusion to primarily long-term homeowners, rather than real estate traders. However, partial exclusions may be available in certain circumstances, if the homeowner does not fully meet this condition. The most straightforward way to avoid capital gains tax is by meeting the two out of five years rule. This way, even if your home appreciates significantly, you'll still be eligible for the exclusion. Although this may require careful planning, especially for those who move frequently, it is a surefire way to reduce or even eliminate capital gains tax. If you're selling an investment property, you could potentially defer capital gains tax through a like-kind or 1031 exchange. This IRS provision allows you to reinvest the proceeds from the sale into a similar type of investment property. However, the rules around this can be complex, and it's recommended to work with a tax professional or real estate attorney to ensure all requirements are met. This strategy allows real estate investors to continue growing their portfolio without the immediate burden of tax. Previously, homeowners could avoid paying capital gains tax by using the sale proceeds to buy a more expensive home. However, this law was replaced in 1997 with the current primary residence exclusion. Nonetheless, buying a more expensive home can still work in tandem with the primary residence exclusion to help you defer and reduce long-term capital gains tax. This method allows you to enjoy a better property while still enjoying tax benefits. Improvements made to your home can increase the cost basis, thereby reducing the capital gains when you sell. A cost basis is the original value of an asset for tax purposes, usually the purchase price, adjusted for stock splits, dividends, and return of capital distributions. This is used to calculate the capital gain or loss on an investment for tax purposes. By keeping track of these improvements and their costs, you can legitimately increase your home's cost basis, thus potentially lowering your capital gains tax obligation. If you've inherited a property, you typically receive a "step-up" in basis, which means the cost basis of the property is the fair market value at the time of the previous owner's death. This can significantly reduce capital gains tax when you sell the property. This step-up can potentially erase large taxable gains that had accrued during the decedent’s lifetime, providing a silver lining in what is often a difficult time. If you transferred your home to a spouse or ex-spouse as part of a divorce settlement, you can include the time they owned the home when determining if you meet the two-out-of-five-years test. This means you don't lose out on the opportunity to exclude gains just because of the change in ownership. This provision can be incredibly beneficial during a period that is often financially challenging. If you're unable to meet the two-out-of-five-years test due to unforeseen circumstances like health issues, job changes, or other situations, you may be eligible for a partial exclusion. The IRS has specific guidelines defining these circumstances, and it's always advisable to consult with a tax professional. Remember, even a partial exclusion can result in substantial tax savings. While many people handle their taxes independently, there are times when seeking professional tax advice can be worthwhile. If you're dealing with complex issues like selling a home, particularly if large capital gains are involved, getting professional advice can ensure you understand all the tax implications and opportunities to reduce your tax burden. Professionals stay up-to-date with changing tax laws and can provide insights that you may not be aware of. Choosing the right tax advisor requires careful consideration. Look for professionals who are experienced in real estate transactions and capital gains tax. They should have an in-depth understanding of tax laws and be able to provide clear advice tailored to your personal situation. Remember, a good tax advisor can provide not only valuable advice but also peace of mind. Navigating the complexities of capital gains tax on home sales can be challenging, but understanding the qualifications for tax exclusion, along with strategic planning, can significantly minimize or even avoid these taxes. Living in your home for a minimum of two years, utilizing a 1031 exchange for investment properties, upgrading your residence, and adjusting your cost basis through home improvements are all viable strategies. Special circumstances, such as inherited properties, divorce, and unforeseen situations, may also influence your capital gains tax obligations. To maximize benefits and ensure compliance with tax laws, professional tax advice is highly recommended, especially when large capital gains are involved. By choosing a tax advisor with real estate and capital gains expertise, you can confidently navigate your tax situation, make informed decisions, and potentially realize substantial savings. Understanding Capital Gains Tax

Qualifying Conditions for Capital Gains Tax Exclusion on Home Sale

Ownership Test

Use Test

Exclusion Frequency

Strategies to Minimize or Avoid Capital Gains Tax

Live in the Home for at Least Two Years

Use a 1031 Exchange for Investment Properties

Upgrade to a More Expensive Home

Make Home Improvements and Adjust Cost Basis

Special Circumstances for Capital Gains Tax Exclusion on Home Sale

Tax Implications for Inherited Properties

Divorce and Capital Gains Tax

Partial Exclusion in Certain Conditions

Role of Tax Professionals in Capital Gains Planning

When to Seek Professional Tax Advice

Choose the Right Tax Advisor for Your Situation

Bottom Line

Strategies on How to Avoid Capital Gains Tax on Your House FAQs

Capital gains tax is a levy on the profit made from selling a house. It's based on the appreciation in the house's value during the time you owned it.

The primary residence exclusion allows you to exclude up to $250,000 ($500,000 for married couples) of capital gains on your home sale from your taxable income, given that you meet specific requirements.

Living in your house for at least two of the last five years before the sale qualifies you for the primary residence exclusion, allowing you to avoid capital gains tax.

A 1031 exchange allows you to defer capital gains tax on investment properties. You must reinvest the proceeds from the original sale into a similar investment property.

A tax advisor can provide expert guidance on tax laws and strategies, helping you navigate complex situations and maximize your tax savings when selling your house.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.