Tax loss carryforward refers to the mechanism that allows taxpayers, both individuals and corporations, to offset taxable income in future years using the losses they've incurred in the current year. This feature essentially "carries forward" the loss to offset future profits and potentially reduce tax liabilities in those subsequent years. The concept of tax loss carryforward has its roots in ensuring fairness within the tax system. It was introduced to ensure that businesses with fluctuations in profitability do not face an undue tax burden during successful periods due to a temporary setback or a downturn in a particular year. Tax loss carryforward was implemented as a cushion for businesses and individuals facing unexpected losses. The aim was to provide a safety net, allowing them to recoup losses in future prosperous years. For corporations, especially those in industries with volatile earnings, tax loss carryforward is an essential tool to stabilize tax obligations over time. Individuals, especially those in businesses or with significant investments, can also use this feature to mitigate the impact of a particularly bad financial year, ensuring that a single year's loss does not unfairly influence their long-term financial planning. NOL arises when a business's tax deductions exceed its taxable income within a tax year. This figure forms the basis for tax loss carryforwards and represents the amount that can potentially be offset against future taxable profits. Deductible losses encompass not just operational losses but also capital losses from the sale of assets, unrecouped costs of investments, and other financial setbacks. Each jurisdiction has specific rules about what constitutes a deductible loss. Most jurisdictions have set limits on how long you can carry forward a tax loss. For instance, in some regions, you may carry forward the loss indefinitely until it's fully offset against future profits, while others may restrict this to a set number of years. In subsequent profitable years, the carried forward tax loss can be deducted from the taxable profit, thus reducing the tax obligation for that year. It's crucial to be aware of the order in which multiple years' worth of losses are applied, with earlier years typically being utilized first. By offsetting taxable income in prosperous years with previous losses, businesses, and individuals can substantially decrease their tax bill, thereby conserving cash. With a reduced tax bill, businesses can retain a larger portion of their profits, aiding in liquidity management and supporting operational needs or expansion plans. With tax loss carryforward in mind, businesses and individuals can decide on realizing certain losses in a given year, knowing they can be offset in future profitable years. Tax loss carryforward provides leeway in deciding when to sell or retain assets, based on projected future profits and existing carryforward losses, to optimize the tax outcome. One of the significant challenges is the potential expiration of carryforwards before they're fully used, especially in jurisdictions with time limitations. The potential expiration can affect strategic decisions, especially when businesses are uncertain about generating enough profits in the carryforward period to utilize the losses. Maintaining accurate and comprehensive records of tax losses and the subsequent use of these losses can be administratively intensive, demanding additional resources. If there are discrepancies in how tax losses are calculated or applied, it might lead to disputes with tax authorities, further straining resources and potentially leading to penalties. Tax laws, by nature, are dynamic. They evolve in response to shifts in the economic, political, and social landscapes. For businesses and individuals looking to harness the full potential of tax loss carryforwards, a keen awareness of these shifts becomes crucial. This awareness not only prevents inadvertent legal missteps but also opens doors to new avenues of tax savings. By regularly monitoring changes, businesses can strategically adjust and refine their tax strategies, ensuring they derive maximum benefits while remaining compliant. The importance of detailed bookkeeping cannot be overstated when it comes to tax matters. An up-to-date and accurate record aids in meticulously tracking tax loss carryforwards. This ensures that no potential tax breaks slip through the cracks. Moreover, when tax authorities request documentation or validation, organized records facilitate smoother audits and verifications. Implementing digital accounting tools and software can further streamline this process, allowing for easy access and retrieval of financial data when needed. A tax professional can offer insights tailored to a business's unique financial situation. They can illuminate potential pitfalls, highlight opportunities, and devise strategies to optimize the use of tax loss carryforwards. Moreover, in the event of regulatory changes, these professionals can offer timely advice, ensuring businesses and individuals pivot effectively. The dual challenge for businesses and individuals is to derive the utmost advantage from tax loss carryforwards while strictly adhering to regulatory mandates. Here, again, tax professionals play a pivotal role. With their in-depth knowledge, they can chart out a roadmap that perfectly balances benefit optimization with stringent compliance. By following such a roadmap, businesses can ensure that they not only reduce their tax liabilities but also fortify their financial position in the long run, all the while staying within the boundaries of the law. Tax loss carryforward serves as a pivotal tool in the financial toolkit for businesses and individuals, enabling them to stabilize tax obligations by applying losses from one year to future profitable periods. Rooted in the principle of tax fairness, it offers a reprieve during years of profitability by reflecting the challenges faced in leaner times. While there are undeniable advantages, such as improved cash flow and strategic tax planning, one must navigate potential pitfalls like carryforward expirations and intricate record-keeping demands. As tax laws evolve, staying informed and seeking expert guidance becomes paramount. In a fluctuating economic landscape, understanding and effectively leveraging tax loss carryforward can be the difference between merely surviving and thriving financially.What Is Tax Loss Carryforward?

How Tax Loss Carryforward Works

Calculation of Tax Losses

Understanding Net Operating Losses (NOL)

Determining Deductible Losses

Application to Future Tax Years

Carryforward Periods and Limits

Application Against Future Profits

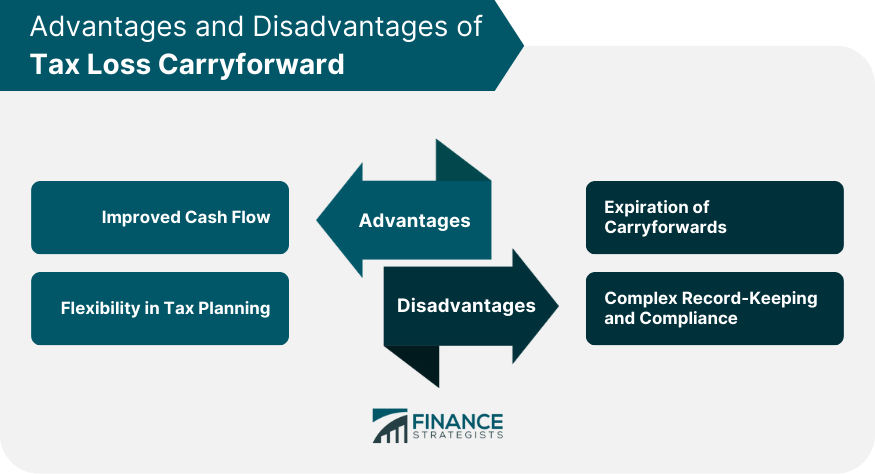

Advantages of Tax Loss Carryforward

Improved Cash Flow

Reduced Tax Liability in Profitable Years

Enhanced Liquidity for Businesses

Flexibility in Tax Planning

Strategic Realization of Losses

Timing Advantages

Disadvantages of Tax Loss Carryforward

Expiration of Carryforwards

Losses May Expire Before They Can Be Utilized

Impact on Long-Term Business Planning

Complex Record Keeping and Compliance

Requirements for Tracking and Reporting

Potential for Disputes With Tax Authorities

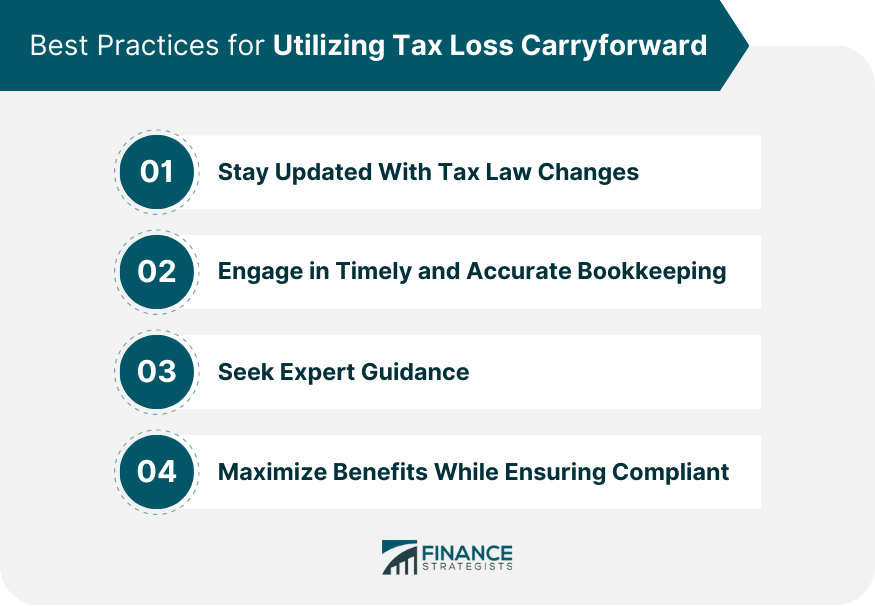

Best Practices for Utilizing Tax Loss Carryforward

Stay Updated With Tax Law Changes

Engage in Timely and Accurate Bookkeeping

Seeking Expert Guidance

Maximizing Benefits While Ensuring Compliant

Final Thoughts

Tax Loss Carryforward FAQs

Tax loss carryforward allows taxpayers, both businesses and individuals, to apply their financial losses from one year to offset taxable income in future years. This helps reduce tax liabilities in those subsequent profitable years.

The duration for which you can carry forward a tax loss varies by jurisdiction. Some regions allow indefinite carryforward until the loss is fully utilized, while others restrict it to a specific number of years. It's vital to understand the regulations in your respective jurisdiction.

Net Operating Losses (NOL) occur when a business's allowable tax deductions exceed its taxable income for a tax year. This NOL amount can potentially be carried forward to offset future taxable profits.

Yes, challenges include the potential expiration of carryforwards before they're fully utilized, especially in areas with time limits. Additionally, businesses may face complex record-keeping and compliance requirements, with potential disputes arising with tax authorities over discrepancies.

It's beneficial to consult a tax professional when planning significant financial decisions, navigating complex tax scenarios, or if there are uncertainties about how to optimally use tax loss carryforwards. Experts can provide guidance on compliance and maximizing financial benefits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.