The Common Reporting Standard (CRS) is an international agreement designed to facilitate the automatic exchange of financial account information between participating jurisdictions. Developed by the Organization for Economic Co-operation and Development (OECD), CRS aims to increase transparency in global tax matters and combat tax evasion. Tax authorities can more effectively identify and address tax evasion and fraud by sharing financial account information. Before the implementation of the CRS, information exchange between countries primarily relied on the exchange of information on request. This method proved insufficient in tackling global tax evasion, as it needed to be faster and often required extensive evidence to support the request. The CRS was developed in response to the need for a more efficient and comprehensive approach to sharing financial account information. Its purpose is to enhance tax transparency, fight tax evasion, and promote fairness and integrity in the global tax system. The CRS promotes tax transparency by facilitating the automatic exchange of financial account information between participating jurisdictions. Financial institutions must collect and report account holder information, which is then shared with tax authorities in the account holder's country of residence. This increased transparency allows tax authorities to identify undeclared assets and income held in offshore accounts, ensuring taxpayers accurately report their financial affairs. By sharing financial account information, the CRS makes it more difficult for individuals and entities to evade taxes by hiding assets and income in offshore accounts. The automatic exchange of information makes it easier for tax authorities to detect and pursue tax evaders, reducing tax fraud opportunities. Ultimately, this helps to ensure that taxpayers are paying their fair share of taxes and contributes to the overall fairness and integrity of the global tax system. At the heart of the CRS is the Automatic Exchange of Information (AEOI), which refers to the systematic and periodic transmission of taxpayer information by the source jurisdiction to the taxpayer's jurisdiction of residence. AEOI eliminates the need for specific information requests and allows tax authorities to receive financial account information on a regular basis. This streamlined process improves the efficiency and effectiveness of cross-border tax information exchange. Financial institutions play a critical role in implementing CRS, as they are responsible for conducting due diligence on their account holders. This involves identifying reportable accounts, collecting account holder information, and reporting this information to the relevant tax authorities. To ensure compliance, financial institutions must establish and maintain appropriate policies, procedures, and controls that enable them to identify and report the required information accurately. The implementation of the CRS has taken place in stages, with early adopters commencing the exchange of information in 2017. These early adopters included several European Union (EU) member states and other jurisdictions committed to tax transparency. Following the success of the early adopters, a wider group of jurisdictions began implementing CRS, with over 100 countries now participating in the automatic exchange of information. To participate in the CRS, jurisdictions must implement domestic legislation and regulations that align with the CRS requirements. This includes adopting due diligence procedures for financial institutions, reporting requirements, and mechanisms for exchanging information with other jurisdictions. Once the necessary legislation and regulations are in place, jurisdictions can move forward with the automatic exchange of information under the CRS framework. Financial institutions must review their records for pre-existing individual accounts to identify any reportable accounts under CRS. This involves determining the account holder's jurisdiction of residence based on available information, such as mailing addresses, telephone numbers, and tax identification numbers. If an account is identified as reportable, the financial institution must collect the required information and report it to the relevant tax authority. For new individual accounts, financial institutions must obtain a self-certification from the account holder, including their residence jurisdiction and tax identification number. The financial institution must validate this self-certification, and any discrepancies must be resolved before the account can be opened. If the account is deemed reportable, they must report the required information to the relevant tax authority. Under the CRS, financial institutions are required to report specific information about their account holders and their financial accounts. This information includes: Account Holder Information: Name, address, jurisdiction of residence, and tax identification number. Account Balance or Value: The total balance or value of the account at the end of the reporting period. Gross Proceeds from the Sale or Redemption of Financial Assets: Proceeds from the sale or redemption of assets held in the account. Financial institutions must report the required account information to their local tax authority annually. The information is then shared with the account holder's jurisdiction of residence through the automatic exchange of information process. This regular reporting helps to ensure that tax authorities have access to up-to-date information about their taxpayers' offshore financial accounts. To participate in the CRS, jurisdictions must meet certain criteria, including implementing domestic legislation and regulations that align with the CRS requirements and establishing information exchange agreements with other participating jurisdictions. Additionally, participating jurisdictions must demonstrate a commitment to tax transparency and be willing to share financial account information with other jurisdictions in accordance with the CRS framework. Over 100 countries are currently participating in the CRS, including major financial centers and emerging economies. The list of participating jurisdictions continues to grow as more countries commit to enhancing tax transparency and combating tax evasion. The OECD regularly updates the list of participating jurisdictions on its website. Non-participating jurisdictions may face reputational risks and potential sanctions from other countries, as they are perceived to be less committed to tax transparency and the fight against tax evasion. Additionally, financial institutions in participating jurisdictions must apply stricter due diligence procedures to accounts held by residents of non-participating jurisdictions, which may discourage investment and financial transactions with these countries. Implementing CRS has increased compliance requirements for taxpayers and financial institutions. Taxpayers must ensure that they accurately report their offshore financial accounts and income, while financial institutions must establish and maintain effective due diligence procedures and reporting systems. Failure to comply with these requirements can result in penalties, fines, and reputational damage. Non-compliance with the CRS can result in significant penalties for both taxpayers and financial institutions. Taxpayers who fail to report their offshore financial accounts accurately and income may face increased scrutiny from tax authorities and fines and penalties for tax evasion. Financial institutions that fail to comply with their due diligence and reporting obligations may also face fines, penalties, and reputational harm. One of the primary criticisms of the CRS is the potential risk to personal privacy and data protection. The automatic exchange of financial account information raises concerns about the security and confidentiality of sensitive personal data and the potential for misuse by tax authorities or other parties. To address these concerns, the OECD has established strict guidelines for protecting personal data. Participating jurisdictions must implement robust data security measures to ensure the confidentiality of the information exchanged. Implementing the CRS has resulted in significant costs for financial institutions, as they must invest in new systems and processes to comply with the due diligence and reporting requirements. This has raised concerns about the financial burden placed on smaller financial institutions and the potential for these costs to be passed on to customers through higher fees and charges. Some critics argue that the CRS may have unintended consequences, such as encouraging taxpayers to move their assets to non-participating jurisdictions or finding other ways to evade taxes. Additionally, the increased compliance requirements and costs associated with CRS implementation may create barriers to entry for new financial institutions, potentially reducing competition and innovation in the financial sector. The Common Reporting Standard (CRS) represents a significant step forward in the global effort to enhance tax transparency and combat tax evasion. By facilitating the automatic exchange of financial account information between participating jurisdictions, the CRS enables tax authorities to more effectively identify and address tax evasion, thereby promoting fairness and integrity in the global tax system. Despite the criticisms and challenges associated with its implementation, the CRS has notably impacted global tax transparency and fairness. As more jurisdictions adopt the CRS and participate in the automatic exchange of information, the overall effectiveness of the CRS will likely continue to improve, creating a more equitable and transparent global tax environment.What Is the Common Reporting Standard (CRS)?

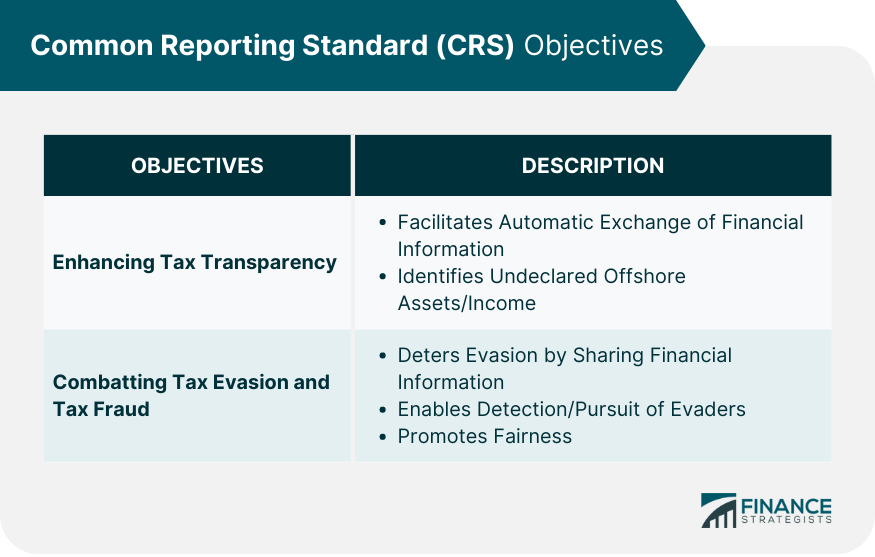

CRS Objectives

Enhancing Tax Transparency

Combatting Tax Evasion and Tax Fraud

Key Components of CRS

Automatic Exchange of Information (AEOI)

Due Diligence Procedures for Financial Institutions

Implementation of CRS

Stages of Implementation

Domestic Legislation and Regulations

Due Diligence Procedures

Pre-existing Individual Accounts

New Individual Accounts

Reporting Requirements

Financial Account Information to be Reported

Reporting Timeframe and Frequency

Participating Jurisdictions

Criteria for Participation

List of Participating Jurisdictions

Non-participating Jurisdictions and Their Implications

Impact of CRS on Taxpayers and Financial Institutions

Compliance Requirements

Penalties for Non-compliance

Criticisms and Controversies

Privacy and Data Protection Concerns

Implementation Costs

Unintended Consequences

Conclusion

Common Reporting Standard (CRS) FAQs

The Common Reporting Standard (CRS) is a global standard for the automatic exchange of financial account information between tax authorities of different countries. It aims to enhance tax transparency and combat tax evasion by providing tax authorities with information about the offshore financial accounts of their residents. CRS is important because it helps prevent tax evasion and ensures that individuals and entities pay their fair share of taxes.

The Common Reporting Standard (CRS) requires financial institutions in participating countries to collect and report information about the financial accounts held by non-resident individuals and entities to their local tax authorities. The information is then exchanged automatically between the tax authorities of the participating countries annually. This allows tax authorities to identify and address potential tax evasion cases involving offshore accounts.

Over 100 countries and jurisdictions have committed to implementing the Common Reporting Standard (CRS). These countries include major financial centers and a wide range of developed and developing countries. The Organisation for Economic Co-operation and Development (OECD) maintains the list of participating countries and is subject to change as more countries join the initiative.

Under the Common Reporting Standard (CRS), financial institutions must report certain information about the financial accounts held by non-resident individuals and entities. This information includes the account holder's name, address, tax identification number, account number, account balance or value, and certain income and payments associated with the account (e.g., interest, dividends, and proceeds from the sale of financial assets).

The Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA) are both initiatives to enhance tax transparency and combat tax evasion. However, there are key differences between the two. FATCA is a U.S. law that requires foreign financial institutions to report information about financial accounts held by U.S. taxpayers to the U.S. Internal Revenue Service (IRS). Conversely, CRS is a global standard developed by the OECD and involves the automatic exchange of financial account information between participating countries. While FATCA is specific to the U.S., CRS has a broader scope and includes many more participating countries.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.