The De Minimis Tax Rule refers to a provision in tax laws that allows for the exemption or simplified treatment of small-scale or low-value transactions. In the context of real estate investment, it provides certain advantages and benefits to investors by reducing administrative burden and simplifying tax calculations for smaller real estate transactions. Understanding the De Minimis Tax Rule is crucial for real estate investors as it provides opportunities for tax savings and encourages small-scale real estate investments. By taking advantage of this rule, investors can streamline their tax compliance obligations and potentially reduce the overall tax liability associated with their real estate investments. The De Minimis Tax Rule is a tax provision that allows for exemptions or simplified treatment of transactions below a certain threshold. It recognizes that small-scale transactions may not require the same level of administrative effort or have significant tax implications compared to larger transactions. This rule aims to reduce the administrative burden on taxpayers and promote efficiency in tax compliance. The De Minimis Tax Rule is applicable to real estate investments, particularly for smaller transactions. It offers simplified tax treatment, which means that investors may have reduced reporting obligations and simplified tax calculations for transactions that fall below the specified threshold limits. The De Minimis Tax Rule establishes threshold limits or exemptions, which vary depending on the tax jurisdiction and specific regulations. These thresholds are typically set based on the value or nature of the transaction. Transactions that fall below these thresholds may be exempted from certain tax reporting requirements or subject to simplified tax calculations. One of the primary advantages of the De Minimis Tax Rule is the reduction of administrative burden for small-scale real estate transactions. By exempting or simplifying reporting obligations, taxpayers are relieved of certain administrative requirements, such as detailed record-keeping or complex tax calculations. The De Minimis Tax Rule simplifies tax calculations for small-scale real estate investments. Instead of applying complex tax rules and calculations, investors can benefit from a simplified approach, which saves time and effort in determining their tax liability. The De Minimis Tax Rule encourages small-scale real estate investments by providing favorable treatment for these transactions. The simplified tax compliance requirements and potential tax savings incentivize investors to engage in smaller real estate deals, which can contribute to economic growth and stimulate the real estate market. By exempting or simplifying the tax treatment for small-scale transactions, investors may reduce their overall tax liability, leading to potential savings and improved profitability in their real estate investments. While the De Minimis Tax Rule provides benefits for small-scale transactions, it may not be applicable or beneficial for larger real estate investments. Investors engaged in substantial real estate deals may still be subject to complex tax rules and reporting requirements, which could increase their administrative burden and limit the advantages of the De Minimis Tax Rule. The De Minimis Tax Rule may involve trade-offs and trade restrictions for investors. Depending on the specific regulations, investors may need to consider certain limitations or trade-offs in exchange for the simplified tax treatment. These restrictions could include limitations on deductible expenses, capital gains treatment, or the ability to claim certain tax credits. It is important to note that the De Minimis Tax Rule does not exist in isolation but interacts with other tax regulations and rules. Investors need to consider how this rule aligns with other tax provisions and ensure compliance with all relevant tax laws and regulations. Failing to do so could result in unintended tax consequences or non-compliance with tax obligations. Although the De Minimis Tax Rule simplifies tax compliance for smaller real estate transactions, investors must still maintain proper documentation and records. Keeping accurate and organized records of transactions, receipts, and supporting documents is essential to demonstrate compliance with tax regulations and to fulfill reporting obligations when required. While the De Minimis Tax Rule may exempt or simplify certain reporting requirements, investors must ensure they comply with any reporting obligations to the relevant tax authorities. It is important to understand the specific requirements of the tax jurisdiction and to stay informed about any changes or updates to reporting obligations that may apply to real estate investments. Navigating tax regulations and understanding the implications of the De Minimis Tax Rule can be complex. Seeking professional advice and guidance from tax professionals, accountants, or legal experts who specialize in real estate taxation is recommended. These professionals can provide valuable insights and ensure compliance with the applicable tax laws while maximizing the benefits of the De Minimis Tax Rule. The De Minimis Tax Rule is a tax provision that provides exemptions or simplified treatment for small-scale real estate transactions. It is applicable to real estate investments, providing simplified tax treatment for smaller transactions. It offers advantages such as reduced administrative burden, simplified tax calculations, and potential tax savings for investors engaged in smaller real estate deals. However, it may have limitations for larger real estate investments and requires careful consideration of trade-offs and compliance with other tax regulations. By considering the thresholds, exemptions, and compliance requirements associated with the rule, investors can make informed decisions and optimize the tax treatment of their real estate investments.What Is the De Minimis Tax Rule?

Understanding the De Minimis Tax Rule

Explanation of the De Minimis Tax Rule

Applicability to Real Estate Investments

Threshold Limits and Exemptions

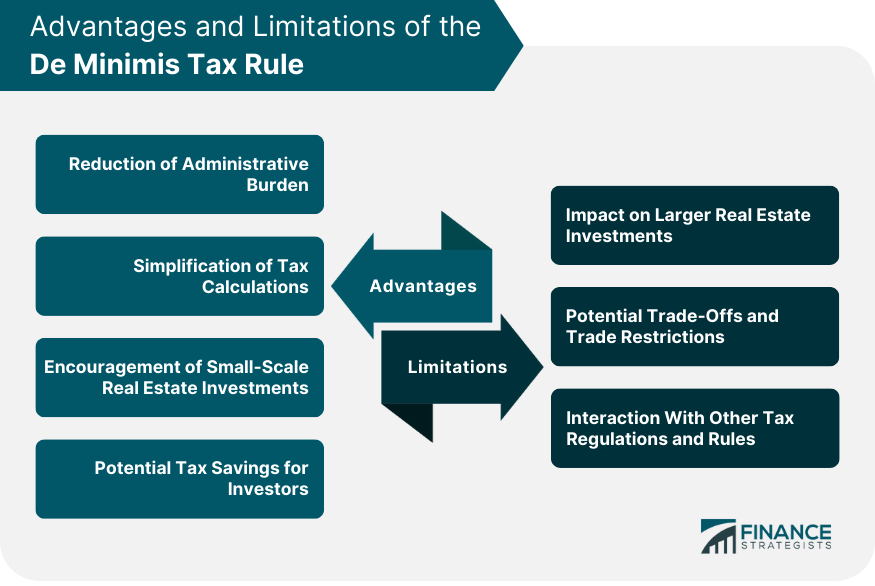

Advantages of the De Minimis Tax Rule

Reduction of Administrative Burden

Simplification of Tax Calculations

Encouragement of Small-Scale Real Estate Investments

Potential Tax Savings for Investors

Limitations of the De Minimis Tax Rule

Impact on Larger Real Estate Investments

Potential Trade-Offs and Trade Restrictions

Interaction With Other Tax Regulations and Rules

Compliance and Reporting Requirements

Documentation and Record-Keeping Obligations

Reporting Obligations to Tax Authorities

Professional Advice and Guidance

Final Thoughts

De Minimis Tax Rule FAQs

The applicability of the De Minimis Tax Rule may vary depending on the tax jurisdiction and specific regulations. In some cases, the rule may be limited to certain types of real estate transactions, such as residential properties or properties below a certain value threshold. It is important to consult the tax laws and regulations of the relevant jurisdiction to determine if and how the De Minimis Tax Rule applies.

Yes, the De Minimis Tax Rule can apply to real estate investment properties held for rental income. If the rental property falls within the threshold limits set by the rule, investors may benefit from simplified tax calculations and reduced reporting obligations. However, it is crucial to understand the specific rules and requirements of the tax jurisdiction to ensure compliance.

While the De Minimis Tax Rule can provide advantages and simplify tax compliance, there are potential risks to consider. Relying solely on the De Minimis Tax Rule for tax planning purposes without fully understanding other tax regulations and rules could lead to unintended non-compliance or missed opportunities for tax optimization. It is advisable to seek professional advice and consider the complete tax landscape before making tax planning decisions.

The De Minimis Tax Rule can apply to both individual and corporate real estate investors, depending on the specific regulations and thresholds set by the tax jurisdiction. However, it is important to note that there may be variations in the application of the rule based on the taxpayer's classification. Consultation with tax professionals is recommended to determine the specific implications for individual or corporate real estate investors.

Tax laws and regulations are subject to change over time, including the provisions related to the De Minimis Tax Rule. It is crucial for investors to stay informed about any changes or updates to the rule that may affect their real estate investments. Regularly consulting with tax professionals, staying updated on tax legislation, and conducting due diligence are essential to ensure compliance and optimize tax planning strategies related to the De Minimis Tax Rule.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.