What Is the Economic Recovery Tax Act of 1981 (ERTA)?

The Economic Recovery Tax Act of 1981 was a significant tax legislation passed in the United States under President Ronald Reagan.

It aimed to stimulate economic growth, reduce unemployment, and curb inflation through a series of tax cuts and incentives for individuals and businesses.

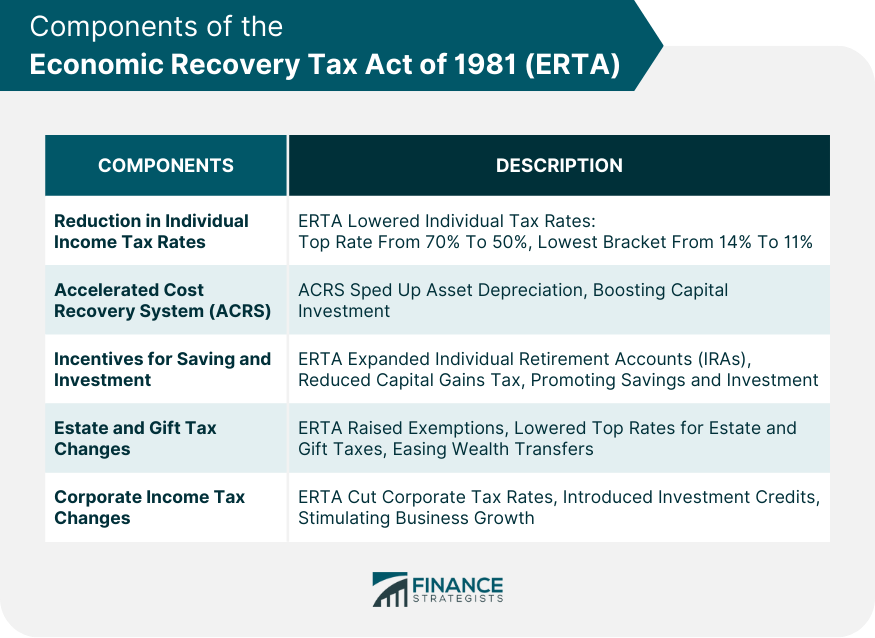

ERTA implemented significant tax cuts across various fronts. It reduced individual income tax rates by lowering the top marginal tax rate from 70% to 50% and reducing the lowest bracket from 14% to 11%.

These rate reductions incentivized consumer spending, provided individuals with more disposable income, and encouraged entrepreneurship.

The Act also introduced the Accelerated Cost Recovery System (ACRS), a new method of calculating depreciation for business assets.

By replacing the traditional depreciation methods, such as straight-line and declining balance, ACRS allowed businesses to recover the costs of their investments more rapidly.

This change aimed to stimulate capital investment, encourage businesses to update and expand their infrastructure, and foster economic growth.

Components of the Economic Recovery Tax Act of 1981

Reduction in Individual Income Tax Rates

Tax Brackets and Rate Changes

ERTA reduced individual income tax rates across all tax brackets. The top marginal tax rate was reduced from 70% to 50%, while the lowest bracket was cut from 14% to 11%.

Implementation Timeline

The tax rate reductions were implemented in three phases from 1981 to 1984.

Accelerated Cost Recovery System (ACRS)

Depreciation Calculation Methods

The ACRS introduced a new method of calculating depreciation for business assets, replacing the traditional straight-line and declining balance methods. This system allowed businesses to recover costs more quickly and stimulated investment in capital assets.

Impact on Investment and Businesses

The ACRS led to increased business investment and capital spending, ultimately resulting in job creation and economic growth.

Incentives for Saving and Investment

Individual Retirement Accounts (IRAs)

ERTA expanded the availability of IRAs, allowing all taxpayers to contribute to these tax-deferred retirement accounts, regardless of their participation in employer-sponsored retirement plans.

Reduction in Capital Gains Tax

Capital gains tax rates were lowered, encouraging individuals and businesses to invest more in stocks, bonds, and other financial assets.

Estate and Gift Tax Changes

Increase in Exemption Amounts

ERTA increased the estate tax exemption amount, reducing the number of estates subject to taxation.

Reduction in Tax Rates

The legislation also lowered the top estate and gift tax rates, further alleviating the tax burden on wealth transfers.

Corporate Income Tax Changes

Reduction in Corporate Tax Rates

ERTA lowered corporate income tax rates, making the United States more competitive in the global market and promoting business growth.

Investment Tax Credits

The Act introduced investment tax credits, incentivizing businesses to invest in new equipment and machinery, spurring economic growth.

Economic Impact of the Economic Recovery Tax Act of 1981

Short-Term Effects

Consumer Spending and Economic Growth

The initial tax rate reductions led to increased consumer spending, contributing to short-term economic growth.

Business Investment and Expansion

The ACRS and investment tax credits spurred businesses to invest in new equipment and expand operations, further stimulating the economy.

Long-Term Effects

Job Creation and Unemployment Rate

ERTA's provisions helped create new jobs and reduce the unemployment rate in the long run.

Tax Revenues and Federal Budget Deficit

While the Act was successful in stimulating the economy, it also led to a decrease in tax revenues, contributing to the federal budget deficit.

Influence on Subsequent Tax Reforms

Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA)

TEFRA was enacted in response to the revenue losses and increased deficits resulting from ERTA. This legislation aimed to increase tax revenues by closing loopholes, limiting tax deductions, and raising certain taxes.

Tax Reform Act of 1986 (TRA)

The TRA was a major tax reform that simplified the tax code and further lowered individual and corporate tax rates. It was influenced by the successes and shortcomings of ERTA and aimed to create a more efficient and equitable tax system.

Criticisms of the Economic Recovery Tax Act of 1981

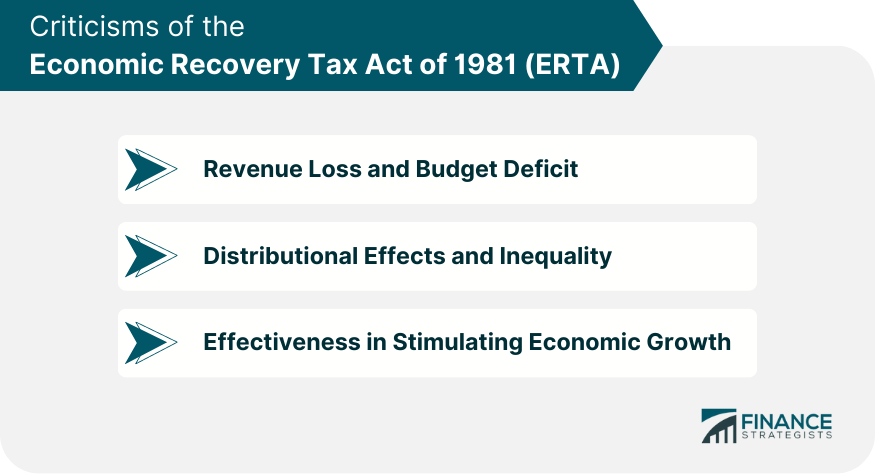

Revenue Loss and Budget Deficit

One of the main criticisms of ERTA was its contribution to revenue loss and the subsequent increase in the federal budget deficit. Critics argued that the tax cuts were not offset by sufficient economic growth or spending cuts.

Distributional Effects and Inequality

Another criticism of ERTA was that its provisions disproportionately benefited high-income earners and corporations, exacerbating income inequality in the United States.

Effectiveness in Stimulating Economic Growth

While ERTA did have some positive effects on the economy, its overall effectiveness in stimulating long-term economic growth has been debated.

Some argue that the benefits were short-lived and that the long-term consequences, such as increased deficits, outweighed the gains.

Legacy of the Economic Recovery Tax Act of 1981 (ERTA)

Shift in US Tax Policy

ERTA marked a significant shift in U.S. tax policy, emphasizing supply-side economics and tax cuts as a means to stimulate economic growth. This approach would continue to influence tax policy in the following decades.

Influence on Later Tax Reforms and Economic Policies

The successes and failures of ERTA influenced subsequent tax reforms, such as TEFRA and TRA, as lawmakers sought to address the issues arising from the 1981 legislation.

Lessons Learned for Future Economic Recovery Efforts

ERTA offers valuable lessons for future economic recovery efforts, highlighting the importance of balancing tax cuts with revenue generation and addressing potential issues of inequality and distributional effects.

Conclusion

The Economic Recovery Tax Act of 1981 (ERTA) was a landmark tax legislation that aimed to stimulate economic growth and reduce unemployment through tax cuts and incentives for individuals and businesses.

ERTA included provisions such as lowering individual income tax rates, introducing the ACRS, incentivizing savings and investments, and altering estate and gift tax laws.

While the legislation did stimulate short-term economic growth, it also contributed to revenue loss and increased deficits.

ERTA's lasting effects include its influence on subsequent tax reforms and its role in shaping U.S. tax policy. The legislation's successes and shortcomings offer valuable lessons for future economic recovery efforts.

The ERTA played a crucial role in shaping U.S. economic policy, marking a shift towards supply-side economics and tax cuts to stimulate economic growth. Its legacy continues to influence tax policy and economic recovery efforts to this day.

Economic Recovery Tax Act of 1981 (ERTA) FAQs

The Economic Recovery Tax Act of 1981 was a U.S. law that stimulated economic growth through significant tax cuts and incentives.

ERTA included individual income tax rate reductions, an accelerated cost recovery system, incentives for saving and investment, changes to estate and gift taxes, and corporate tax rate reductions.

ERTA had short-term effects of increased consumer spending and business investment, leading to economic growth. It also had long-term effects on job creation, tax revenues, and the federal budget deficit.

ERTA served as a catalyst for subsequent tax reforms, such as the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA) and the Tax Reform Act of 1986 (TRA), which built upon and modified ERTA's provisions.

ERTA faced criticisms regarding its revenue loss and contribution to the budget deficit, concerns about its distributional effects and inequality, and debates over its effectiveness in stimulating economic growth.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.