A flat tax system is a single-rate tax applied uniformly to all income levels without considering deductions, exemptions, or varying tax brackets. It simplifies the taxation system, making it easier for taxpayers to understand and comply with tax laws. The concept of a flat tax has been debated and analyzed by economists, politicians, and tax professionals for decades. The primary goals of implementing a flat tax system include simplifying the tax code, promoting economic growth, reducing tax evasion, and ensuring transparency and fairness. Proponents of the flat tax argue that it can alleviate many of the issues associated with progressive tax systems, which often lead to complexity and loopholes that enable tax evasion. The idea of a flat tax can be traced back to the late 19th century, with American economist Henry George advocating for a single land tax. Over time, the concept evolved and gained traction in various countries. Under a flat tax system, all individuals, regardless of their income level, are subject to the same tax rate. There are no progressive tax brackets where higher income earners face higher tax rates. The single tax rate simplifies the tax structure and promotes fairness, as everyone is treated equally in terms of their tax obligations. This feature eliminates the complexity associated with multiple tax brackets, making it easier for individuals and businesses to understand and calculate their tax liabilities. Flat tax systems eliminate the need for a tiered structure of tax brackets. In traditional progressive tax systems, different income levels are taxed at varying rates, creating a complex tax structure. By removing the intricate system of tax brackets, a flat tax system streamlines the tax code and reduces administrative burden for both taxpayers and tax authorities. Taxpayers no longer need to navigate through different tax rates based on their income, simplifying tax planning and compliance. Another key feature of a flat tax system is the reduction or elimination of numerous deductions and exemptions that exist in progressive tax systems. Deductions and exemptions often complicate tax calculations and create opportunities for tax avoidance. With a flat tax, many of these deductions and exemptions are removed, resulting in a more straightforward and transparent tax structure. By minimizing or eliminating these tax breaks, a flat tax system aims to promote fairness and equal treatment among taxpayers. It reduces the chances of individuals exploiting loopholes or engaging in aggressive tax planning to reduce their tax liabilities. One of the main benefits of a flat tax system is its simplicity. With a single tax rate, taxpayers can easily calculate their tax liability, which may result in fewer errors and reduced administrative costs. This simplicity also contributes to greater compliance, as taxpayers will likely feel more relaxed by complicated tax codes. Flat tax proponents argue that it can stimulate economic growth by providing work, investment, and entrepreneurship incentives. By reducing the overall tax burden, individuals and businesses have more disposable income, which can be invested or spent, potentially boosting the economy. A flat tax system may help minimize tax evasion and avoidance by simplifying the tax code and eliminating many loopholes. When tax rates are uniform, there is less incentive for individuals and businesses to exploit the system or engage in aggressive tax planning. Flat tax systems are often seen as more transparent and fair than progressive ones. With a single rate applied to all income levels, taxpayers can easily understand their tax obligations. Additionally, the flat tax can reduce the influence of special interest groups and lobbyists, who often push for tax breaks and loopholes in progressive tax systems. Critics of flat tax systems argue that they can be regressive and exacerbate income inequality. A flat tax system typically places a higher tax burden on lower-income individuals, who pay the same percentage of their income in taxes as wealthier individuals. This may widen the income gap and disproportionately affect vulnerable populations. Implementing a flat tax system could lead to a reduction in government revenue. Lower tax rates may need to generate more revenue to maintain public services and programs, which could result in spending cuts or increased deficits. The loss of revenue could be particularly detrimental during economic downturns, when governments may need to increase spending to stimulate growth. A flat tax system eliminates tax incentives and deductions that may encourage certain behaviors or activities, such as charitable giving or investments in renewable energy. Without these incentives, taxpayers may be less likely to engage in activities that promote social welfare or contribute to economic growth. Transitioning from a progressive tax system to a flat one can be challenging. Governments may need more support from taxpayers, businesses, and interest groups that benefit from the existing system. Implementation requires careful planning, communication, and evaluation to ensure a smooth transition and minimize unintended consequences. Flat tax systems and progressive tax systems differ in their approach to taxing income. While flat tax systems apply a single tax rate to all income levels, progressive tax systems use multiple tax rates that increase as income rises. Both systems have their advantages and disadvantages, with ongoing debates surrounding their effectiveness, fairness, and economic impact. Proponents of flat tax systems argue that they are simpler, more transparent, and promote economic growth. Critics contend that flat tax systems are regressive and exacerbate income inequality. On the other hand, supporters of progressive tax systems argue that they are more equitable and generate necessary revenue for governments. Opponents claim that progressive tax systems are overly complex and create disincentives for work and investment. Some countries have adopted hybrid tax systems that combine elements of both flat and progressive tax systems. These approaches may include multiple tax rates with a broad base or a single tax rate with progressive exemptions and deductions. Hybrid systems aim to balance flat taxes' simplicity and economic growth benefits with progressive taxes' equity and revenue-generation advantages. A negative income tax is a proposed alternative to a flat tax system that provides income support for low-income individuals and families. Under this system, individuals with income below a certain threshold receive payments from the government, while those with income above the threshold pay taxes. This approach addresses poverty and income inequality without the complexity and potential disincentives associated with traditional welfare programs. A consumption tax is levied on purchasing goods and services rather than on income. This type of tax may be implemented as a sales tax, excise tax, or value-added tax (VAT). Consumption taxes shift the focus of taxation from income to spending, which may encourage saving and investment. However, consumption taxes can be regressive, as lower-income individuals typically spend a higher proportion of their income on goods and services. A value-added tax (VAT) is a consumption tax applied at each stage of production and distribution based on the value added to goods and services. VAT is widely used in many countries, including members of the European Union, as a primary source of government revenue. While VAT is relatively simple to administer and can generate significant revenue, it may disproportionately affect lower-income individuals who spend a larger share of their income on consumption. A land value tax (LVT) is a tax levied on the unimproved value of land rather than on its buildings or improvements. Proponents of LVT argue that it encourages efficient land use, discourages land speculation, and reduces tax evasion. However, implementing an LVT can be challenging due to difficulties in accurately valuing land and potential resistance from landowners. When evaluating the feasibility of a flat tax system, it is essential to consider its potential economic impact. Factors to consider include the effect on economic growth, income distribution, tax revenue, and compliance. A flat tax system may stimulate growth by encouraging investment and entrepreneurship, but it could also exacerbate income inequality and reduce government revenue. The political and social landscape plays a significant role in the feasibility of implementing a flat tax system. Public opinion, the influence of interest groups, and policymakers' priorities can all affect the likelihood of adopting a flat tax. Additionally, transitioning to a flat tax system may require significant political capital, compromise, and effective communication with stakeholders and the public. Examining international experiences with flat tax systems can provide valuable insights into the potential benefits, drawbacks, and challenges associated with their implementation. By analyzing the experiences of countries that have adopted flat taxes, such as Estonia, Latvia, and Russia, policymakers can identify best practices, avoid potential pitfalls, and adapt their approaches to suit the unique circumstances of their own countries. A flat tax system applies a single tax rate to all income levels, eliminating complex tax brackets and various deductions and exemptions. It simplifies the tax structure, enhances transparency, and reduces opportunities for tax evasion. Proponents argue that a flat tax promotes simplicity, economic growth, and fairness. However, critics raise concerns about regressivity and potential loss of government revenue. A comparison with progressive tax systems reveals distinct advantages and disadvantages of each approach. Hybrid systems combining elements of both approaches have also been adopted by some countries. Alternative tax systems, such as negative income tax, consumption tax, value-added tax (VAT), and land value tax, offer different approaches to taxation. When evaluating the feasibility of a flat tax, economic, political, and social factors must be considered, alongside lessons learned from international experiences.What Is Flat Tax?

Key Features of Flat Tax

Single Tax Rate for All Income Levels

Elimination of Complex Tax Brackets

Removal of Various Deductions and Exemptions

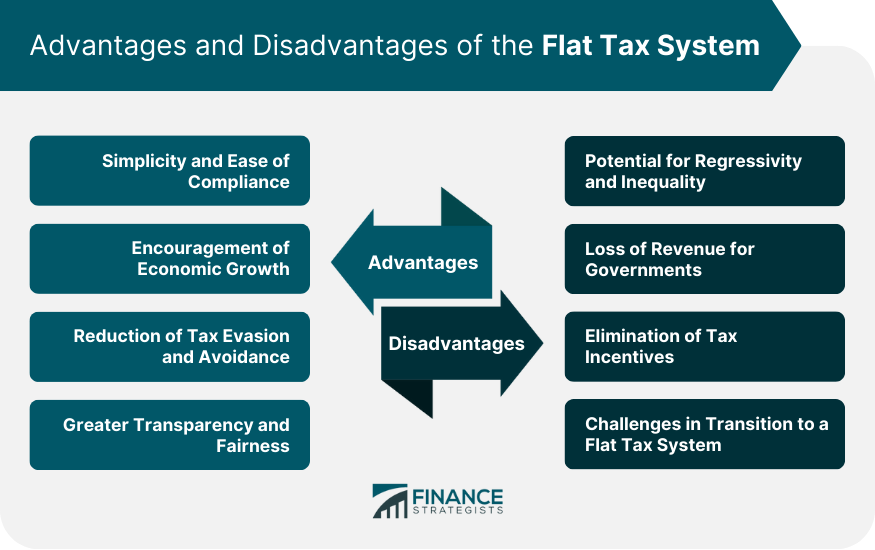

Advantages of Flat Tax

Simplicity and Ease of Compliance

Encouragement of Economic Growth

Reduction of Tax Evasion and Avoidance

Greater Transparency and Fairness

Disadvantages of Flat Tax

Potential for Regressivity and Inequality

Loss of Revenue for Governments

Elimination of Tax Incentives

Challenges in Transition to a Flat Tax System

Flat Tax vs Progressive Tax

Comparison of the Two Systems

Arguments for and Against Each System

Hybrid Approaches Combining Elements of Both Systems

Alternatives to Flat Tax

Negative Income Tax

Consumption Tax

Value Added Tax (VAT)

Land Value Tax

Evaluating the Feasibility of Flat Tax

Economic Considerations

Political and Social Factors

International Experiences and Lessons

Conclusion

Flat Tax FAQs

A flat tax is a system where individuals or businesses are taxed at a fixed rate, regardless of their income or financial situation.

The advantages of a flat tax include simplicity and ease of compliance, encouragement of economic growth, reduction of tax evasion and avoidance, and greater transparency and fairness in the tax system.

Yes, there are some disadvantages to a flat tax. These include the potential for regressivity and inequality, loss of revenue for governments, elimination of tax incentives, and challenges in transitioning to a flat tax system.

A flat tax applies a single tax rate to all taxpayers, while a progressive tax system applies different tax rates based on income levels. In a flat tax system, everyone pays the same percentage, whereas a progressive tax imposes higher rates on higher incomes.

Some alternatives to a flat tax include a negative income tax, consumption tax, value-added tax (VAT), and land value tax. These alternative systems aim to address different aspects of taxation and achieve specific objectives.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.