The Foreign Earned Income Exclusion (FEIE) is a tax provision designed to provide relief to U.S. citizens and resident aliens who earn income while living and working in foreign countries. The purpose of the FEIE is to reduce the potential for double taxation and help taxpayers avoid paying income tax in both their home country and the country where they work. To qualify for the FEIE, taxpayers must meet specific criteria related to their citizenship or residency status, their foreign residence or physical presence, and the nature of their foreign income. The FEIE is available to U.S. citizens and resident aliens who have a tax home in a foreign country. Resident aliens must also meet the requirements of a tax treaty between the United States and their country of residence. To claim the FEIE, taxpayers must establish a bona fide foreign residence or meet the physical presence test. Bona Fide Residence Test: Taxpayers can qualify as bona fide foreign residents if they can demonstrate that they have established a permanent residence in a foreign country and intend to remain there for an indefinite period. Factors that may be considered include the taxpayer's purpose for moving, the duration of their stay, and the nature of their employment or business activities. Physical Presence Test: Alternatively, taxpayers can qualify for the FEIE if they are physically present in a foreign country or countries for at least 330 full days during a consecutive 12-month period. This test focuses solely on the number of days spent abroad and does not require taxpayers to establish a permanent residence. Only earned income from foreign sources is eligible for the FEIE. Earned income includes salaries, wages, commissions, bonuses, professional fees, and self-employment income. It does not include passive income, such as interest, dividends, rents, or capital gains. The FEIE has specific limitations regarding the annual exclusion limit and the types of income that can be excluded. The FEIE has an annual exclusion limit, which is adjusted for inflation each year. For the 2024 tax year, the limit is $126,500. This means that eligible taxpayers can exclude up to $126,500 of their foreign earned income from U.S. income tax. Any amount above the exclusion limit remains subject to U.S. income tax. The FEIE applies to various types of earned income, including: Salaries and wages Commissions and bonuses Professional fees Self-employment income Certain fringe benefits, such as housing allowances or cost-of-living adjustments Some types of income are not eligible for the FEIE, including: Passive income, such as interest, dividends, rents, or capital gains Pensions or annuities Social Security benefits Unemployment compensation Scholarships, fellowships, or grants In addition to the FEIE, eligible taxpayers may also claim a foreign housing exclusion or deduction to offset the costs of housing expenses incurred while living abroad. The foreign housing exclusion or deduction allows taxpayers to exclude or deduct a portion of their housing expenses from their taxable income, providing additional tax relief for those living and working in foreign countries with higher living costs. To be eligible for the foreign housing exclusion or deduction, taxpayers must meet the same eligibility criteria as for the FEIE, including having a tax home in a foreign country and meeting either the bona fide residence or physical presence test. Qualified housing expenses include rent, utilities (excluding telephone charges), real estate taxes, insurance, and certain other expenses related to maintaining a home in a foreign country. The foreign housing exclusion or deduction is calculated by determining the excess of housing expenses over a base amount (16% of the FEIE limit) and then applying an annual housing expense limitation. The IRS adjusts the annual housing expense limitation for specific high-cost locations. There are several limitations and restrictions for the foreign housing exclusion or deduction, including: The exclusion applies only to the taxpayer's employer-provided housing costs, while the deduction applies to self-employed individuals. Taxpayers cannot claim both the exclusion and the deduction for the same expenses. The foreign housing exclusion or deduction cannot exceed the taxpayer's total foreign earned income for the tax year. To claim the FEIE and foreign housing exclusion or deduction, taxpayers must file specific forms with their U.S. income tax return. Taxpayers must complete Form 2555, Foreign Earned Income, to calculate and claim the FEIE and the foreign housing exclusion or deduction. This form requires taxpayers to provide information about their foreign residence, physical presence, and foreign earned income. In addition to Form 2555, taxpayers must also file Form 1040, U.S. Individual Income Tax Return, along with Schedule 1, Additional Income and Adjustments to Income. The excluded foreign earned income and housing expenses should be reported on Schedule 1, and the remaining taxable income should be reported on Form 1040. The regular deadline for filing a U.S. income tax return is April 15. However, taxpayers who live and work abroad may qualify for an automatic two-month extension, making their deadline June 15. Taxpayers who require additional time may request a further extension by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. The Foreign Tax Credit (FTC) is another tax provision available to U.S. taxpayers with foreign income, designed to offset taxes paid to foreign governments. It is essential to understand the differences and interactions between the FEIE and FTC to determine the optimal strategy for minimizing tax liability. The FTC allows taxpayers to claim a credit for income taxes paid or accrued to a foreign government on their U.S. income tax return, reducing their overall U.S. tax liability. While both the FEIE and FTC aim to alleviate double taxation, they function differently. The FEIE allows eligible taxpayers to exclude a specific amount of foreign earned income from U.S. taxation, while the FTC provides a credit for foreign taxes paid on foreign income. Taxpayers with foreign income may benefit from using either the FEIE or the FTC, or a combination of both, depending on their specific circumstances. Taxpayers should carefully evaluate their foreign income, tax rates, and expenses to determine the best approach for minimizing their tax liability. In some cases, it may be advantageous to claim the FEIE for certain income and the FTC for other income. Taxpayers should consult with a tax professional to develop a tailored strategy that maximizes their tax savings. While the FEIE can provide significant tax benefits for eligible taxpayers, there are several potential risks and considerations that taxpayers should be aware of before claiming the exclusion. Although the FEIE helps reduce the likelihood of double taxation, it does not entirely eliminate the possibility. Taxpayers with foreign income above the annual exclusion limit or income that does not qualify for the FEIE may still be subject to taxation in both the United States and the foreign country. In these cases, taxpayers should explore other options, such as the Foreign Tax Credit, to further mitigate double taxation. While the FEIE applies to federal income tax, individual states may have different rules regarding the taxation of foreign income. Taxpayers should review their state's tax laws and consult with a tax professional to determine the impact of the FEIE on their state tax liability. The FEIE does not exclude foreign earned income from Social Security and Medicare taxes. Taxpayers who are employees of U.S. companies working abroad may still be subject to these taxes. Self-employed taxpayers should also be aware that they may be required to pay self-employment tax on their foreign earned income, regardless of the FEIE. Claiming the FEIE may affect a taxpayer's ability to claim benefits under a tax treaty between the United States and the foreign country. Tax treaties often contain provisions that reduce or eliminate double taxation, and claiming the FEIE may limit a taxpayer's eligibility for these benefits. Taxpayers should carefully review the terms of any applicable tax treaties and consult with a tax professional to determine the potential impact of the FEIE on their tax treaty benefits. Understanding the Foreign Earned Income Exclusion is crucial for U.S. citizens and resident aliens with foreign income, as it can provide significant tax savings and help alleviate the burden of double taxation. By familiarizing themselves with the eligibility requirements, exclusion limitations, filing processes, and potential risks associated with the FEIE, taxpayers can make informed decisions about their tax planning strategies and ensure compliance with U.S. tax laws. When in doubt, it is always advisable to consult with a tax professional who has expertise in international taxation to navigate the complexities of the FEIE and maximize tax savings.What Is the Foreign Earned Income Exclusion (FEIE)?

Eligibility for Foreign Earned Income Exclusion

US Citizens and Resident Aliens

Bona Fide Foreign Residence or Physical Presence

Earned Income From Foreign Sources

Foreign Earned Income Exclusion Limitations

Annual Exclusion Limit

Types of Income Excluded

Types of Income Not Excluded

Foreign Housing Exclusion or Deduction

Definition and Purpose

Eligibility Criteria

Calculation of Foreign Housing Costs

Limitations and Restrictions

Filing Process and Tax Forms

Form 2555

Form 1040 and Schedule 1

Filing Deadlines and Extensions

Interaction With Foreign Tax Credit

Definition of Foreign Tax Credit (FTC)

Comparison of FEIE and FTC

Strategies for Maximizing Tax Savings

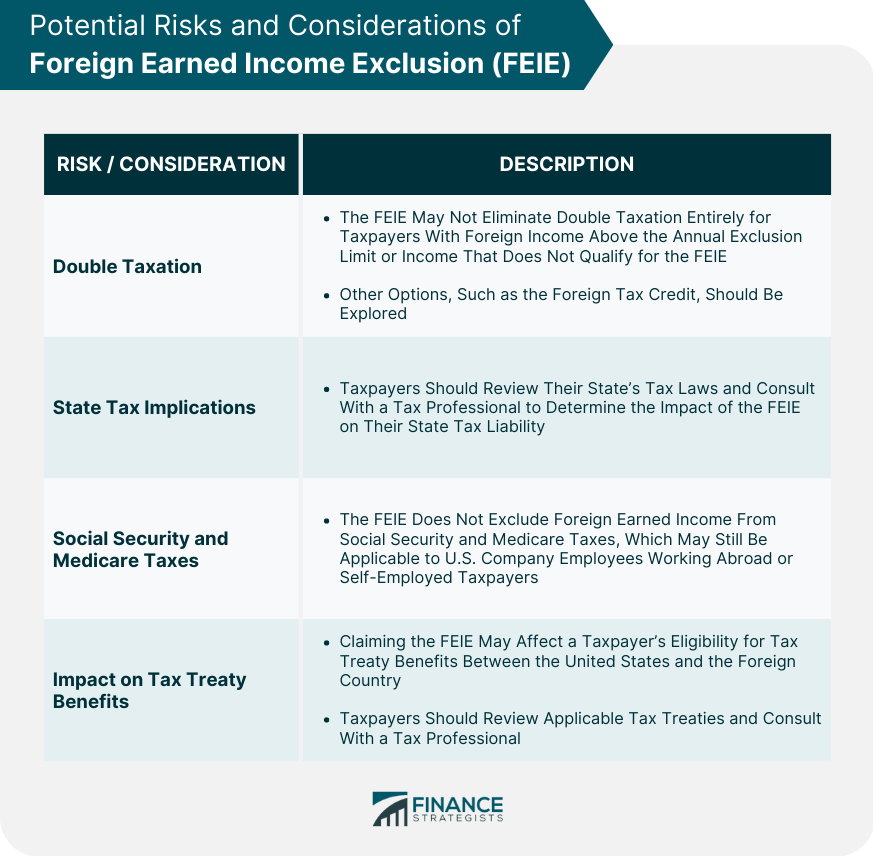

Potential Risks and Considerations of FEIE

Double Taxation

State Tax Implications

Social Security and Medicare Taxes

Impact on Tax Treaty Benefits

Conclusion

Foreign Earned Income Exclusion FAQs

The foreign earned income exclusion is a provision of the U.S. tax code that allows eligible taxpayers to exclude a portion of their foreign earned income from U.S. taxation.

U.S. citizens and resident aliens who live and work abroad for at least 330 days during a 12-month period, or who meet certain bona fide residence requirements, may be eligible for the foreign earned income exclusion.

Most types of earned income, including salaries, wages, and self-employment income, may qualify for the foreign earned income exclusion as long as they meet the eligibility criteria.

The maximum amount of foreign earned income that can be excluded in 2024 is $126,500 per qualifying individual.

Yes, even if you claim the foreign earned income exclusion, you must still file a tax return and report all of your income. However, you may not owe any U.S. tax on the excluded foreign earned income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.