Form 1099-R is an essential tax document used to report distributions from various types of retirement plans, annuities, and pensions. The Internal Revenue Service (IRS) requires financial institutions to issue this form to individuals who received distributions during a tax year. The information provided on Form 1099-R helps taxpayers accurately report their retirement income and calculate their tax liability, if applicable. The form is crucial for the taxpayers and the IRS in tracking retirement income and ensuring compliance with tax laws. In addition, it helps the IRS identify any discrepancies or fraud related to retirement account distributions. Form 1099-R contains several sections that provide essential information about the payer, recipient, distribution type, and amounts. The form has fields for the payer's and recipient's names, addresses, and tax identification numbers. Additionally, it includes boxes for gross distribution, taxable amount, federal and state income tax withheld, net unrealized appreciation, distribution code(s), and employee contributions, among others. Understanding each section and its information is critical for accurate tax reporting. Taxpayers should review their Form 1099-R carefully to ensure all the details are correct and take note of any discrepancies that may need rectifying. Form 1099-R is issued to individuals who have received distributions from various retirement plans during the tax year. The form is provided to both the recipient and the IRS, allowing the IRS to track and verify the retirement income reported on the taxpayer's return. Examples of retirement plans include pensions, annuities, 401(k) plans, and IRAs. In addition to direct distributions, Form 1099-R is also issued to individuals who have completed a rollover or conversion between retirement accounts. These transactions may not always result in a tax liability, but they must still be reported to the IRS. Taxpayers must accurately report these rollovers and conversions on their tax returns to avoid any penalties or additional taxes. Beneficiaries of inherited retirement accounts, such as IRAs, 401(k)s, and annuities, also receive Form 1099-R. The form provides crucial information about the distribution received and any taxes withheld, which the beneficiary must report on their tax return. Individuals receiving periodic payments from annuities, such as fixed or variable annuities, are also required to receive Form 1099-R. The form will report the total amount received during the tax year and any taxable portion that must be reported as income. Form 1099-R is used to report distributions from pension and annuity plans. These plans typically provide a fixed income stream to retirees or other beneficiaries. The form will indicate the total amount paid during the tax year and any taxable portion that must be reported as income. Form 1099-R also covers distributions from traditional, Roth, SEP, and SIMPLE IRAs. Whether the distribution is a regular withdrawal, a required minimum distribution (RMD), or an early distribution, the form will provide essential information about the amount and any taxes withheld. 401(k) plan distributions, including regular withdrawals and RMDs, are reported on Form 1099-R. The form will indicate any taxes withheld and help taxpayers determine their tax liability related to the distribution. In addition, the form will report any 401(k) rollovers or 401(k) conversions to another retirement account. Form 1099-R reports distributions from 403(b) plans, which are tax-deferred retirement plans available to certain tax-exempt organizations and public school employees. The form provides information on the total amount of the distribution, any taxable portion, and taxes withheld. Distributions from 457(b) plans, which are non-qualified deferred compensation plans for state and local government employees and certain non-governmental employers, are also reported on Form 1099-R. The form will indicate the gross distribution amount, any taxable portion, and federal income tax withheld. Form 1099-R reports distributions from TSPs, which are retirement plans available to federal employees and members of the uniformed services. The form provides information about the distribution amount, taxable portion, and any taxes withheld. Distributions from SEP IRAs, a type of retirement plan used by small businesses and self-employed individuals, are reported on Form 1099-R. The form will indicate the gross distribution amount, any taxable portion, and taxes withheld. Form 1099-R is used to report distributions from SIMPLE IRAs, a type of retirement plan designed for small businesses with 100 or fewer employees. The form details the distribution amount, taxable portion, and any taxes withheld. The payer's information section of Form 1099-R includes the name, address, and taxpayer identification number (TIN) of the financial institution or plan administrator responsible for issuing the distribution. This information is essential for accurately reporting the distribution on your tax return and resolving any discrepancies or issues with the form. This section includes the recipient's name, address, and TIN, typically their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). It is crucial to verify this information to ensure the correct taxpayer is reporting the distribution. The gross distribution amount represents the total amount of the distribution before any taxes or other deductions. This figure calculates the taxable portion of the distribution and should be reported on your tax return. The taxable amount is the distribution portion subject to federal income tax. This figure should be reported as income on your tax return, and any discrepancies between the reported taxable amount and your records should be resolved with the payer. This section shows the amount of federal income tax withheld from the distribution. This amount should be reported on your tax return as tax withheld and will be credited against your tax liability for the year. The NUA is the increase in value of employer securities held within a qualified retirement plan that is not subject to tax upon distribution. If applicable, this section will report the NUA, which should be considered when calculating your tax liability. The distribution code(s) indicate the type of distribution received and can help determine if any penalties or additional taxes apply. The codes range from normal distributions to early withdrawals and rollovers, and understanding their meaning is essential for accurate tax reporting. This checkbox indicates whether the distribution is from an IRA, SEP, or SIMPLE plan. This information is necessary to correctly report the distribution on your tax return and determine any potential tax consequences or penalties associated with the distribution. This section reports the total amount of employee contributions, including any after-tax contributions to the retirement plan. This information is essential for calculating the taxable portion of the distribution and ensuring accurate tax reporting. The Roth IRA contributions section indicates the number of contributions made to a Roth IRA, which is essential for determining the tax-free portion of any distributions received from the account. This section provides information about state income tax withheld from the distribution, which should be reported on your state tax return. It also includes the payer's state identification number, which may be required for state tax reporting purposes. The taxable amount from your Form 1099-R should be reported as income on your Form 1040 or Form 1040-SR. Generally, this amount will be included in the "IRA distributions" or "Pensions and annuities" lines, depending on the type of retirement plan. Ensure to report the correct amount and account for any taxes withheld to avoid discrepancies with the IRS. If you took an early distribution from your retirement account, you might be subject to an additional 10% tax penalty. To report this penalty, you must complete Form 5329, "Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts." Include the distribution amount and calculate the penalty, which should be added to your total tax liability for the year. Rollovers and conversions should be reported on your tax return, even if they are not taxable events. Generally, you'll include the rollover amount on the appropriate line of your Form 1040 or 1040-SR and indicate that it is a rollover or conversion by entering the word "Rollover" or "Conversion" next to the line. You should contact the payer to request a corrected form if you find any discrepancies or errors on your Form 1099-R, such as an incorrect distribution amount or tax withholding. Make sure to keep records of your communications and any supporting documentation in case of an IRS inquiry. Payers must furnish Form 1099-R to recipients by January 31st of the year following the tax year in which the distribution occurred. If you have yet to receive your Form 1099-R by this date, contact the payer to inquire about the status of your form. If a payer discovers an error or receives updated information after issuing a Form 1099-R, they must issue a corrected form. The corrected form should include accurate information and be marked as "Corrected" at the top. Make sure to review the corrected form and adjust your tax return if necessary. When filing your tax return, make sure to include the information from your Form 1099-R accurately. You do not need to attach the form to your return, but you should keep a copy for your records if the IRS requests it. Keep a copy of your Form 1099-R and any supporting documentation for at least seven years. This recordkeeping will help you address any future inquiries from the IRS or state tax authorities and provide documentation for any tax planning or financial decisions related to your retirement accounts. Form 1099-R is a critical tax document that reports distributions from retirement plans, annuities, and pensions. Understanding the form's purpose, sections, and reporting requirements is essential for accurate tax reporting and compliance with tax laws. Ensure you carefully review your Form 1099-R, report the correct amounts on your tax return, and consult professional guidance if you have any questions or concerns about your specific tax situation. By staying informed and proactive, you can better manage your retirement income and minimize potential tax liabilities.What Is Form 1099-R?

Who Should Receive Form 1099-R?

Recipients of Distributions from Retirement Plans

Individuals With a Rollover or Conversion

Inherited Retirement Account Beneficiaries

Recipients of Periodic Payments From Annuities

Types of Retirement Plans and Distributions Associated With Form 1099-R

Pensions and Annuities

Individual Retirement Accounts (IRAs)

401(k) Plans

403(b) Plans

457(b) Plans

Thrift Savings Plans (TSPs)

Simplified Employee Pension (SEP) IRAs

Savings Incentive Match Plan for Employees (SIMPLE) IRAs

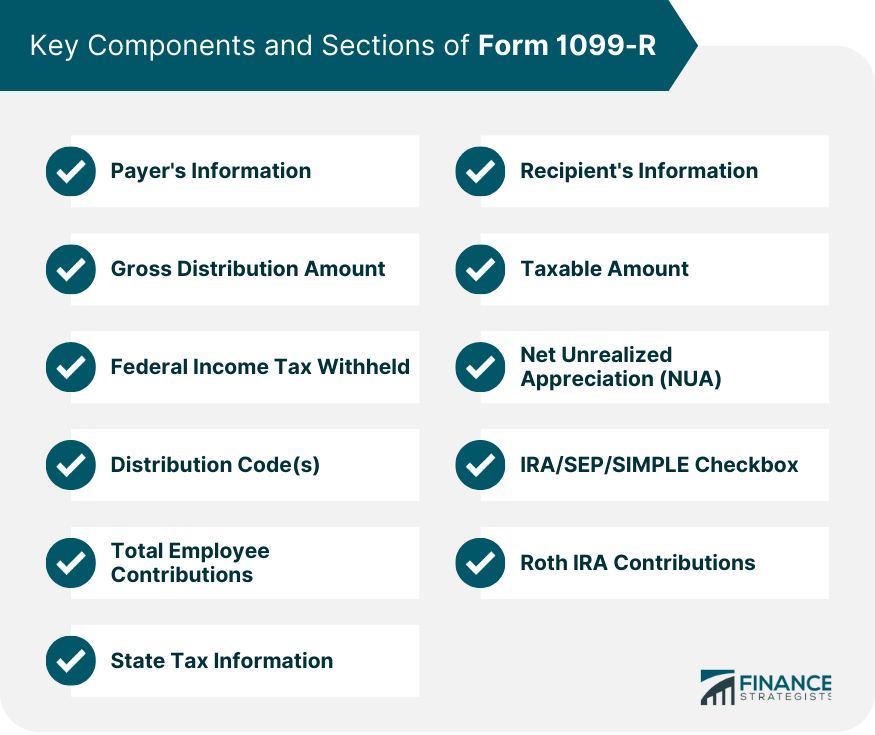

Key Components and Sections of Form 1099-R

Payer's Information

Recipient's Information

Gross Distribution Amount

Taxable Amount

Federal Income Tax Withheld

Net Unrealized Appreciation (NUA)

Distribution Code(s)

IRA/SEP/SIMPLE Checkbox

Total Employee Contributions

Roth IRA Contributions

State Tax Information

How to Report Form 1099-R on Your Tax Return

Reporting Taxable Amounts on Form 1040 or Form 1040-SR

Reporting Early Distributions and Penalties on Form 5329

Reporting Rollovers and Conversions

Addressing Discrepancies or Errors on Form 1099-R

Important Deadlines and Filing Requirements

Deadline for Receiving Form 1099-R From the Payer

Corrected Form 1099-R

Filing Your Tax Return With Form 1099-R Information

Recordkeeping for Future Reference

Conclusion

Form 1099-R FAQs

Form 1099-R is a tax form issued by the Internal Revenue Service (IRS) in the United States. It reports distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, and certain disability payments.

Financial institutions that manage retirement accounts or make distributions from these accounts are required to file Form 1099-R. If you received a distribution from such an account during the tax year, you should receive a Form 1099-R from the institution that manages the account.

If you receive a Form 1099-R, you should include the information on the form when you file your federal income tax return. The form will show the amount of the distribution and the amount of any federal income tax withheld. This information is necessary to calculate your tax liability for the year accurately.

If you took a distribution from your retirement account but have yet to receive a Form 1099-R, you should contact the financial institution that manages the account. They are required to provide you with this form. Even if you don't receive the form, you are still responsible for reporting the distribution on your tax return.

If the 'taxable amount not determined' box is checked on your Form 1099-R, the payer must have all the information needed to determine the taxable amount of your distribution. In this case, you may need to calculate the taxable portion of your distribution yourself, or consult with a tax professional.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.