A gift tax return is a formal document that individuals must file with the tax authorities to report gifts given to other individuals. The purpose of the gift tax return is to provide information about the gifts and assess any potential gift tax liabilities. Gift tax regulations vary by jurisdiction, but generally, they are in place to prevent individuals from avoiding estate taxes by transferring assets as gifts during their lifetime. By requiring the reporting of gifts, tax authorities can monitor and regulate large or significant transfers of wealth. When a gift exceeds the annual gift tax exclusion amount set by the tax laws, or if the gift qualifies for other exemptions, individuals are typically required to file a gift tax return. The gift tax return provides crucial information, including details about the donor, recipient, and specifics of the gifts. It allows the tax authorities to evaluate whether any gift tax is owed by the donor. The U.S. tax code treats gifts as a category of transfers that are not compensated by an equivalent return. When someone gives another person money or property without expecting anything of equal value in return, that transfer is a gift in the eyes of the tax law. A gift can be anything of value. This means cash, stocks, bonds, real estate property, tangible personal property like jewelry or cars, or even interest in a business. Transfers of property in exchange for less than full consideration may also be considered gifts for tax purposes. For example, if you sell a house to a relative for half its market value, the IRS might deem the discounted portion as a gift. Not all transfers are gifts, even if no payment is received. For example, a transfer of property as a result of a death is not a gift. It's considered part of the decedent's estate. Transfers of property in exchange for services are also not gifts; they're considered payment for the services and may be treated as income to the recipient. You can also make an indirect gift. For example, if you pay someone else's bills without reimbursement, those payments could be considered gifts to that person. Similarly, if you put money into an account that someone else can control and spend as they wish, the IRS may consider your contribution as a gift. In certain circumstances, loans may be considered gifts. For example, if you lend money to a relative with no interest or below the market rate of interest. The IRS might consider part of the loan amount (calculated based on the difference between the market rate and your rate) to be a gift. The U.S. federal government allows every individual to give a certain amount to any other individual each year without having to report the gift. This is known as the annual gift tax exclusion. If the value of your gift to any one individual exceeds this amount in a given year, you are required to file a gift tax return, even if no tax is due. Here are some key points to understand: The annual exclusion limit for 2024 is $18,000. This means that you can give up to $18,000 to as many individuals as you want in 2024 without having to file a gift tax return. This limit is per recipient, so if you give $18,000 to ten different people, you still won't have to file a gift tax return. When determining whether you need to file a gift tax return, consider the total value of the gifts given to each individual. For instance, if you gift someone $20,000 in 2024, you will only need to report the amount exceeding the $18,000 annual exclusion, i.e., $2,000. If your spouse is a U.S. citizen, there is no limit on the amount you can give them each year. Gifts to your spouse do not count toward the annual exclusion limit. For non-citizen spouses, there is a different, higher limit. If you're married, you and your spouse can each gift up to the annual exclusion amount to the same person. This is known as "gift splitting." It effectively allows a couple to double the amount they can give to any one person without triggering the need for a gift tax return. But remember, if you choose to split gifts, both of you must file a gift tax return, even if no tax is due. If you exceed the annual exclusion limit, you must file IRS Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. Keep in mind, filing a gift tax return does not necessarily mean you owe gift tax. You would only owe gift tax if you exceed the lifetime exemption, which was $13.61 million as of 2024. The lifetime gift tax exemption is an amount set by the U.S. federal tax law that a person can give away during their lifetime without incurring gift tax. Here are some key points: The lifetime exemption amount, as of 2024, is $13.61 million. This means that an individual can give away up to this amount over their lifetime, in excess of the annual gift exclusion, without incurring gift tax. Gifts exceeding the annual exclusion limit ($18,000 per recipient as of 2024) are counted against the lifetime exemption. For example, if you gave a gift of $118,000 to a single recipient in 2024, $18,000 would be exempt under the annual exclusion, and the remaining $100,000 would count against your lifetime exemption. When you give gifts that exceed the annual exclusion limit, you're required to file a gift tax return (IRS Form 709). On this form, you'll declare the amount of the gift that exceeds the annual exclusion and that you're using a portion of your lifetime exemption for it. This doesn't mean you'll owe gift tax at that time—it's more like keeping a tally of the portion of your lifetime exemption you've used so far. The lifetime gift tax exemption is unified with the estate tax exemption. This means that the gifts you give during your lifetime, which count against your lifetime exemption, also reduce the amount of your estate that can be exempted from estate tax when you die. For instance, if you used $2 million of your lifetime exemption on gifts during your lifetime, you'd have $11.61 million left as an estate tax exemption. Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, is used to report gifts that are subject to the gift tax and generation-skipping transfer (GST) tax. The purpose of Form 709 is to report gifts that exceed the annual gift tax exclusion amount to the Internal Revenue Service (IRS). This form is also used to report generation-skipping transfers, which are transfers or gifts made to individuals who are more than one generation below the donor (typically grandchildren). Form 709 must be filed if you made gifts to someone in a given year that exceeded the annual gift tax exclusion limit ($18,000 in 2024). It's important to note that you need to file this form for the year in which you made the gift. Filing this form allows the IRS to keep track of your lifetime gift tax exemption usage. Even if no tax is owed (due to the lifetime gift tax exemption), the form still needs to be filed if the gift exceeded the annual exclusion limit. Failing to do so could potentially lead to penalties. 1. Donor's Identification: At the top of Form 709, fill in your name, Social Security Number, and address. 2. Tax Computation: In Part 1 of the "Tax Computation" section, you will enter the value of your gifts for the current year and any previous gifts that were subject to gift tax. 3. Schedule A - Computation of Taxable Gifts: In this section, you detail each gift made during the tax year, its value, and to whom it was made. Gifts are categorized into indirect skips, direct skips, and other transfers. 4. Schedules B, C, D: These sections deal with the specifics of split gifts (if you're married and you and your spouse have agreed to split the gifts you've made), taxable gifts from prior periods, and GST tax computation. 5. Sign and Date: The last step is to sign and date the form. If you're splitting gifts with your spouse, both of you need to sign. The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. Here are some more details on each point: When you give a gift to someone, the first $18,000 (as of 2024) is excluded from the gift tax. This is known as the annual exclusion. The taxable amount of a gift is the amount that exceeds this exclusion. For example, if you give a gift of $20,000, the taxable amount is $2,000. This does not necessarily mean you will owe tax, however, due to the lifetime exemption. 1. Add up the total value of your gifts to each person in a year. 2. Subtract the annual exclusion ($18,000 as of 2024) from this total. This will give you the taxable amount for each person. 3. Add up the taxable amounts for all individuals to get your total taxable gifts for the year. 4. The total taxable gifts for the year are then added to the total of your taxable gifts from previous years. This sum is applied to the gift tax rates to determine the tentative tax. 5. You then subtract the unified credit applicable for the year from the tentative tax. This will give you the amount of gift tax you owe, if any. Annual Exclusion: Gifts to any individual that do not exceed the annual exclusion ($18,000 as of 2024) are not subject to the gift tax. Tuition or Medical Expenses: If you pay someone's tuition or medical expenses directly to the educational or medical institution, those payments are not considered gifts and are not subject to the gift tax. Spousal Gifts: Gifts to your spouse are typically not subject to the gift tax due to the unlimited marital deduction. Charitable Gifts: Gifts to charitable organizations are usually exempt from the gift tax. Lifetime Exemption: If the sum of the taxable amount of gifts given during your lifetime is less than the lifetime exemption amount ($13.61 million as of 2024), you won't owe any gift tax, even if you're required to file a Form 709. A gift tax return, represented by IRS Form 709, is used to report gifts that exceed the annual gift tax exclusion amount, which is $18,000 as of 2024. A gift can be anything of value and can also include certain loans, indirect gifts, or property sold below its market value. Not all transfers are gifts, however. Transfers without full consideration, such as inheritance or payment for services, are not considered gifts. A gift tax return must be filed when the total value of gifts to an individual exceeds the annual exclusion limit. The lifetime gift tax exemption, set at $13.61 million as of 2024, allows a person to give away this amount during their lifetime without incurring gift tax. However, exceeding the annual exclusion limit still requires filing a gift tax return, even if no tax is due. Calculating gift tax involves tallying total gift value, subtracting any deductions like the annual exclusion, and applying the tax rate. No gift tax is due in cases of gifts within the annual exclusion limit, direct payments of tuition or medical expenses, gifts to a spouse, or when the sum of gifts given is less than the lifetime exemption amount.What Is a Gift Tax Return?

Basics of Gift Tax Returns

Understanding What Constitutes a Gift

Types of Gifts

Transfers Without Full Consideration

Non-gift Transfers

Indirect Gifts

Loans and Gifts

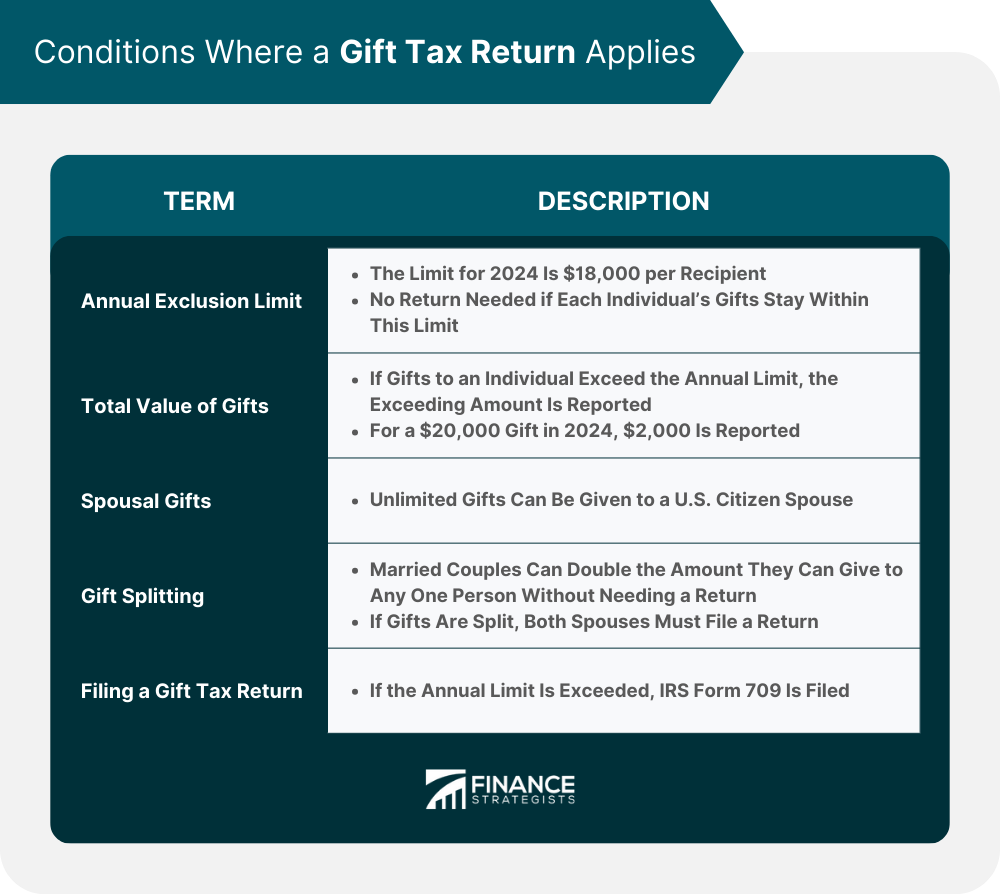

Conditions Where a Gift Tax Return Applies

Annual Exclusion Limit

Total Value of Gifts

Spousal Gifts

Gift Splitting

Filing a Gift Tax Return

Concept of a Lifetime Gift Tax Exemption

Amount of the Exemption

How It Works

Gift Tax Return and the Lifetime Exemption

Impact on Estate Tax

Understanding the Gift Tax Return Form (Form 709)

When and Why You Should File Form 709

Instructions for Filling Out Form 709

In Part 2, you will calculate your tentative tax (the tax based on the sum of the current and previous gifts). Finally, in Part 3, you calculate the tax payable, if any, by subtracting any credits.

Calculating the Gift Tax

Determining the Taxable Amount of a Gift

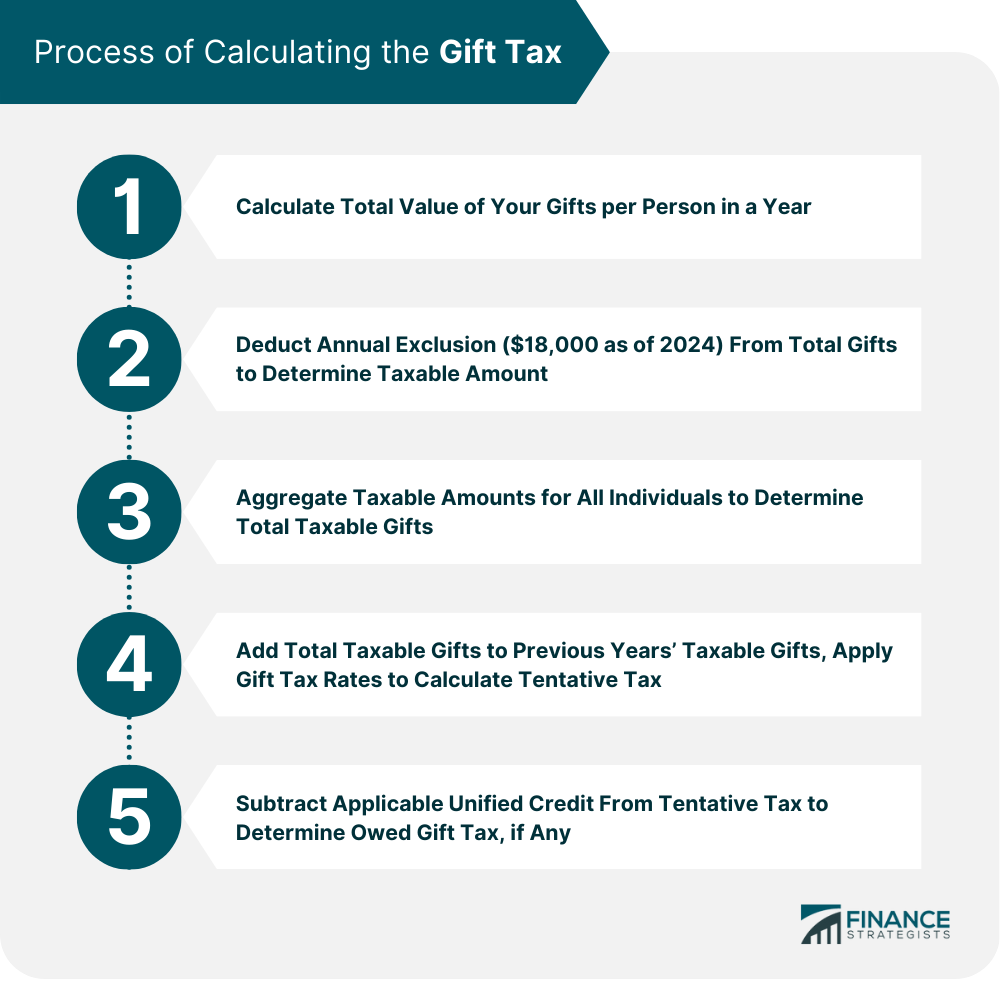

Process of Calculating the Gift Tax

Situations When No Gift Tax Is Due

Conclusion

Gift Tax Return FAQs

A Gift Tax Return is a document (IRS Form 709) filed by an individual who gifts amounts exceeding the annual exclusion limit ($18,000 as of 2024) to another person within a year.

You need to file a Gift Tax Return when the total amount you gift to an individual in a year surpasses the annual exclusion limit. However, gifts to a U.S. citizen spouse are exempted.

A Gift Tax Return allows the IRS to track an individual's use of the lifetime exemption, which is $13.61 million as of 2024. Once this limit is exceeded, gift tax becomes due.

The annual exclusion ($18,000 as of 2024) is deducted from your total gifts to each individual in a year. Only the amount exceeding the exclusion is reported on the Gift Tax Return.

Not necessarily. Filing a Gift Tax Return does not mean you owe gift tax unless your cumulative gifts over your lifetime exceed the lifetime exemption limit ($13.61 million as of 2024).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.