Income tax planning is the process of carefully examining and organizing an individual's or a business's finances to minimize the amount of taxes owed. The objective is to use legal and financial strategies to stay compliant with tax laws while maximizing savings. Proper income tax planning can help reduce tax liabilities, increase deductions and credits, ensure compliance with tax laws, and improve overall financial well-being. The main aims of income tax planning are to lower taxable income, make use of tax credits and deductions, defer tax liabilities, and plan for long-term financial goals like retirement. By engaging in careful income tax planning, individuals and businesses can save significantly on taxes and achieve greater financial stability. There are three primary types: earned income, which includes salaries and wages; passive income, such as rental properties and royalties; and portfolio income, which comes from investments like stocks and bonds. Earned income is the money received for work performed, such as salaries, wages, and self-employment income. This type of income is subject to federal and state income taxes and payroll taxes, making it crucial for tax planning purposes. Passive income is generated from activities where the taxpayer does not actively participate, such as rental properties, royalties, and some business ventures. Proper tax planning can help minimize the tax burden on this type of income. Portfolio income includes interest, dividends, and capital gains from investments like stocks, bonds, and mutual funds. Tax planning strategies can help investors manage their tax liability on portfolio income. The United States uses a progressive tax system, where tax rates increase as income levels rise. Understanding your tax bracket and applicable rates is essential for effective income tax planning, as it allows you to estimate your tax liability and make informed financial decisions. Deductions and credits are essential components of income tax planning, as they can help reduce your tax liability. Deductions lower your taxable income, while credits directly reduce the amount of tax owed. Your filing status, such as single, married filing jointly, or head of household, can significantly impact your tax liability. Choosing the correct filing status is a crucial aspect of income tax planning and can help maximize deductions and credits. Income tax planning is essential for maximizing tax savings and minimizing your tax liability. Here are some income tax planning strategies that can help you achieve these goals: 1. Tax-Deferred Retirement Accounts: Contribute to retirement accounts like 401(k)s, 403(b)s, or Traditional IRAs, which allow your investments to grow tax-deferred until you withdraw the funds in retirement. 2. Roth IRA Conversions: If you expect your tax bracket to be higher in retirement, consider converting a portion of your Traditional IRA to a Roth IRA. You'll pay taxes on the converted amount now but enjoy tax-free growth and withdrawals in the future. 3. Harvest Tax Losses: Offset capital gains by selling underperforming investments to realize capital losses. This is called tax-loss harvesting and can help you reduce your taxable income. 4. Charitable Giving: Make tax-deductible donations to charitable organizations. You can also consider donating appreciated securities to avoid capital gains tax on the growth. 5. Utilize Tax Credits and Deductions: Be aware of available tax credits and deductions, such as the child tax credit, education credits, and deductions for mortgage interest or medical expenses. 6. Maximize Pre-Tax Deductions: Take advantage of pre-tax deductions for expenses like health savings accounts (HSAs), flexible spending accounts (FSAs), and transportation costs. 7. Income Shifting: Shift income between family members in lower tax brackets to reduce your overall tax liability. This could include employing a family member in your business or gifting income-producing assets. 8. Tax-Efficient Investments: Invest in tax-efficient assets like municipal bonds or index funds, which generally have lower taxable distributions. 9. Small Business Strategies: If you own a small business, consider options like setting up a retirement plan, using a tax-advantaged business structure, or deducting business expenses to reduce your taxable income. 10. Seek Professional Advice: Consult with a tax advisor or financial planner to identify specific strategies that may be suitable for your individual circumstances. Selecting tax-efficient investments can help minimize tax liability and enhance overall investment returns. Examples of tax-efficient investments include municipal bonds, index funds, ETFs, and tax-managed funds. Municipal bonds are issued by state and local governments and are generally exempt from federal income tax. These bonds can be an attractive option for income tax planning, as they provide tax-free interest income. Index funds and ETFs are passively managed investment vehicles that typically generate fewer taxable events than actively managed funds. This makes them a tax-efficient choice for income tax planning and long-term investing. Tax-managed funds are specifically designed to minimize the tax impact on investors. These funds employ strategies such as minimizing turnover and capital gains distributions, making them a suitable option for income tax planning. Asset location strategies involve placing tax-efficient investments in taxable accounts and tax-inefficient investments in tax-advantaged accounts. This can help minimize tax liability and improve overall investment returns. Tax-efficient investments, such as municipal bonds and index funds, should be placed in taxable accounts to take advantage of their tax benefits. This can help lower the tax burden on investment income. Tax-inefficient investments, like actively managed funds and high-dividend stocks, should be placed in tax-advantaged accounts, such as IRAs or 401(k)s. This can help defer taxes on these investments and improve overall returns. Tax-loss harvesting involves selling investments at a loss to offset capital gains and reduce taxable income. This strategy can be an effective income tax planning tool, as it can help minimize tax liability while maintaining a diversified investment portfolio. Deferring income can help taxpayers reduce their tax liability by postponing taxable income to future years. This can be achieved through strategies such as delaying bonuses, increasing retirement contributions, and utilizing installment sales. Delaying the receipt of bonuses and commissions until the following tax year can help lower taxable income in the current year. This strategy can be beneficial for taxpayers who anticipate being in a lower tax bracket in the future. Increasing contributions to tax-deferred retirement accounts can help lower taxable income in the current year. This strategy not only reduces tax liability but also helps individuals save for retirement. Installment sales allow taxpayers to spread the recognition of income from the sale of an asset over several years. This strategy can help manage tax liability by deferring income and potentially placing taxpayers in lower tax brackets. Income splitting involves shifting income between family members to minimize overall tax liability. Strategies for income splitting include spousal income shifting, family business strategies, and utilizing trusts and estate planning tools. Spousal income shifting involves transferring income between spouses to take advantage of lower tax rates. This can be achieved through strategies such as income-producing investments and pension income splitting. Family business strategies involve employing family members and distributing income to minimize overall tax liability. This can include hiring children or spouses, paying reasonable wages, and splitting business income among family members. Trusts and other estate planning tools can help shift income to family members in lower tax brackets, reducing overall tax liability. Proper planning and structuring of these tools is essential for effective income tax planning. Selecting the appropriate business entity can significantly impact tax liability for small business owners. Common entity types include sole proprietorships, partnerships, corporations, S corporations, and limited liability companies (LLCs). Sole Proprietorship: A sole proprietorship is a simple business structure with minimal legal requirements. However, the owner is personally liable for all business debts, and income is taxed at the individual level. Partnership: Partnerships involve two or more individuals sharing profits and losses. Income and deductions flow through to the partners, who report them on their personal tax returns. Corporation: A corporation is a separate legal entity that provides limited liability protection to its owners. Corporations are subject to double taxation, as both corporate profits and shareholder dividends are taxed. S Corporation: An S corporation is a special type of corporation that avoids double taxation by passing income and deductions directly to shareholders. S corporations have specific eligibility requirements and limitations. Limited Liability Company (LLC): An LLC combines the limited liability protection of a corporation with the pass-through taxation of a partnership. Owners, known as members, report their share of income and deductions on their personal tax returns. Understanding and maximizing business deductions and credits can help small business owners reduce their tax liability. Common business deductions include operating expenses, such as rent, utilities, and advertising; depreciation of business assets; and employee wages and benefits. Identifying and claiming these deductions can help reduce taxable income. Business tax credits, such as the Work Opportunity Tax Credit and the Research and Development Tax Credit, can directly reduce tax liability. Understanding and claiming these credits can lead to significant tax savings. To maximize business deductions and credits, small business owners should keep accurate records, track expenses, and stay informed about tax law changes. Proper planning and organization can help ensure that all available deductions and credits are claimed, reducing tax liability. Managing payroll taxes and employee benefits is a crucial aspect of income tax planning for small business owners. Properly handling payroll taxes can help avoid penalties, while offering tax-advantaged benefits can provide tax savings for both the business and its employees. At the end of the year, taxpayers should review their financial records to assess their income, expenses, and potential tax liability. This review can help identify areas for tax savings and inform necessary adjustments to minimize tax liability. After reviewing financial records, taxpayers may need to make adjustments to their income, deductions, or credits to optimize their tax situation. These adjustments could include deferring income, accelerating deductions, or adjusting investment strategies. Seeking the advice of a tax professional can be beneficial in identifying tax-saving opportunities and ensuring compliance with tax laws. Tax professionals can provide guidance on year-end tax planning strategies tailored to an individual's or business's unique circumstances. Income tax planning is a crucial aspect of managing personal and business finances, aimed at minimizing tax liabilities while maximizing savings. There are three primary types of income, earned, passive, and portfolio income, which are subject to different tax rates and deductions. Understanding income tax brackets, deductions, credits, and filing status is crucial for effective income tax planning. There are several income tax planning strategies available, such as tax-deferred retirement accounts, charitable giving, tax-loss harvesting, and utilizing tax-efficient investments. Small business owners can choose the appropriate business entity type, maximize deductions and credits, and manage payroll taxes and employee benefits. Reviewing financial records, making necessary adjustments, and consulting with a tax professional at year-end can help identify tax-saving opportunities and ensure compliance with tax laws. Effective income tax planning can lead to significant tax savings, increased financial security, and improved overall financial well-being.What Is Income Tax Planning?

Understanding Income Tax Fundamentals

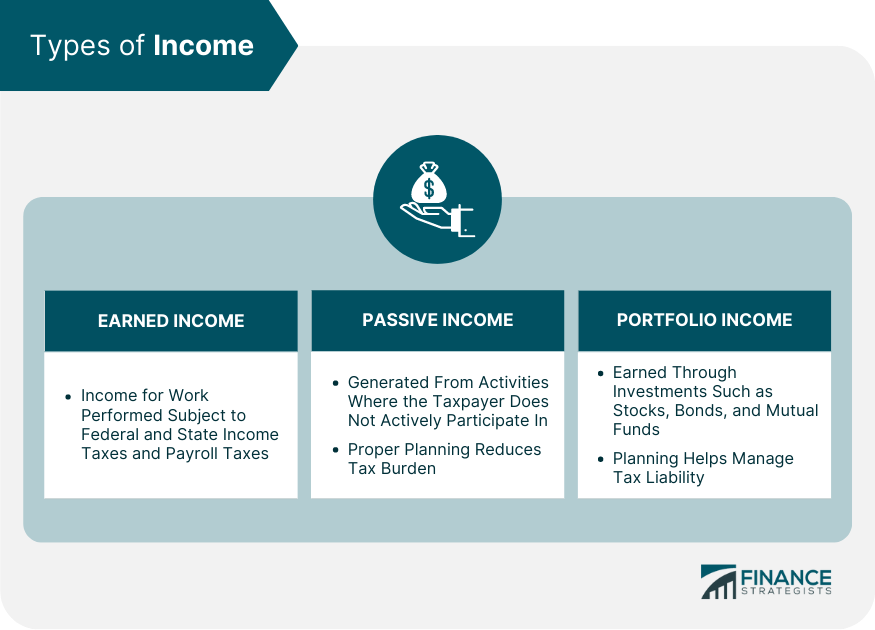

Types of Income

Earned Income

Passive Income

Portfolio Income

Income Tax Brackets and Rates

Income Tax Deductions and Credits

Income Tax Filing Status

Income Tax Planning Strategies

Tax-Efficient Investing for Income Tax Planning

Tax-Efficient Investments

Municipal Bonds

Index Funds and ETFs

Tax-Managed Funds

Asset Location Strategies in Income Tax Planning

Placing Tax-Efficient Investments in Taxable Accounts

Placing Tax-Inefficient Investments in Tax-Advantaged Accounts

Tax-Loss Harvesting in Income Tax Planning

Income Shifting Strategies for Income Tax Planning

Deferring Income

Bonuses and Commissions

Retirement Contributions

Installment Sales

Income Splitting

Spousal Income Shifting

Family Business Strategies

Trusts and Other Estate Planning Tools

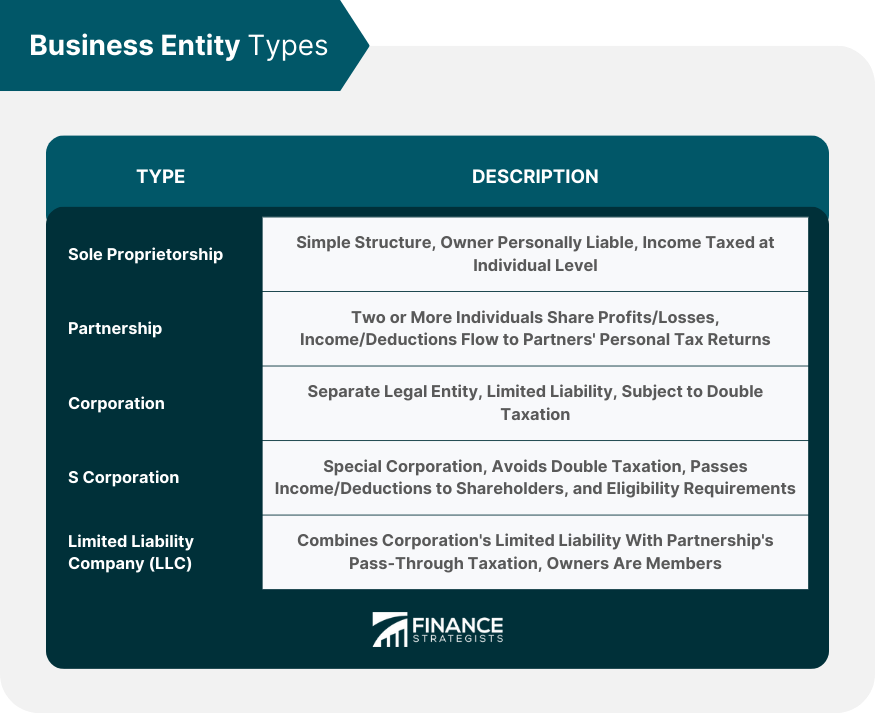

Income Tax Planning for Small Business Owners

Choosing the Right Business Entity for Income Tax Planning

Business Deductions and Credits in Income Tax Planning

Common Business Deductions

Business Tax Credits

Maximizing Business Deductions and Credits

Payroll Taxes and Employee Benefits in Income Tax Planning

Year-End Income Tax Planning

Reviewing Financial Records for Income Tax Planning

Making Necessary Adjustments for Income Tax Planning

Consulting with a Tax Professional for Income Tax Planning

Final Thoughts

Income Tax Planning FAQs

Income tax planning is the process of organizing and managing one's financial affairs to minimize tax liability and maximize available deductions and credits. It is essential for individuals and businesses because it helps optimize financial resources and ensures compliance with tax laws.

Income tax planning strategies, such as maximizing itemized deductions, claiming eligible tax credits, and making tax-efficient investment choices, can help taxpayers reduce their tax liability and take full advantage of available tax-saving opportunities.

Retirement planning is a crucial aspect of income tax planning, as contributions to tax-advantaged retirement accounts, such as IRAs and 401(k)s, can reduce taxable income and provide long-term tax benefits. Proper retirement planning can help individuals save for their future while minimizing their tax liability.

Small business owners can benefit from income tax planning by choosing the right business entity, maximizing business deductions and credits, and managing payroll taxes and employee benefits. These strategies can help businesses minimize their tax liability, increase profits, and ensure compliance with tax laws.

It is beneficial to consult with a tax professional for income tax planning if you need guidance on complex tax issues, want to ensure compliance with tax laws, or seek personalized advice on optimizing your tax situation. Tax professionals can provide valuable insights and assistance in navigating the complexities of tax planning and regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.