International tax treaties are agreements between two or more countries that provide guidelines for the allocation of taxing rights and the avoidance of double taxation. These treaties promote cooperation and economic relations between countries by eliminating barriers to cross-border trade and investment. The primary purpose of tax treaties is to prevent double taxation, which occurs when the same income is taxed in multiple jurisdictions. Tax treaties also facilitate information exchange between tax authorities, reduce tax evasion and avoidance, and encourage international trade and investment by creating a stable tax environment. The historical development of tax treaties dates back to the early 20th century when countries started negotiating bilateral agreements to prevent double taxation. Over time, these agreements evolved into more comprehensive tax treaties, with the League of Nations and later the United Nations and OECD playing significant roles in shaping global tax treaty policy. The residence principle in international tax treaties determines a taxpayer's jurisdiction of residence for tax purposes. Under this principle, a person or company is considered a resident of the country where they maintain their primary economic and social ties. This principle helps to allocate taxing rights and prevent double taxation. The source principle refers to the concept that income should be taxed in the jurisdiction where it is generated. Tax treaties use the source principle to allocate taxing rights between countries and ensure that the country where the income arises has the primary right to tax that income, subject to certain limitations. The non-discrimination principle in tax treaties ensures that taxpayers in similar situations are treated equally, regardless of their nationality or the origin of their investment. This principle promotes fairness and prevents discriminatory tax treatment that could hinder cross-border trade and investment. The mutual agreement procedure (MAP) is a dispute resolution mechanism provided in tax treaties that allow countries to resolve tax disputes and interpret treaty provisions. MAP ensures that taxpayers are not subject to double taxation or discriminatory treatment, and promotes cooperation between tax authorities. The exchange of information provisions in tax treaties enables tax authorities to share relevant information with each other to ensure compliance with domestic tax laws and combat tax evasion and avoidance. These provisions enhance transparency and international cooperation in tax matters. The OECD Model Tax Convention is a widely followed template for negotiating tax treaties that provide guidance on the allocation of taxing rights between countries. It primarily focuses on the interests of developed countries and promotes a more balanced distribution of taxing rights between residence and source countries. The UN Model Tax Convention is another major template for negotiating tax treaties, with a focus on the interests of developing countries. It generally allocates more taxing rights to the source country, recognizing the need for developing countries to mobilize domestic resources for development. The United States Model Income Tax Convention is a template for tax treaties used by the United States in its negotiations with other countries. It reflects US-specific policy considerations and aims to protect US taxpayers from double taxation while promoting cross-border trade and investment. While the OECD, UN, and US model tax conventions share several common features, they differ in their allocation of taxing rights and focus on the interests of different groups of countries. Comparing and contrasting these models helps to understand the underlying policy considerations and the implications of adopting one model over another. The pre-negotiation phase involves identifying potential treaty partners, conducting internal analyses, and establishing negotiating priorities. During this phase, countries assess their economic and tax policy objectives, evaluate the potential benefits and drawbacks of entering into a tax treaty, and develop a strategic approach to address their specific needs and interests in the upcoming negotiations. The negotiation phase involves discussions between the treaty partners to reach a consensus on the specific provisions of the tax treaty. This phase requires a thorough understanding of each country's tax system, objectives, and priorities, as well as the ability to compromise and find mutually acceptable solutions. The post-negotiation phase entails finalizing the treaty text, translating it into the official languages of the treaty partners, and preparing it for signature. During this phase, countries may conduct a legal and technical review of the treaty provisions to ensure their accuracy and consistency with domestic tax laws. The ratification process involves the approval of the tax treaty by the legislative bodies of the treaty partners. This process ensures that the treaty is in line with each country's legal and constitutional requirements and signifies the country's commitment to implementing the treaty provisions. Tax treaties enter into force after the ratification process is completed and the treaty partners exchange diplomatic notes. The treaty provisions usually become effective from the beginning of the following calendar or fiscal year. Termination of tax treaties can occur by mutual agreement or unilateral action, subject to the notice period specified in the treaty. International tax treaties play a critical role in preventing double taxation by allocating taxing rights between treaty partners and providing mechanisms for relief from double taxation. This ensures that taxpayers are not subject to tax in multiple jurisdictions on the same income, promoting fairness and efficiency in the global tax system. By reducing tax barriers and creating a stable tax environment, tax treaties encourage cross-border trade and investment. They help to eliminate tax-related uncertainties and facilitate the flow of goods, services, and capital between countries, ultimately contributing to global economic growth. Tax treaties promote cooperation between tax authorities by providing mechanisms for information exchange, mutual assistance in tax collection, and dispute resolution. This enhanced cooperation helps to ensure tax compliance, combat tax evasion and avoidance, and maintain a level playing field for taxpayers. International tax treaties contribute to combating tax evasion and avoidance by facilitating information exchange and providing mechanisms for cooperation between tax authorities. These provisions enable tax authorities to detect and address non-compliant behaviors, ensuring a fair and transparent global tax system. Base erosion and profit shifting (BEPS) refer to tax planning strategies employed by multinational enterprises to exploit gaps and mismatches in tax rules, leading to the artificial shifting of profits to low-tax jurisdictions. International tax treaties can inadvertently facilitate BEPS, making it crucial for countries to address these issues and ensure a fair allocation of taxing rights. Tax competition among countries can lead to a race to the bottom, with some jurisdictions adopting harmful tax practices to attract investment. Tax havens, characterized by low or zero tax rates and a lack of transparency, can undermine the effectiveness of tax treaties by facilitating tax evasion and avoidance. Developing countries often face challenges in negotiating and implementing tax treaties, including limited resources and expertise. They may also receive a smaller share of taxing rights in treaties, which can hinder their ability to mobilize domestic resources for development. Although tax treaties facilitate information exchange, some countries may still face difficulties in obtaining the necessary information to ensure tax compliance. Legal and administrative barriers, as well as the lack of automatic exchange of information provisions in some treaties, can hamper transparency and international cooperation in tax matters. Dispute resolution mechanisms in tax treaties, such as the mutual agreement procedure (MAP), aim to resolve tax disputes between treaty partners and provide relief to taxpayers. However, these mechanisms can sometimes be lengthy and complex, making it important for countries to explore more efficient and effective dispute-resolution alternatives. International tax treaties play a crucial role in promoting cooperation and economic relations between countries. They prevent double taxation, facilitate information exchange, reduce tax evasion and avoidance, and encourage international trade and investment. The negotiation process involves a pre-negotiation phase, negotiation phase, post-negotiation phase, and ratification process. Tax treaties impact global taxation by preventing double taxation, encouraging trade and investment, enhancing cooperation between tax authorities, and addressing tax evasion and avoidance. However, there are challenges and controversies, including BEPS, tax competition, and tax havens, developing countries' concerns and issues, transparency and information exchange issues, and dispute resolution mechanisms. By understanding the underlying policy considerations and implications of international tax treaties, countries can better address these challenges and promote a fair and transparent global tax system.What Are International Tax Treaties?

Key Principles of International Tax Treaties

Residence Principle

Source Principle

Non-discrimination Principle

Mutual Agreement Procedure

Exchange of Information

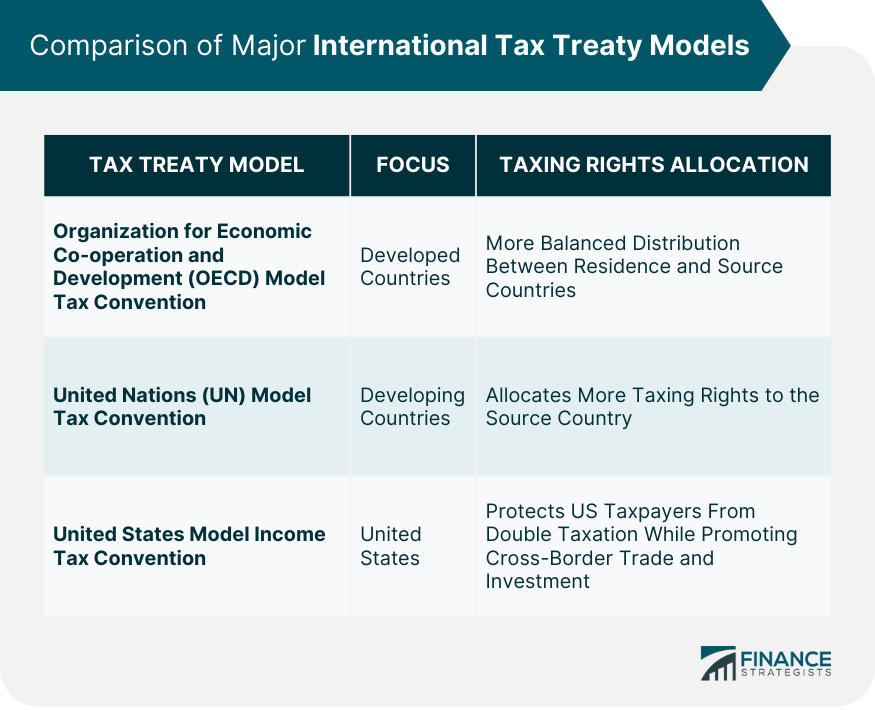

Major International Tax Treaty Models

Organization for Economic Co-operation and Development (OECD) Model Tax Convention

United Nations (UN) Model Tax Convention

United States Model Income Tax Convention

Comparison and Contrasting of the Models

Tax Treaty Negotiation Process

Pre-negotiation Phase

Negotiation Phase

Post-negotiation Phase

Ratification Process

Entry into Force and Termination of Tax Treaties

Impact of International Tax Treaties on Global Taxation

Prevention of Double Taxation

Encouragement of International Trade and Investment

Enhanced Cooperation Between Tax Authorities

Addressing Tax Evasion and Avoidance

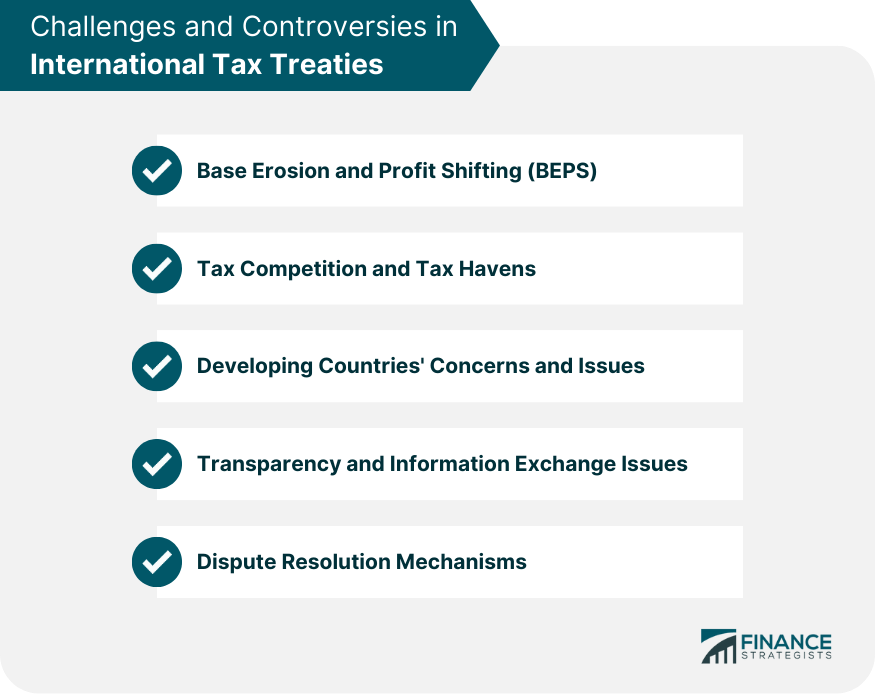

Challenges and Controversies in International Tax Treaties

Base Erosion and Profit Shifting (BEPS)

Tax Competition and Tax Havens

Developing Countries' Concerns and Issues

Transparency and Information Exchange Issues

Dispute Resolution Mechanisms

Final Thoughts

International Tax Treaties FAQs

International tax treaties are agreements between two or more countries that establish guidelines for the allocation of taxing rights, the prevention of double taxation, and the promotion of economic cooperation. These treaties facilitate cross-border trade and investment.

International tax treaties are important because they help prevent double taxation, which occurs when the same income is taxed by multiple jurisdictions. By eliminating barriers to cross-border trade and investment, tax treaties promote economic relations and cooperation between countries.

Tax treaties prevent double taxation by allocating taxing rights between the treaty partners. They specify which country has the right to tax certain types of income and provide mechanisms, such as tax credits, to offset taxes paid in one country against taxes owed in another.

Both individuals and businesses that engage in cross-border activities can benefit from tax treaties. These treaties provide greater certainty about tax obligations, reduce the risk of double taxation, and promote a favorable environment for international trade and investment.

The negotiation process typically involves pre-negotiation, negotiation, and post-negotiation phases. Once the treaty text is finalized and signed, it undergoes a ratification process in each country's legislative body. After ratification, the treaty enters into force and becomes effective.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.