Inherited money is generally not subject to income tax, but it may be subject to inheritance tax depending on the state in which the deceased lived and the relationship between the deceased and the beneficiary. Some states impose an inheritance tax on inherited assets, which is typically calculated based on the value of the assets and the tax rate set by the state. However, there are exceptions and exclusions that may apply, such as exemptions for certain types of property and gifts given during the deceased person's lifetime. It is important to consult with an attorney or tax professional to understand the specific inheritance tax laws in your state and any estate planning strategies that can be used to minimize your tax liability.

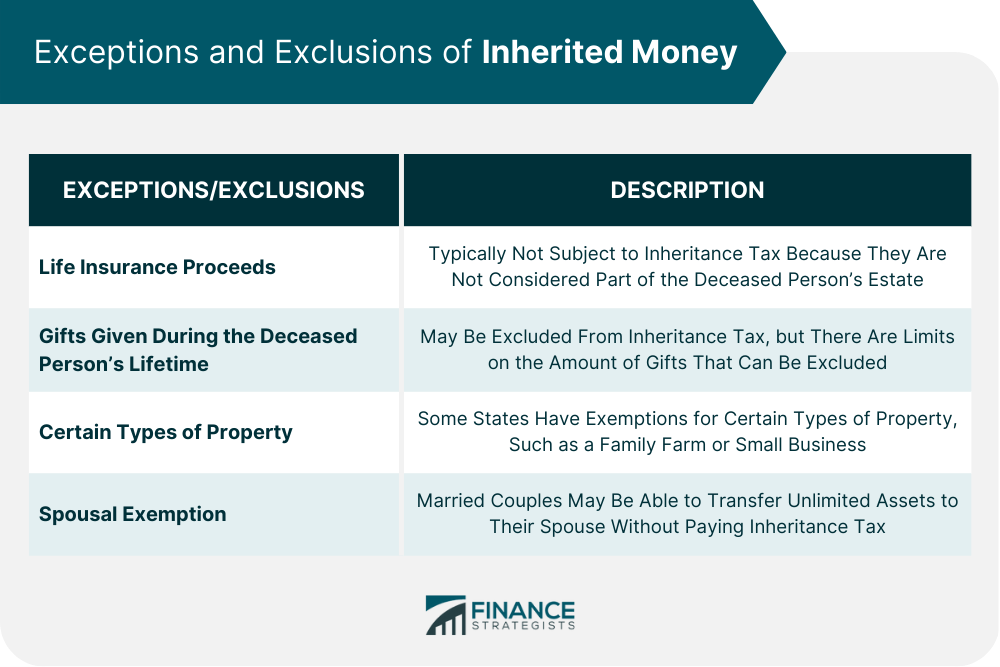

An inheritance tax is a tax that is imposed on the transfer of property or money from a deceased person to their beneficiaries. This tax is separate from the estate tax, which is a tax on the value of a deceased person's estate. Inheritance tax is typically paid by the beneficiary of the inherited money, while the estate tax is paid by the estate of the deceased person. The federal government does not have an inheritance tax, but several states do. As of 2024, there are six states that impose an inheritance tax: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. Each state has its own rules and rates for inheritance tax, so it is important to understand the specific laws in your state. Generally speaking, inherited money is not subject to income tax. This means that if you inherit money, you do not have to report that money as income on your tax return. However, if you receive interest on the inherited money, that interest is subject to income tax. Additionally, if you sell an inherited asset, such as a stock or real estate, you may be subject to capital gains tax on any appreciation in value since the date of the deceased person's death. Inheritance tax is typically calculated based on the value of the inherited assets, and the tax rate varies depending on the state. In some states, the tax rate is progressive, meaning that the tax rate increases as the value of the inherited assets increases. In other states, the tax rate is fixed, regardless of the value of the inherited assets. It is important to note that in most cases, the executor of the deceased person's estate is responsible for filing and paying any inheritance tax owed. However, in some cases, the responsibility may fall to the beneficiary of the inherited money. Exceptions and exclusions play an important role in determining whether inherited money is taxable. Some common exceptions and exclusions include life insurance proceeds, gifts given during the deceased person's lifetime, and exemptions for certain types of property. In addition, married couples may be able to transfer unlimited assets to their spouse without paying taxes, and bequests to qualified charitable organizations may also be exempt from inheritance tax. It is important to understand the specific inheritance tax laws in your state and any exceptions or exclusions that may apply to your situation. Consulting with an attorney or tax professional can help ensure that you are taking advantage of any available exceptions and exclusions and minimizing your tax liability. Below are some examples of exceptions to taxation on inheritance. If you are concerned about inheritance tax, there are several estate planning strategies that you can use to minimize your tax liability. One common strategy is to set up a trust. A trust is a legal entity that holds and manages property for the benefit of one or more beneficiaries. When you transfer assets into a trust, those assets are no longer considered part of your estate, which can reduce your estate tax liability. Additionally, if the trust is set up as an irrevocable trust, the assets in the trust may also be exempt from inheritance tax. Another estate planning strategy to consider is to give gifts to your beneficiaries during your lifetime. As mentioned earlier, gifts that are given during your lifetime may be excluded from inheritance tax. By giving gifts to your beneficiaries prior to your death, you can reduce the size of your estate and potentially reduce your estate tax liability. Finally, it is important to have a solid estate plan in place to ensure that your assets are distributed according to your wishes and to minimize the tax liability for your beneficiaries. This may include creating a will, setting up a trust, and reviewing beneficiary designations on retirement accounts and life insurance policies. Inheritance tax and the taxation of inherited money can be complex topics, and the laws vary depending on the state in which the deceased lived and the relationship between the deceased and the beneficiary. However, by understanding the basics of inheritance tax and exploring estate planning strategies, you can minimize your tax liability and ensure that your assets are distributed according to your wishes. If you have recently inherited money or are in the process of estate planning, it is important to consult with an attorney or tax professional to ensure that you are taking advantage of any available exceptions and exclusions and to understand the specific laws in your state. With the right guidance, you can navigate the tax implications of inherited money and create a solid estate plan that protects your assets and your beneficiaries.Is Inherited Money Taxable?

What Is Inheritance Tax?

Taxation of Inherited Money

Exceptions and Exclusions of Inherited Money

Estate Planning Strategies That Can Minimize Inheritance Tax

The Bottom Line

Is Inherited Money Taxable? FAQs

Generally, inherited money is not subject to income tax, but it may be subject to inheritance tax depending on the state in which the deceased lived and the relationship between the deceased and the beneficiary.

No, life insurance proceeds are typically not subject to inheritance tax because they are not considered to be part of the deceased person's estate.

Yes, gifts that are given during the deceased person's lifetime may be excluded from inheritance tax, but there are limits on the amount of gifts that can be excluded.

There are several estate planning strategies that you can use to minimize your tax liability, such as setting up a trust, giving gifts during your lifetime, and creating a solid estate plan.

If you have inherited money, it is important to consult with an attorney or tax professional to understand the specific inheritance tax laws in your state and any exceptions or exclusions that may apply. You should also consider estate planning strategies to minimize your tax liability and ensure that your assets are distributed according to your wishes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.