Like-kind exchanges are transactions in which two parties exchange assets of a similar nature without incurring tax liabilities. These exchanges allow investors to defer capital gains taxes on the exchanged property. The main purpose of like-kind exchanges is to promote investment in real estate and business assets. Investors can maximize their wealth and contribute to economic growth. Section 1031 of the Internal Revenue Code provides the legal basis for like-kind exchanges in the United States. This provision allows taxpayers to defer capital gains taxes on qualifying property exchanges, subject to certain rules and restrictions. Improved properties refer to those with buildings or other structures, while unimproved properties are undeveloped land. Both types of real estate can be involved in like-kind exchanges, provided they meet the necessary requirements. Leasehold interests represent the lessee's right to use a property for a specific period. These interests can qualify for like-kind exchanges if the remaining lease term is at least 30 years, including any renewal options. Vehicles, such as cars, trucks, and boats, can be involved in like-kind exchanges if they are held for business or investment purposes. Exchanging vehicles can help businesses defer taxes on gains from the sale of older assets. Artwork and collectibles, including paintings, sculptures, and rare coins, can qualify for like-kind exchanges if held for investment purposes. This allows collectors to trade pieces without incurring immediate capital gains taxes. Businesses can exchange equipment and machinery used in their operations as part of a like-kind exchange. This enables companies to upgrade their assets while deferring taxes on gains from the sale of older equipment. To qualify for a like-kind exchange, properties must be held for investment or used in a trade or business. Personal-use assets, such as primary residences, are generally not eligible for like-kind exchanges. For a successful like-kind exchange, the exchanged properties must be of a similar nature and character. This requirement ensures that the properties involved in the exchange serve a similar purpose or function in the taxpayer's investment or business activities. Primary residences, or the homeowner's main dwelling, are not eligible for like-kind exchanges. This exclusion is in place because the tax code intends to promote investment and business growth, rather than personal asset exchanges. Financial instruments, such as stocks, bonds, and other securities, do not qualify for like-kind exchanges. These assets are treated differently under tax law and are subject to different rules and regulations. Interests in partnerships, such as ownership shares in a limited liability company, are not eligible for like-kind exchanges. This is because partnership interests represent a share in a business entity rather than direct ownership of specific assets. The 45-day rule requires taxpayers to identify potential replacement properties within 45 days of transferring their relinquished property. This identification period is crucial for a successful like-kind exchange, as failing to meet the deadline may result in taxable gains. Taxpayers can identify up to three replacement properties during the 45-day identification period. This rule offers flexibility in choosing a suitable replacement property and helps ensure a successful exchange. The 180-day rule mandates that taxpayers must complete their like-kind exchange by acquiring the replacement property within 180 days of transferring the relinquished property. Failing to comply with this deadline may result in the recognition of taxable gains. Taxpayers must also complete their like-kind exchange before the due date of their tax return for the year of the transfer. This requirement ensures that the tax implications of the exchange are properly reported and accounted for. Qualified intermediaries (QIs) play a crucial role in facilitating like-kind exchanges by holding the proceeds from the sale of the relinquished property and acquiring the replacement property on behalf of the taxpayer. They help ensure compliance with Section 1031 regulations. QIs must meet specific requirements and follow regulations, including not being a disqualified person, such as a close relative or an agent of the taxpayer. They must also execute a written exchange agreement and adhere to strict timelines for property transfers. One of the primary benefits of like-kind exchanges is the deferral of capital gains taxes on exchanged properties. This allows taxpayers to reinvest the full proceeds from the sale of a property, leading to increased wealth accumulation and investment opportunities. In a like-kind exchange, the taxpayer's basis in the replacement property is generally equal to the basis in the relinquished property, adjusted for any boot received or given. This adjusted basis impacts future depreciation deductions and potential capital gains on the subsequent sale of the replacement property. In some like-kind exchanges, taxpayers may receive a "boot" or additional value that is not considered like-kind property. This boot may be subject to capital gains taxes, which can reduce the tax benefits of the exchange. If an exchange only partially qualifies under Section 1031, the taxpayer may still be subject to capital gains taxes on the non-qualifying portion of the transaction. Careful planning is necessary to maximize the tax benefits of like-kind exchanges. Like-kind exchanges offer a valuable opportunity for investors to defer capital gains taxes on the exchange of similar assets. Section 1031 of the Internal Revenue Code provides the legal basis for like-kind exchanges in the United States, subject to certain rules and restrictions. These exchanges can involve real estate, leasehold interests, vehicles, artwork, collectibles, and equipment and machinery. The identification period and exchange period are crucial for a successful like-kind exchange, and taxpayers must also complete the exchange before the due date of their tax return for the year of the transfer. Qualified intermediaries play a critical role in facilitating exchanges, and careful planning is necessary to avoid potential tax risks and pitfalls, such as boot and partially qualifying exchanges. Overall, like-kind exchanges promote investment and business growth and provide a valuable opportunity for taxpayers to defer capital gains taxes and maximize their wealth accumulation and investment opportunities.What Are Like-Kind Exchanges?

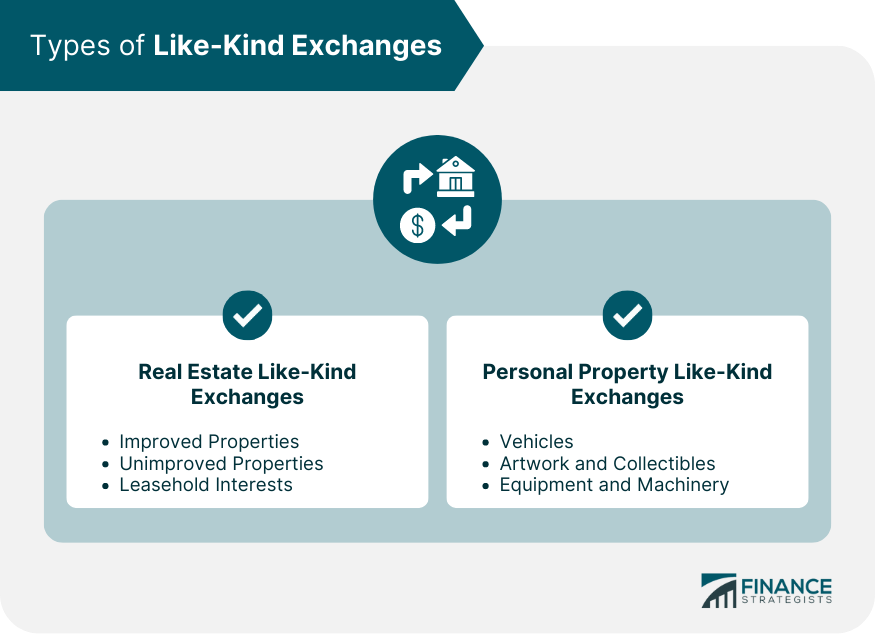

Types of Like-Kind Exchanges

Real Estate Like-Kind Exchanges

Improved and Unimproved Properties

Leasehold Interests

Personal Property Like-Kind Exchanges

Vehicles

Artwork and Collectibles

Equipment and Machinery

Qualifying Properties and Requirements for Like-Kind Exchanges

Properties Held for Investment or Business Use

Properties of Similar Nature and Character

Excluded Properties

Primary Residences

Stocks, Bonds, and Other Securities

Partnership Interests

Like-Kind Exchange Process

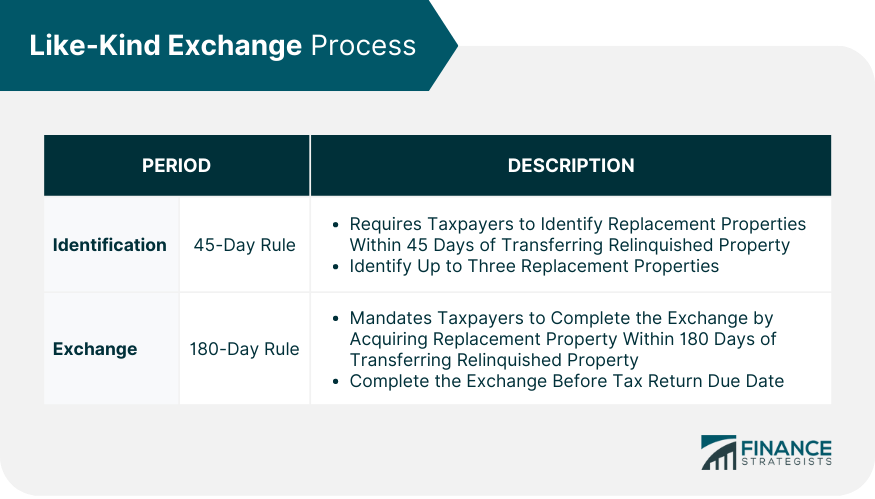

Identification Period in Like-Kind Exchanges

45-Day Rule

Identifying Up to Three Replacement Properties

Exchange Period in Like-Kind Exchanges

180-Day Rule

Completing the Exchange Before Tax Return Due Date

Qualified Intermediaries in Like-Kind Exchanges

Role in Facilitating Exchanges

Requirements and Regulations

Tax Implications and Benefits of Like-Kind Exchanges

Deferral of Capital Gains Taxes

Basis Calculation and Depreciation

Potential Tax Risks and Pitfalls

Boot and Taxable Gain

Partially Qualifying Exchanges

Final Thoughts

Like-Kind Exchanges FAQs

The primary benefits of like-kind exchanges include the deferral of capital gains taxes on exchanged properties, allowing investors to maximize wealth accumulation and reinvestment opportunities. These exchanges are particularly advantageous for real estate investments.

Properties that qualify for like-kind exchanges include real estate, such as improved and unimproved properties, and leasehold interests with a remaining lease term of at least 30 years. Personal property-like-kind exchanges are no longer permitted following the Tax Cuts and Jobs Act of 2017.

Qualified intermediaries (QIs) play a crucial role in facilitating like-kind exchanges by holding the proceeds from the sale of the relinquished property and acquiring the replacement property on behalf of the taxpayer. QIs help ensure compliance with Section 1031 regulations and manage the exchange process.

Two critical timelines in like-kind exchanges are the 45-day identification period, during which taxpayers must identify up to three potential replacement properties, and the 180-day exchange period, in which the replacement property must be acquired. Additionally, the exchange must be completed before the taxpayer's tax return due date for the year of the transfer.

Investors can stay informed about changes in like-kind exchange regulations by monitoring tax news, consulting with tax professionals, and staying up-to-date on legislative developments. This awareness allows investors to adjust their investment strategies and tax planning in response to regulatory changes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.