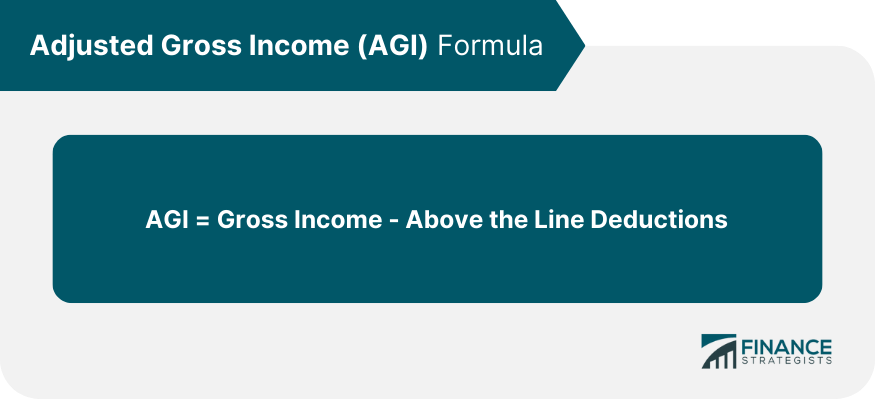

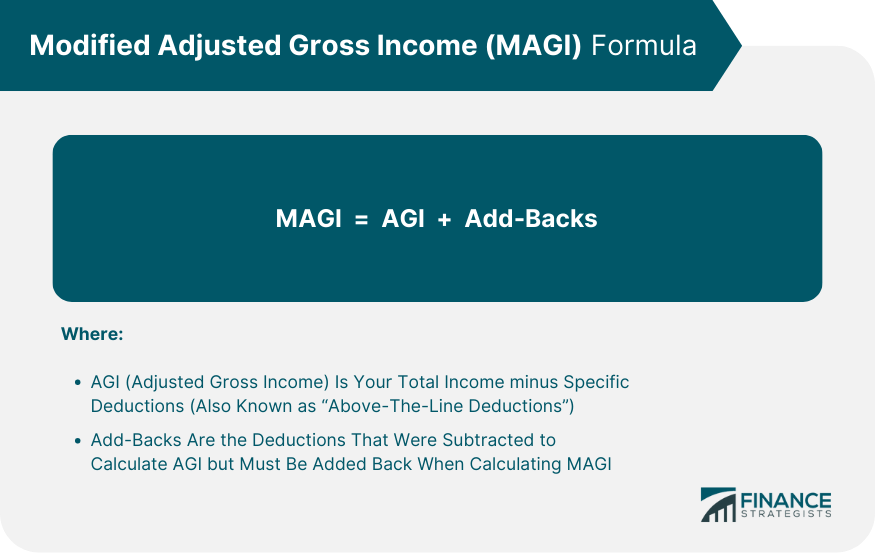

Modified Adjusted Gross Income is a financial metric used by the Internal Revenue Service (IRS) to determine eligibility for certain tax credits, deductions, and benefits. It is calculated by adjusting the Adjusted Gross Income (AGI) by adding back certain deductions and tax-exempt income items. It serves as the basis for various tax provisions, including income tax brackets, child tax credits, earned income tax credits, education tax credits, and retirement savings contributions credits. Moreover, MAGI impacts healthcare premiums and student financial aid. There is a difference between AGI and MAGI. AGI is the total income a taxpayer earns minus specific deductions, such as contributions to retirement accounts, alimony payments, and student loan interest. MAGI builds on AGI by adding back certain deductions and tax-exempt income items to provide a more comprehensive view of a taxpayer's financial situation. This adjusted figure is used to determine eligibility for various tax benefits and financial aid programs. To calculate your MAGI, you first need to compute your AGI. AGI is calculated by subtracting specific deductions, also known as "above-the-line deductions," from your total income. Total income includes all sources of income, such as wages, salaries, tips, interest, dividends, and capital gains. Once you have calculated your AGI, you can then determine your MAGI by adding back certain deductions that were previously subtracted to compute AGI. The formula for MAGI is as follows: The specific add-backs can vary depending on the tax benefit or federal program you're applying for, but some common add-backs include: Deductible IRA contributions Deductible contributions to a self-employed retirement plan, such as SEP, SIMPLE, or Keogh Student loan interest Tuition and fees deduction Passive loss or passive income Rental losses Exclusion for income from U.S. savings bonds used for higher education expenses Exclusion for employer-provided adoption assistance programs Any foreign-earned income exclusion or foreign housing exclusion It's important to consult the relevant guidelines and tax laws to determine the appropriate add-backs for your specific situation when calculating your MAGI. The U.S. federal income tax system uses progressive tax brackets, meaning that taxpayers with higher MAGI pay a higher percentage of their income in taxes. Each taxpayer's MAGI determines their placement within the tax brackets, with different rates applied to various income ranges. MAGI is used to determine a taxpayer's placement within the federal income tax brackets. Taxpayers with lower MAGI fall into lower tax brackets, resulting in a lower tax liability. Conversely, taxpayers with higher MAGI are placed into higher tax brackets and face a higher tax liability. There are several strategies taxpayers can use to reduce their MAGI, thereby lowering their tax liability. These strategies may include maximizing retirement account contributions, utilizing tax-advantaged accounts such as Health Savings Accounts (HSAs), and engaging in strategic charitable giving. The Child Tax Credit is a valuable tax credit that helps offset the cost of raising children. A taxpayer's MAGI determines their eligibility for the CTC and the amount they can claim. Taxpayers with lower MAGI may be eligible for a higher CTC, while those with higher MAGI may see a reduced credit or be ineligible. The Earned Income Tax Credit is a refundable tax credit designed to assist low- to moderate-income working individuals and families. MAGI plays a crucial role in determining a taxpayer's eligibility for the EITC, with specific income limits established for various family sizes and situations. Education tax credits, such as the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), help offset the cost of higher education. A taxpayer's MAGI is used to determine eligibility for these credits and the amount they can claim. Taxpayers with lower MAGI may be eligible for higher education tax credits, while those with higher MAGI may see a reduced credit or be ineligible. The Retirement Savings Contributions Credit, also known as the Saver's Credit, is a non-refundable tax credit that encourages low- to moderate-income taxpayers to save for retirement. MAGI is used to determine eligibility for the Saver's Credit, with specific income limits established to target lower-income individuals and families. Several other tax credits and deductions are affected by a taxpayer's MAGI, including the Premium Tax Credit for health insurance, adoption tax credits, and deductions for medical expenses. A lower MAGI can increase eligibility for these tax benefits, while a higher MAGI may reduce or eliminate eligibility for these credits and deductions. It is crucial for taxpayers to understand their MAGI and how it impacts their overall tax situation. MAGI is a critical factor in determining eligibility for premium tax credits under the Affordable Care Act (ACA). These tax credits help eligible individuals and families afford health insurance purchased through the Health Insurance Marketplace. Taxpayers with lower MAGI may qualify for higher premium tax credits, which can significantly reduce their health insurance costs. Medicaid is a state and federal program that provides health coverage to low-income individuals and families. MAGI is used to determine eligibility for Medicaid in most states. Individuals and families with lower MAGI may qualify for Medicaid coverage, while those with higher MAGI may be ineligible. Medicare is a federal health insurance program for individuals aged 65 and older, as well as certain younger individuals with disabilities. MAGI plays a role in determining Medicare premium surcharges, which are additional costs imposed on higher-income beneficiaries. Individuals with higher MAGI may be subject to these premium surcharges, resulting in higher out-of-pocket costs for Medicare coverage. MAGI is an essential component in determining eligibility for federal student aid, such as grants, loans, and work-study programs. The Free Application for Federal Student Aid (FAFSA) uses MAGI to calculate the Expected Family Contribution (EFC), which is a measure of a family's financial strength and ability to contribute to college costs. The Expected Family Contribution is calculated using a formula that considers a family's MAGI, assets, and other financial information. A lower MAGI typically results in a lower EFC, which may increase a student's eligibility for need-based financial aid. A higher MAGI, on the other hand, can result in a higher EFC, potentially reducing a student's eligibility for need-based aid. There are several strategies that families can use to minimize their MAGI for financial aid purposes. These strategies may include maximizing contributions to tax-advantaged retirement accounts, utilizing tax-advantaged savings vehicles like 529 college savings plans, and timing income and expenses strategically. Effective tax planning strategies can help taxpayers manage their MAGI and optimize their tax benefits. These strategies may include maximizing deductions, deferring income, and utilizing tax-advantaged investment vehicles. Maximizing contributions to tax-advantaged retirement accounts, such as IRAs and 401(k)s, can help lower MAGI and reduce tax liability. These contributions may also increase eligibility for certain tax credits and deductions, as well as financial aid for higher education. Strategic charitable giving can help taxpayers manage their MAGI by reducing their taxable income. Donations to qualified charitable organizations can be deducted from taxable income, resulting in a lower MAGI and potential tax savings. Other strategies to reduce MAGI and optimize tax benefits may include utilizing tax-advantaged accounts like Health Savings Accounts (HSAs), timing income and expenses strategically, and investing in tax-exempt bonds. Modified Adjusted Gross Income is a critical financial metric used by the IRS to determine eligibility for certain tax credits, deductions, and benefits. MAGI impacts various aspects of a taxpayer's financial situation, including tax brackets, health care premiums, and student financial aid. To calculate MAGI, taxpayers must first calculate their AGI and then add back certain deductions to arrive at the adjusted figure. A lower MAGI can increase eligibility for tax benefits, health care subsidies, and financial aid, while a higher MAGI can result in higher tax liability, reduced benefits, and higher out-of-pocket costs. Taxpayers can use strategies such as maximizing retirement account contributions, engaging in strategic charitable giving, and utilizing tax-advantaged accounts to reduce their MAGI and optimize their tax benefits. It is crucial to consult with a tax professional or financial advisor to develop a comprehensive MAGI management plan.What Is Modified Adjusted Gross Income (MAGI)?

Calculating Modified Adjusted Gross Income

MAGI and Federal Income Tax Brackets

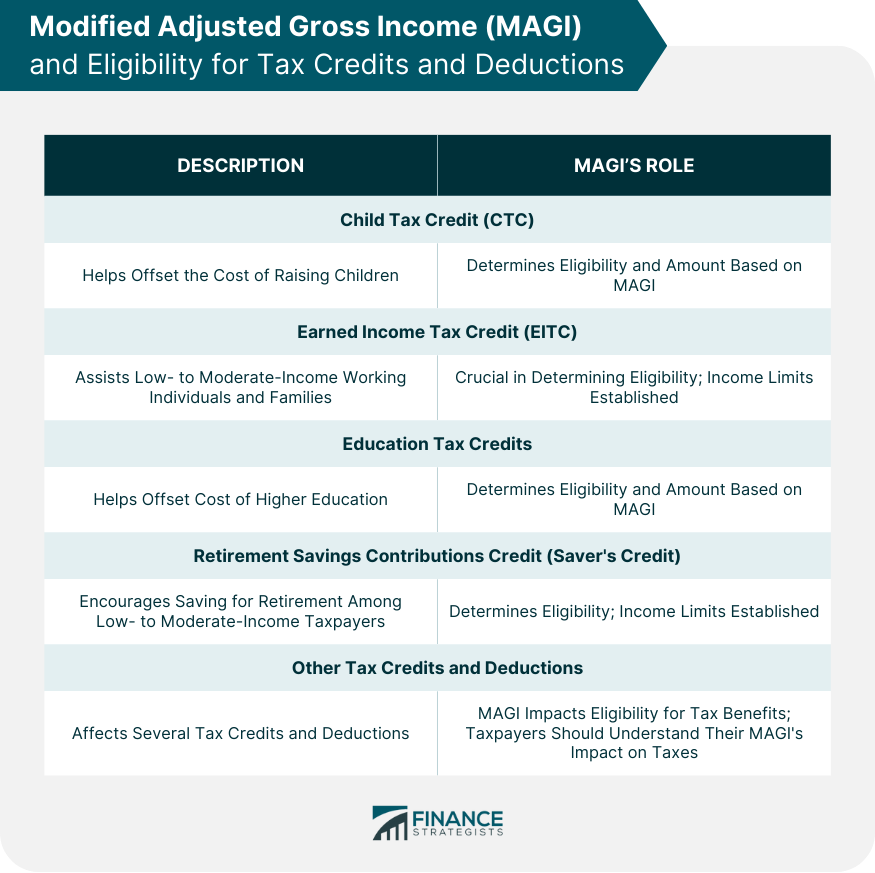

MAGI and Eligibility for Tax Credits and Deductions

Child Tax Credit (CTC)

Earned Income Tax Credit (EITC)

Education Tax Credits

Retirement Savings Contributions Credit (Saver's Credit)

Other Tax Credits and Deductions Affected by MAGI

MAGI and Health Care

Affordable Care Act (ACA) Premium Tax Credits

Medicaid Eligibility

Medicare Premium Surcharges

MAGI and Student Financial Aid

Federal Student Aid Eligibility

Expected Family Contribution (EFC) Calculation

Strategies to Minimize MAGI for Financial Aid Purposes

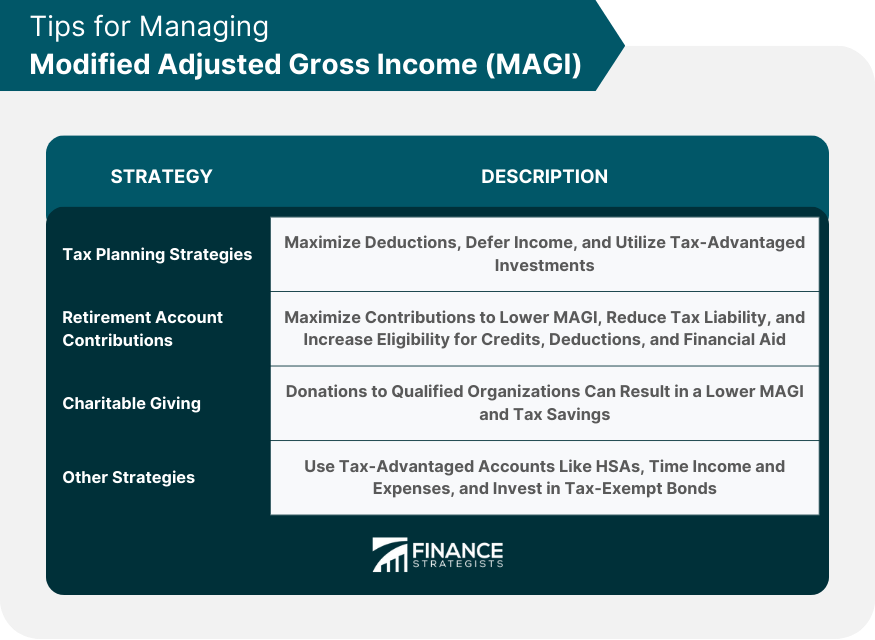

Tips for Managing MAGI

Tax Planning Strategies

Retirement Account Contributions

Charitable Giving

Other Strategies to Reduce MAGI and Optimize Tax Benefits

Final Thoughts

Modified Adjusted Gross Income (MAGI) FAQs

Adjusted Gross Income (AGI) is a taxpayer's total income minus specific deductions, while Modified Adjusted Gross Income (MAGI) builds on AGI by adding back certain deductions and tax-exempt income items. MAGI provides a more comprehensive view of a taxpayer's financial situation and is used to determine eligibility for various tax benefits and financial aid programs.

To calculate MAGI, start with your Adjusted Gross Income (AGI) and add back specific deductions and tax-exempt income items, such as non-taxable Social Security benefits, tax-exempt interest, deductions for IRA contributions, and deductions for student loan interest, among others. The resulting figure is your MAGI, which is used to determine your eligibility for certain tax credits, deductions, and benefits.

MAGI is used to determine eligibility for various tax credits and deductions, such as the Child Tax Credit, Earned Income Tax Credit, education tax credits, and the Saver's Credit. Taxpayers with lower MAGI may qualify for higher tax credits and deductions, while those with higher MAGI may see reduced benefits or be ineligible.

MAGI plays a crucial role in determining eligibility for financial aid programs, such as federal student aid, and healthcare programs like premium tax credits under the Affordable Care Act and Medicaid. Lower MAGI typically increases eligibility for these programs, while higher MAGI may reduce or eliminate eligibility.

Effective strategies to manage your MAGI may include maximizing contributions to tax-advantaged retirement accounts, utilizing tax-advantaged accounts like Health Savings Accounts (HSAs), engaging in strategic charitable giving, and timing income and expenses strategically. Consulting with a tax professional is recommended to develop a personalized tax planning strategy based on your specific financial situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.