Pre-tax contributions are amounts set aside from an employee's income before taxes are deducted. These contributions are directed towards various savings or investment accounts, which are designed to help employees reach specific financial goals while reducing their taxable income. The primary purpose of pre-tax contributions is to encourage individuals to save for long-term financial goals, such as retirement or healthcare expenses. By reducing taxable income, pre-tax contributions lower an individual's tax liability, providing immediate tax savings and potentially increased take-home pay. Various types of accounts are available for pre-tax contributions, including retirement savings plans, health savings accounts, and flexible spending accounts. Each account type serves a unique purpose and offers different benefits, depending on the individual's financial goals and circumstances. Retirement savings plans are designed to help individuals save for their post-working years. These plans offer a tax-efficient way to invest and grow savings for retirement, often with employer contributions or matching programs. A 401(k) plan is a retirement savings plan offered by private-sector employers. It allows employees to contribute a portion of their pre-tax income to an investment account, which can grow tax-deferred until withdrawal in retirement. A 403(b) plan is similar to a 401(k) but is designed for employees of public schools, tax-exempt organizations, and certain ministers. Like a 401(k), contributions are made pre-tax, and investment earnings grow tax-deferred until withdrawal. The 457 plan is a deferred compensation plan available to state and local government employees and some non-profit organizations. Participants can contribute pre-tax income to the plan, with investment earnings growing tax-deferred until withdrawn in retirement. A traditional IRA is an individual retirement account that allows eligible individuals to contribute pre-tax income. The contributions and investment earnings grow tax-deferred until withdrawal, at which point they are taxed as ordinary income. Health savings accounts (HSAs) are tax-advantaged accounts designed for individuals with high-deductible health plans. These accounts allow users to save pre-tax income for qualified medical expenses, and any unused funds can be rolled over year-to-year. Flexible spending accounts (FSAs) are employer-sponsored accounts that allow employees to set aside pre-tax income for eligible expenses. These accounts typically have a "use-it-or-lose-it" policy, requiring employees to spend the funds within the plan year or forfeit the remaining balance. A health FSA is a type of flexible spending account that allows employees to save pre-tax income for eligible healthcare expenses. This can include expenses like copayments, prescription medications, and medical equipment. A dependent care FSA allows employees to set aside pre-tax income for eligible dependent care expenses. This can include childcare or adult daycare expenses for a qualifying dependent, such as a child or an elderly parent. In addition to the more common pre-tax contribution plans, there are other options available to help employees save and invest their income tax-efficiently. An employee stock purchase plan (ESPP) allows employees to purchase company stock at a discounted price using pre-tax income. This can provide an opportunity for employees to invest in their company's growth and potentially realize tax savings on the investment gains. Commuter benefits are employer-sponsored programs that allow employees to set aside pre-tax income for eligible commuting expenses. This can include costs for public transportation, parking, or even bicycle maintenance, helping employees save on the expenses associated with their daily commute to work. Before making pre-tax contributions, individuals must determine their eligibility for the various types of pre-tax contribution accounts. This may involve reviewing income limits, employment status, and other relevant factors to ensure they can participate in the desired account type. Once eligibility is confirmed, individuals can enroll in a pre-tax contribution plan through their employer or by opening an individual account. This may involve completing paperwork, selecting investment options, and designating contribution amounts. Determining the appropriate contribution amount for a pre-tax contribution account depends on an individual's financial goals, budget, and tax situation. It is important to consider factors such as contribution limits, employer matching, and potential tax savings when making these decisions. Regularly reviewing and adjusting pre-tax contributions can help ensure that individuals remain on track to meet their financial goals. This may involve increasing contributions, reallocating investments, or changing account types based on life events, income changes, or changes in financial goals. Pre-tax contributions are the amounts set aside from an individual's income before taxes are deducted. These contributions are made to qualified retirement accounts such as 401(k)s, 403(b)s, and traditional IRAs. By contributing pre-tax dollars, individuals are able to reduce their taxable income and defer taxes on their contributions and earnings until they withdraw the money during retirement. The main advantage of pre-tax contributions is the immediate tax savings they provide. By lowering taxable income, individuals may find themselves in a lower tax bracket, which could lead to significant tax savings. Additionally, earnings on pre-tax contributions grow tax-deferred, meaning individuals will not be required to pay taxes on their investment gains until they withdraw the funds in retirement. When funds are withdrawn from a pre-tax retirement account during retirement, they are treated as ordinary income and are subject to federal and possibly state income taxes. If withdrawals are made before the age of 59½, an additional 10% early withdrawal penalty may apply unless specific exceptions are met. Post-tax contributions refer to the amounts that are set aside from an individual's income after taxes have been deducted. These contributions are made to retirement accounts such as Roth IRAs and Roth 401(k)s. Unlike pre-tax contributions, post-tax contributions do not provide an immediate tax break, but they offer tax-free growth and withdrawals in retirement. The main advantage of post-tax contributions is the tax-free growth and withdrawals they provide during retirement. While there are no immediate tax savings when making post-tax contributions, the money invested grows tax-free, and qualified withdrawals are not subject to income taxes. This means that individuals can enjoy their retirement savings without worrying about paying taxes on their investment gains. Qualified withdrawals from a post-tax retirement account, such as a Roth IRA or Roth 401(k), are tax-free, provided certain conditions are met. These conditions typically include that the account has been held for at least five years and the individual is at least 59½ years old. Early withdrawals may be subject to taxes and penalties, depending on the specific circumstances. One of the main advantages of pre-tax contributions is the reduction of an individual's taxable income. By contributing a portion of their income before taxes, individuals can lower their tax liability, which may result in increased take-home pay and immediate tax savings. Pre-tax contributions typically grow tax-deferred within the chosen investment or savings account. This means that the interest, dividends, and capital gains generated within the account are not taxed until withdrawn, allowing the invested funds to grow more rapidly than they would in a taxable account. By lowering taxable income and allowing for tax-deferred growth, pre-tax contributions can increase an individual's overall savings potential. This can lead to greater long-term wealth accumulation, especially when paired with employer-matching programs or other incentives. Many employers offer matching contributions for certain pre-tax contribution plans, such as 401(k) or 403(b) plans. These matching contributions can significantly increase an individual's total retirement savings and provide an additional incentive to participate in pre-tax contribution plans. Each type of pre-tax contribution account has annual contribution limits set by the IRS. These limits dictate the maximum amount an individual can contribute to the account each year. Exceeding these limits may result in penalties or other negative tax consequences. Pre-tax contribution accounts often have restrictions on when and under what circumstances funds can be withdrawn. For example, retirement accounts typically impose penalties for early withdrawals before a certain age or specific qualifying events, such as disability or financial hardship. While pre-tax contributions grow tax-deferred, withdrawals from these accounts are typically subject to income tax. This means that the funds withdrawn in retirement or for other qualified expenses will be taxed as ordinary income, which could impact an individual's overall tax liability. Certain pre-tax contribution accounts, such as traditional IRAs and 401(k) plans, require individuals to take required minimum distributions (RMDs) starting at age 73. These mandatory withdrawals can have tax implications and may impact an individual's overall retirement income strategy. Pre-tax contributions offer a tax-efficient way for individuals to save for long-term financial goals while reducing their taxable income. There are various types of accounts available for pre-tax contributions, including retirement savings plans, health savings accounts, and flexible spending accounts. Before making pre-tax contributions, individuals must understand their eligibility, enroll in a pre-tax contribution plan, select contribution amounts, and monitor and adjust contributions regularly. Pre-tax contributions offer immediate tax savings, tax-deferred growth, increased savings potential, and employer matching contributions. However, they also have potential disadvantages such as contribution limits, withdrawal restrictions, potential tax implications upon withdrawal, and mandatory required minimum distributions. Understanding the benefits and drawbacks of pre-tax contributions can help individuals make informed decisions and plan for their long-term financial goals effectively. By seeking professional guidance, individuals can make informed decisions and take advantage of the full range of tax-saving opportunities available to them.What Are Pre-tax Contributions?

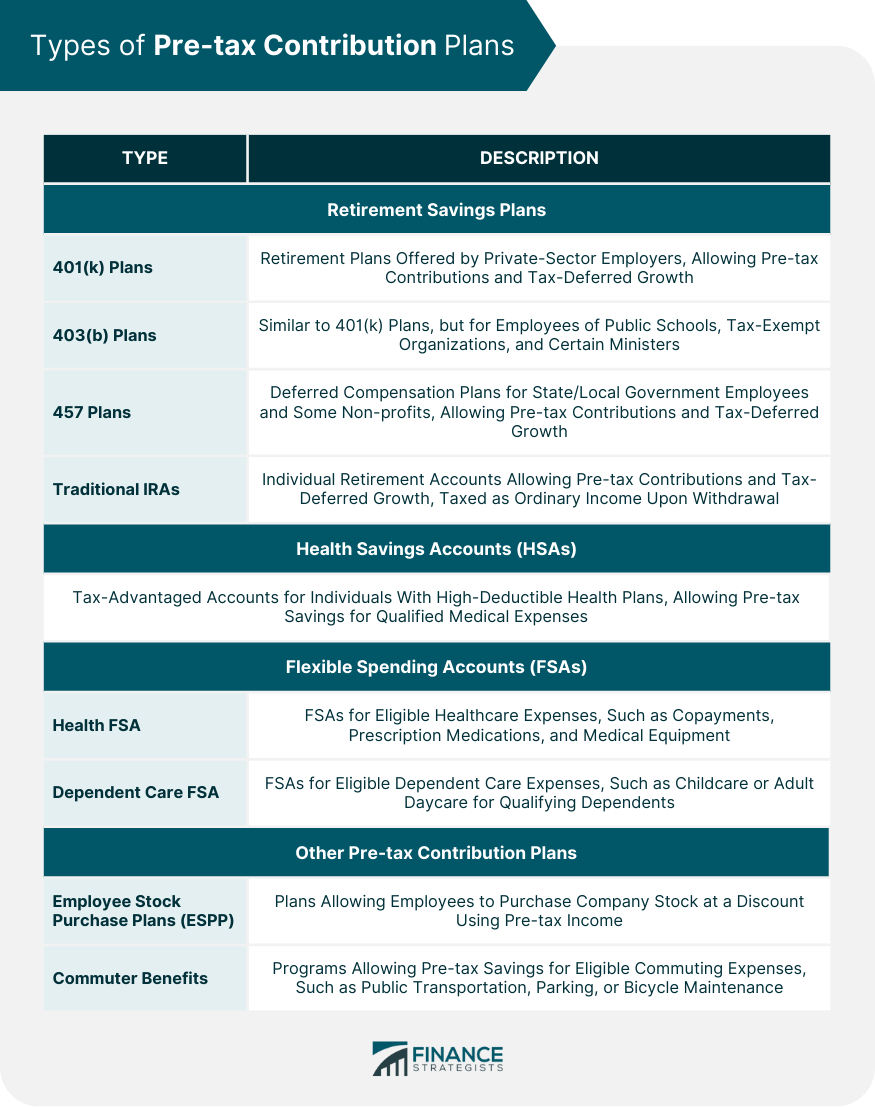

Types of Pre-tax Contribution Plans

Retirement Savings Plans

401(k) Plans

403(b) Plans

457 Plans

Traditional IRAs

Health Savings Accounts (HSAs)

Flexible Spending Accounts (FSAs)

Health FSA

Dependent Care FSA

Other Pre-tax Contribution Plans

Employee Stock Purchase Plans (ESPP)

Commuter Benefits

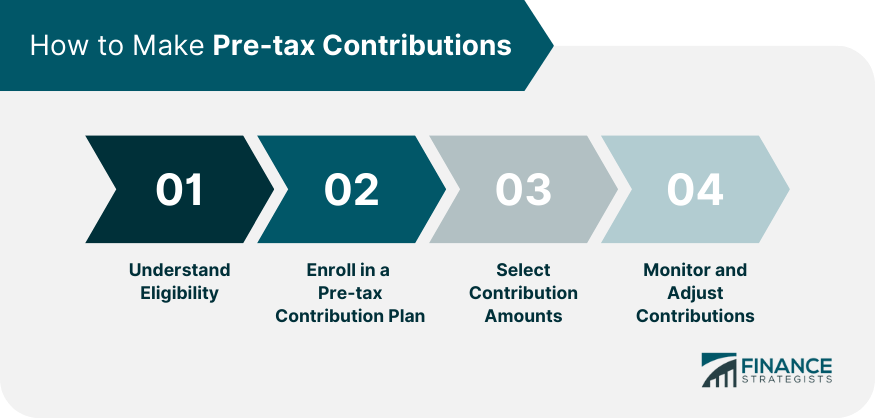

How to Make Pre-tax Contributions

Understand Eligibility

Enroll in a Pre-tax Contribution Plan

Select Contribution Amounts

Monitor and Adjust Contributions

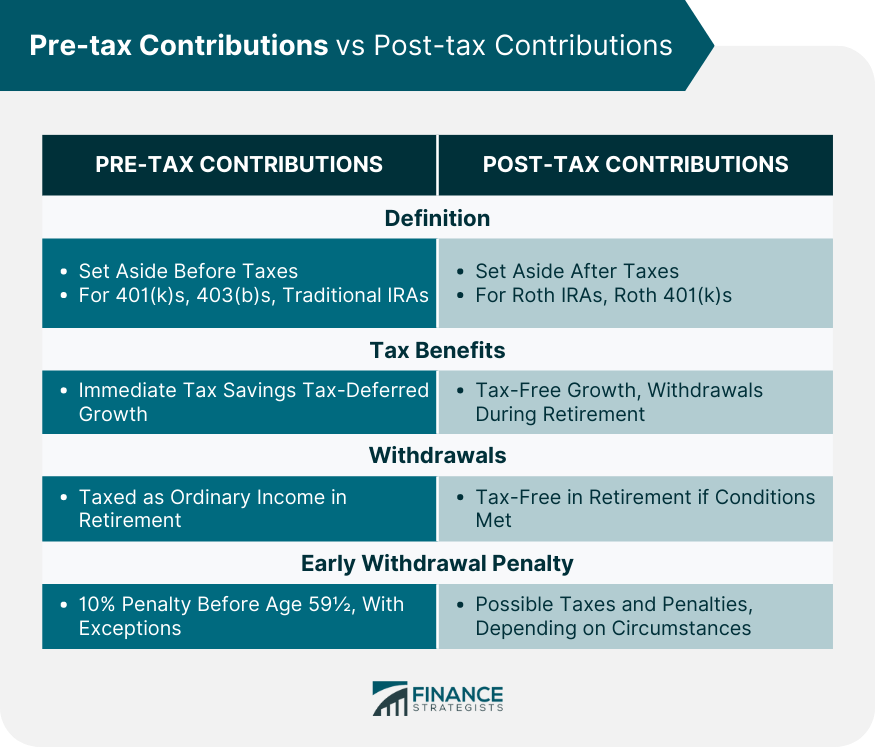

Pre-tax Contributions vs Post-tax Contributions

Pre-tax Contributions

Tax Benefits

Withdrawals

Post-tax Contributions

Tax Benefits

Withdrawals

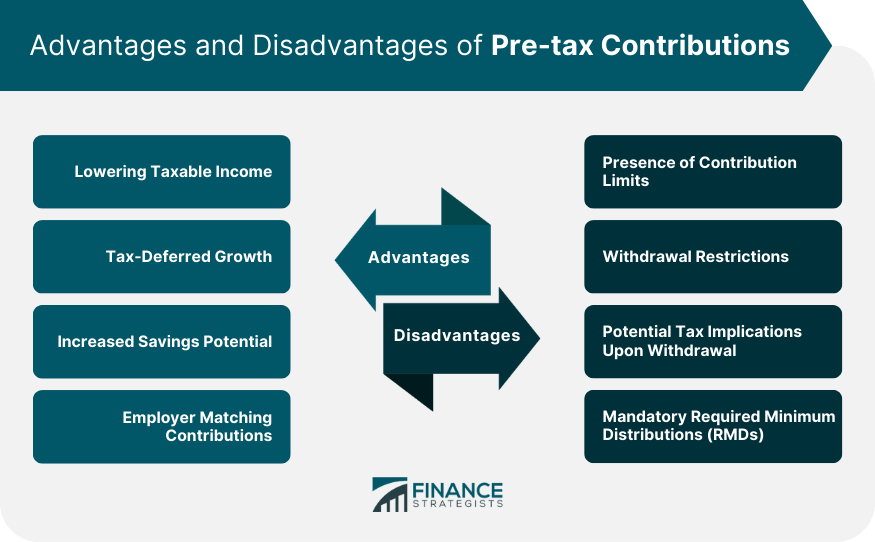

Advantages of Pre-tax Contributions

Lowering Taxable Income

Tax-deferred Growth

Increased Savings Potential

Employer Matching Contributions

Disadvantages of Pre-tax Contributions

Presence of Contribution Limits

Withdrawal Restrictions

Potential Tax Implications Upon Withdrawal

Mandatory Required Minimum Distributions (RMDs)

Final Thoughts

Pre-tax Contributions FAQs

The main benefits of pre-tax contributions include lowering taxable income, enabling tax-deferred growth, increasing savings potential, and potentially receiving employer-matching contributions. These advantages can help individuals accumulate wealth more efficiently and reach their long-term financial goals.

Yes, there are limitations to consider when making pre-tax contributions. These include annual contribution limits, withdrawal restrictions, potential tax implications upon withdrawal, and required minimum distributions (RMDs) for certain accounts. It is essential to understand these limitations when developing a tax-efficient savings and investment strategy.

Pre-tax contributions are made from income before taxes are deducted, while post-tax contributions are made from income after taxes have been withheld. The main difference lies in the taxation of withdrawals: pre-tax contributions are taxed upon withdrawal, while post-tax contributions are generally tax-free.

Eligibility for pre-tax contribution accounts depends on factors such as income, employment status, and other individual circumstances. To determine your eligibility, review the specific requirements for each account type or consult with a tax planning professional or financial advisor for personalized guidance.

When deciding between pre-tax and post-tax contributions, consider factors such as current and future tax rates, investment growth potential, and financial goals. A balanced approach that includes both pre-tax and post-tax contributions may be optimal for some individuals, depending on their unique circumstances. Consulting with a tax planning professional or financial advisor can provide personalized advice and help you make an informed decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.