A Qualified Birth or Adoption Distribution is a provision of the SECURE Act (Setting Every Community Up for Retirement Enhancement Act) passed in 2019 in the United States. QBAD allows individuals to withdraw funds from their retirement accounts without incurring the usual 10% early withdrawal penalty for certain qualified birth or adoption expenses. Under QBAD, an individual can withdraw up to $5,000 from their individual retirement accounts (IRAs) or employer-sponsored retirement plans, such as 401(k)s, without facing the early withdrawal penalty. The purpose of QBAD is to ease the financial burden on parents and adoptive parents by allowing them to withdraw funds from their retirement accounts without incurring the standard 10% early withdrawal penalty. The distribution must be made during a 1-year period that begins on the exact date when your child is born or when the legal adoption is finalized. This means if the distribution occurs outside this window, it will not be eligible for the QBAD, and the typical early withdrawal penalties may apply. In the case of adoption, the SECURE Act specifies that the individual being adopted must be either under the age of 18 or a person who is physically or mentally incapable of self-support. This requirement is to ensure that the QBAD provision supports the adoption of children or individuals who require significant care and resources. The individual being adopted cannot be the child of the taxpayer's spouse. This is likely designed to prevent abuse of the QBAD provision in situations that may not involve the same level of financial impact typically associated with births and adoptions. As mentioned above, the limit is set at $5,000. However, if both parents have separate retirement accounts, each one is allowed to take a QBAD of $5,000. This means that a couple could receive a total of $10,000 penalty-free to support costs associated with a birth or adoption. If the individual chooses, they can repay a QBAD to an eligible retirement plan or IRA, and that repayment will be treated as a trustee-to-trustee transfer. It doesn't count against the annual contribution limits, which offers some flexibility for individuals to replenish their retirement savings after making a QBAD. When taking a QBAD, individuals must consider the income tax implications. Although the 10% early withdrawal penalty is waived for QBADs, the distribution is still subject to income taxes. This means that the withdrawn amount will be added to the individual's taxable income for the year, potentially increasing their overall tax liability. It is important to consult with a tax professional or financial advisor to understand the specific tax implications of a QBAD. Traditional Individual Retirement Accounts are tax-deferred retirement accounts. Individuals contribute pre-tax dollars, and the contributions may be tax-deductible. The funds grow tax-deferred until retirement, at which time withdrawals are taxed as ordinary income. Contributions to Roth IRAs are made with after-tax dollars, and qualified distributions are tax-free. Roth IRAs also grow tax-free, which means you do not have to pay taxes on the earnings within the account as long as you meet the requirements for a qualified distribution. These are employer-sponsored retirement plans. Employees make contributions on a pre-tax basis, and some employers may match a portion of these contributions. Funds in a 401(k) grow tax-deferred, and withdrawals are taxed as ordinary income. 403(b) plans are similar to 401(k) plans but are designed for employees of public schools, certain tax-exempt organizations, and certain ministers. Like 401(k) plans, contributions are made on a pre-tax basis, the funds grow tax-deferred, and withdrawals are taxed as ordinary income. These are non-qualified, tax-advantaged deferred compensation retirement plans. They are available to certain state and local government and non-governmental employees. The tax treatment is similar to 401(k) and 403(b) plans. The TSP is a retirement savings plan for federal employees and members of the uniformed services. It's similar to a 401(k) plan in its tax treatment. The most notable benefit is the exemption from the 10% early withdrawal penalty, which can provide significant savings for new parents. Additionally, the repayment option allows individuals to replenish their retirement account after taking the distribution, potentially mitigating the long-term impact on their retirement savings. Furthermore, the flexibility in using funds for any expenses related to the birth or adoption of a child provides additional financial support for new parents. On the other hand, there are some disadvantages to consider when utilizing a QBAD. One of the main concerns is the potential impact on long-term retirement savings, as withdrawing funds from a retirement account can reduce the account's growth potential. The income tax implications can also increase an individual's tax liability for the year, potentially leading to a higher tax bill. Finally, the limited availability of QBAD, with its specific eligibility criteria and time frame, may only accommodate some individuals' unique situations. It's often advisable to leave retirement savings untouched until retirement if at all possible. If you're expecting a new child by birth or adoption and are worried about the financial implications, consider the following: An HSA is a special type of savings account designed for individuals with high-deductible health insurance plans. Contributions to an HSA are made pre-tax, meaning they lower your taxable income. Additionally, the interest and earnings on HSA funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free. If your plan allows it, you can use HSA funds to cover medical costs related to prenatal care, delivery, postnatal care, and any eligible medical expenses for your newly adopted child. An FSA is an employer-sponsored account that allows you to use pre-tax dollars to pay for eligible healthcare expenses. Like an HSA, an FSA can help you manage the increased medical costs typically associated with the birth or adoption of a child. However, note that FSAs typically operate on a use-it-or-lose-it principle, where unused funds at the end of the year (or grace period if provided) are forfeited. This type of insurance can replace a portion of your income for a specific period, typically several weeks to months, if you're unable to work due to a temporary disability. In many cases, pregnancy and childbirth are covered events, so you could receive benefits during your pregnancy and postpartum recovery period. Policies and coverage vary, so it's important to understand the terms and conditions of your specific policy. In some circumstances, you might consider personal loans or credit cards to manage immediate expenses. Keep in mind that these often come with high interest rates, and without careful management, the debt can compound quickly. It's crucial to have a plan for repayment and ideally, use these options only as a last resort. Depending on your financial situation, you might qualify for public assistance programs. Many local, state, and federal programs are designed to help with costs associated with raising a child, such as the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), Medicaid, or the Children's Health Insurance Program (CHIP). The Qualified Birth or Adoption Distribution provision of the SECURE Act offers individuals the opportunity to withdraw funds from their retirement accounts without facing the usual 10% early withdrawal penalty. Eligible individuals can withdraw up to $5,000 from their retirement accounts within a one-year period from the birth or legal adoption date, providing significant savings and flexibility. However, it is important to carefully consider the potential drawbacks of QBAD. Withdrawing funds from retirement accounts can have a long-term impact on savings and reduce the account's growth potential. Additionally, QBAD distributions are subject to income taxes, which may increase an individual's tax liability for the year. It is advisable to assess personal finances, consult with professionals, and explore alternative options such as HSAs, FSAs, short-term disability insurance, loans or credit, and public assistance programs to make well-informed decisions that best support the financial needs of growing families. By carefully weighing the advantages and disadvantages, individuals can determine the most suitable approach for managing the expenses associated with welcoming a new child into their lives.What Is Qualified Birth or Adoption Distribution (QBAD)?

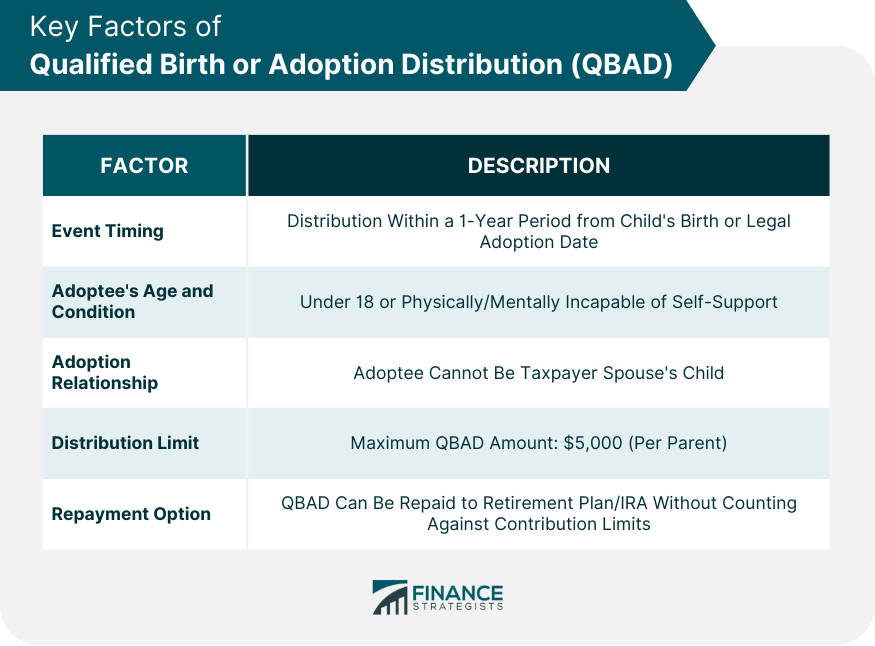

Key Factors of QBAD

Event Timing

Adoptee's Age and Condition

Adoption Relationship

Distribution Limit

Repayment Option

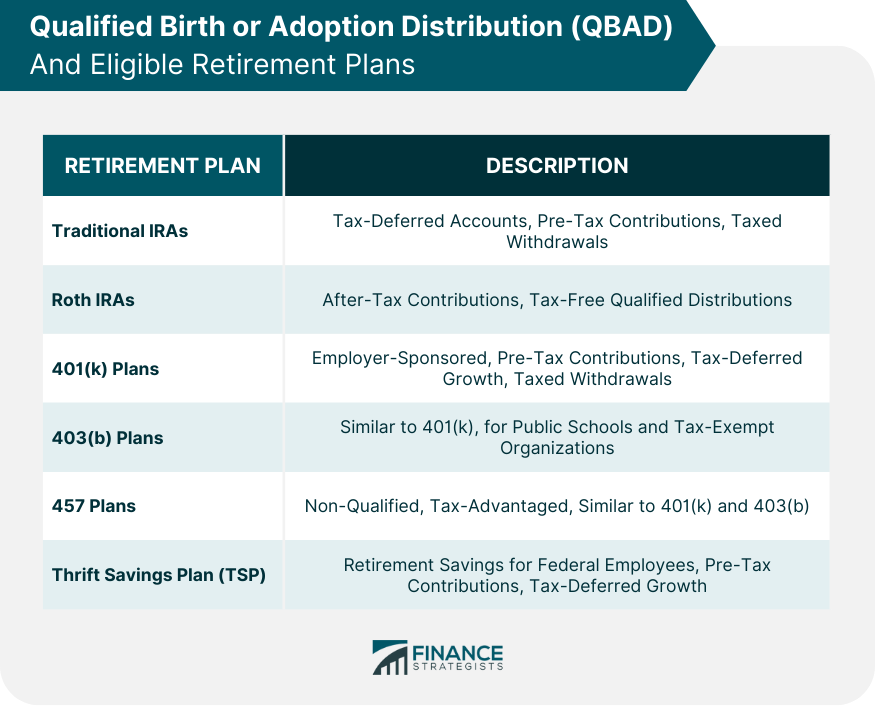

Tax Implications of QBADQBAD and Eligible Retirement Plans

Traditional Individual Retirement Accounts (IRAs)

Roth IRAs

401(k) Plans

403(b) Plans

457 Plans

Thrift Savings Plan (TSP)

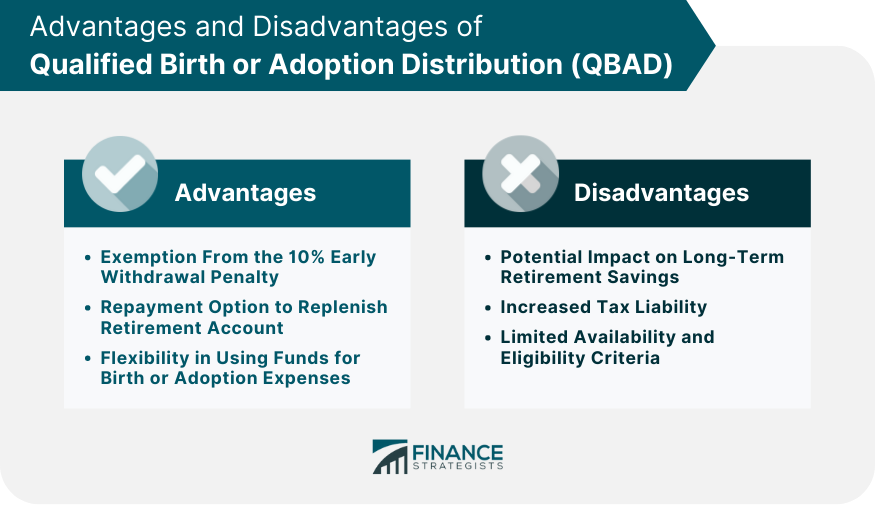

Advantages and Disadvantages of QBAD

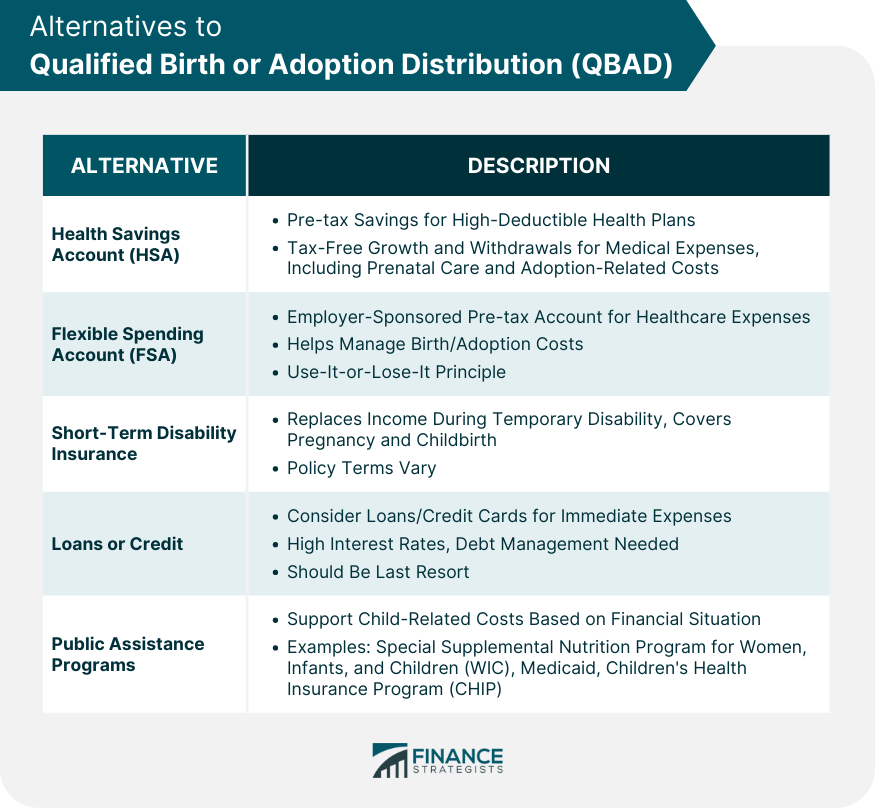

Alternatives to QBAD

Health Savings Account (HSA)

Flexible Spending Account (FSA)

Short-Term Disability Insurance

Loans or Credit

Public Assistance Programs

Conclusion

Qualified Birth or Adoption Distribution (QBAD) FAQs

A Qualified Birth or Adoption Distribution is a special type of distribution from certain retirement accounts that allows individuals to withdraw up to $5,000 without incurring the typical 10% early withdrawal penalty. This distribution can be taken in connection with the birth of a child or the legal adoption of a child under the age of 18.

Individuals can take a QBAD if they have recently had a child or legally adopted a child under 18. Both parents are eligible to take a QBAD, meaning that a couple could withdraw a combined total of $10,000 without penalty.

A QBAD can be taken from eligible retirement accounts, including traditional IRAs, Roth IRAs, and certain employer-sponsored retirement plans such as 401(k) and 403(b) plans. It's important to check with your plan administrator to confirm whether your specific plan allows QBADs.

A QBAD can be taken within one year of the birth or adoption of a child. The distribution must be made within this time frame to qualify for the 10% early withdrawal penalty exemption.

While a QBAD is exempt from the 10% early withdrawal penalty, it is still subject to regular income taxes. However, individuals can repay the QBAD to their retirement account within three years of the distribution, effectively making it a tax-free, interest-free loan. If the distribution is repaid within this time frame, it is treated as a rollover and is not subject to income taxes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.