Tax deductibility refers to the process of reducing an individual's or a business's taxable income by accounting for certain allowable expenses, known as tax deductions. These deductions can be claimed when filing a federal income tax return, effectively lowering the overall amount of income subject to tax. Deductions play a significant role in the tax system, allowing taxpayers to decrease their tax liability in line with their financial situation and specific expenses. Tax deductibility serves a crucial function in the tax system by providing taxpayers with an avenue to lower their tax burden. By permitting individuals and businesses to account for specific expenditures, tax deductibility promotes fairness within the tax system and acknowledges the diverse financial circumstances of taxpayers. Furthermore, tax deductions can incentivize certain behaviors, such as charitable giving or investment in education and healthcare, by reducing the after-tax cost of these activities. The standard deduction is a fixed amount that taxpayers can subtract from their taxable income to reduce their tax liability. This deduction simplifies the tax-filing process for many taxpayers, as it does not require the itemization of specific expenses. The amount of the standard deduction varies based on filing status, age, and whether the taxpayer is blind or disabled. The Internal Revenue Service (IRS) adjusts the standard deduction amounts annually for inflation. Taxpayers can claim a deduction for qualifying medical and dental expenses that exceed a certain percentage of their adjusted gross income (AGI). These expenses may include payments for diagnoses, treatments, and preventive care, as well as the cost of medical equipment, supplies, and certain transportation expenses related to medical care. Taxpayers can deduct state and local income taxes or state and local sales taxes, as well as property taxes, up to a specified limit. This deduction aims to reduce the burden of double taxation, where taxpayers face taxes at both the federal and state levels. The mortgage interest deduction allows taxpayers to deduct the interest paid on a mortgage for their primary residence or a second home, up to certain limits. This deduction encourages homeownership by reducing the after-tax cost of mortgage interest payments. Taxpayers can deduct donations made to qualified charitable organizations, subject to certain limitations based on their AGI. The charitable contribution deduction encourages philanthropy and supports the work of nonprofit organizations. Some miscellaneous expenses, such as unreimbursed employee expenses, tax preparation fees, and investment expenses, may also be deductible, subject to specific limitations and thresholds. All taxpayers are generally eligible to claim the standard deduction, regardless of the specific expenses they incur during the tax year. However, the standard deduction amount varies based on factors such as filing status, age, and disability status. Nonresident aliens and individuals who are married but filing separately and whose spouse itemizes deductions are not eligible to claim the standard deduction. Some itemized deductions have threshold limits, meaning that only expenses exceeding a certain percentage of the taxpayer's AGI are deductible. For example, medical and dental expenses must exceed a specific percentage of AGI to qualify for a deduction. These thresholds ensure that deductions are available only to taxpayers with significant qualifying expenses relative to their income. Certain itemized deductions may be subject to phase-out limits, which gradually reduce the deduction amount for taxpayers with higher incomes. These phase-out limits aim to balance the benefits of tax deductions with the need for fiscal responsibility and revenue generation. One of the primary benefits of tax deductibility is the reduction in tax liability for taxpayers. By lowering taxable income through the standard or itemized deductions, individuals and businesses can decrease their overall tax burden, providing relief from taxes and freeing up resources for other purposes. Tax deductions can lead to an increase in disposable income for taxpayers, as they reduce the amount of income subject to tax. This increased disposable income can be used for various purposes, such as saving, investing, or spending on goods and services. As a result, tax deductions can contribute to economic growth by stimulating consumer demand and investment. Tax deductibility, particularly through the charitable contribution deduction, encourages philanthropy and supports the work of nonprofit organizations. By reducing the after-tax cost of charitable donations, the tax system incentivizes taxpayers to contribute to causes and organizations they believe in, promoting a culture of giving and supporting the vital work carried out by charities. One limitation of tax deductibility is the Alternative Minimum Tax (AMT), which aims to ensure that high-income taxpayers pay a minimum amount of tax, regardless of the deductions they claim. The AMT can reduce the benefits of tax deductions for some taxpayers by imposing a separate tax calculation that may result in a higher tax liability. As mentioned earlier, some itemized deductions are subject to phase-out limits, which can reduce the overall benefit of tax deductibility for higher-income taxpayers. These limits can create complexity in the tax system and may discourage taxpayers from engaging in activities that would otherwise be incentivized through tax deductions. The tax benefit rule is a limitation on tax deductibility that requires taxpayers to include in their income any previously deducted expenses that are later reimbursed or otherwise recovered. This rule aims to prevent taxpayers from receiving a double benefit by both deducting the expense and keeping the recovered amount tax-free. However, the tax benefit rule can create complexity and may require taxpayers to amend prior-year tax returns in some cases. Tax Deductibility refers to the ability of individuals or businesses to reduce their taxable income by claiming certain expenses, deductions, or allowances on their tax return. The reduction in taxable income results in a lower tax liability and potentially higher disposable income. Tax deductibility is a critical aspect of the tax system, allowing taxpayers to reduce their taxable income through the standard deduction or itemized deductions. This reduction in taxable income can lower tax liability, increase disposable income, and encourage behaviors such as charitable giving. Eligibility for tax deductions depends on various factors, including specific requirements and limitations for each deduction category. However, tax deductibility is not without its limitations, such as the Alternative Minimum Tax, phase-out limits, and the tax benefit rule. By understanding the benefits and limitations of tax deductibility, taxpayers and policymakers alike can engage in informed discussions about the future of tax policy and its impact on individuals, businesses, and society as a whole.Definition of Tax Deductibility

Types of Tax Deductions

Standard Deduction

Medical and Dental Expenses

State and Local Taxes

Mortgage Interest

Charitable Contributions

Miscellaneous Expenses

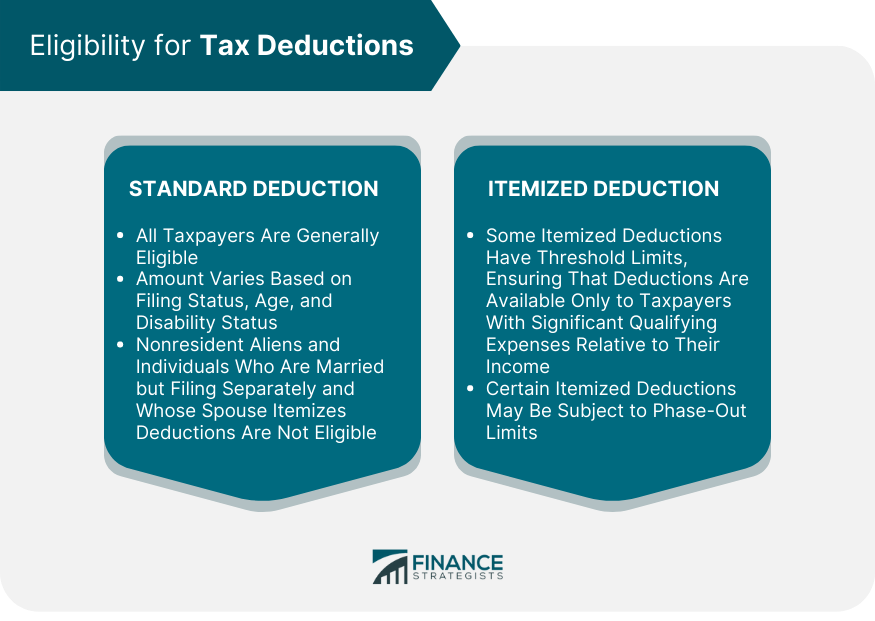

Eligibility for Tax Deductions

Requirements for Standard Deduction

Requirements for Itemized Deductions

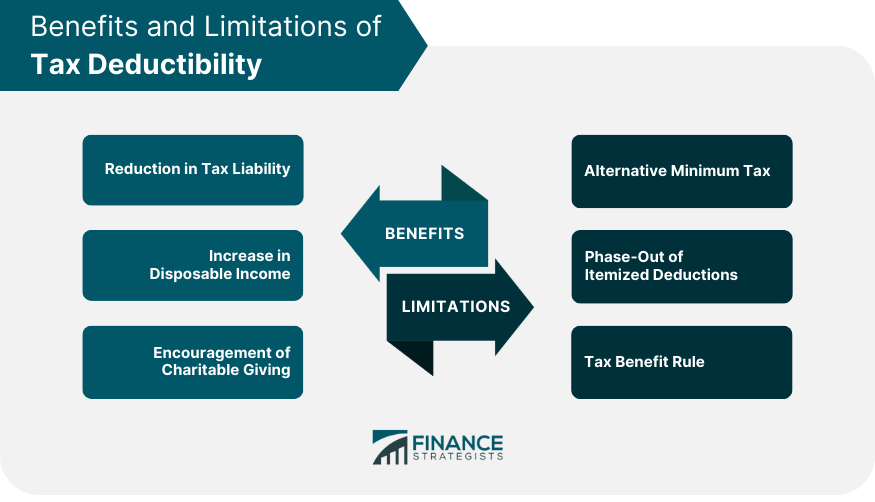

Benefits of Tax Deductibility

Reduction in Tax Liability

Increase in Disposable Income

Encouragement of Charitable Giving

Limitations of Tax Deductibility

Alternative Minimum Tax

Phase-Out of Itemized Deductions

Tax Benefit Rule

Bottom Line

Tax Deductibility FAQs

Tax deductibility refers to the reduction in taxable income that an individual or business can claim on their tax return.

There are two types of tax deductions: standard deductions and itemized deductions.

Eligibility for tax deductions depends on several factors, including filing status, income level, and types of expenses incurred.

The benefits of tax deductibility include a reduction in tax liability, an increase in disposable income, and encouragement of charitable giving.

Limitations of tax deductibility include the alternative minimum tax, phase-out of itemized deductions, and the tax benefit rule.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.