Tax-deferred refers to the postponement of taxes on certain types of investments until a later date, typically during withdrawal or distribution. This allows individuals to invest and grow their money without facing immediate tax consequences. Tax-deferred accounts and investments are often used in retirement planning to maximize long-term growth and minimize taxes paid during an individual's working years. Examples of tax-deferred accounts include Traditional IRAs, 401(k) plans, and 403(b) plans. A tax-deferred account allows investors to postpone paying taxes on their investments until a later time. This can lead to significant tax savings, as individuals can defer taxes until they are in a lower tax bracket, such as during retirement. Tax-deferred accounts play a crucial role in retirement planning, as they can help maximize an individual's long-term investment growth. By deferring taxes, these accounts allow for more money to be invested, which can lead to a larger retirement nest egg. A Traditional Individual Retirement Account (IRA) allows individuals to save for retirement with tax-deferred growth. Contributions to a Traditional IRA may be tax-deductible, depending on an individual's income and whether they have access to an employer-sponsored retirement plan. A 401(k) plan is a tax-deferred employer-sponsored retirement account. Employees can contribute a portion of their pre-tax income to the plan, which can then be invested in a variety of investment options. Employers may also match a percentage of employee contributions. A 403(b) plan is a tax-deferred retirement plan available to employees of certain non-profit organizations and public schools. Similar to a 401(k) plan, participants can contribute pre-tax income and choose from a range of investment options, with potential for employer matching contributions. Deferred annuities are long-term investment contracts offered by insurance companies. They allow individuals to accumulate tax-deferred earnings over time, which can then be converted into a stream of income payments during retirement. One of the main benefits of tax-deferred accounts is the ability to delay taxation on investment growth. This allows individuals to defer paying taxes until they withdraw funds in retirement, potentially resulting in a lower tax burden due to a reduced income level. Tax-deferred accounts allow for increased compound interest, as the money that would have been paid in taxes remains invested. This can lead to a greater accumulation of wealth over time, enhancing the overall growth potential of the account. Contributions to tax-deferred accounts can reduce an individual's taxable income. This can result in lower taxes owed in the present, allowing for more money to be invested and compounded over time. Withdrawing funds from a tax-deferred account before the specified age (usually 59½) can result in penalties and taxes. This includes a 10% early withdrawal penalty, in addition to ordinary income taxes on the withdrawn amount. Tax-deferred accounts are subject to required minimum distributions (RMDs) once the account holder reaches a certain age (currently 72). This can have tax implications, as RMDs are treated as ordinary income and may push the individual into a higher tax bracket. While tax-deferred accounts can help reduce taxes in the present, individuals must consider the tax implications during retirement. Withdrawals from these accounts are taxed as ordinary income, which may impact an individual's overall tax burden in retirement. Stocks and bonds can be held within a tax-deferred account, allowing for the potential growth of investments without the burden of immediate taxation. This can enhance the long-term growth potential of a portfolio, as taxes are deferred until withdrawal. Mutual funds can be an attractive investment option within tax-deferred accounts, as they offer diversification and professional management. The growth and income generated by the fund can accumulate tax-deferred, enhancing the long-term growth potential of the investment. Real Estate Investment Trusts (REITs) are companies that own and manage income-producing real estate properties. By holding REITs within a tax-deferred account, individuals can benefit from the income and growth generated by the trust without facing immediate tax consequences. Tax-deferred refers to an investment or account that allows individuals to postpone paying taxes on their earnings until a later time, usually during retirement. By deferring taxes, investors can benefit from potential tax savings, as they may be in a lower tax bracket when they eventually withdraw the funds. Tax-deferred accounts are often used in retirement planning, as they can help maximize long-term investment growth by allowing more money to be invested and compound over time. Tax-deferred accounts offer numerous benefits for long-term retirement planning, including delayed taxation, increased compound interest, and reduced taxable income. Various types of tax-deferred accounts exist, such as Traditional IRAs, 401(k) plans, 403(b) plans, and deferred annuities, each with their own unique features and benefits. Tax-deferred accounts can be an invaluable part of an individual's overall financial plan. By understanding the various types of tax-deferred accounts and considering the benefits and drawbacks, individuals can make informed decisions about their retirement savings and investments, ultimately working towards a more secure financial future.What Is Tax-Deferred?

Types of Tax-Deferred Accounts

Traditional IRA

401(k) Plan

403(b) Plan

Deferred Annuities

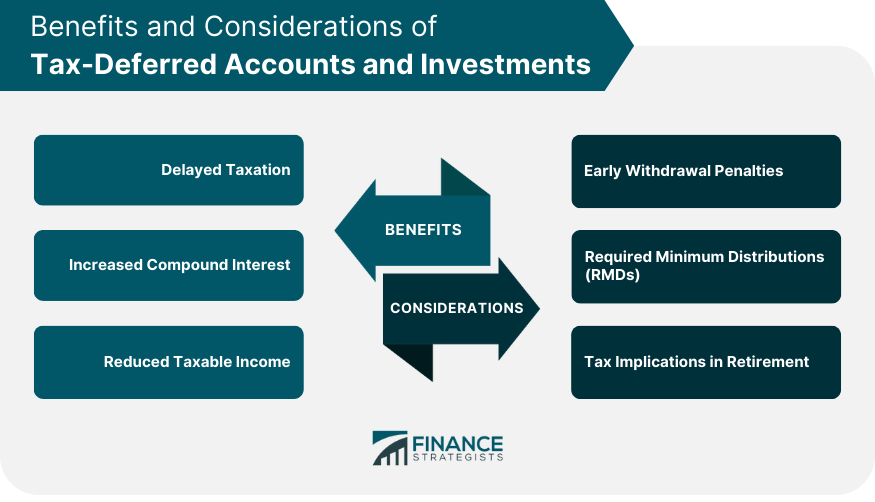

Benefits of Tax-Deferred Accounts

Delayed Taxation

Increased Compound Interest

Reduced Taxable Income

Considerations Before Choosing Tax-Deferred Accounts

Early Withdrawal Penalties

Required Minimum Distributions (RMDs)

Tax Implications in Retirement

Examples of Tax-Deferred Investments

Stocks and Bonds

Mutual Funds

Real Estate Investment Trusts (REITs)

Conclusion

Tax-Deferred FAQs

Tax-deferred refers to a financial arrangement or investment vehicle where taxes on income or gains are postponed until a later date. This means that instead of paying taxes immediately, individuals can delay tax payments and potentially benefit from the compounding of investment earnings over time.

There are several types of tax-deferred accounts. Some common examples include Individual Retirement Accounts (IRAs), 401(k) plans, 403(b) plans (for certain nonprofit employees), and annuities. These accounts allow individuals to contribute pre-tax income, grow investments tax-free, and defer taxes until withdrawals are made in retirement or according to specific rules.

Tax-deferred accounts offer several advantages. Firstly, contributions to these accounts are made with pre-tax income, reducing an individual's taxable income for the current year. Secondly, investment earnings within the account grow tax-free, allowing for potential compound growth. Lastly, individuals may be in a lower tax bracket during retirement, potentially resulting in lower overall taxes paid on withdrawals.

It's important to consider a few factors when utilizing tax-deferred accounts. One consideration is the possibility of future tax rates. If tax rates increase in the future, individuals may end up paying higher taxes on their withdrawals. Additionally, early withdrawals before reaching the specified age limit may result in penalties and taxes. Finally, individuals should evaluate their investment options within tax-deferred accounts to ensure they align with their long-term goals and risk tolerance.

Yes, there are contribution limits for tax-deferred accounts. These limits vary depending on the type of account and are set by the Internal Revenue Service (IRS). For example, in 2024, the annual contribution limit for an IRA is $7,000 (or $8,000 for individuals aged 50 and older), while the annual contribution limit for a 401(k) plan is $23,000 (or $30,500 for individuals aged 50 and older). It's essential to stay updated on these limits and ensure compliance with IRS guidelines.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.