Tax-deferred investments are financial products that allow you to postpone paying taxes on the earnings you generate until you withdraw the money in the future. This delay in taxation can help you grow your investments faster and potentially save you money on taxes. By investing in these accounts, you can enjoy the benefits of compounding interest without the immediate impact of taxes on your earnings. This can be particularly beneficial for long-term investors who want to maximize their returns. Additionally, tax-deferred investments can provide a tax-advantaged way to save for retirement. By contributing to these accounts, investors can often reduce their taxable income and lower their current tax liability. This can help individuals save more for their future while also benefiting from potential tax savings today. A Traditional IRA (Individual Retirement Arrangement) is a tax-deferred investment account that allows individuals to save for retirement. Contributions to a Traditional IRA may be tax-deductible, depending on the investor's income level and participation in an employer-sponsored retirement plan. Earnings within a Traditional IRA grow tax-deferred, which means that taxes on investment gains are not due until the funds are withdrawn during retirement. Withdrawals during retirement are taxed as ordinary income, which may result in lower taxes if the investor is in a lower tax bracket at the time of withdrawal. A 401(k) is an employer-sponsored retirement plan that allows employees to contribute a portion of their salary to a tax-deferred investment account. Employers may also choose to match a percentage of employee contributions, providing an additional incentive for employees to save for retirement. Contributions to a 401(k) are made with pre-tax dollars, reducing an employee's taxable income for the year. Earnings within the account grow tax-deferred, and taxes are not due until the funds are withdrawn during retirement. Similar to a Traditional IRA, withdrawals are taxed as ordinary income. A 403(b) plan is a tax-deferred retirement plan designed for employees of certain non-profit organizations, public schools, and religious institutions. These plans function similarly to 401(k) plans, with employees contributing a portion of their salary to a tax-deferred investment account. Like 401(k) plans, contributions to a 403(b) are made with pre-tax dollars, and earnings grow tax-deferred. Withdrawals during retirement are taxed as ordinary income. Additionally, some 403(b) plans offer a Roth option, which allows employees to make after-tax contributions and enjoy tax-free withdrawals during retirement. A 457(b) plan is a tax-deferred retirement plan available to employees of state and local governments and certain non-profit organizations. Similar to 401(k) and 403(b) plans, employees can contribute a portion of their salary to a tax-deferred investment account, reducing their taxable income for the year. Earnings within a 457(b) plan grow tax-deferred, and taxes on withdrawals during retirement are treated as ordinary income. One unique feature of 457(b) plans is the absence of an early withdrawal penalty. Participants can access their funds without penalty before age 59½ if they separate from service, making it an attractive option for those who may need to access their retirement savings earlier. One of the primary benefits of tax-deferred investments is the potential for tax savings. By deferring taxes on investment gains, investors can reduce their current tax liability and possibly save money on taxes in the long run. This is particularly beneficial for investors in higher tax brackets, as the tax savings can be more substantial. Additionally, tax-deferred accounts can help reduce taxable income by allowing individuals to make pre-tax contributions. This can lead to lower income taxes for the year and additional savings for retirement. The power of compound interest is another significant advantage of tax-deferred investments. As earnings within the account grow tax-deferred, investors can benefit from the compounding effect of their investments without being hindered by taxes. By deferring taxes, investors can effectively reinvest their earnings and generate even greater returns over time. This can significantly impact the growth of their investment portfolio and help them achieve their long-term financial goals. Tax-deferred investments often offer a great deal of flexibility, allowing investors to choose from a variety of investment options and make adjustments to their portfolios as needed. This flexibility can be particularly beneficial for investors who want to actively manage their investments and adjust their strategies over time. Furthermore, some tax-deferred accounts, such as Roth IRAs and 457(b) plans, offer additional flexibility in terms of withdrawal rules, allowing investors to access their funds without penalties under certain circumstances. One of the drawbacks of tax-deferred investments is the withdrawal limitations imposed on most accounts. Typically, investors cannot access their funds without incurring penalties before reaching a certain age, usually 59½. This can be restrictive for individuals who may need to access their savings earlier due to unforeseen circumstances or financial needs. Tax penalties can be another disadvantage of tax-deferred investments. Early withdrawals from tax-deferred accounts can result in hefty penalties and taxes, negating some of the benefits of tax deferral. These penalties can be a significant deterrent for individuals considering accessing their funds before the designated retirement age. Required Minimum Distributions (RMDs) are another potential drawback of some tax-deferred investments, such as Traditional IRAs and 401(k) plans. RMDs mandate that investors begin withdrawing a minimum amount from their accounts starting at age 73. This can be disadvantageous for individuals who may not need to access their funds at that time or who would prefer to continue growing their investments tax-deferred. When selecting tax-deferred investments, it's essential to consider your personal financial goals and objectives. Different investment options may be more suitable for different goals, such as saving for retirement, funding education, or accumulating wealth for other purposes. Your investment time horizon is another crucial factor to consider when choosing tax-deferred investments. The longer your time horizon, the more you can potentially benefit from the tax deferral and compounding effects of these investments. Investors with shorter time horizons may need to carefully weigh the potential benefits against the withdrawal limitations and tax implications associated with tax-deferred accounts. Understanding your risk tolerance is essential when selecting tax-deferred investments. Different investment options carry varying levels of risk, and it's crucial to choose investments that align with your comfort level and ability to withstand potential losses. Contribution limits are another important factor to consider when selecting tax-deferred investments. Different accounts have varying contribution limits, which can impact your ability to save for your financial goals. It's essential to understand these limits and how they may affect your investment strategy. Lastly, it's crucial to consider the fees and expenses associated with different tax-deferred investments. These costs can significantly impact your investment returns over time, so it's essential to choose investment options with reasonable fees and expenses. Tax-deferred investments provide individuals with the opportunity to postpone paying taxes on their earnings, allowing for potential tax savings and the benefits of compounding interest. These investments can offer significant benefits for investors, including tax savings, compound interest growth, and flexibility. However, they also come with potential disadvantages, such as withdrawal limitations, tax penalties, and required minimum distributions. When choosing tax-deferred investments, it's crucial to consider factors such as personal financial goals, time horizon, risk tolerance, contribution limits, and fees and expenses. Tax-deferred investments can be an excellent tool for investors looking to grow their wealth and save for retirement while enjoying potential tax advantages. By carefully considering the various types, advantages, and disadvantages of tax-deferred investments, investors can make informed decisions and develop strategies that align with their financial goals and needs.What Are Tax-Deferred Investments?

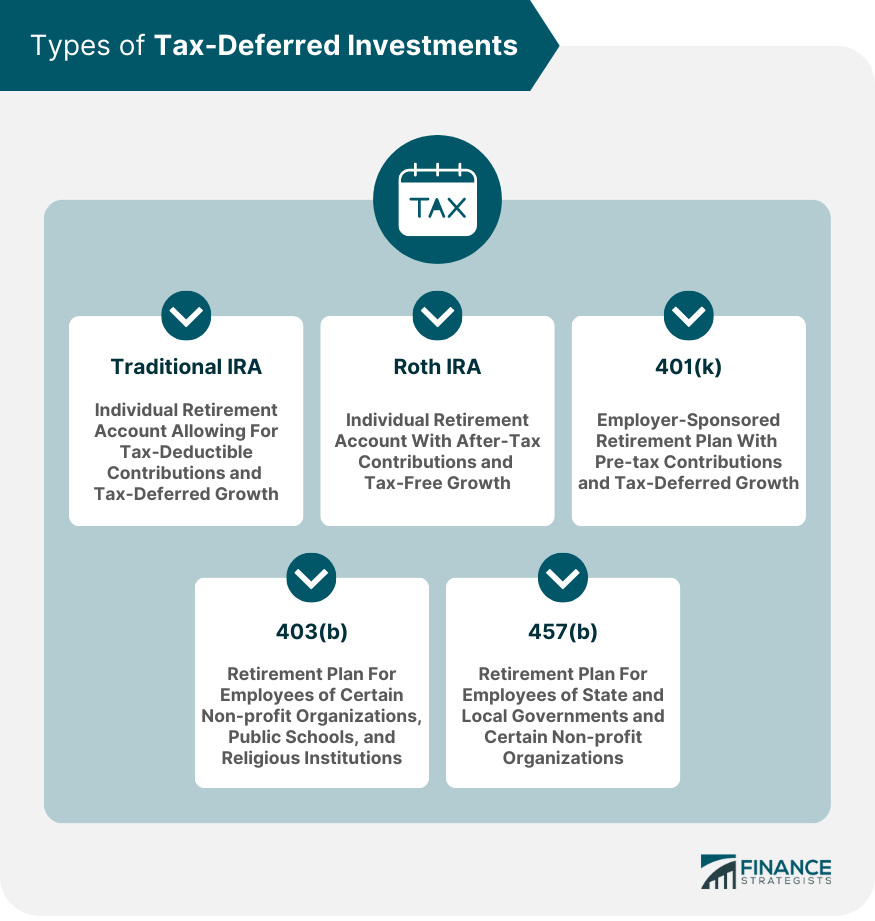

Types of Tax-Deferred Investments

Traditional IRA

401(k)

403(b)

457(b)

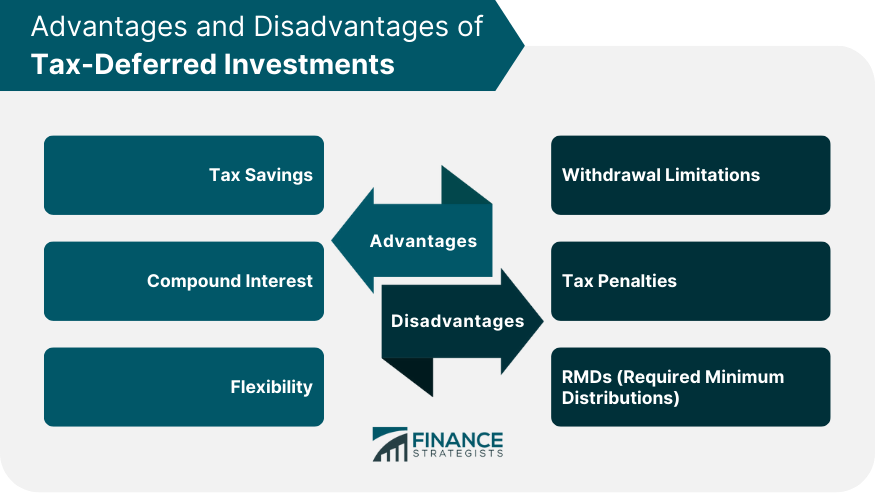

Advantages of Tax-Deferred Investments

Tax Savings

Compound Interest

Flexibility

Disadvantages of Tax-Deferred Investments

Withdrawal Limitations

Tax Penalties

Required Minimum Distribution (RMDs)

Factors to Consider When Choosing Tax-Deferred Investments

Personal Financial Goals

Time Horizon

Risk Tolerance

Contribution Limits

Fees and Expenses

Conclusion

Traditional IRAs, Roth IRAs, 401(k) plans, 403(b) plans, and 457(b) plans are common types of tax-deferred investments, each with their own advantages and considerations.

Tax-Deferred Investments FAQs

Tax-deferred investments are investment vehicles that allow you to postpone paying taxes on the gains until you withdraw the money.

Types of tax-deferred investments include Individual Retirement Arrangements (IRA), 401(k), 403(b), 457(b), and other employer-sponsored retirement plans.

Tax-deferred investments offer tax savings, compound interest, and flexibility in investment choices.

Withdrawal limitations, tax penalties, and required minimum distributions (RMDs) are some of the disadvantages of tax-deferred investments.

Consider factors such as personal financial goals, time horizon, risk tolerance, contribution limits, and fees and expenses when choosing tax-deferred investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.