Tax-exempt investments are financial instruments that generate income or returns that are not subject to federal, state, or local taxes. These types of investments are designed to encourage investors to allocate their resources to sectors that serve a public purpose, such as infrastructure development or education. Tax-exempt investments can also help investors diversify their portfolios, optimize their after-tax returns, and achieve specific financial goals. Municipal bonds are debt securities issued by state and local governments to finance public projects, such as schools, highways, or water treatment plants. The interest income earned on municipal bonds is typically exempt from federal income taxes and, in some cases, state and local taxes as well. Municipal bonds can be an attractive investment option for individuals seeking tax-free income and a relatively low-risk investment. Tax-exempt money market funds are mutual funds that invest primarily in short-term, tax-exempt debt securities, such as municipal bonds. These funds aim to provide investors with a stable share price and tax-free income, making them an appealing option for individuals in higher tax brackets looking for a low-risk investment. 529 college savings plans are tax-advantaged investment accounts designed to help families save for future education expenses. Earnings in a 529 plan grow tax-deferred, and withdrawals used for qualified education expenses are exempt from federal income taxes and, in many cases, state income taxes as well. This tax-exempt investment can be an attractive option for parents and grandparents looking to save for a child's or grandchild's education. Health Savings Accounts are tax-advantaged savings accounts used in conjunction with a high-deductible health plan (HDHP) to pay for qualified medical expenses. Contributions to an HSA are tax-deductible, and the earnings within the account grow tax-free. Withdrawals for qualified medical expenses are also tax-free, making HSAs an attractive tax-exempt investment option for individuals seeking to save for healthcare costs. A charitable gift annuity is a contract between a donor and a charitable organization in which the donor makes a sizable gift to the charity in exchange for a fixed income stream for the donor's lifetime. A portion of the income generated by a charitable gift annuity is typically tax-free, making this an attractive investment option for individuals seeking to support a charitable cause while receiving tax-exempt income. A Roth IRA is a tax-advantaged retirement account in which contributions are made with after-tax dollars. Earnings within the Roth IRA grow tax-free, and qualified withdrawals in retirement are also tax-free. This tax-exempt investment can be an attractive option for individuals looking to maximize their after-tax retirement income. By investing in tax-exempt securities, investors can reduce their overall tax burden and increase their after-tax returns. This can be particularly beneficial for individuals in higher tax brackets who are subject to higher tax rates on their investment income. Tax-exempt investments can provide higher yields for investors, particularly those in higher tax brackets. Because the income generated by tax-exempt investments is not subject to taxation, investors can effectively earn a higher after-tax yield compared to equivalent taxable investments. Many tax-exempt investments, such as municipal bonds and tax-exempt money market funds, are considered relatively low-risk investments. These investments are often backed by stable entities, such as state and local governments, which makes them less likely to default on their obligations. This can be an attractive feature for conservative investors seeking to preserve their capital while generating tax-free income. Some tax-exempt investments, like municipal bonds, may have lower liquidity compared to other investment options, such as stocks or corporate bonds. Lower liquidity means that it may be more challenging to buy or sell these investments quickly and at a favorable price. This could be a disadvantage for investors who require easy access to their funds or need to make frequent transactions. Tax-exempt investments may have limited availability, particularly for individual investors. Some tax-exempt securities, like municipal bonds, may have high minimum investment requirements, making them less accessible to smaller investors. Additionally, certain tax-exempt investments, like Roth IRAs, have contribution limits, which may restrict the amount an individual can invest in these vehicles. Some tax-exempt investments, such as tax-exempt mutual funds or 529 college savings plans, may have higher fees compared to their taxable counterparts. These fees can eat into an investor's overall returns and negate some of the tax benefits offered by these investments. Before investing in tax-exempt vehicles, investors should carefully consider the fees associated with these investments and weigh them against the potential tax benefits. An investor's tax bracket is an essential factor to consider when deciding whether to invest in tax-exempt investments. Tax-exempt investments tend to be more advantageous for individuals in higher tax brackets, as they stand to benefit the most from the tax savings provided by these investments. Investors should consider their overall investment goals before deciding to invest in tax-exempt investments. For example, if an investor's primary goal is to save for retirement, a Roth IRA or a traditional IRA may be more appropriate than investing in municipal bonds. Conversely, if an investor is looking to generate tax-free income, tax-exempt bonds or tax-exempt money market funds may be a more suitable option. While many tax-exempt investments are considered relatively low-risk, they may not be appropriate for investors with a higher risk tolerance seeking potentially higher returns. Investors should carefully assess their risk tolerance and investment objectives before deciding to invest in tax-exempt securities. The investment horizon, or the length of time an investor plans to hold an investment, is another important consideration when choosing tax-exempt investments. Some tax-exempt investments, like municipal bonds, may be more suitable for long-term investors, while others, like tax-exempt money market funds, may be more appropriate for investors with a shorter investment horizon. Tax-exempt investments are a valuable tool for investors seeking a tax-efficient way to generate income or gain. These types of investments can include municipal bonds, certain mutual funds and ETFs, and other financial products. The key benefit of tax-exempt investments is that they can provide income that is not subject to federal, state, or local income taxes. While tax-exempt investments offer several advantages, they also have some drawbacks. One major disadvantage is that they may have lower yields compared to taxable investments. Additionally, the tax-exempt status of these investments can be affected by changes in tax laws or other economic factors. However, tax-exempt investments can be a good choice for investors looking for a reliable source of tax-free income. Tax-exempt investments can be a useful part of a diversified investment portfolio. By understanding the definition of tax-exempt investments, as well as their advantages and disadvantages, investors can make informed decisions. As with any investment, it is important to do your research and consult with a financial advisor to determine if tax-exempt investments are right for you.What Are Tax-Exempt Investments?

Types of Tax-Exempt Investments

Municipal Bonds

Tax-Exempt Money Market Funds

529 College Savings Plans

Health Savings Accounts (HSAs)

Charitable Gift Annuities

Roth IRAs

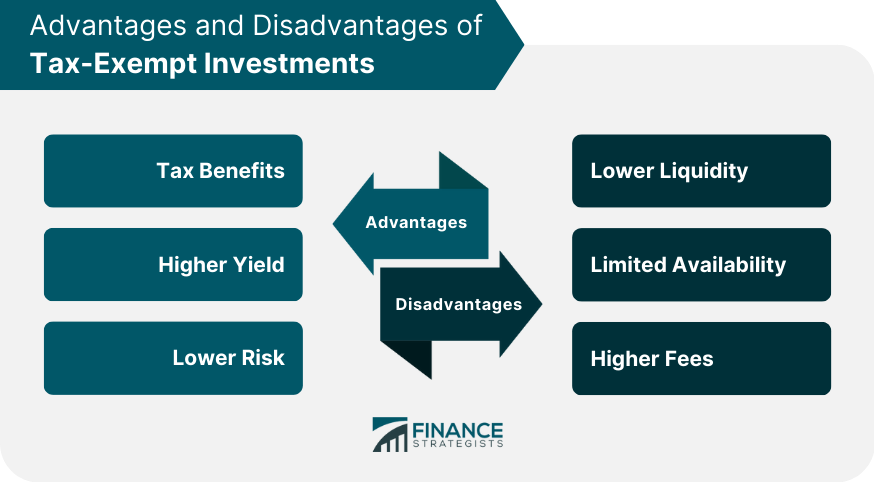

Advantages of Tax-Exempt Investments

Tax Benefits

Higher Yield

Lower Risk

Disadvantages of Tax-Exempt Investments

Lower Liquidity

Limited Availability

Higher Fees

Considerations Before Investing in Tax-Exempt Investments

Tax Bracket

Investment Goals

Risk Tolerance

Investment Horizon

The Bottom Line

Tax-Exempt Investments FAQs

Tax-exempt investments are financial products that generate income or gains that are not subject to federal, state, or local income taxes.

Some examples of tax-exempt investments include municipal bonds, certain types of mutual funds, and exchange-traded funds (ETFs) that hold municipal bonds.

Tax-exempt investments can benefit individuals in higher tax brackets, as well as those who live in states with high income tax rates. They can also be advantageous for investors looking for a reliable source of tax-free income.

No investment is entirely risk-free, including tax-exempt investments. However, municipal bonds, which are a common type of tax-exempt investment, are generally considered to be low-risk investments.

You can purchase tax-exempt investments through a financial advisor, a broker, or an online investment platform. It is important to do your research and consider the fees, risks, and tax implications before making any investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.