A tax filing status is a classification used by the Internal Revenue Service (IRS) and other tax authorities to determine how an individual's tax liability is calculated. It is based on factors such as marital status, family situation, and financial support provided to dependents. The primary purpose of a tax filing status is to establish the appropriate tax rates, deductions, and credits applicable to an individual's specific situation. Selecting the correct tax filing status is crucial for accurately calculating tax liability and ensuring compliance with tax laws. The appropriate filing status can significantly impact the amount of taxes owed or the size of a tax refund, as well as determine eligibility for certain tax benefits. Filing under the wrong status can result in penalties, interest, and potential audits by tax authorities. The single filing status applies to taxpayers who are unmarried, legally separated, or divorced as of the last day of the tax year. Single taxpayers generally face higher tax rates and lower income thresholds for tax brackets compared to other filing statuses. However, they are eligible for the standard deduction and may also qualify for various tax credits, depending on their income and specific circumstances. Married couples have the option to file their taxes jointly, combining their incomes, deductions, and credits on a single tax return. This filing status typically results in lower tax rates and larger standard deductions compared to filing separately. Married filing jointly can be advantageous for couples with disparate incomes, as the higher-earning spouse's income can be offset by the lower-earning spouse's deductions and credits. Married couples also have the option to file their taxes separately, with each spouse reporting their individual income, deductions, and credits. This filing status may be advantageous in certain situations, such as when one spouse has significant deductions or credits, or when couples want to keep their financial affairs separate for legal reasons. However, married filing separately can result in higher tax rates and reduced eligibility for certain tax benefits compared to filing jointly. The head of household filing status is available to unmarried taxpayers who provide financial support for at least one qualifying person, such as a child or dependent relative. To qualify, taxpayers must meet specific criteria regarding their relationship to the dependent, the amount of support provided, and the dependent's residency. This filing status offers lower tax rates and a higher standard deduction than the single filing status, potentially resulting in lower tax liability. The qualifying widow(er) with dependent child filing status allows a surviving spouse to continue using the same tax rates and standard deduction as married filing jointly for up to two years following the death of their spouse, provided they have a dependent child. This filing status can offer significant tax advantages for surviving spouses, easing the financial burden during a difficult time. A taxpayer's marital status is a key factor in determining their tax filing status. Tax authorities typically consider an individual's marital status as of the last day of the tax year. If a taxpayer is married, they have the option to file jointly or separately. Unmarried taxpayers, on the other hand, must file as single, head of household, or qualifying widow(er) with dependent child, depending on their specific situation. Having dependents can impact a taxpayer's filing status, as certain statuses require financial support for qualifying individuals. For example, to qualify as head of household or a qualifying widow(er) with dependent child, taxpayers must provide more than half of the financial support for at least one qualifying person during the tax year. Dependents can include children, relatives, or other individuals who meet specific criteria set by the IRS. The support test is used to determine if a taxpayer meets the requirements for certain filing statuses that involve providing financial support to dependents. To pass the support test, the taxpayer must provide more than half of the total financial support for a qualifying individual during the tax year. This includes expenses such as housing, food, clothing, education, and medical care. Residency requirements also play a role in determining tax filing status, particularly for head of household and qualifying widow(er) with dependent child statuses. In most cases, the dependent must live with the taxpayer for more than half of the tax year to qualify. There are, however, exceptions for temporary absences due to factors such as illness, education, or military service. Tax filing status directly impacts the tax rates and brackets applicable to an individual's taxable income. Different filing statuses have different tax rate schedules, which can result in higher or lower tax liability depending on the taxpayer's situation. For example, married filing jointly and qualifying widow(er) with dependent child statuses generally have lower tax rates and wider tax brackets compared to single and married filing separately statuses. Tax filing status also affects the deductions and credits available to taxpayers. Some deductions and credits are only available to taxpayers with specific filing statuses, while others may have different income thresholds or phase-out limits based on the taxpayer's filing status. Choosing the correct filing status can help taxpayers maximize their deductions and credits, reducing their overall tax liability. Certain tax benefits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, or education tax credits, have eligibility requirements tied to the taxpayer's filing status. Filing under the wrong status may disqualify taxpayers from claiming these valuable tax benefits, increasing their tax liability and potentially causing them to miss out on significant tax savings. Each filing status has its own set of potential tax advantages and disadvantages. For example, while married filing jointly can result in lower tax rates and a larger standard deduction, it can also expose both spouses to joint liability for tax debts. On the other hand, while married filing separately may protect each spouse from the other's tax liabilities, it often results in higher tax rates and reduced eligibility for certain tax benefits. Evaluating the potential tax implications of different filing statuses is crucial for making an informed decision. Unmarried individuals must choose between filing as single, head of household, or qualifying widow(er) with dependent child, depending on their specific circumstances. Factors to consider include whether they have dependents, if they provide more than half of the financial support for their dependents, and if their dependents meet the residency requirements. Married individuals must decide whether to file jointly or separately, taking into account factors such as income disparity between spouses, potential deductions and credits, and any legal reasons for keeping finances separate. Comparing the tax implications of both filing statuses can help couples determine which option is most advantageous for their situation. Taxpayers should carefully evaluate the potential tax implications of each filing status before making a decision. This may involve reviewing tax rate schedules, considering the impact on deductions and credits, and assessing eligibility for specific tax benefits. In some cases, taxpayers may wish to prepare their tax returns using multiple filing statuses to compare the results and determine the most advantageous option. In some situations, taxpayers may find it beneficial to seek professional advice from a tax advisor, accountant, or attorney when choosing their tax filing status. This can be particularly helpful for individuals with complex financial situations or those who are unsure about the tax implications of different filing statuses. Professional advice can help taxpayers make informed decisions and ensure compliance with tax laws, ultimately minimizing tax liability and maximizing potential tax savings. One of the most common mistakes taxpayers make is claiming the wrong tax filing status on their tax returns. This can result from a lack of understanding of the requirements for each filing status, changes in personal circumstances, or simple oversight. Incorrectly claiming a filing status can lead to an inaccurate calculation of tax liability, missed tax benefits, and potential penalties. Filing under the wrong tax filing status can have several consequences, including paying more in taxes than necessary, missing out on valuable tax benefits, and potentially facing penalties from the IRS. Additionally, if the error is discovered during an audit, the taxpayer may be required to pay back taxes, interest, and penalties, which can be financially burdensome. The IRS may impose penalties on taxpayers who claim the wrong filing status on their tax returns. These penalties can include accuracy-related penalties, which are typically calculated as a percentage of the underpayment resulting from the error. In more severe cases, the IRS may also impose civil fraud penalties or pursue criminal charges against taxpayers who intentionally claim the wrong filing status to evade taxes. Tax filing status is a crucial element in determining an individual's tax liability, as it establishes the tax rates, deductions, and credits applicable to their specific situation. Choosing the correct filing status is essential for accurately calculating tax liability, ensuring compliance with tax laws, and maximizing potential tax savings. There are several tax filing statuses available to taxpayers, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Each filing status has its own set of criteria and potential tax implications, making it important for taxpayers to carefully evaluate their options and choose the most advantageous status for their situation. Taxpayers should consider factors such as marital status, dependent status, support test, and residency requirements when selecting their tax filing status. Additionally, they should evaluate the potential tax implications of each status, seeking professional advice if needed, to ensure they make the most informed decision possible. It is always recommended that taxpayers seek professional advice and review IRS guidelines when choosing their tax filing status, particularly if they have complex financial situations or are unsure about the requirements for each status. What Is a Tax Filing Status?

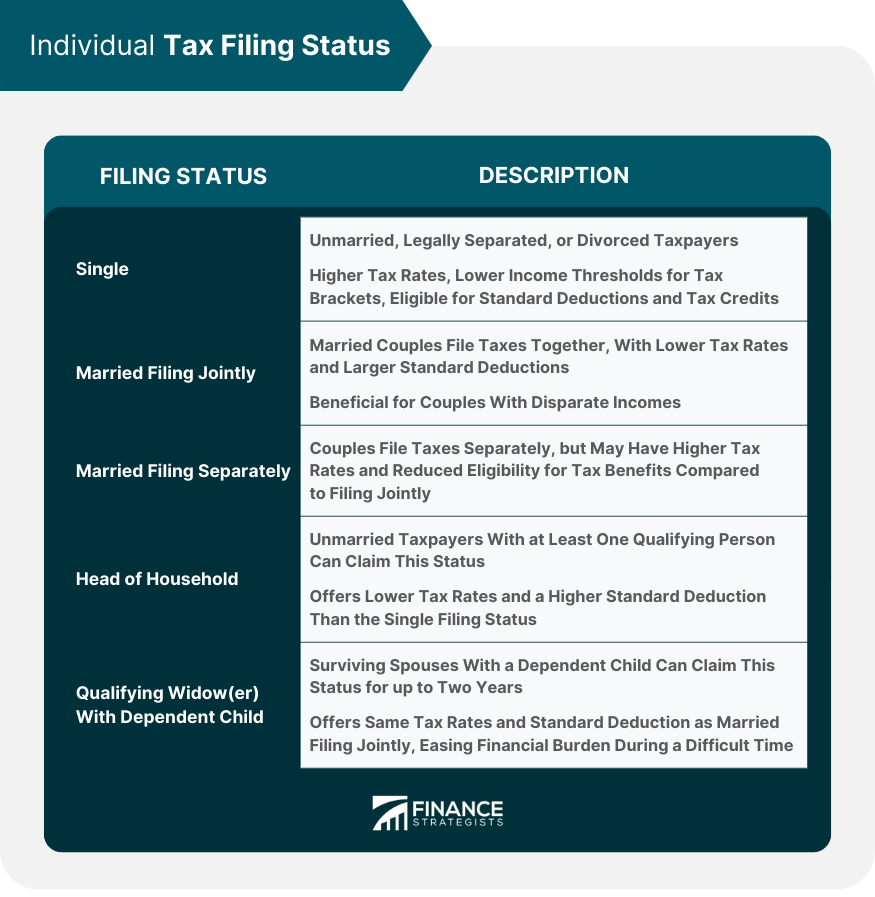

Individual Tax Filing Status

Single

Married Filing Jointly

Married Filing Separately

Head of Household

Qualifying Widow(er) With Dependent Child

Criteria for Determining Tax Filing Status

Marital Status

Dependent Status

Support Test

Residency Requirements

Impact of Tax Filing Status on Tax Liability

Tax Rates and Brackets

Deductions and Credits

Eligibility for Certain Tax Benefits

Potential Tax Advantages and Disadvantages for Different Filing Statuses

Choosing the Correct Tax Filing Status

Considerations for Unmarried Individuals

Considerations for Married Individuals

Evaluating Potential Tax Implications

Seeking Professional Advice

Common Mistakes and Penalties

Incorrectly Claiming a Tax Filing Status

Consequences of Filing Under the Wrong Status

IRS Penalties for Tax Filing Status Errors

Conclusion

Tax Filing Status FAQs

Tax filing status is a designation that determines how an individual's income tax return is filed.

The five tax filing statuses are single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

Marital status, dependent status, residency requirements, and support test are used to determine tax filing status.

Tax filing status affects your tax liability by determining your tax rates, deductions, credits, and eligibility for certain tax benefits.

Generally, you cannot change your tax filing status after you file your return, but you may be able to amend your return to correct a mistake or claim a different status.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.