Tax gain harvesting is a strategy that involves realizing capital gains on investments before they would otherwise be subject to higher tax rates. This tactic aims to minimize overall tax liability by taking advantage of lower tax rates on long-term capital gains. The primary purpose of tax gain harvesting is to strategically realize capital gains in a way that minimizes the tax burden. Investors employ this strategy to take advantage of current lower tax rates or to offset existing capital losses in their portfolio. Tax gain harvesting is an important strategy for investors seeking to optimize their tax situation. By carefully managing the realization of capital gains, investors can potentially reduce their overall tax liability and enhance their long-term investment returns. Tax Gain Harvesting works by selling appreciated securities to realize capital gains, which are then offset by capital losses to reduce the tax bill. The strategy is based on the concept of taking advantage of the tax code, which taxes capital gains and losses differently. By selling investments that have appreciated in value, investors can generate gains that are subject to lower long-term capital gains tax rates. At the same time, losses can be used to offset gains or deducted from taxable income, reducing the overall tax bill. Tax Gain Harvesting can be done on an ongoing basis or at the end of the year to optimize tax efficiency. While both strategies involve the management of capital gains and losses, tax gain harvesting focuses on realizing gains at favorable tax rates. In contrast, tax loss harvesting seeks to minimize tax liability by offsetting gains with losses. Both strategies can contribute to overall tax efficiency in an investment portfolio. Tax gain harvesting can increase tax efficiency by taking advantage of lower capital gains tax rates. By realizing gains at favorable tax rates, investors can potentially reduce their overall tax burden and improve their after-tax investment returns. Tax gain harvesting can create opportunities for portfolio rebalancing. As investors realize gains in certain assets, they may use the proceeds to invest in other assets, maintaining their desired asset allocation and mitigating risk. By minimizing tax liability through tax gain harvesting, investors can enhance their overall investment returns. Lower taxes allow more of the gains to remain invested, potentially leading to greater long-term growth. The primary risk associated with tax gain harvesting is the potential for increased capital gains taxes. If not managed carefully, realizing gains could result in a higher tax burden, negating the benefits of the strategy. Tax gain harvesting carries certain risks, such as the possibility of triggering the wash sale rule or incurring additional transaction costs. Investors must carefully consider these risks when employing tax gain harvesting strategies. Implementing tax gain harvesting strategies can involve additional costs, such as transaction fees and potential tax preparation expenses. Investors should weigh the potential benefits of tax gain harvesting against these costs to determine if the strategy is worthwhile. Investors must understand the difference between short-term and long-term capital gains, as this is crucial for tax gain harvesting. Short-term gains are profits from the sale of securities held for less than one year and are taxed at higher ordinary income tax rates. On the other hand, long-term gains are profits from the sale of securities held for more than one year and are taxed at lower long-term capital gains tax rates. Investors may focus on realizing long-term gains to minimize tax liability. The wash sale rule is a tax provision that prohibits investors from claiming a tax loss on the sale of a security if they purchase a substantially identical security within 30 days before or after the sale. This means that if an investor sells a security for a loss and then purchases the same or a substantially identical security within 30 days, they cannot claim a tax loss on the sale. To avoid triggering the wash sale rule, investors must carefully time their tax gain harvesting transactions. Timing is a critical factor in tax gain harvesting. Investors should consider factors such as market conditions, tax rate changes, and their individual tax situation when deciding when to implement tax gain harvesting strategies. Investors may consider selling securities in a year where they have unused capital losses that can be used to offset gains. They may also sell securities at a time when they have lower taxable income, such as during retirement, to take advantage of lower tax rates. Tax gain harvesting is a strategy that focuses on realizing capital gains at favorable tax rates to minimize overall tax liability and enhance after-tax investment returns. When executed correctly, tax gain harvesting can lead to increased tax efficiency, portfolio rebalancing opportunities, and improved investment returns. However, investors must carefully consider the risks and costs associated with the strategy before implementing it in their portfolio. Tax gain harvesting can be a valuable tool for investors seeking to optimize their tax situation and enhance their investment returns. By understanding the nuances of this strategy and carefully considering the potential benefits and risks, investors can make more informed decisions about whether tax gain harvesting is appropriate for their individual circumstances.What Is Tax Gain Harvesting?

How Tax Gain Harvesting Works

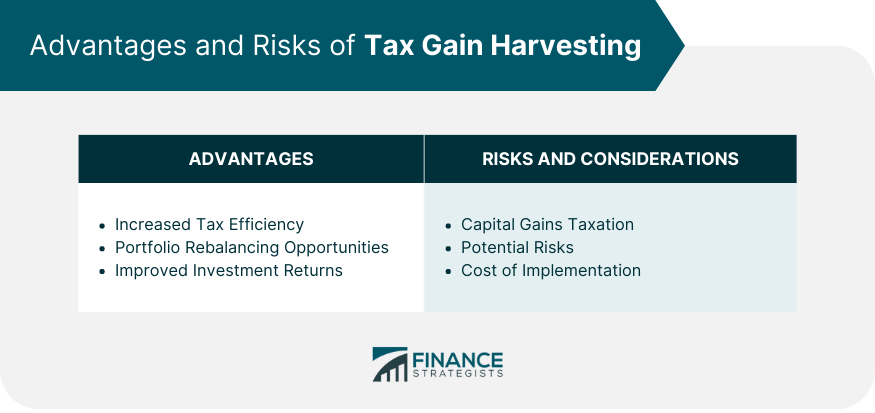

Advantages of Tax Gain Harvesting

Increased Tax Efficiency

Portfolio Rebalancing Opportunities

Improved Investment Returns

Risks and Considerations of Tax Gain Harvesting

Capital Gains Taxation

Potential Risks

Cost of Implementation

Tax Gain Harvesting Strategies

Short-Term and Long-term Capital Gains

Wash Sale Rule

Timing Considerations

Bottom Line

Tax Gain Harvesting FAQs

Tax gain harvesting is a strategy used by investors to realize capital gains on their investments deliberately. It involves selling appreciated assets to take advantage of favorable tax rates and offsetting those gains with capital losses, resulting in reduced tax liability.

Tax gain harvesting works by selling investments that have increased in value since their purchase. By realizing these gains, investors can utilize favorable tax rates, such as long-term capital gains rates, which are typically lower than ordinary income tax rates. They can then offset these gains by selling investments that have incurred losses, reducing their overall tax liability.

Tax gain harvesting offers several advantages. Firstly, it allows investors to take advantage of lower long-term capital gains tax rates, which can lead to significant tax savings. Secondly, by offsetting gains with losses, investors can minimize their taxable income, potentially reducing their overall tax liability. Additionally, tax gain harvesting can help rebalance investment portfolios and optimize the tax efficiency of investments.

While tax gain harvesting can provide tax benefits, there are risks to consider. One risk is that by selling appreciated assets, investors may miss out on potential future gains if the investments continue to perform well. Another risk is the potential for transaction costs, such as brokerage fees or capital gains taxes, which may diminish the overall tax savings. It's also important to comply with tax laws and regulations to ensure the strategy is executed correctly.

Yes, there are some restrictions and limitations to tax gain harvesting. One key limitation is the "wash-sale rule," which prohibits investors from claiming a capital loss if they repurchase a substantially identical investment within 30 days. Additionally, the tax code sets limits on the amount of capital losses that can be used to offset gains in a given year. It's essential to consult with a tax professional to navigate these restrictions and ensure compliance with applicable tax regulations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.