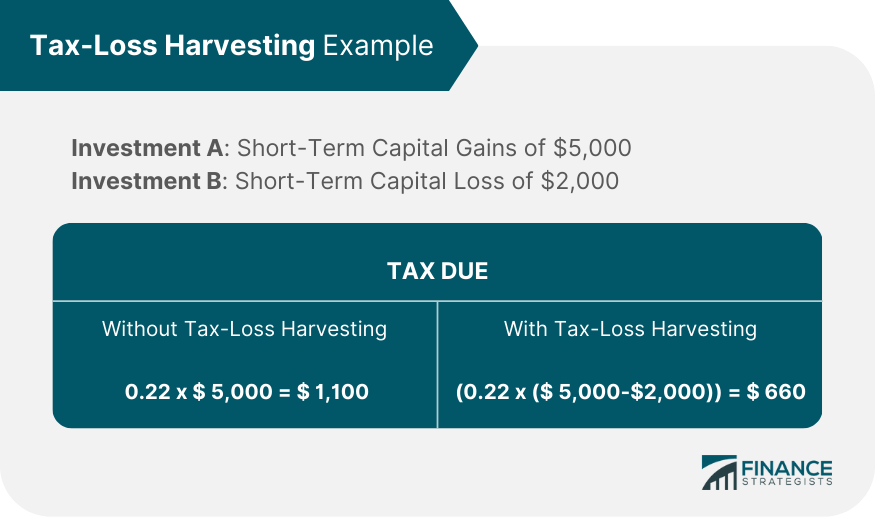

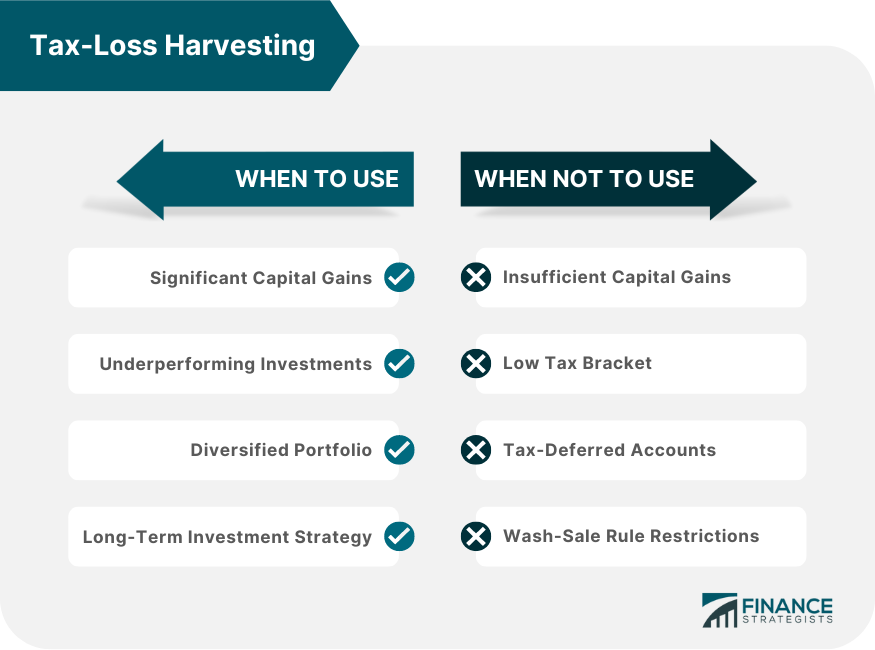

Tax-loss harvesting is a tax strategy investors utilize to reduce their tax liability on investment gains. This practice involves intentionally selling investments that have decreased in value to offset the tax liability from gains in other investments. The approach is frequently employed to restrict the impact of short-term capital gains, which are usually taxed at a higher rate than long-term capital gains. When investors sell an investment that has decreased in value, the resulting capital loss can be used to balance the capital gains from other investments. Tax-loss harvesting can be complex and must be implemented carefully to avoid violating Internal Revenue Service (IRS) regulations. Taking advantage of tax services from professionals may be beneficial. The tax-loss harvesting approach can be implemented through several steps: Investors identify investments that have decreased in value since their purchase or have not performed as well as expected. Once these investments have been identified, they can be sold to generate a capital loss. The second step involves taking the money from the sale of the underperforming investments and putting it into new investments that are substantially different from those sold. This is important to avoid violating the wash-sale rule, which will be discussed below. This is done by subtracting the capital losses from the capital gains, reducing taxable income from investment gains. In turn, this lowers the amount of taxes an investor is required to pay on those gains. The individual can employ the loss amount to counteract capital gains by reporting the transaction on their income tax return. Additionally, suppose the capital losses exceed the capital gains. The excess can offset up to $3,000 of ordinary income in a given tax year. The IRS has set forth rules and regulations that must be followed when executing tax-loss harvesting. The wash-sale rule prohibits an investor from purchasing a substantially identical security in the span of 30 days before or after the sale of the security that resulted in the capital loss. If this rule is violated, the losses associated with the sale are disallowed and must be added back to the investor’s basis. The cost basis of an investment is the amount that an investor paid to acquire it. It is important to keep accurate records of cost-basis calculations, as these will be used to determine the amount of capital gains or losses for tax purposes. Let's say that an investor has two investments in their portfolio; Investment A and Investment B were held for less than a year. Investment A has increased in value, resulting in a short-term capital gain of $5,000, while Investment B has decreased in value, resulting in a short-term capital loss of $2,000. The investor could sell Investment B to realize the $2,000 capital loss in this scenario. The investor could then use this loss to offset the $5,000 capital gain from Investment A, thereby reducing tax liability. Assuming a tax rate of 22%, the investor would owe $ 1,100 in taxes on the $5,000 capital gain from Investment A. However, by using tax-loss harvesting to offset the capital gain with the capital loss from Investment B, the investor would owe taxes on only $3,000 of the capital gain, resulting in a tax liability of $660. Tax-loss harvesting is most effective when an investor has realized significant capital gains that could result in a high tax liability. By offsetting these gains with capital losses, an investor can reduce their tax burden. The strategy is also useful when an investor has investments in their portfolio that are underperforming or have decreased in value. Further, it is beneficial when an investor has a diversified portfolio with multiple investments. Similarly, tax-loss harvesting is appropriate when used as part of a long-term investment strategy. Overall, it allows for greater flexibility in timing the sale of underperforming investments and realizing capital losses. If an investor has not realized significant capital gains during the year, tax-loss harvesting may not be necessary. Similarly, this strategy is not recommended if an investor is in a low tax bracket. In both cases, the benefits of tax-loss harvesting may be outweighed by the transaction costs and potential disruption to the portfolio. It may be more beneficial for the investor to focus on other investment strategies. Tax-loss harvesting is only effective for taxable investments. Retirement accounts such as IRAs and 401(k)s are tax-deferred and do not allow offsetting of taxable gains. Consequently, this strategy cannot be employed with these accounts. The wash-sale rule can limit the effectiveness of tax-loss harvesting in some cases. Suppose an investor repurchases security within 30 days of selling it at a loss. In that case, they cannot claim the loss on their tax return. This can limit the flexibility of tax-loss harvesting in certain situations. Tax-loss harvesting entails selling losing investments to offset gains in other investments and reduce overall tax liability. While it can be an effective tax-saving method, it should be executed cautiously to avoid violating IRS regulations. The wash-sale rule of the IRS and accurate cost-basis calculations must be considered to execute tax-loss harvesting effectively and avoid any potential penalties or disallowed losses. Tax-loss harvesting can be an effective investment strategy when an investor has realized significant capital gains, holds underperforming investments, has a diversified portfolio, and follows a long-term investment strategy. However, there may be better choices than tax-loss harvesting in certain circumstances, such as when there are insufficient capital gains, the investor is in a low tax bracket, or on tax-deferred accounts.What Is Tax-Loss Harvesting?

How Tax-Loss Harvesting Works

Sell Underperforming Investments

Put the Money Into New Investments

Balance Capital Gains With Losses

IRS Rules on Tax-Loss Harvesting

The Wash-Sale Rule

Cost-Basis Calculations

Example of Tax-Loss Harvesting

When to Use Tax-Loss Harvesting

When Not to Use Tax-Loss Harvesting

Final Thoughts

Tax-Loss Harvesting FAQs

Tax-loss harvesting is an investment strategy that involves selling underperforming investments at a loss to offset capital gains from other investments, thus reducing an investor's tax liability. The resulting capital losses can be used to offset any capital gains realized during the calendar year.

The amount of losses that can be used to offset capital gains is limited to $3,000 per year, and any unused losses can be carried forward to future years.

You should consider tax-loss harvesting when you have realized significant capital gains during the year that could result in a high tax liability. It is also useful when you have underperforming investments or investments that have decreased in value. Additionally, tax-loss harvesting is most effective when you have a diversified portfolio with multiple investments and when it is part of a long-term investment strategy.

The risks of tax-loss harvesting include the potential for the IRS to disallow the losses claimed if the wash-sale rule is not followed properly, resulting in penalties and additional taxes. Additionally, there is the risk that an investor may sell an underperforming investment that later recovers in value, missing out on potential gains.

Tax-loss harvesting aims to offset taxable capital gains with realized capital losses in an investment portfolio. Investors can decrease their tax burden and raise their after-tax returns by selling investments that have decreased in value and using the losses to counterbalance gains from other investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.