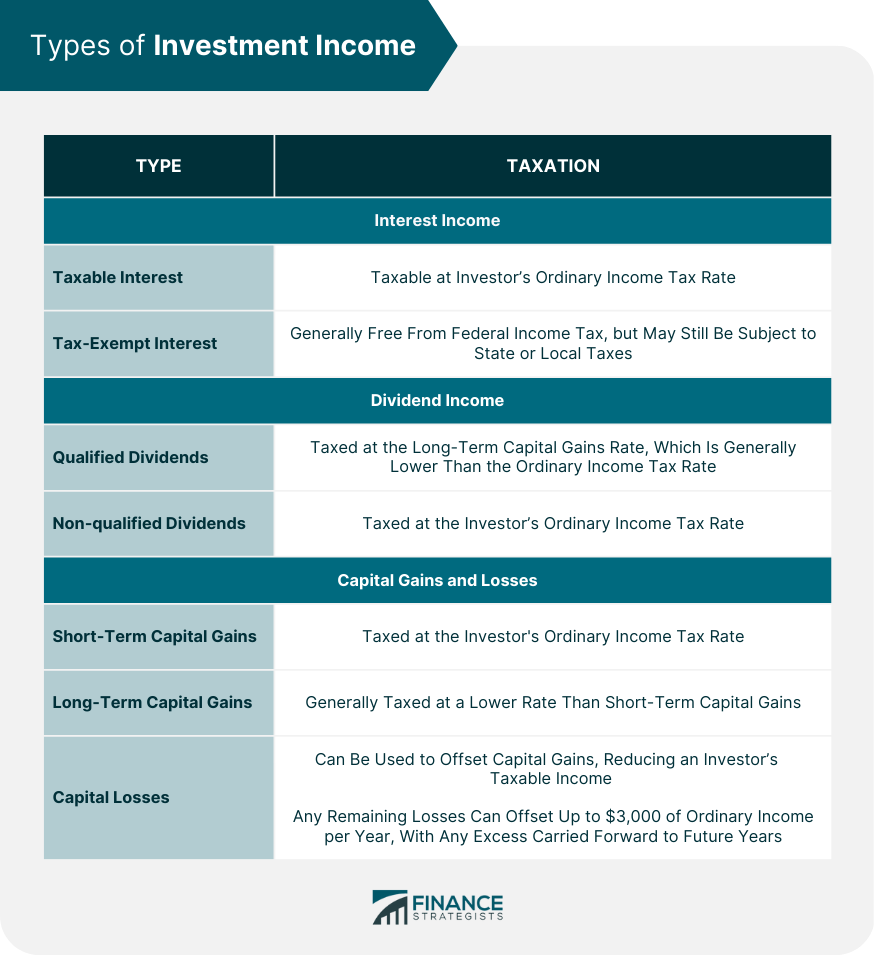

Tax planning for investments refers to the process of structuring one's investments in a way that maximizes tax benefits and minimizes tax liabilities. The goal is to optimize investment returns while also taking advantage of tax deductions, credits, and other benefits provided by the tax code. This article explores various tax-efficient investment strategies, types of investment income and taxes, tax planning for different investment types, tax implications of investment transactions, and working with tax professionals. Proper asset allocation is crucial for tax-efficient investing. By distributing investments across various account types, investors can optimize tax benefits. Taxable accounts include individual or joint investment accounts, bank accounts, and brokerage accounts. These accounts do not offer any tax advantages, and any income generated is subject to taxes in the year it is received. Tax-deferred accounts, such as traditional Individual Retirement Accounts (IRAs) and 401(k) plans, allow investments to grow tax-free until withdrawn during retirement. Taxes are paid at the time of withdrawal, generally at a lower rate due to a reduced income level during retirement. Tax-free accounts, such as Roth IRAs and Roth 401(k) plans, allow for contributions to be made with after-tax dollars. The investments grow tax-free, and qualified withdrawals during retirement are not subject to income tax. Tax-loss harvesting involves selling investments that have experienced losses to offset gains realized from other investments. This strategy can help reduce an investor's overall tax liability. By selling investments that have decreased in value, investors can recognize a capital loss. This loss can be used to offset capital gains, reducing taxable income. Capital losses can offset capital gains, potentially lowering an investor's tax bill. If capital losses exceed capital gains, the remaining loss can offset up to $3,000 of ordinary income per year. Any leftover losses can be carried forward to future years. Maximizing the use of tax-advantaged accounts can help investors minimize their tax liability and grow their investments more efficiently. IRAs offer tax advantages, such as tax-deferred growth for traditional IRAs and tax-free growth for Roth IRAs. Contributions may also be tax-deductible, depending on the investor's income and participation in an employer-sponsored retirement plan. 401(k) plans are employer-sponsored retirement accounts that offer tax-deferred growth and potential employer matching contributions. Contributions are made with pre-tax dollars, lowering the investor's taxable income. 529 plans are tax-advantaged investment accounts designed to help save for education expenses. Earnings grow tax-free, and qualified withdrawals for education expenses are not subject to federal income tax. HSAs are tax-advantaged accounts used in conjunction with high-deductible health plans (HDHPs). Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free. Interest income is generated from investments such as savings accounts, certificates of deposit (CDs), and bonds. Most interest income is taxable at the investor's ordinary income tax rate. This includes interest from bank accounts, CDs, and corporate bonds. Some interest income is tax-exempt, such as interest from municipal bonds. While this income is generally free from federal income tax, it may still be subject to state or local taxes. Dividend income is generated from investments in stocks, mutual funds, and exchange-traded funds (ETFs) that pay dividends. Qualified dividends are typically paid by U.S. corporations and some foreign corporations. These dividends are taxed at the long-term capital gains rate, which is generally lower than the ordinary income tax rate. Non-qualified dividends, such as those paid by real estate investment trusts (REITs), do not qualify for the lower tax rate and are taxed at the investor's ordinary income tax rate. Capital gains and losses occur when investments, such as stocks, bonds, and real estate, are sold for a profit or loss. Short-term capital gains occur when investments are sold within one year of purchase. These gains are taxed at the investor's ordinary income tax rate. Long-term capital gains, unlike short-term, occur when investments are sold after being held for more than one year. These gains are generally taxed at a lower rate than short-term capital gains. Capital losses can be used to offset capital gains, reducing an investor's taxable income. Any remaining losses can offset up to $3,000 of ordinary income per year, with any excess carried forward to future years. Investors should consider holding stocks for more than one year to take advantage of the lower long-term capital gains tax rate. Additionally, focusing on investments that generate qualified dividends can help minimize tax liability. When investing in bonds, consider the tax implications of interest income. Municipal bonds offer tax-exempt interest income, while corporate bonds generate taxable interest income. Treasury bonds are exempt from state and local income taxes but are subject to federal income tax. Mutual funds can generate interest, dividend, and capital gain income. Investors should be aware of the tax implications of these income sources and consider tax-efficient mutual funds, which aim to minimize taxable distributions. ETFs are similar to mutual funds but trade like stocks on an exchange. They can be more tax-efficient due to their unique structure, which allows for the avoidance of some taxable events. Real estate investments, such as REITs and rental properties, can generate income and potential capital gains. Investors should consider the tax implications of these investments, including depreciation and potential deductions for rental property expenses. There are generally no immediate tax implications when purchasing investments. However, investors should consider the potential tax consequences of future income and capital gains generated by the investment. Selling investments can result in capital gains or losses, which have tax implications. Short-term capital gains are taxed at the investor's ordinary income tax rate, while long-term capital gains are taxed at a lower rate. Exchanging investments, such as mutual funds or ETFs, can result in capital gains or losses. Investors should be aware of the tax consequences of these transactions. Investment income, such as interest and dividends, is generally taxable in the year it is received. Investors should be aware of the tax treatment of different types of investment income and plan accordingly. When selecting a tax advisor, consider their experience, qualifications, and expertise in investment-related tax planning. Tax professionals can help investors navigate complex tax laws and regulations, identify tax-saving opportunities, and ensure compliance with tax reporting requirements. Effective tax planning should be integrated into an investor's overall financial planning strategy. By working with a financial planner and tax professional, investors can create a comprehensive plan that takes into account their financial goals, risk tolerance, and tax situation. Tax planning for investments is important for maximizing returns and minimizing tax liability. Tax-efficient investment strategies include proper asset allocation, tax-loss harvesting, and utilizing tax-advantaged accounts such as IRAs, 401(k)s, 529 plans, and HSAs. Different types of investment income and taxes include taxable and tax-exempt interest, qualified and non-qualified dividends, and short-term and long-term capital gains and losses. When planning for different investment types, investors should consider the tax implications of interest income for bonds, tax-efficient mutual funds for mutual funds, and focusing on qualified dividends for stocks. Finally, working with tax professionals can be helpful in creating a tax-efficient investment plan.What Is Tax Planning for Investments?

Tax planning for investments is an essential aspect of managing one's finances and maximizing returns. It involves strategically arranging investments to minimize tax liability and make the most of available tax benefits. Tax-Efficient Investment Strategies

Asset Allocation

Taxable Accounts

Tax-Deferred Accounts

Tax-Free Accounts

Tax-Loss Harvesting

Selling Losing Investments

Offsetting Gains with Losses

Utilizing Tax-Advantaged Accounts

Individual Retirement Accounts (IRAs)

401(k) Plans

529 College Savings Plans

Health Savings Accounts (HSAs)

Types of Investment Income and Taxes

Interest Income

Taxable Interest

Tax-Exempt Interest

Dividend Income

Qualified Dividends

Non-qualified Dividends

Capital Gains and Losses

Short-Term Capital Gains

Long-Term Capital Gains

Capital Losses

Tax Planning for Different Investment Types

Stocks

Bonds

Mutual Funds

Exchange-Traded Funds (ETFs)

Real Estate Investments

Tax Implications of Investment Transactions

Tax Implications of Buying Investments

Tax Implications of Selling Investments

Tax Implications of Exchanging Investments

Tax Implications of Receiving Investment Income

Working With Tax Professionals

Choosing a Tax Advisor

Understanding the Role of Tax Professionals

Incorporating Tax Planning Into Overall Financial Planning

Conclusion

Tax Planning for Investments FAQs

Tax planning for investments involves making investment decisions with a focus on minimizing tax liability and maximizing after-tax returns.

Tax planning for investments can help you minimize your tax liability and increase your after-tax returns, which can result in more money in your pocket.

Tax-efficient investment strategies include investing in tax-deferred retirement accounts, such as a 401(k) or IRA, utilizing tax-loss harvesting to offset capital gains with capital losses, and investing in tax-exempt bonds.

You can determine the tax implications of your investments by reviewing your investment portfolio and identifying the tax consequences of each investment. You can also consult with a tax professional to help you understand the tax implications of your investments.

It's never too early to start tax planning for your investments. The earlier you start, the more time you have to implement tax-efficient investment strategies and minimize your tax liability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.