Trust income taxation refers to the process of determining and imposing taxes on income generated by trusts. A trust is a legal entity created by a grantor to hold and manage assets for the benefit of beneficiaries. The trust may generate income from investments or other sources, and this income is subject to taxation. The tax rules and regulations that apply to trust income are complex and vary depending on several factors, such as the type of trust, the source of the income, and the tax status of the beneficiaries. Understanding trust income taxation is crucial for grantors, trustees, and beneficiaries to ensure compliance with tax laws and optimize tax efficiency.

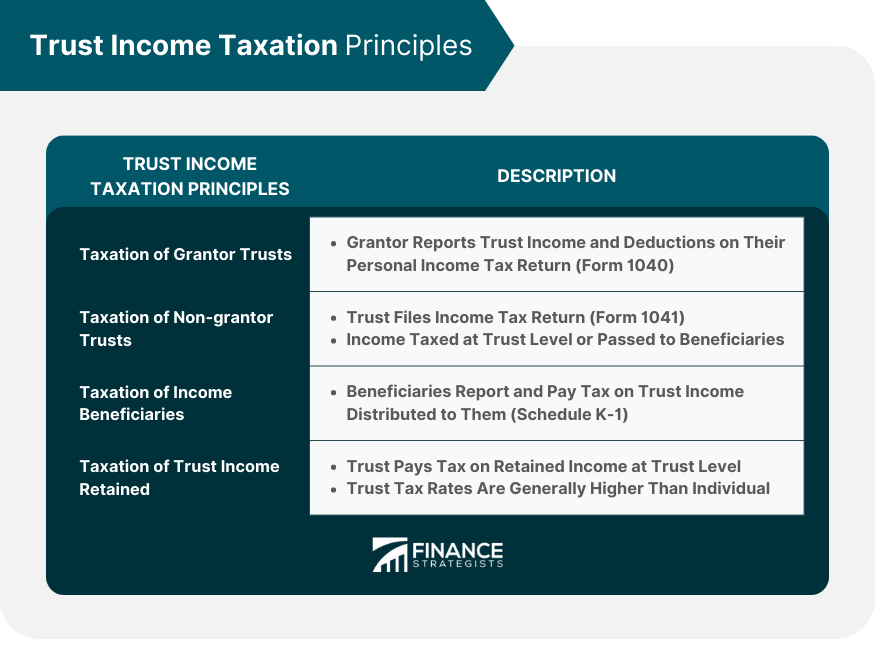

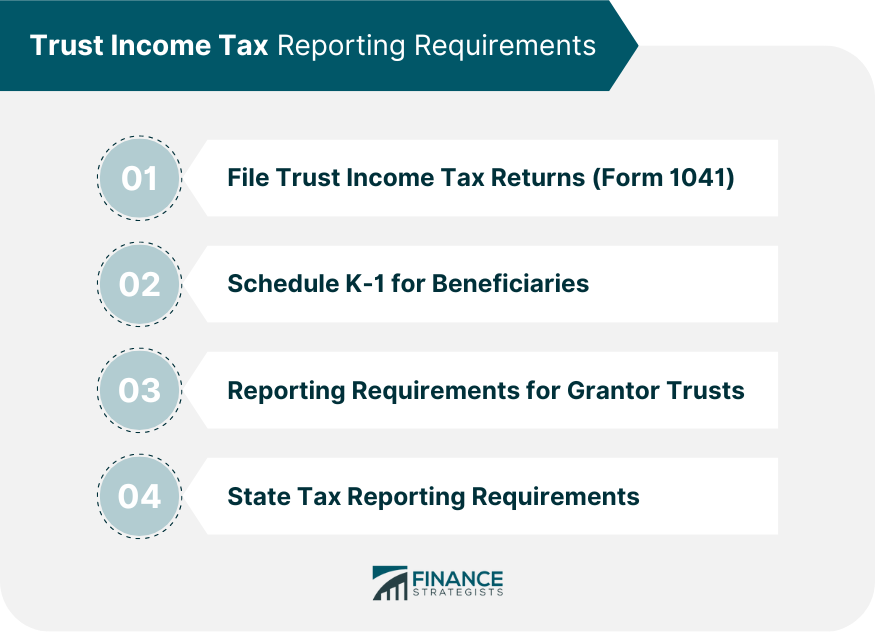

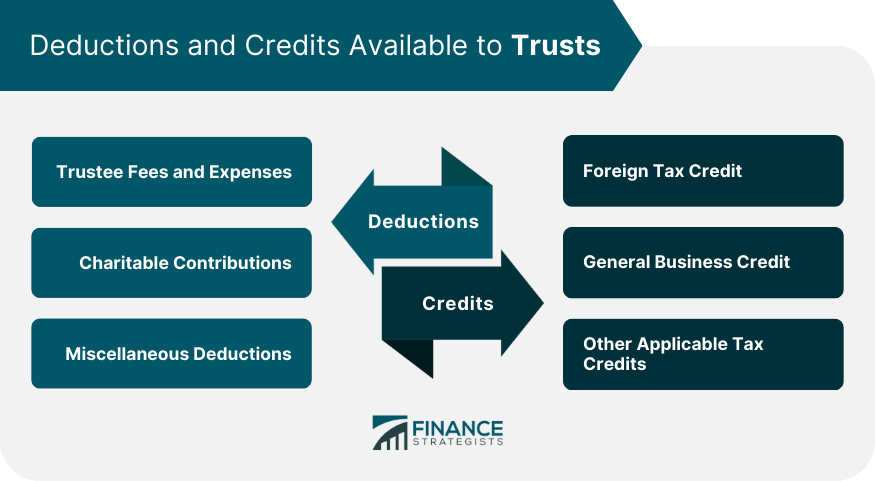

In a revocable trust, the grantor maintains control over the trust assets and can amend or revoke the trust at any time. For tax purposes, the grantor is considered the owner of the trust assets, and the trust's income and deductions are reported on the grantor's personal income tax return (Form 1040). Some irrevocable trusts are treated as grantor trusts for tax purposes, depending on the trust provisions and the grantor's control over the trust assets. Similar to revocable trusts, the income, and deductions of these trusts are reported on the grantor's personal income tax return. A simple trust is a non-grantor trust that distributes all of its income to the beneficiaries each year. The trust itself is not taxed on its income but is required to file an income tax return (Form 1041). The beneficiaries are taxed on the income distributed to them, which is reported on Schedule K-1. A complex trust is a non-grantor trust that may accumulate income, distribute principal, or make charitable contributions. Similar to simple trusts, complex trusts must file Form 1041, and the beneficiaries are taxed on the income distributed to them. However, the trust itself may also be taxed on any undistributed income. Trust income beneficiaries are generally taxed on the income they receive from the trust, which is reported on Schedule K-1. The type and character of the income (e.g., interest, dividends, capital gains) are retained when distributed to the beneficiaries and may affect their overall tax liability. Trusts that retain income rather than distribute it to beneficiaries are taxed on the retained income at the trust level. Trust tax rates are generally higher than individual tax rates, which can result in a higher overall tax liability. Non-grantor trusts are required to file an annual income tax return using Form 1041. The form reports the trust's income, deductions, and credits, as well as any income distributed to beneficiaries. Trusts that distribute income to beneficiaries must issue a Schedule K-1 to each beneficiary, which reports the beneficiary's share of the trust's income, deductions, and credits. Beneficiaries use this information to report their share of the trust income on their personal income tax returns. Grantor trusts typically do not file a separate income tax return. Instead, the grantor reports the trust's income and deductions on their personal income tax return (Form 1040). In addition to federal tax reporting, trusts may also be subject to state income tax reporting requirements, depending on the state in which the trust is administered and the residency of the grantor and beneficiaries. Trusts are allowed to deduct reasonable trustee fees and expenses related to trust administration. These deductions help offset the trust's taxable income and can include legal fees, accounting fees, and investment management fees, among others. Trusts that make charitable contributions may be eligible for a tax deduction. The deduction is generally limited to the trust's adjusted gross income, with certain limitations and carryover provisions applying to excess contributions. Some trusts may qualify for additional deductions, such as depreciation on trust-owned property or casualty and theft losses. These deductions can help further reduce the trust's taxable income. Trusts that pay foreign taxes on income earned in other countries may be eligible for a foreign tax credit, which can offset the trust's U.S. tax liability. Trusts that engage in certain business activities may qualify for the general business credit, which encompasses a range of tax credits related to investment, employment, and research activities. Depending on the trust's specific activities and investments, additional tax credits may be available, such as the low-income housing credit or the renewable energy credit. By carefully planning the timing and character of trust income distributions, grantors and trustees can minimize the overall tax liability for both the trust and its beneficiaries. This may involve distributing income to beneficiaries in lower tax brackets or making distributions in years when beneficiaries have lower overall income. Incorporating charitable giving into a trust's distribution plan can provide tax benefits while supporting the grantor's philanthropic goals. Charitable remainder trusts and charitable lead trusts are two common structures that enable tax-efficient giving. Trustees can pursue investment strategies that emphasize tax-efficient income, such as investing in municipal bonds or stocks that pay qualified dividends. Additionally, careful management of capital gains and losses can help minimize the trust's tax liability. Trust income taxation plays a critical role in wealth management and estate planning. By understanding the principles of trust income taxation for different types of trusts, such as grantor and non-grantor trusts, individuals can optimize their tax strategies and ensure compliance with tax laws. Key tax reporting requirements, such as filing Form 1041 for non-grantor trusts and issuing Schedule K-1 for beneficiaries, must be adhered to for proper trust administration. Trusts can minimize tax liability by utilizing available deductions and credits, including expenses, charitable contributions, and various tax credits. Employing tax planning strategies like distribution planning, charitable giving, and tax-efficient investments can further optimize trust income taxation. Staying informed about changes in tax laws and working with professional advisors are crucial to maintain tax-efficient trust structures and adapt to the evolving tax landscape.Definition of Trust Income Taxation

Trust Income Taxation Principles

Taxation of Grantor Trusts

Revocable Trusts

Irrevocable Trusts With Grantor Trust Status

Taxation of Non-Grantor Trusts

Simple Trusts

Complex Trusts

Taxation of Income Beneficiaries

Taxation of Trust Income Retained by the Trust

Trust Income Taxation Reporting Requirements

Filing of Trust Income Tax Returns (Form 1041)

Schedule K-1 for Beneficiaries

Reporting Requirements for Grantor Trusts

State Tax Reporting Requirements

Trust Income Taxation Deductions and Credits

Deductions Available to Trusts

Trustee Fees and Expenses

Charitable Contributions

Miscellaneous Deductions

Credits Available to Trusts

Foreign Tax Credit

General Business Credit

Other Applicable Tax Credits

Tax Planning Strategies for Trust Income Taxation

Distribution Strategies to Minimize Taxes

Charitable Giving Strategies

Investment Strategies to Generate Tax-Efficient Income

Bottom Line

Trust Income Taxation FAQs

Trust income taxation refers to the tax treatment of income generated by various trust structures. Understanding trust income taxation is crucial for grantors and beneficiaries to optimize tax strategies, ensure compliance with tax laws, and minimize overall tax liability in wealth management and estate planning.

In grantor trusts, the grantor is considered the owner of the trust assets for tax purposes, and the trust's income and deductions are reported on the grantor's personal income tax return. In non-grantor trusts, the trust itself is a separate taxable entity, and its income is either taxed at the trust level or passed through to beneficiaries, who are then taxed on the distributed income.

For non-grantor trusts, an annual income tax return (Form 1041) must be filed, and beneficiaries receiving income distributions must be issued a Schedule K-1. Grantor trusts typically report the trust's income and deductions on the grantor's personal income tax return (Form 1040). Trusts may also be subject to state income tax reporting requirements.

Trusts can deduct various expenses, such as trustee fees, charitable contributions, and certain miscellaneous deductions. Tax credits may also be available, including the foreign tax credit, general business credit, and other credits specific to the trust's activities and investments.

Tax planning strategies for trust income taxation include carefully planning the timing and character of trust income distributions, incorporating charitable giving strategies, and pursuing investment strategies that generate tax-efficient income. Staying informed about changes in tax laws and working with professional advisors can help ensure tax-efficient trust management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.