Trust tax reporting refers to the process of preparing and filing tax documents related to the income, deductions, and distributions of a trust. A trust is a legal arrangement in which one party, the trustee, holds and manages assets on behalf of another party, the beneficiary. Trusts can be created for various purposes, including estate planning, asset protection, or charitable giving.

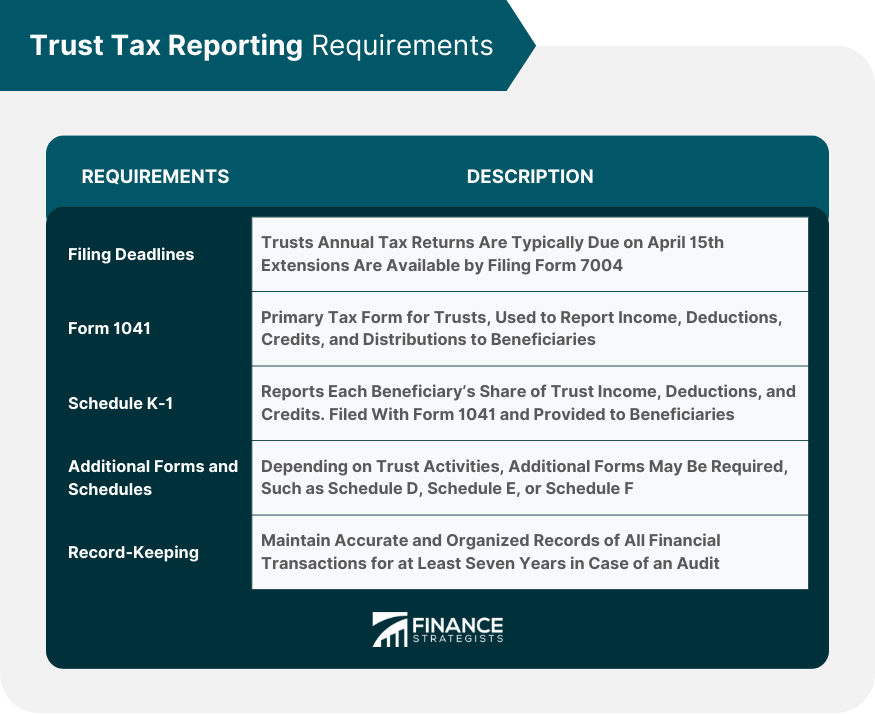

Trusts are required to file annual tax returns, just like individuals and corporations. The filing deadline for a trust's tax return is typically April 15th of the year following the tax year. However, trusts can request an extension by filing Form 7004, which grants an additional five months to file the return. There are several tax forms and schedules that trusts may need to file, depending on their specific circumstances: This is the primary tax form for trusts, used to report the trust's income, deductions, and credits, as well as any distributions to beneficiaries. This form is used to report each beneficiary's share of the trust's income, deductions, and credits. It is filed along with Form 1041 and provided to beneficiaries for use in preparing their personal tax returns. Depending on the trust's activities, additional forms and schedules may be required, such as Schedule D (Capital Gains and Losses), Schedule E (Supplemental Income and Loss), or Schedule F (Profit or Loss from Farming). Maintaining accurate and organized records is crucial for trust tax reporting. Trusts should keep records of all financial transactions, including income, expenses, and distributions. These records should be retained for at least seven years in case of an audit. Trusts can receive various types of income, which must be reported on Form 1041: Interest Income: This includes interest earned on bank accounts, bonds, and other debt instruments. Dividend Income: This includes dividends received from stocks and mutual funds. Capital Gains and Losses: Trusts must report any gains or losses realized from the sale of capital assets, such as stocks, real estate, or other investments. Rental and Royalty Income: Income derived from renting property or receiving royalties from intellectual property rights must also be reported. Business Income: If the trust operates a business, it must report the income generated from those activities. Trusts can claim deductions for various expenses related to the administration and operation of the trust: These include fees paid to trustees, accountants, attorneys, and other professionals involved in managing the trust. If the trust makes charitable donations, it can claim a deduction for the amount contributed. Trusts can claim deductions for depreciation on assets used in business activities and the depletion of natural resources, such as oil or minerals. Other deductions may be available for specific expenses, such as investment interest expenses, casualty losses, or tax preparation fees. Trusts can distribute income and principal to beneficiaries according to the terms of the trust agreement. These distributions are generally subject to taxation at the beneficiary level. Trust distributions can be categorized into two types: These are distributions of the trust's income, such as interest, dividends, and rental income. Income distributions are typically taxed to the beneficiary as ordinary income. These are distributions of the trust's principal or corpus, which usually consists of the original assets contributed to the trust. Principal distributions are generally not taxable to the beneficiary, as they are considered a return of capital. Beneficiaries must report trust distributions on their personal tax returns: Income distributions are reported on the beneficiary's personal tax return using the information provided on Schedule K-1. Beneficiaries may also be eligible for deductions and credits related to trust income, such as foreign tax credits or deductions for investment expenses. Beneficiaries may be able to claim deductions and credits based on their share of the trust's income, deductions, and credits. Examples include the foreign tax credit, the credit for taxes paid on undistributed capital gains, and deductions for investment expenses. Trusts can employ various tax planning strategies to reduce their tax liability: By strategically timing trust distributions, trustees can minimize the overall tax liability for the trust and its beneficiaries. For example, a trust might make a distribution in a year when the beneficiary's tax bracket is lower. Trusts can minimize their tax liability by making charitable contributions, which are deductible from the trust's taxable income. Trustees can manage investments to minimize taxes by considering factors such as capital gains rates, dividend tax rates, and the tax-exempt status of certain investments. When a trust terminates, its assets are distributed to the beneficiaries, and any remaining trust income must be reported on the trust's final tax return. Beneficiaries may be subject to taxes on these final distributions. Given the complexity of trust tax planning, it is often beneficial to consult with a tax advisor who can help navigate the tax laws and develop strategies to minimize tax liability. Some common trust tax reporting mistakes include failing to file required tax forms, underreporting income, overreporting deductions, and not maintaining proper records. These mistakes can lead to penalties and interest charges. Non-compliance with trust tax reporting requirements can result in significant penalties, interest charges, and potential audits by the Internal Revenue Service (IRS). If a trust is audited by the IRS, it is essential to be prepared and respond appropriately: Gather all relevant records and documentation, including income statements, expense receipts, and proof of distributions. Work with a tax professional to address any discrepancies or issues raised by the IRS during the audit. If there is a disagreement with the IRS regarding the trust's tax liability, consider working with a tax attorney or advisor to resolve the dispute through negotiation or litigation. Trust tax reporting is a crucial process that involves preparing and filing tax documents related to the income, deductions, and distributions of a trust. Trusts must file annual tax returns and various forms and schedules, such as Form 1041 and Schedule K-1. Trusts can claim deductions for expenses related to the administration and operation of the trust, and distributions to beneficiaries are subject to taxation. Beneficiaries must report trust distributions on their personal tax returns and may be eligible for deductions and credits. Trusts can minimize their tax liability through tax planning strategies, such as timing of distributions, charitable giving, and investment strategies. Non-compliance with trust tax reporting requirements can result in significant penalties and interest charges, and trust audits can be challenging to handle without proper preparation and professional guidance.What Is Trust Tax Reporting?

Trust Tax Reporting Requirements

Filing Deadlines and Extensions

Tax Forms for Trusts

Form 1041: U.S. Income Tax Return for Estates and Trusts

Schedule K-1: Beneficiary's Share of Income, Deductions, Credits, and Others

Other Relevant Forms and Schedules

Record-Keeping for Trust Tax Reporting

Trust Income and Deductions of Trust Tax Reporting

Types of Trust Income

Trust Deductions and Expenses

Trust Administration Expenses

Charitable Contributions

Depreciation and Depletion

Miscellaneous Deductions

Distributions to Beneficiaries of Trust Tax Reporting

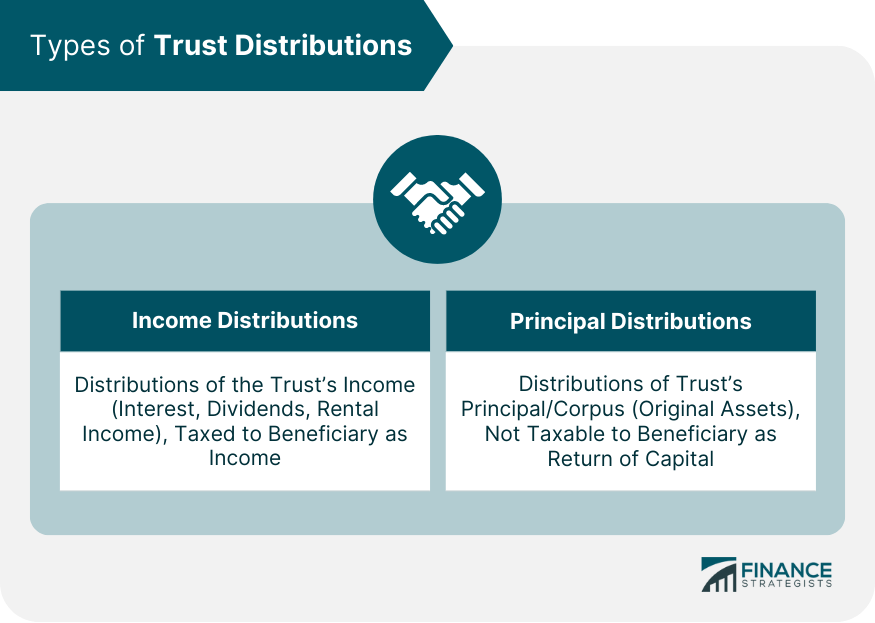

Trust Distribution Rules

Types of Trust Distributions

Income Distributions

Principal Distributions

Tax Implications for Beneficiaries

Reporting Trust Distributions on Personal Tax Returns

Deductions and Credits Available to Beneficiaries

Trust Tax Reporting for Trusts

Strategies to Minimize Trust Tax Liability

Timing of Trust Distributions

Charitable Giving

Asset Allocation and Investment Strategies

Tax Implications of Trust Termination

Role of a Tax Advisor in Trust Tax Planning

Trust Tax Reporting Compliance and Audits

Common Trust Tax Reporting Mistakes

Consequences of Non-compliance

Dealing With Trust Tax Audits

Preparing for an Audit

Responding to Audit Findings

Resolving Disputes with the IRS

Conclusion

Trust Tax Reporting FAQs

Trust tax reporting involves filing annual tax returns, and reporting the trust's income, deductions, credits, and distributions to beneficiaries using Form 1041 and Schedule K-1. Accurate record-keeping and adherence to filing deadlines are crucial for maintaining compliance with tax laws.

Trust tax reporting directly affects beneficiaries as they must report income distributions from the trust on their personal tax returns. Beneficiaries may also be eligible for deductions and credits related to trust income.

Common mistakes in trust tax reporting include failing to file required tax forms, underreporting income, overreporting deductions, and not maintaining proper records. These errors can result in penalties, interest charges, and potential audits by the Internal Revenue Service (IRS).

Strategies to minimize tax liability in trust tax reporting include timing trust distributions, making charitable contributions, and employing asset allocation and investment strategies. Consulting with a tax advisor can help trustees navigate tax laws and develop effective tax planning strategies.

To prepare for a trust tax reporting audit, gather all relevant records and documentation, including income statements, expense receipts, and proof of distributions. Work with a tax professional to address any discrepancies or issues raised by the IRS during the audit and resolve disputes if necessary.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.