Unrelated Business Taxable Income (UBTI) is the income generated by a tax-exempt organization from activities that are unrelated to its primary mission or purpose. UBTI is subject to federal income tax under the Internal Revenue Code (IRC) to ensure that tax-exempt organizations do not gain an unfair advantage over for-profit businesses in the same industry. The concept of UBTI seeks to maintain a level playing field between tax-exempt organizations and for-profit entities by taxing income from activities unrelated to the organization's core purpose. This prevents exempt organizations from using their tax-free status to outcompete businesses in the same industry. UBTI aims to ensure that tax-exempt organizations do not exploit their tax-exempt status to generate significant income from unrelated activities. By taxing unrelated business income, the federal government aims to prevent tax-exempt organizations from unfairly competing with taxable entities in the same industry. UBTI is important because it helps maintain the integrity of the tax-exempt status of organizations while promoting fair competition in the market. It also serves as a source of revenue for the government, ensuring that organizations pay their fair share of taxes on income unrelated to their exempt purposes. The primary provisions governing UBTI are found in Sections 511, 512, and 513 of the IRC. Section 511 imposes a tax on the unrelated business income of certain tax-exempt organizations. Section 512 provides rules for computing UBTI, while Section 513 defines what constitutes an unrelated trade or business. These provisions establish the legal foundation for taxing unrelated business income and provide the necessary guidelines for tax-exempt organizations to calculate and report their UBTI. The Internal Revenue Service (IRS) provides guidance and rulings on UBTI to help tax-exempt organizations understand and comply with the IRC provisions. This guidance includes revenue rulings, private letter rulings, and other published materials that explain the rules and regulations regarding UBTI. Tax-exempt organizations must stay updated on the latest IRS guidance and rulings to ensure compliance with the UBTI rules and avoid potential penalties or loss of their tax-exempt status. Court cases and decisions related to UBTI have helped shape the interpretation and application of the IRC provisions. These cases often involve disputes between tax-exempt organizations and the IRS, with the courts providing clarity on various aspects of UBTI, such as the definition of unrelated trade or business and the calculation of UBTI. By staying informed of relevant court decisions, tax-exempt organizations can better understand the legal landscape surrounding UBTI and make informed decisions to minimize their tax liability and maintain compliance. A trade or business is defined as any activity intended to generate income or profit from selling goods or services. To be considered a trade or business for UBTI purposes, an activity must be carried on to produce income or profit. Tax-exempt organizations must evaluate each of their income-generating activities to determine if they meet the definition of a trade or business. Activities that are incidental to the organization's exempt purpose, such as occasional fundraising events, may not be considered a trade or business and may not generate UBTI. For an activity to generate UBTI, it must be regularly carried on by the tax-exempt organization. This means that the activity is conducted with a frequency and continuity similar to comparable commercial activities by for-profit businesses. To determine if an activity is regularly carried on, tax-exempt organizations should consider factors such as the frequency of the activity, the length of time it is conducted, and its seasonal or cyclical nature. Activities that are sporadic, occasional, or irregular may not be considered regularly carried on and may not generate UBTI. An activity generates UBTI if it is not substantially related to the organization's tax-exempt purpose, aside from the need to generate funds. The relationship between the activity and the exempt purpose must be significant and contribute to accomplishing the organization's mission. Organizations must carefully assess their income-generating activities to determine if they are substantially related to their exempt purpose. Activities unrelated to the organization's core mission and do not contribute to accomplishing its objectives may generate UBTI and be subject to taxation. Certain types of investment income, such as dividends, interest, and capital gains, are generally excluded from UBTI. This exception allows tax-exempt organizations to invest their funds without generating taxable income if the investments are not debt-financed. Royalty income, which includes payments for using intangible property such as patents, copyrights, and trademarks, is generally exempt from UBTI. This exception allows tax-exempt organizations to generate income from their intellectual property without incurring tax liability. Rental income from real property, such as land or buildings, is generally excluded from UBTI unless the property is debt-financed or the rental income is derived from personal property leased with the real property. This exception enables tax-exempt organizations to generate income from their real estate holdings without incurring tax liability. Gains and losses from the sale of property held for investment purposes, such as stocks and bonds, are generally excluded from UBTI. However, gains from selling property used in an unrelated trade or business may be subject to UBTI. Income derived from research activities is generally excluded from UBTI if the research is conducted for the public benefit or is made available to the public on a non-discriminatory basis. Income generated from activities in which substantially all the work is performed by volunteers is generally excluded from UBTI. This exception recognizes the importance of volunteerism in tax-exempt organizations and encourages their continued reliance on volunteer support. Income generated from the sale of goods or services to members, students, patients, officers, or employees of the tax-exempt organization is generally excluded from UBTI if the sales are primarily for the convenience of these individuals. Income generated from the sale of merchandise that has been donated to the tax-exempt organization is generally excluded from UBTI. This exception allows organizations like thrift stores to generate income from donated goods without incurring tax liability. Various tax-exempt organizations are subject to UBTI, including: Charitable Organizations (501(c)(3)): These organizations, such as educational institutions, religious organizations, and hospitals, must pay taxes on unrelated business income. Social Welfare Organizations (501(c)(4)): Organizations that promote social welfare, such as civic leagues and community associations, are also subject to UBTI. Labor Organizations (501(c)(5)): Labor unions and agricultural organizations must report and pay taxes on their UBTI. Trade Associations (501(c)(6)): Business leagues, chambers of commerce, and professional associations are subject to UBTI rules. Other Tax-Exempt Entities: Additional tax-exempt organizations, such as veterans' organizations and fraternal societies, may also be subject to UBTI. Tax-exempt organizations with UBTI must file IRS Form 990-T, the Exempt Organization Business Income Tax Return, to report their unrelated business income and calculate the tax due. Organizations must file Form 990-T if their gross unrelated business income exceeds $1,000 for the tax year. The due date for filing Form 990-T is typically the 15th day of the 5th month following the end of the organization's fiscal year. Extensions may be available if the organization requests additional time to file. Proper recordkeeping and documentation are essential for tax-exempt organizations to report their UBTI and accurately comply with tax regulations. Organizations should maintain records of unrelated business activities, including financial statements, contracts, and other relevant documents supporting their UBTI calculations. Organizations should also retain records of their exempt activities and income to demonstrate compliance with the UBTI rules and substantiate any claims for exceptions or modifications. A tax-exempt organization may jeopardize its tax-exempt status if it generates excessive unrelated business income. The IRS may determine that the organization is primarily engaged in a trade or business unrelated to its exempt purpose, resulting in the loss of its tax-exempt status and the imposition of taxes on all of its income. Failure to properly report and pay taxes on UBTI may result in penalties and interest assessed by the IRS. Organizations that file Form 990-T or pay the taxes due on their unrelated business income may avoid penalties for late filing, late payment, and underpayment of estimated tax. Unrelated Debt-Financed Income (UDFI) is a specific type of UBTI that arises when tax-exempt organizations or retirement plans use debt to finance investments in real estate or other income-producing property. The portion of the income or gain attributable to the debt-financed property is subject to UBTI and must be reported on Form 990-T. IRAs, including traditional, Roth, SEP, and SIMPLE IRAs, may be subject to UBTI if they engage in activities that generate unrelated business income or invest in debt-financed property. IRA owners must be aware of the potential UBTI implications and ensure proper reporting and payment of taxes on unrelated business income. 401(k) plans may also be subject to UBTI if they engage in activities that generate unrelated business income or invest in debt-financed property. Plan sponsors must monitor the investments and activities of the 401(k) plan to ensure compliance with UBTI rules and avoid potential tax liabilities. Other types of retirement plans, such as 403(b) plans and pension plans, may also be subject to UBTI if they engage in activities that generate unrelated business income or invest in debt-financed property. Plan sponsors and administrators should be aware of the potential UBTI implications and ensure proper reporting and payment of taxes on unrelated business income. Tax-exempt organizations should implement processes to identify and track activities that generate UBTI. This may involve reviewing financial statements, contracts, and other relevant documents to determine if any activities meet the criteria for unrelated business income. Monitoring activities and income sources can help organizations proactively address potential UBTI issues and maintain compliance. Organizations can minimize their UBTI exposure by implementing various strategies, including: Utilizing Subsidiaries: Tax-exempt organizations can establish taxable subsidiaries to conduct unrelated business activities. The subsidiary's income will be subject to corporate income tax, but the parent organization's tax-exempt status will be preserved. Managing Debt-Financed Properties: Organizations can minimize UDFI by reducing the amount of debt used to finance property investments or by disposing of debt-financed properties before realizing significant income or gains. Maximizing Exceptions and Modifications: Organizations should be familiar with the various exceptions and modifications to UBTI and take advantage of them to minimize their taxable income. Tax-exempt organizations should establish effective compliance and reporting systems to ensure accurate reporting of UBTI and timely payment of taxes. This may involve implementing internal controls, training staff on UBTI rules and regulations, and maintaining detailed records of unrelated business activities and income. Tax-exempt organizations should consult with tax professionals and legal advisors to ensure compliance with UBTI rules and minimize tax liability. Professionals with experience in UBTI issues can provide valuable guidance on identifying and managing unrelated business activities, navigating complex tax regulations, and implementing effective compliance strategies. UBTI is essential for tax-exempt organizations to understand and manage, as it impacts their tax liabilities and compliance with federal tax regulations. By familiarizing themselves with the rules surrounding UBTI, implementing effective compliance and reporting systems, and collaborating with tax professionals and legal advisors, tax-exempt organizations can minimize their UBTI exposure and maintain their tax-exempt status. Understanding and managing UBTI is crucial for tax-exempt organizations to preserve their tax-exempt status and avoid potential penalties or loss of tax-exempt status. By proactively addressing UBTI issues and implementing strategies to minimize taxable income, organizations can focus on their core mission and continue to serve their communities without the burden of excessive tax liabilities. Tax-exempt organizations should stay informed about changes to UBTI rules and regulations, as tax laws and IRS guidance can impact their UBTI exposure and compliance requirements. By staying up-to-date on the latest developments and trends, organizations can adapt their UBTI strategies and maintain compliance with evolving tax regulations.What Is Unrelated Business Taxable Income (UBTI)?

Legal Framework

Internal Revenue Code (IRC) Provisions

IRS Guidance and Rulings

Relevant Court Cases and Decisions

Determining UBTI

Definition of Trade or Business

Regularly Carried On

Unrelated to Exempt Purpose

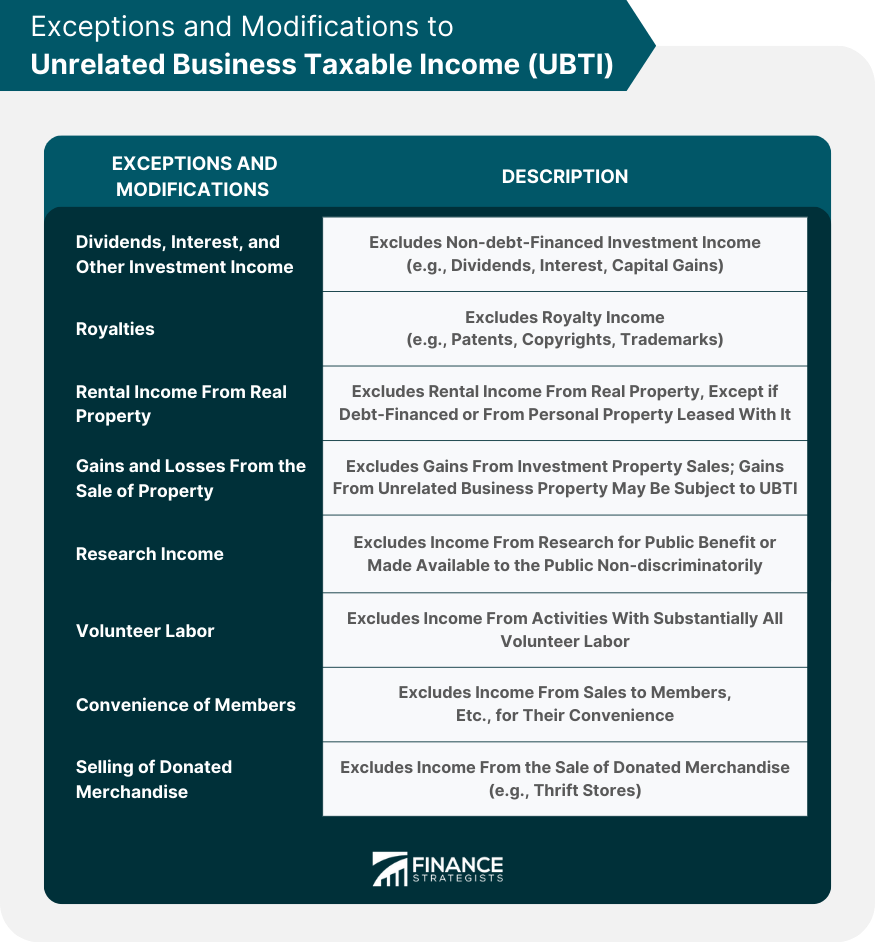

Exceptions and Modifications to UBTI

Dividends, Interest, and Other Investment Income

Royalties

Rental Income from Real Property

Gains and Losses From the Sale of Property

Research Income

Volunteer Labor

Convenience of Members

Selling of Donated Merchandise

UBTI and Tax-Exempt Organizations

Types of Tax-Exempt Organizations Subject to UBTI

Filing Requirements

Recordkeeping and Documentation

Potential Consequences for Excessive UBTI

Revocation of Tax-Exempt Status

Penalties and Interest

UBTI and Retirement Plans

Unrelated Debt-Financed Income (UDFI)

Impact on Individual Retirement Accounts (IRAs)

Impact on 401(k) Plans

Impact on Other Retirement Plans

UBTI Planning and Strategies

Identifying and Tracking UBTI-Generating Activities

Minimizing UBTI Exposure

Implementing Effective Compliance and Reporting Systems

Collaborating With Tax Professionals and Legal Advisors

Conclusion

Unrelated Business Taxable Income (UBTI) FAQs

Unrelated Business Taxable Income (UBTI) is income a tax-exempt organization generates from a trade or business that is not substantially related to the organization's tax-exempt purpose. UBTI is subject to federal income tax under the Internal Revenue Code.

UBTI is calculated by taking the gross income from an unrelated trade or business, subtracting allowable deductions directly connected to the business, and adding any modifications required by the Internal Revenue Code. The result is the organization's UBTI, which is subject to tax.

Tax-exempt organizations must be concerned about UBTI because it can impact their tax-exempt status. If a significant portion of an organization's income is derived from unrelated business activities, it may lose its tax-exempt status. Additionally, UBTI is subject to federal income tax, which can affect the organization's financial position.

Yes, IRAs can be subject to UBTI if they invest in certain types of assets or activities that generate income unrelated to the purpose of the IRA. For example, if an IRA invests in a partnership that operates a trade or business, the IRA's share of the partnership's income may be considered UBTI and subject to tax.

Yes, there are several exceptions to the UBTI rules. For example, income from dividends, interest, royalties, certain rental income, and capital gains from property sales is generally excluded from UBTI. Additionally, income from activities conducted by volunteers or for the convenience of the organization's members may be exempt from UBTI.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.