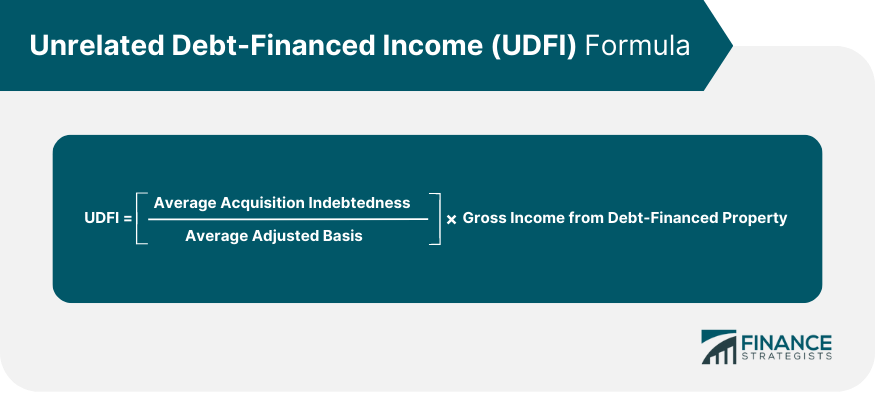

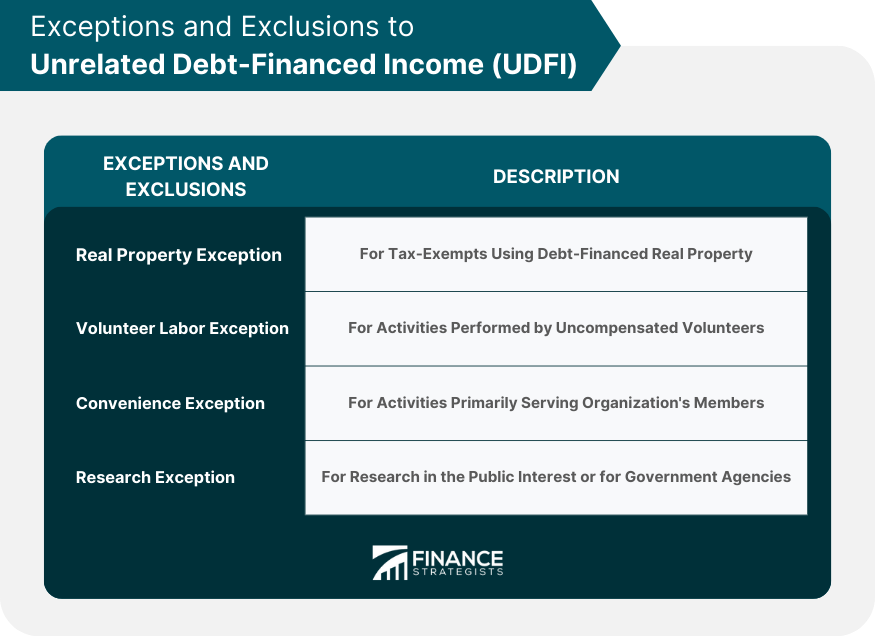

Unrelated Debt-Financed Income (UDFI) refers to income generated by a tax-exempt organization through the use of debt financing to invest in income-producing properties or activities that are not directly related to the organization's tax-exempt purpose. UDFI is a specific type of Unrelated Business Income (UBI) subject to taxation under the Unrelated Business Income Tax (UBIT) rules. The concept of UDFI is essential for tax-exempt organizations to understand, as it can impact their tax liability and overall financial planning. Tax-exempt organizations need to be aware of the implications of UDFI for their tax planning strategies. Ignoring or mismanaging UDFI can lead to unexpected tax liabilities, penalties, and potential loss of tax-exempt status. Understanding UDFI allows organizations to make informed decisions about their investments and debt financing, helping them to maintain their tax-exempt status while optimizing their financial growth. A tax-exempt organization is a type of entity that is exempt from federal income tax under the Internal Revenue Code (IRC). These organizations are typically formed for charitable, religious, educational, scientific, or other public-benefit purposes. There are several types of tax-exempt organizations, including 501(c)(3) organizations (charitable, religious, and educational organizations), 501(c)(4) organizations (social welfare organizations), and 501(c)(6) organizations (business leagues and trade associations), among others. To qualify for tax-exempt status, an organization must meet specific criteria outlined in the IRC, such as operating exclusively for exempt purposes and ensuring that no part of its net earnings benefits private individuals. Unrelated Business Income (UBI) is the income generated by a tax-exempt organization through activities that are not directly related to its tax-exempt purpose. These activities are considered "unrelated" if they do not contribute significantly to the organization's mission or primary function. The IRS imposes an Unrelated Business Income Tax (UBIT) on UBI to ensure that tax-exempt organizations do not gain an unfair advantage over taxable entities when engaging in commercial activities. UBIT is calculated based on the organization's net income from unrelated business activities, with specific deductions and exclusions considered. The general formula for calculating UDFI is as follows: UDFI = (Average Acquisition Indebtedness / Average Adjusted Basis) x Gross Income from Debt-Financed Property This formula helps tax-exempt organizations determine the portion of their income subject to UBIT due to debt financing. The calculation takes into account the organization's acquisition indebtedness (the outstanding debt incurred to acquire, improve, or maintain the debt-financed property), the average adjusted basis of the property (the property's cost, adjusted for improvements and depreciation), and the gross income generated by the property. Several factors can influence the calculation of UDFI for a tax-exempt organization. First, the acquisition indebtedness is a critical component, as higher debt levels increase the proportion of income subject to UDFI. Second, the property's average adjusted basis plays a role in determining the debt financing ratio to the property's value. Finally, the gross income from the property affects the total amount of income subject to UDFI. Understanding these factors and their implications can help organizations make informed decisions about their debt-financed investments and manage their exposure to UDFI. One significant exception to UDFI is the real property exception, also known as the "qualified organization exception." This exception applies to certain tax-exempt organizations, such as schools, colleges, and universities, that use debt financing to acquire or improve real property used directly for their exempt purpose. To qualify for this exception, the organization must demonstrate that the property's use substantially contributes to its tax-exempt mission and that the property is not used for commercial purposes. If these requirements are met, the income generated by the debt-financed property may be excluded from UDFI. Another exception to UDFI is the volunteer labor exception, which applies when substantially all the work related to an unrelated trade or business activity is performed by volunteers who receive no compensation. In this case, the income generated by the activity is not considered UDFI and is not subject to UBIT. The convenience exception excludes income from unrelated business activities that are conducted primarily for the convenience of an organization's members, students, patients, or employees. For example, a university-operated bookstore or cafeteria may be considered exempt from UDFI under the convenience exception, as these activities primarily serve the university's population. Income derived from research activities conducted by tax-exempt organizations may also be exempt from UDFI, provided that the research is carried out in the public interest or for the direct benefit of governmental agencies. Self-directed IRAs are retirement accounts that allow investors to choose their investments, including alternative assets such as real estate, private equity, and precious metals. When a self-directed IRA uses debt financing to invest in assets that generate income unrelated to the IRA's tax-exempt purpose, the income may be subject to UDFI and UBIT. This can result in unexpected tax liabilities for the IRA owner. The impact of UDFI on IRA investments can be significant, as the tax liability can reduce the overall return on investment and limit the growth potential of the retirement account. Investors need to understand the implications of UDFI for their self-directed IRA investments and develop strategies to minimize its impact. Several strategies can help self-directed IRA owners minimize their exposure to UDFI. These strategies include using non-recourse loans to finance investments, investing in properties that qualify for the real property exception, and structuring investments through tax-exempt entities such as limited liability companies (LLCs) or partnerships. Real estate investments can be attractive for tax-exempt organizations seeking to diversify their portfolios and generate income. However, organizations must know the potential UDFI implications of debt-financed real estate investments. If an investment generates income unrelated to the organization's tax-exempt purpose, a portion of that income may be subject to UDFI and UBIT, impacting the organization's overall tax liability and financial performance. Tax-exempt organizations can employ various strategies to minimize their exposure to UDFI when investing in real estate. These strategies include selecting properties that qualify for the real property exception, using non-recourse loans for debt financing, and structuring investments through tax-exempt entities such as LLCs or partnerships. By carefully considering these strategies and their implications, organizations can make informed decisions about their real estate investments while minimizing the impact of UDFI on their tax liability. When tax-exempt organizations invest in real estate, it is essential to consider the tax structuring of the investment to minimize the impact of UDFI. This may involve setting up a separate legal entity, such as an LLC or partnership, to hold the investment. Additionally, organizations should work with legal and tax services professionals to ensure compliance with federal, state, and local tax regulations and to optimize the investment's tax structure for maximum benefits. Tax-exempt organizations that generate UDFI must report this income and any associated UBIT liabilities using IRS Form 990-T, Exempt Organization Business Income Tax Return. Form 990-T provides a detailed account of the organization's unrelated business income, deductions, and tax liabilities. It is crucial for organizations to accurately and timely complete and file this form to maintain their tax-exempt status and avoid penalties. The filing deadline for Form 990-T is typically the 15th day of the 5th month following the end of the organization's tax year. For example, if an organization's tax year ends on December 31, Form 990-T must be filed by May 15 of the following year. Organizations must also make estimated tax payments annually if their expected UBIT liability is $1000 or more. Failure to meet these filing deadlines and requirements can result in penalties and potential loss of tax-exempt status. Non-compliance with UDFI reporting and tax payment requirements can lead to significant penalties for tax-exempt organizations. These penalties may include late filing fees, late payment penalties, and interest on unpaid taxes. An organization may severely lose its tax-exempt status, resulting in significant financial and operational challenges. Organizations must comply with UDFI reporting and payment requirements to avoid these penalties and protect their tax-exempt status. Managing debt levels is crucial for minimizing UDFI exposure. Organizations should carefully analyze their debt levels and consider the impact of acquisition indebtedness on their UDFI calculations. Organizations can reduce their UDFI exposure and optimize their financial performance by maintaining appropriate debt levels. Structuring investments to minimize UDFI exposure is another essential strategy for tax-exempt organizations. This may involve investing in assets that qualify for UDFI exceptions or exclusions, using non-recourse loans for debt financing, or structuring investments through tax-exempt entities such as LLCs or partnerships. By carefully considering these strategies and their implications, organizations can make informed decisions about their investments while minimizing the impact of UDFI on their tax liability. Tax-exempt organizations may also consider using tax-exempt financing to fund their investments, as this type of financing is not subject to UDFI. Tax-exempt financing, such as bonds issued by governmental or nonprofit entities, can provide organizations with access to capital while reducing their exposure to UDFI and UBIT. However, organizations must consult with legal and financial advisors to ensure compliance with tax-exempt financing regulations and requirements. Tax-exempt organizations should stay informed about potential regulatory changes that could impact UDFI and UBIT rules. Changes in tax laws, IRS regulations, or judicial interpretations may affect the calculation, reporting, and taxation of UDFI. Staying up-to-date on these developments can help organizations adapt their strategies and maintain compliance with evolving rules and requirements. Economic trends can also influence UDFI and the financial performance of tax-exempt organizations. Interest rates, market fluctuations, and economic cycles can affect the cost and availability of debt financing and the income generated by debt-financed investments. Organizations should monitor these trends and consider their potential impact on UDFI when making investment and financing decisions. Advancements in technology can provide tax-exempt organizations with new tools and resources to manage their UDFI exposure more effectively. Software solutions, data analytics, and financial planning platforms can help organizations track, analyze, and optimize their debt-financed investments to minimize UDFI and UBIT liabilities. Embracing these technologies can lead to more informed decision-making and improved financial performance for tax-exempt organizations. Unrelated Debt-Financed Income (UDFI) is a critical concept for tax-exempt organizations to understand and manage effectively. UDFI is income generated by debt-financed investments unrelated to the organization's tax-exempt purpose and subject to the Unrelated Business Income Tax (UBIT). Organizations can optimize their financial performance while maintaining their tax-exempt status by understanding the calculation, exceptions, and strategies for minimizing UDFI. Staying informed about UDFI and its potential impact on tax-exempt organizations is essential for effective financial planning and decision-making. Organizations should monitor regulatory changes, economic trends, and technological advancements that could affect UDFI and adapt their strategies accordingly. Given the complexities of UDFI and its potential impact on tax-exempt organizations, it is crucial to seek professional guidance from legal, tax, and financial advisors. These professionals can provide expert advice on UDFI compliance, reporting, and minimization strategies, helping organizations navigate the complexities of UDFI and optimize their financial performance.What Is Unrelated Debt-Financed Income (UDFI)?

Conceptual Framework

Tax-Exempt Organizations

Unrelated Business Income (UBI)

UDFI Calculation

General Formula

Factors Affecting UDFI Calculation

Exceptions and Exclusions to UDFI

Real Property Exception

Volunteer Labor Exception

Convenience Exception

Research Exception

UDFI and Individual Retirement Accounts (IRAs)

Self-Directed IRAs and UDFI

UDFI Impact on IRA Investments

Strategies to Minimize UDFI Exposure

UDFI and Real Estate Investments

UDFI Implications for Tax-Exempt Organizations

Real Estate Investment Strategies to Minimize UDFI

Tax Structuring Considerations for Real Estate Investments

Reporting and Compliance

IRS Form 990-T

Filing Deadlines and Requirements

Penalties for Non-compliance

Tax Planning and Minimization Strategies

Analyzing and Managing Debt Levels

Structuring Investments to Minimize UDFI Exposure

Utilizing Tax-Exempt Financing

Future Developments and Considerations

Potential Regulatory Changes

Impact of Economic Trends on UDFI

Technology and UDFI Management

Conclusion

Unrelated Debt-Financed Income (UDFI) FAQs

Unrelated Debt-Financed Income (UDFI) is a type of income that a tax-exempt organization generates through its debt-financed property. When a tax-exempt entity borrows money to purchase an income-producing property, the income derived from that property, proportional to the debt on the property, is subject to Unrelated Business Income Tax (UBIT).

UDFI is calculated based on the average acquisition indebtedness for the tax year divided by the property's average adjusted basis. This ratio is then multiplied by the gross income from the property to determine the amount of income that is considered debt-financed.

Yes, there are several exceptions to UDFI. For instance, it does not apply to properties used directly in performing the organization's exempt purpose, properties whose income would be excluded from unrelated business income, or properties financed through tax-exempt bonds.

Yes, a Self-Directed IRA can be subject to UDFI if it uses debt financing to purchase an income-producing property. The portion of the income or gains derived from the debt-financed property may be subject to UBIT.

One common strategy to mitigate the impact of UDFI is to use a 401(k) plan instead of an IRA to make the investment, as 401(k) plans are exempt from UDFI when investing in real estate. Another strategy is to pay off the debt as quickly as possible to reduce the proportion of income that is considered debt-financed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.