The dividend payout ratio is the ratio of total dividends relative to total net income, stated as a percentage. A company may either decide to reinvest its earnings back into the business or pay out its earnings to shareholders—the dividend payout ratio is what percent of earnings is paid out to shareholders as a dividend. The formula for the dividend payout ratio is Dividends Paid divided by Net Income. New companies still in their growth phase often reinvest all or most of their earnings back into their business, whereas more mature companies often pay out a larger percentage of their earnings in the form of dividends. The purpose of paying out dividends is to incentivize investors to hold shares of a company's stock. Investors may hold onto a company's stock with the belief that their compensation will come through appreciating stock prices, dividend payouts, or a mix of both. In general, high payout ratios mean that share prices are unlikely to appreciate rapidly since the company is using its earnings to compensate shareholders rather than reinvest those earnings for future growth. The dividend payout ratio is useful for assessing the following:What Is the Dividend Payout Ratio?

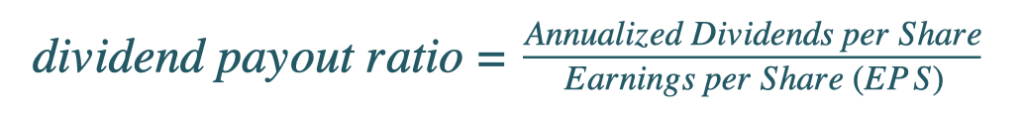

Dividend Payout Ratio Formula

Why Pay Out Dividends

The Bottom Line

Dividend Payout Ratio FAQs

The dividend payout ratio is the ratio of total dividends relative to total net income, stated as a percentage.

A company may either decide to reinvest its earnings back into the business or pay out its earnings to shareholders—the dividend payout ratio is what percent of earnings is paid out to shareholders as a dividend.

The formula for the Dividend Payout Ratio is Dividends Paid divided by Net Income.

New companies still in their growth phase often reinvest all or most of their earnings back into their business, whereas more mature companies often pay out a larger percentage of their earnings in the form of dividends.

On rare occasions, a company may offer a dividend payout ratio of more than 100%. This tactic is often undertaken when attempting to inflate stock prices in the short term.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.