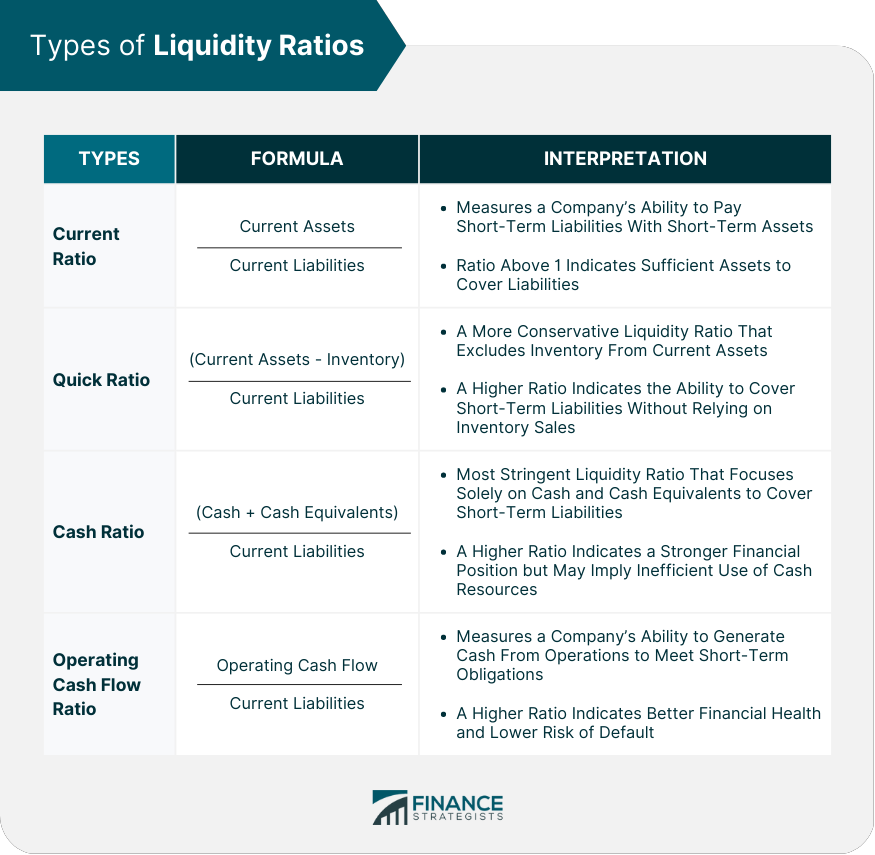

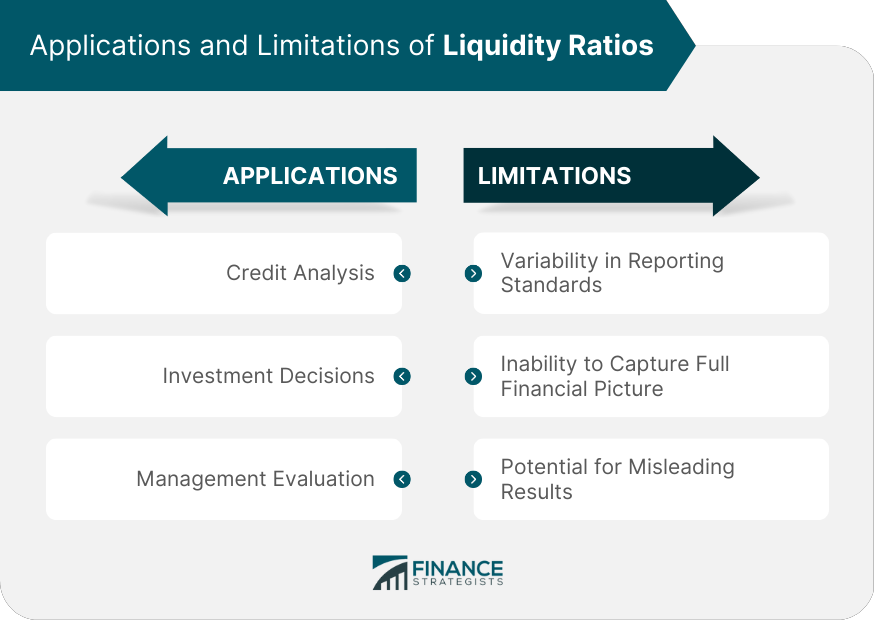

Liquidity ratios are essential financial metrics that help investors, creditors, and financial analysts assess a company's ability to meet its short-term obligations. These ratios measure a company's financial health and indicate the ease with which it can convert assets into cash to pay off liabilities. Liquidity ratios provide an insight into the company's ability to generate cash quickly to cover its short-term debt obligations. They are used to evaluate the effectiveness of a company's working capital management and its overall financial stability. Liquidity ratios are critical components of financial analysis, as they help assess the solvency and creditworthiness of a company. A higher liquidity ratio generally indicates a lower risk of default, making the company more attractive to investors and creditors. There are several types of liquidity ratios, each with its specific purpose and calculation method. Current Ratio = Current Assets / Current Liabilities The current ratio measures a company's ability to pay its short-term liabilities using its short-term assets. A ratio above 1 indicates that the company has enough assets to cover its liabilities, while a ratio below 1 suggests potential liquidity issues. Quick Ratio = (Current Assets - Inventory) / Current Liabilities Also known as the acid-test ratio, the quick ratio is a more conservative measure of a company's liquidity, as it excludes inventory from current assets. A higher quick ratio signifies that the company can cover its short-term liabilities without relying on inventory sales. Cash Ratio = (Cash + Cash Equivalents) / Current Liabilities The cash ratio is the most stringent liquidity ratio, focusing only on the company's cash and cash equivalents to cover its short-term liabilities. A higher cash ratio indicates a stronger financial position, but it may also suggest inefficient use of cash resources. Operating Cash Flow Ratio = Operating Cash Flow / Current Liabilities This ratio measures a company's ability to generate cash from operations to meet its short-term obligations. A higher operating cash flow ratio indicates better financial health and a lower risk of default. Several factors can influence a company's liquidity ratios, including: Different industries have varying liquidity requirements, and comparing companies across industries using liquidity ratios may not provide accurate results. Analysts must consider industry-specific norms when interpreting these ratios. Liquidity ratios can be affected by business cycles, as companies may have fluctuating cash flow and working capital requirements during different stages of the cycle. The size and structure of a company can impact its liquidity ratios, as larger companies might have more diversified revenue streams and better access to financing, while smaller companies may have limited resources and higher liquidity risk. Liquidity ratios have various applications, including: Creditors use liquidity ratios to assess a company's ability to repay its debt, helping them determine the credit risk associated with lending money to the company. A higher liquidity ratio typically results in a lower credit risk and better borrowing terms for the company. Investors analyze liquidity ratios to evaluate the financial stability of a company before making investment decisions. Companies with strong liquidity ratios are considered less risky investments, as they are more likely to meet their short-term obligations and maintain financial stability during economic downturns. Company management uses liquidity ratios to monitor the effectiveness of working capital management and to identify potential liquidity issues early. By tracking these ratios, management can make informed decisions on inventory management, accounts receivable collection, and accounts payable policies to improve the company's financial health. Although liquidity ratios are essential financial tools, they have certain limitations: Differences in accounting policies and reporting standards across companies and industries can lead to inconsistencies in liquidity ratios, making comparisons difficult. Liquidity ratios focus on short-term financial health and may not provide a comprehensive view of a company's overall financial condition. Liquidity ratios can be manipulated through financial engineering, resulting in misleading outcomes that may not reflect the actual financial health of a company. Liquidity ratios are essential tools in financial analysis, as they provide valuable insights into a company's ability to meet its short-term obligations. Although they have some limitations, these ratios remain critical in credit analysis, investment decisions, and management evaluation. To obtain a comprehensive understanding of a company's financial health, it is crucial to use liquidity ratios in conjunction with other financial metrics and consider factors such as industry standards, business cycles, and company size and structure when interpreting the results. In order to gain a deeper understanding of liquidity ratios and their implications on your investments, consider consulting with a financial advisor for expert guidance.What Are Liquidity Ratios?

Types of Liquidity Ratios

Current Ratio

Quick Ratio

Cash Ratio

Operating Cash Flow Ratio

Factors Affecting Liquidity Ratios

Industry Standards

Business Cycle

Company Size and Structure

Applications of Liquidity Ratios

Credit Analysis

Investment Decisions

Management Evaluation

Limitations of Liquidity Ratios

Variability in Reporting Standards

Inability to Capture Full Financial Picture

Potential for Misleading Results

Conclusion

Liquidity Ratio FAQs

Liquidity ratios measure a company's ability to meet its short-term obligations using its assets. They are essential in financial analysis for assessing a company's financial health, solvency, and creditworthiness.

The four main types of liquidity ratios are the current ratio, quick ratio (acid-test ratio), cash ratio, and operating cash flow ratio. Each ratio provides a different perspective on a company's liquidity position.

Industry standards and business cycles can impact liquidity ratios as different industries have varying liquidity requirements, and companies may have fluctuating cash flow and working capital needs during different stages of the business cycle.

Limitations of liquidity ratios include variability in reporting standards, inability to capture the full financial picture, and potential for misleading results due to financial engineering.

Liquidity ratios help investors evaluate a company's financial stability before investing, and creditors assess a company's ability to repay debt, determining the credit risk associated with lending money to the company.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.