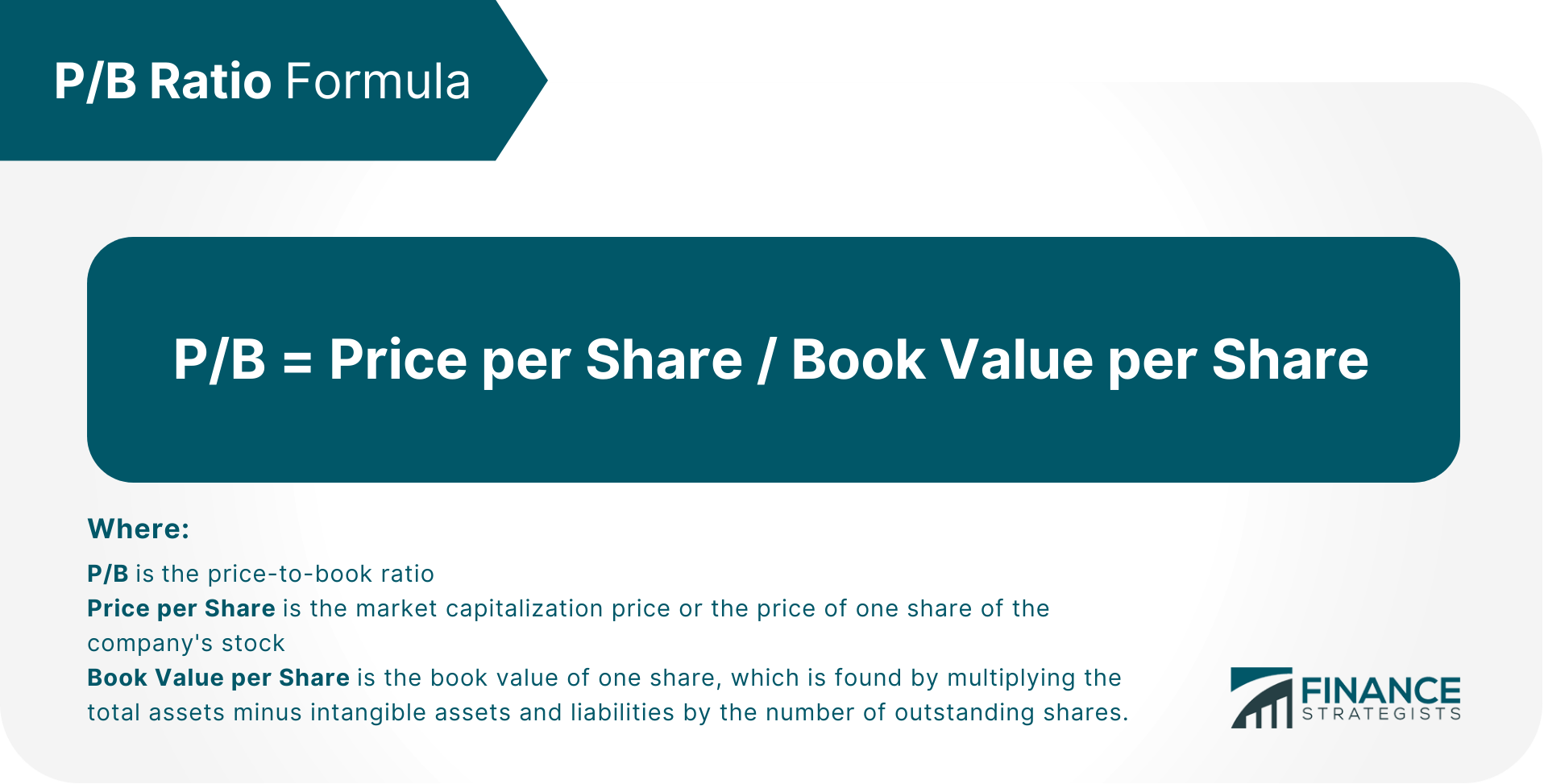

The price to book ratio is a valuation metric that compares a company's share price to its book value. It is used to determine whether a company is undervalued or overvalued. This is done by multiplying the market capitalization price by the number of outstanding shares in order to get the value of equity, and then dividing it by the book value. The result is that price-to-book can be used to compare companies in a similar line of business or industry. For example, if Company A has a higher P/B ratio than Company B, you could assume that Company A's stock price is too high relative to the underlying value of its assets. A good price-to-book ratio varies depending on the industry. In general, a ratio below 1 means that a stock is undervalued or that its share price is below the value of the company's net assets. A ratio between 1 and 2 is considered average, and a ratio above 2 might mean that the stock is overvalued. The price-to-book ratio is used to determine whether a company's stock is undervalued or overvalued. It is often used in conjunction with the P/E ratio. It can be an important indicator of how expensive or cheap a stock may be relative to its peers, which allows investors to get an idea of the current market climate. It can also guide investors in determining whether a company's current stock price is reasonable compared to its growth prospects. Additionally, it can be used as a general indicator of value when considering companies in an industry or sector with similar characteristics. If the ratio shows that the market price is overvalued, it could indicate that it may decline soon and be a good time to sell. On the other hand, if the market price is undervalued, it may be a good time to buy. However, it is important to remember that P/B ratios can vary greatly from company to company and should not be used in isolation. The price-to-book ratio is often categorized as a high or low number depending on the industry and company. Generally, investors look for companies with ratios below one when they are undervalued. A ratio between 1 and 2 is considered average and may indicate that the stock is fairly priced. Any P/B ratio above two means the stock is overvalued. It is important to note that these values can vary greatly from company to company, and ratios should not be used in isolation. Additionally, a low P/B ratio is not always a good thing. It could mean that the company has been through hard times and its assets are worth less than their original value. Alternatively, it could be a sign of future problems if the company is not generating enough revenue to cover its expenses. The price-to-book ratio is calculated by dividing the share price by book value. The book value is defined as the company's total assets minus intangible assets and liabilities. The formula looks like this: To illustrate how the price-to-book ratio works, let's use examples. Company A has 5 million outstanding shares of stock, with total assets worth $2 billion. The company has no intangible assets or liabilities. If the price per share were at $10, the book value per share would be $10 * 5 million = $50 per share. Therefore, its P/B ratio is 10 ($10 market price / $50 book value). Company B also has 5 million outstanding shares of stock, but its total assets are only worth $1 billion. If the price per share were at $20, the book value per share would be $20 * 5 million = $100 per share. Therefore, its P/B ratio is 2 ($20 market price / $100 book value). As you can see, the price-to-book ratio gives a much different value for Company A and B. Company A has a higher stock price but also a higher book value, which means its assets are worth more. Company B has a lower stock price but also a lower book value, which means its assets are worth less. When used in conjunction with other ratios, the price-to-book ratio can give a more complete picture of a company's valuation. The price-to-book ratio is a simple ratio used by investors to determine the value of a company's stock. It is calculated by dividing the share price by book value, which gives a good idea of how much the market values each dollar earned by a company. While it can be an important tool in determining whether a stock is undervalued or overvalued, it should not be used in isolation. Investors should also look at other factors, such as the company's history and growth prospects, to get a more complete picture. Importance of P/B Ratio

What Is Considered a Good Price-To-Book Ratio?

Calculating P/B Ratio

P/B Ratio in Action

Example 1

Example 2

Comparison of the Two Examples

The Bottom Line

Price-To-Book Ratio FAQs

A Price-To-Book Ratio (P/B) is an indicator of a company's worth calculated by dividing its stock price per share by its book value per share.

To calculate P/B, divide the stock price by the book value. The resulting figure is an indicator of a company’s worth.

A higher P/B ratio indicates that the market perceives a company's assets and earnings to be of a higher value than its book value.

A lower P/B ratio indicates that the market perceives a company's assets and earnings to be of a lower value than its book value.

The P/B ratio is important for investors in understanding the value of a company relative to its book value. It is also useful for comparing companies and industries in order to identify undervalued or overvalued opportunities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.