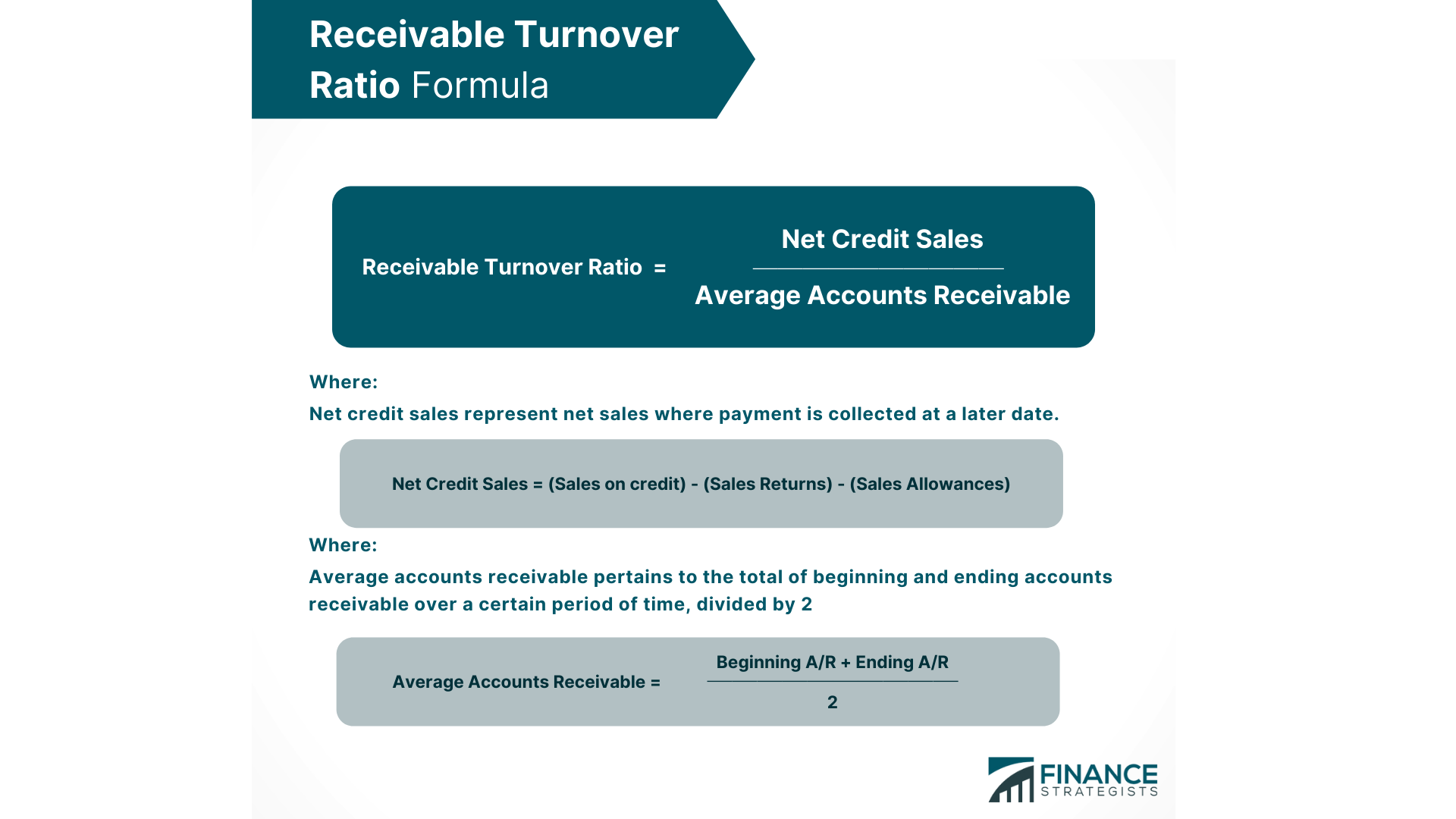

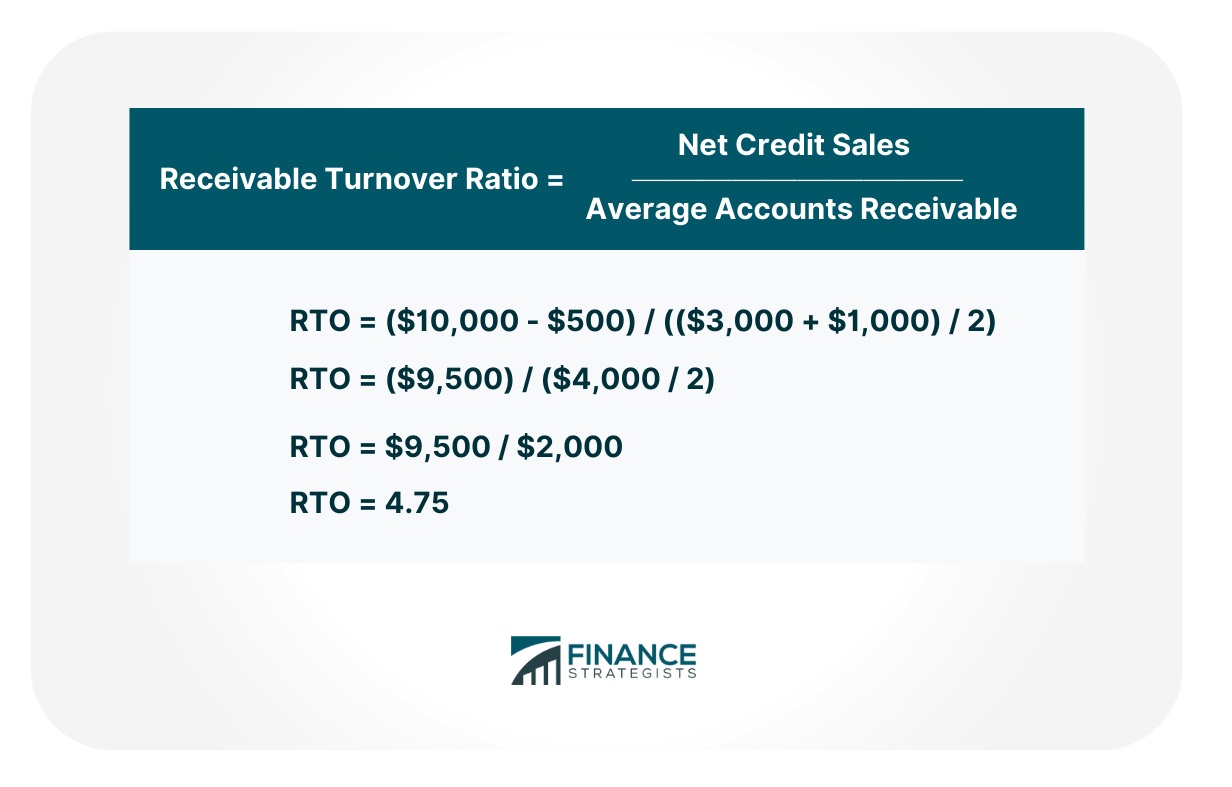

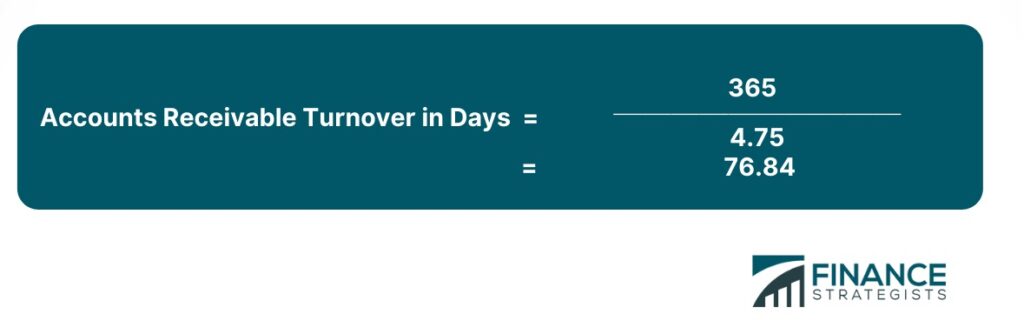

The receivable turnover ratio, otherwise known as the debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. The ratio shows how many times during the period, sales were collected by a business. The receivable turnover ratio is used to measure the financial performance and efficiency of accounts receivables management. This metric helps companies assess their credit policy as well as its process for collecting debts from customers. The higher this number, the better it is because that means a faster collection of accounts receivables. To calculate the receivable turnover ratio, use this formula: Tara’s Vision, Inc. is a shop that sells various kinds of eyewear. Because of decreasing sales, Tara decided to extend credit sales to all her customers. In the fiscal year ending December 31, 2020, the shop recorded gross credit sales of $10,000 and returns amounting to $500. Beginning and ending accounts receivable for the same year were $3,000 and $1,000, respectively. Find out the receivable turnover ratio for the fiscal year 2020. Therefore, Tara’s Vision, Inc. collected its accounts receivable approximately 4.75 times over the year 2020. The number of days it takes for a customer to pay its purchases from a company on credit is called “accounts receivable turnover in days.” Its formula is as follows: To use the sample illustration above from Tara’s Vision, Inc., its accounts receivable turnover in days would be: Hence, its customers take roughly about 77 days to pay for their credit purchases to Tara’s Vision, Inc. As mentioned before, this financial metric shows how quickly a company collects its outstanding accounts receivables and it also indicates whether or not a company has been experiencing difficulty in collecting money from its customers. Since it also helps companies assess their credit policy and process for collecting debts, this metric is often used by financial analysts or investors to measure the liquidity of a certain business. Now that we have understood its importance, here are a few tips for businesses to tap in order to increase the receivable turnover ratio. This is the most common and vital step towards increasing the receivable turnover ratio. Once you know how old your outstanding invoices are, you can work on it accordingly to increase revenue from them or also make a note of those who haven't paid yet for further follow-ups. A strong relationship with your clients will help you understand their needs and demands, which might result in extending the credit period. This way it's convenient for them to pay on time as well as build a healthy business rapport between both parties resulting in an increased receivable turnover ratio. This is something that you need to keep in mind before making any further changes. Once the credit period has been approved for your clients, make sure it's fixed at a certain time interval and not changed on each occasion of late payment or default by them resulting in an increased receivable turnover ratio. If you have some efficient clients who are always on time with their payments, reward them by offering some discounts which will help attract more business without affecting your receivable turnover ratio. This is a great way to increase this ratio as it motivates the clientele of yours to pay faster and be punctual for all future transactions resulting in increased revenue generation. Once you have fixed the credit period for your clients make sure to follow up on them regularly until they pay their dues. This way you will decrease the number of outstanding invoices in your books resulting in an increased receivable turnover ratio. If these tips are followed religiously, it's certain that businesses can tap on improved revenue generation with a reduced level of receivables in their books resulting in increased profit margins. As can be seen from the receivable turnover ratio formula, this financial metric has quite a simple equation. The higher the number of days it takes for customers to pay their bills results in a lower receivable turnover ratio. However, this should not discourage businesses as there are several ways to increase the receivable turnover ratio that will eventually help them improve revenue generation. This way, businesses will have more capital at disposal which can then be used for other purposes like expansion or even debt repayment if necessary without affecting business operations. How to Calculate Receivable Turnover Ratio

Illustration

Accounts Receivable Turnover in Days

The Importance of Receivable Turnover Ratio

Tips to Increase Receivable Turnover Ratio

Create an Accounts Receivable Aging Report

Build Strong Client Relationships

Fix the Credit Policy

Reward Efficient Payments

Follow Up Regularly

The Bottom Line

Receivable Turnover Ratio FAQs

The receivable turnover ratio, otherwise known as debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. The ratio shows how many times during the period, sales were collected by a business.

To compute receivable turnover ratio, net credit sales is divided by the average accounts receivable.

To calculate net credit sales, simply deduct sales returns and allowances from total credit sales. To calculate average accounts receivable, simply find the total of beginning and ending accounts receivable for a certain period and divide it by 2.

Accounts receivable turnover in days refers to the number of days it takes for a customer to pay its purchases from a company on credit.

To calculate the receivable turnover in days, simply divide 365 by the accounts receivable turnover ratio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.