Collateralized Debt Obligations are complex financial instruments that have gained significant attention in the global financial markets. A CDO is a type of structured asset-backed security (ABS) that pools together a portfolio of fixed-income assets, such as bonds, mortgages, or loans, and then issues tranches of securities to investors. These tranches have varying degrees of risk and return, depending on the credit quality of the underlying assets and the priority of payment. CDOs play a crucial role in the financial markets by allowing banks and other financial institutions to transfer credit risk to investors. They also provide investors with opportunities to gain exposure to a diversified pool of assets and earn potentially higher returns than traditional fixed-income investments. However, as witnessed during the 2008 financial crisis, CDOs can pose significant financial stability risks if they are not properly understood and managed. High-grade CDOs are cash-flow CDOs primarily investing in investment-grade assets, such as highly rated corporate bonds or asset-backed securities. These CDOs are considered relatively lower risk than other types of CDOs, as the underlying assets have a lower probability of default. Mezzanine CDOs are cash-flow CDOs that invest in a mix of investment-grade and below-investment-grade assets. These CDOs typically offer higher returns than high-grade CDOs but also entail higher risks due to the lower credit quality of some of the underlying assets. Fully synthetic CDOs do not directly own the underlying assets but instead gain exposure to the credit risk of these assets through the use of credit derivatives, such as credit default swaps (CDS). Investors in a fully synthetic CDO effectively take on the credit risk of a reference portfolio of assets in exchange for receiving periodic payments from the CDO issuer. Hybrid synthetic CDOs combine cash flow and synthetic CDOs, as they invest in physical assets and credit derivatives. These CDOs expose investors to a diversified pool of credit risks while allowing for more flexibility in portfolio management. Asset-backed securities CDOs are a type of structured finance CDO that invests primarily in other asset-backed securities, such as mortgage-backed securities (MBS) or commercial mortgage-backed securities (CMBS). ABS CDOs provide investors with diversified exposure to various types of securitized assets. Collateralized loan obligations (CLOs) are structured finance CDOs that invest primarily in leveraged loans, which are loans made to companies with lower credit ratings or higher levels of debt. CLOs allow investors to gain exposure to the leveraged loan market, which can offer higher yields than traditional fixed-income investments. Senior tranches are the highest-priority tranches in a CDO and are typically assigned the highest credit ratings. They are the first to receive principal and interest payments from the underlying assets and, as a result, have the lowest risk among the tranches. Due to their lower risk, senior tranches generally offer lower yields compared to other tranches in the CDO structure. Mezzanine tranches have a lower priority than senior tranches but a higher priority than equity tranches. They receive principal and interest payments after the senior tranches and, therefore, have a higher level of risk. In exchange for taking on this additional risk, mezzanine tranches typically offer higher yields than senior tranches. Equity tranches are the lowest-priority tranches in a CDO structure and bear the highest level of risk. They receive principal and interest payments only after all other tranches have been paid. Due to their higher risk, equity tranches offer the highest potential returns among the CDO tranches. Still, they also have the highest likelihood of losses in the event of defaults in the underlying assets. The waterfall payment structure is a key feature of CDOs that dictates the order in which payments from the underlying assets are distributed among the tranches. In a typical waterfall structure, interest and principal payments from the assets flow first to the senior tranches, then to the mezzanine tranches, and finally to the equity tranches. This hierarchy helps mitigate the risk for senior and mezzanine tranche investors, who receive payments before the equity tranche investors. Credit enhancement is a technique used in CDOs to improve the credit quality of the issued tranches and reduce the risk of losses for investors. There are two primary types of credit enhancement: internal and external. Internal credit enhancement includes mechanisms such as over-collateralization, where the value of the underlying assets exceeds the value of the issued tranches, and excess spread, where the interest payments from the assets are higher than the required payments to the tranche investors. External credit enhancement involves obtaining guarantees or insurance from third parties, such as banks or monoline insurers, to cover potential losses on the underlying assets. The collapse of the subprime mortgage market in the United States largely triggered the 2008 financial crisis. Many CDOs at the time were heavily invested in subprime mortgage-backed securities, which experienced a sharp increase in default rates as housing prices began to decline. As a result, the value of these CDOs plummeted, leading to significant losses for investors and financial institutions that held these securities. One of the key factors that contributed to the proliferation of risky CDOs prior to the financial crisis was the misalignment of incentives among various market participants. Originators of subprime mortgages had little incentive to ensure the creditworthiness of borrowers, as they could quickly securitize and sell these loans to investment banks. In turn, investment banks had the incentive to create and market CDOs with these risky assets, as they generated significant fees from the process. Investors, who relied on credit ratings to assess the risk of CDOs, were often unaware of the true risks associated with these securities. Rating agencies played a significant role in the buildup of risks in the CDO market prior to the financial crisis. Many CDOs backed by subprime mortgages received high credit ratings, giving investors a false sense of security about the risks associated with these securities. The rating agencies' methodologies and assumptions for assessing the credit risk of CDOs were later criticized for being overly optimistic and failing to capture the risks associated with subprime mortgage-backed securities accurately Following the 2008 financial crisis, regulators around the world implemented various reforms to address the risks associated with CDOs and other complex financial instruments. These reforms included stricter capital requirements for banks that held CDOs, enhanced transparency and disclosure requirements for securitization transactions, and new rules for credit rating agencies to prevent conflicts of interest and improve the accuracy of credit ratings. In the post-crisis era, the CDO market has evolved in response to the new regulatory environment and changing investor preferences. New CDO structures that focus on higher-quality underlying assets, such as prime mortgages or corporate bonds, and incorporate stronger credit enhancement mechanisms to mitigate risks have emerged. Additionally, the market has seen a resurgence in CLOs, which have experienced strong demand from investors seeking higher-yielding, floating-rate investments. Despite the challenges the CDO market faces following the financial crisis, CDOs continue to play a significant role in modern finance. CDOs provide a valuable tool for banks and other financial institutions to manage their credit risk exposures and diversify their investment portfolios. Moreover, they offer investors opportunities to access a broad range of credit risks and potentially earn higher returns than traditional fixed-income investments. Investing in CDOs can offer potentially attractive returns but entail various risks, including credit, interest rate, and liquidity risks. Credit risk arises from the possibility that the underlying assets may default, leading to losses for the CDO investors. Interest rate risk stems from fluctuations in interest rates, which can affect the value of fixed-income investments, including CDOs. Liquidity risk refers to the potential difficulty in selling a CDO investment in the secondary market, particularly during periods of market stress. When considering an investment in a CDO, it is important for investors to carefully evaluate the credit quality of the underlying assets, the structure of the CDO tranches, and the credit enhancement mechanisms in place. In addition, investors should assess the track record and expertise of the CDO manager, as well as the transparency and quality of the information provided by the issuer. CDOs can play a role in a diversified investment portfolio by providing exposure to a broad range of credit risks and potentially enhancing portfolio returns. However, investors should be mindful of the risks associated with CDOs and ensure that their investment in these securities is commensurate with their risk tolerance and investment objectives. The CDO market will likely experience further developments and innovations as the global financial landscape continues evolving. These may include the emergence of new CDO structures that cater to changing investor preferences, the development of new credit enhancement techniques, or the application of advanced data analytics and artificial intelligence in CDO portfolio management. Collateralized Debt Obligations remain an important financial instrument in modern finance despite their association with the 2008 financial crisis. They continue to offer banks and other financial institutions valuable credit risk management tools and provide investors with opportunities for diversification and potential yield enhancement. With the lessons learned from the past and the ongoing evolution of CDO structures and regulations, the future of CDOs looks to be one of continued innovation and growth as long as market participants remain vigilant and proactive in managing the associated risks. If you are interested in investing in CDOs or other complex financial instruments, it is highly recommended that you seek the guidance of a qualified wealth management professional. A wealth management professional can help you assess your risk tolerance, evaluate your investment objectives, and develop a customized investment strategy that aligns with your goals. With the help of a wealth management professional, you can navigate the complexities of the financial markets and make informed investment decisions.What Are Collateralized Debt Obligations (CDOs)?

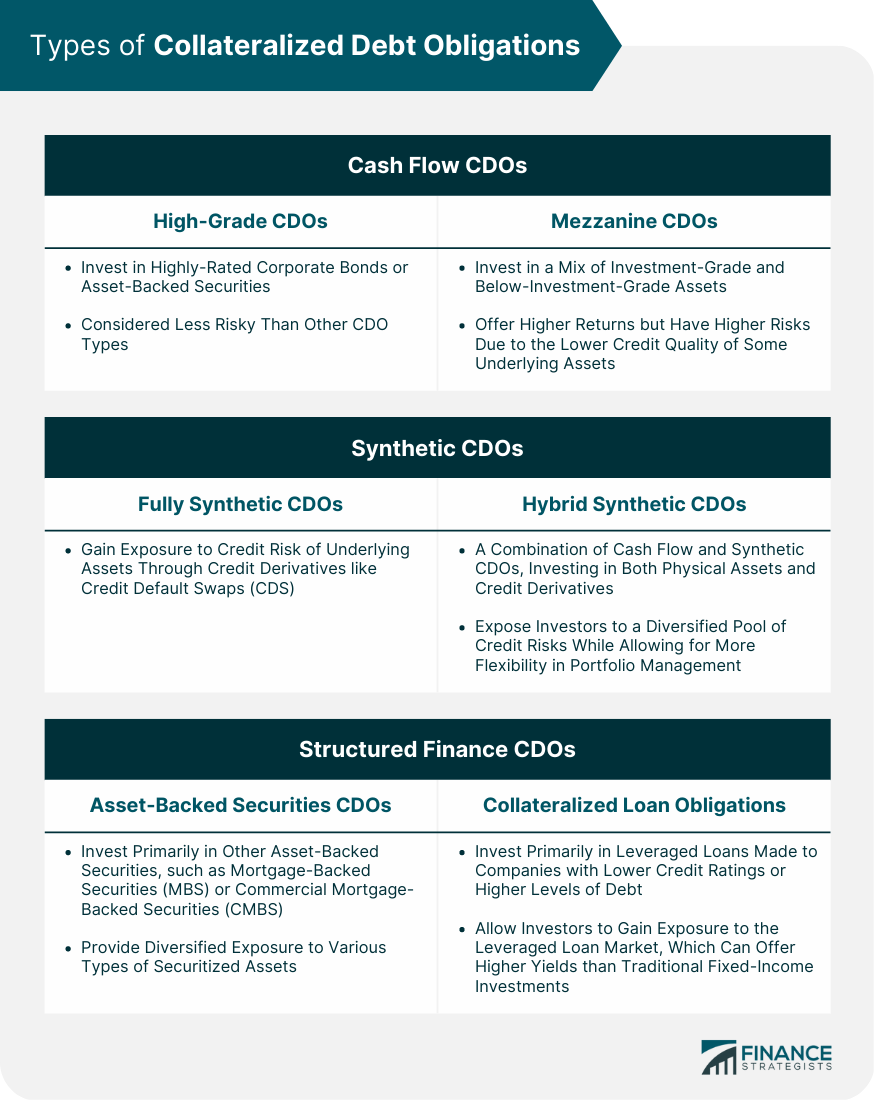

Types of Collateralized Debt Obligations

Cash Flow CDOs

High-Grade CDOs

Mezzanine CDOs

Synthetic CDOs

Fully Synthetic CDOs

Hybrid Synthetic CDOs

Structured Finance CDOs

ABS CDOs

CLOs

The Structure of Collateralized Debt Obligations

CDO Tranches

Senior Tranches

Mezzanine Tranches

Equity Tranches

Waterfall Payment Structure

Credit Enhancement

The Role of Collateralized Debt Obligations in the 2008 Financial Crisis

Subprime Mortgage Crisis and CDOs

Misaligned Incentives and Risk-Taking

Rating Agencies' Role in the Crisis

Collateralized Debt Obligations in the Post-Crisis Era

Regulatory Changes and CDOs

Evolution of CDO Structures

The Resurgence of CDOs and Their Role in Modern Finance

Investing in Collateralized Debt Obligations

Risks and Rewards of CDO Investments

Evaluating CDOs for Potential Investments

The Role of CDOs in a Diversified Portfolio

Takeaway

Collateralized Debt Obligations (CDOs) FAQs

Collateralized Debt Obligations (CDOs) are structured asset-backed securities that pool together a portfolio of fixed-income assets and issue tranches of securities to investors with varying degrees of risk and return. They play a crucial role in financial markets by allowing banks and other financial institutions to transfer credit risk to investors and providing investors with opportunities to gain exposure to a diversified pool of assets and earn potentially higher returns than traditional fixed-income investments.

There are three main types of Collateralized Debt Obligations (CDOs): Cash Flow CDOs (which include high-grade and mezzanine CDOs), Synthetic CDOs (which include fully synthetic and hybrid synthetic CDOs), and Structured Finance CDOs (which include ABS CDOs and CLOs).

CDOs issue tranches of securities with varying degrees of risk and return, depending on the credit quality of the underlying assets and the priority of payment. The tranches are typically classified as senior tranches (lowest risk), mezzanine tranches (medium risk), and equity tranches (highest risk). The waterfall payment structure dictates the order in which payments from the underlying assets are distributed among the tranches, with senior tranches receiving payments first, followed by mezzanine and equity tranches.

CDOs played a significant role in the 2008 financial crisis. Many CDOs were heavily invested in subprime mortgage-backed securities, which experienced a sharp increase in default rates as housing prices declined. The collapse in the value of these CDOs led to significant losses for investors and financial institutions that held these securities. Misaligned incentives among market participants and the role of rating agencies in assigning high credit ratings to risky CDOs also contributed to the buildup of risks in the CDO market prior to the crisis.

In the post-crisis environment, investors should carefully evaluate the credit quality of the underlying assets, the structure of the CDO tranches, and the credit enhancement mechanisms in place when considering an investment in a CDO. They should also assess the track record and expertise of the CDO manager and the transparency and quality of the information provided by the issuer. Including CDOs in a diversified investment portfolio can help mitigate risks, but investors should ensure their investment aligns with their risk tolerance and investment objectives.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.