Collateralized Loan Obligations (CLOs) are structured financing vehicles that pool together a portfolio of loans and issue debt securities to investors. The loans in a CLO are typically leveraged loans, which are loans made to companies with lower credit ratings. CLOs are complex financial instruments that are widely used in global financial markets. They have become an attractive investment for many investors due to their high yields and low default rates. CLOs are structured financing vehicles that specialized investment managers typically manage. The structure of a CLO is similar to that of a collateralized debt obligation (CDO). However, while CDOs pool together a portfolio of various types of debt securities, CLOs pool together a portfolio of leveraged loans. The structure of a CLO typically includes the following components: Special Purpose Vehicle (SPV): This legal entity was created to hold a portfolio of loans and issue debt securities to investors. Collateral Manager: The investment manager is responsible for selecting the loans that will be included in the portfolio, managing the portfolio, and making payments to investors. Rating Agencies: These are independent agencies that assign ratings to the debt securities issued by the CLO based on the credit quality of the underlying loans. Investors: These are the individuals and institutions that purchase the debt securities issued by the CLO. The various parties involved in CLOs have distinct roles and responsibilities. The collateral manager is responsible for managing the portfolio of loans and making payments to investors. The rating agencies assign ratings to the debt securities based on the credit quality of the underlying loans. The investors purchase the debt securities and receive interest payments. CLOs have several key features that make them attractive to investors. These include: Diversification: CLOs are typically structured to provide investors with exposure to a diversified portfolio of loans. High Yields: CLOs offer higher yields than fixed-income securities, such as corporate bonds or government bonds. Low Default Rates: Historically, CLOs have had lower default rates than fixed-income securities. CLOs can be broadly categorized into three types: cash flow CLOs, synthetic CLOs, and hybrid CLOs. Cash flow CLOs are the most common type of CLO. In a cash flow CLO, the cash flows generated by the portfolio of loans are used to pay interest and principal on the debt securities issued by the CLO. Synthetic CLOs are structured differently than cash flow CLOs. In a synthetic CLO, the portfolio of loans is not actually held by the CLO. Instead, the CLO enters into credit default swaps (CDS) or other derivatives contracts that provide exposure to the underlying loans. Hybrid CLOs are a combination of cash flow CLOs and synthetic CLOs. In a hybrid CLO, the cash flows generated by the portfolio of loans are used to pay interest and principal on the debt securities issued by the CLO, but the CLO also enters into derivatives contracts to provide additional exposure to the underlying loans. The market for CLOs has grown significantly in recent years, with new issuances hitting record highs. CLOs are primarily bought by institutional investors such as banks, insurance companies, and pension funds. The size of the CLO market has grown significantly in recent years. In 2022, the issuance of CLOs reached $132 billion, which was the second-highest year on record, slightly ahead of the 2018 figure. However, this amount was down by approximately 28% from the record high of $187 billion issued in 2022. The CLO market has experienced strong growth in recent years, with new issuances hitting record highs. The Securities Industry and Financial Markets Association (SIFMA) reported that the outstanding CLOs at the end of 2020 were approximately $662.3 billion. CLOs are primarily bought by institutional investors such as banks, insurance companies, and pension funds. However, there has been increased interest from retail investors in recent years with the introduction of CLO ETFs. As with any investment, CLOs come with various risks and benefits that investors need to consider. The primary risks associated with investing in CLOs include: Credit Risk: The risk that the underlying loans will default, leading to losses for investors. Interest Rate Risk: The risk that changes in interest rates will negatively impact the value of the debt securities issued by the CLO. Liquidity Risk: The risk that investors may be unable to sell their holdings in the CLO if needed. Market Risk: The risk that changes in market conditions will negatively impact the value of the debt securities issued by the CLO. The benefits of investing in CLOs include: High Yields: CLOs typically offer higher yields than other fixed-income securities. Diversification: CLOs provide investors with exposure to a diversified portfolio of loans. Low Default Rates: Historically, CLOs have had lower default rates than fixed-income securities. CLOs are subject to regulatory oversight by various agencies, including the Securities and Exchange Commission (SEC) and the Federal Reserve. The CLO market has seen several recent developments that are worth noting. The COVID-19 pandemic caused significant disruptions to the global economy and financial markets, including the CLO market. As businesses struggled to stay afloat, default rates on the underlying leveraged loans in CLO portfolios increased, leading to a drop in CLO prices. The market also experienced decreased demand for new issuances as investors became more risk-averse. However, the CLO market rebounded as the global economy began to recover and government stimulus measures were implemented. Default rates have since stabilized, and demand for new issuances has returned to pre-pandemic levels. Despite the initial impact of COVID-19 on the CLO market, it has proven to be a resilient asset class that continues to attract investors looking for high yields and diversification. There have been several recent developments in CLO technology, including using blockchain technology to streamline the issuance and settlement of CLOs. The future outlook for the CLO market is positive, with many investors continuing to see CLOs as an attractive investment option. Collateralized Loan Obligations (CLOs) are complex financial instruments that have become increasingly popular in global financial markets due to their high yields, diversification, and historically low default rates. Despite the benefits, investors must also be aware of the risks associated with investing in CLOs, such as credit, interest rate, liquidity, and market risks. The CLO market has experienced significant growth in recent years, with new issuances hitting record highs. While the future outlook for the CLO market is positive, investors should consult with a wealth management expert to determine if CLOs are suitable for their financial goals and risk tolerance. If you are interested in exploring investment opportunities in CLOs or other financial instruments, consider hiring a wealth management expert who can help you navigate the complex world of finance and make informed investment decisions.What Are Collateralized Loan Obligations (CLOs)?

Structure of Collateralized Loan Obligations (CLOs)

Overview of CLO Structure

Roles of Various Parties Involved in CLOs

Key Features of CLOs

Types of Collateralized Loan Obligations (CLOs)

Cash Flow CLOs

Synthetic CLOs

Hybrid CLOs

Market for Collateralized Loan Obligations (CLOs)

Size of the CLO market

For 2024, Bank of America estimates US CLO issuance will reach $110 billion.Growth of the CLO market

Types of Investors in the CLO Market

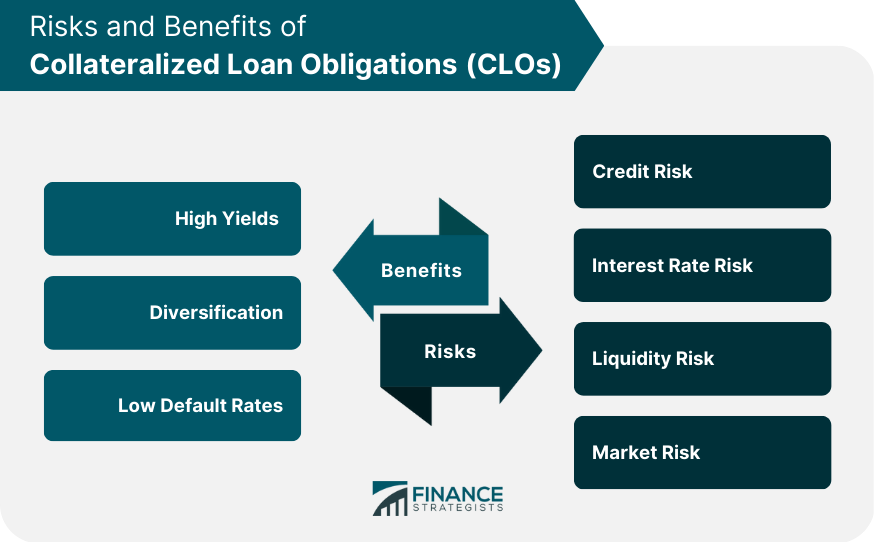

Risks and Benefits of Collateralized Loan Obligations (CLOs)

Risks Associated With Investing in CLOs

Benefits of Investing in CLOs

Regulatory Oversight of CLOs

Recent Developments in Collateralized Loan Obligations (CLOs)

Impact of COVID-19 on the CLO Market

Developments in CLO Technology

Future Outlook for the CLO Market

Takeaway

Collateralized Loan Obligations (CLOs) FAQs

CLOs are securitization structures that pool together a portfolio of loans and issue debt securities to investors. The loans in a CLO are typically leveraged loans, which are loans made to companies with lower credit ratings.

The benefits of investing in CLOs include high yields, diversification, and historically low default rates compared to other types of fixed-income securities.

The primary risks associated with investing in CLOs include credit, interest rate, liquidity, and market risks.

According to data from the Securities Industry and Financial Markets Association (SIFMA), the total outstanding amount of CLOs in the U.S. market was approximately $662.3 billion as of 2020.

Despite the impact of COVID-19, the future outlook for the CLO market is positive, with many investors continuing to see CLOs as an attractive investment option. However, investors should consult with a wealth management expert to determine if CLOs are suitable for their financial goals and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.