Commercial Mortgage-Backed Securities (CMBS) are a type of mortgage-backed security that is secured by commercial mortgages rather than residential mortgages. These commercial mortgages are loans issued to businesses to purchase or refinance commercial properties, such as office buildings, shopping centers, hotels, and multifamily housing. The mortgages are pooled together and sold to investors as securities, providing a way for lenders to free up capital and reduce risk. The CMBS market emerged in the early 1990s as an innovative solution for financing commercial real estate. The market experienced significant growth throughout the 1990s and early 2000s before facing a sharp decline during the 2008 financial crisis. In the years following the crisis, the market has gradually recovered, with new regulations and improved underwriting standards shaping its future trajectory. Commercial mortgage lenders, such as banks, insurance companies, and other financial institutions, originate loans for businesses seeking to finance commercial property purchases or refinance. These loans are typically underwritten based on the borrower's creditworthiness, the property's value, and its projected income stream. Once originated, commercial mortgages are pooled together by the lender or a financial intermediary. This pooling process helps diversify the risk associated with individual loans, combining mortgages with varying credit qualities, property types, and geographic locations. The pooled mortgages are then packaged into a trust, which issues CMBS to investors. The securities are divided into different tranches, each with a unique risk profile and return potential. This process, known as securitization, allows lenders to sell the pooled mortgages to investors, freeing up capital for further lending. Senior tranches are considered the least risky and therefore offer the lowest yields. They have the highest priority for principal and interest payments, meaning they are more likely to be paid in full, even in the event of borrower defaults. Mezzanine tranches carry a higher risk than senior tranches, as they are only paid after the senior tranches have received their principal and interest payments. This increased risk comes with the potential for higher yields. Equity tranches are the riskiest and offer the highest yields. They are the last to receive principal and interest payments, making them most susceptible to losses in the event of borrower defaults or declining property values. CMBS investments provide a source of diversification for fixed-income portfolios, as a diverse pool of commercial mortgages backs them. This diversification can help mitigate the risk associated with concentrating investments in a single asset class or sector. CMBS often offer higher yields than other types of fixed-income securities, such as government bonds or corporate bonds. This is particularly attractive to investors seeking higher returns in a low-interest-rate environment. CMBS investments typically include prepayment protection features, such as yield maintenance or defeasance clauses, which help to protect investors from the risk of early mortgage prepayments. This provides a more stable and predictable income stream for CMBS investors. The CMBS market offers a relatively high degree of liquidity compared to other fixed-income investments, such as private loans or real estate equity. This allows investors to buy and sell CMBS more easily, providing greater flexibility in managing their portfolios. One of the primary risks associated with investing in CMBS is the potential for borrower defaults on the underlying commercial mortgages. Defaults can result from various factors, such as a decline in the property's income stream or a deterioration in the borrower's financial condition. CMBS investors are also exposed to the risk of fluctuations in the value of the underlying commercial properties. Declining property values can lead to higher loan-to-value ratios and increase the likelihood of borrower defaults. As with other fixed-income investments, CMBS are subject to interest rate risk. When interest rates rise, the market value of existing CMBS can decline as investors seek higher-yielding securities. This can result in capital losses for investors who must sell their CMBS before maturity. The CMBS market can experience periods of volatility due to changes in market sentiment, credit conditions, or macroeconomic factors. This volatility can lead to fluctuations in CMBS prices and affect the overall return on investment. Investing in CMBS also involves legal and regulatory risks, such as changes in government regulations or tax laws that could impact the CMBS market or the underlying commercial mortgages. Commercial mortgage lenders, such as banks and insurance companies, originate loans for businesses seeking to finance commercial property purchases or refinance. These lenders play a crucial role in the CMBS market by providing the underlying loans that are pooled and securitized. CMBS issuers are financial intermediaries that pool commercial mortgages, package them into trusts, and issue CMBS to investors. Issuers facilitate the securitization process and are responsible for ensuring the securities' proper structuring and legal compliance. Institutional investors, such as pension funds, insurance companies, and mutual funds, are significant buyers of CMBS. These investors typically have a long-term investment horizon and are attracted to the diversification, yield, and prepayment protection offered by CMBS. Retail investors can also invest in CMBS directly or through mutual funds and exchange-traded funds (ETFs) that focus on mortgage-backed securities. Retail investors can benefit from the diversification and attractive yields offered by CMBS but should be aware of the associated risks. Rating agencies play an essential role in the CMBS market by evaluating and assigning credit ratings to the different tranches of CMBS. These ratings help investors assess each tranche's relative risk and return potential and can influence the pricing and marketability of CMBS. Servicers and trustees are responsible for the ongoing administration and management of CMBS trusts. Their duties include collecting mortgage payments, managing delinquencies and defaults, and distributing principal and interest payments to CMBS investors. The CMBS market experienced rapid growth leading up to the 2008 financial crisis, fueled by a combination of low-interest rates, aggressive lending practices, and strong investor demand for higher-yielding securities. This growth contributed to a broader expansion of credit in the commercial real estate sector, leading to inflated property values and increased leverage. The surge in CMBS issuance played a role in inflating the real estate bubble by providing easy access to financing for commercial properties, often with lax underwriting standards. As a result, many commercial properties were financed at unsustainable levels, which contributed to the eventual collapse of the market. When the real estate bubble burst, the CMBS market experienced a sharp decline, with defaults on commercial mortgages rising and the value of CMBS plummeting. This collapse contributed to the broader financial crisis by causing significant losses for investors and financial institutions, ultimately requiring government interventions and bailouts to stabilize the financial system. In response to the financial crisis, the U.S. government enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act, which introduced a range of new regulations to improve the financial system's stability and transparency. Some provisions of the Act, such as risk retention rules, directly impacted the CMBS market by requiring issuers to retain a portion of the credit risk associated with the securities they issue. Risk-retention rules were designed to better align the interests of CMBS issuers and investors by ensuring that issuers have a financial stake in the performance of the underlying mortgages. This has led to more conservative underwriting practices and improved the overall credit quality of CMBS. Following the financial crisis, underwriting standards in the CMBS market have become more stringent, with lenders focusing more on borrower creditworthiness, property cash flows, and loan-to-value ratios. This has contributed to a reduction in the overall risk profile of CMBS. The CMBS market has gradually recovered from the 2008 financial crisis, with new issuance levels increasing and credit quality improving. However, the market remains subject to ongoing macroeconomic uncertainties, regulatory changes, and potential disruptions from emerging technologies, such as online lending platforms and real estate crowdfunding. As a result, the future of the CMBS market will likely be shaped by the continued evolution and adaptation to a changing financial landscape. Commercial Mortgage-Backed Securities are a type of mortgage-backed security that provides a way for lenders to sell pooled mortgages to investors, freeing up capital for further lending. While CMBS investments offer several benefits, including diversification, attractive yields, prepayment protection, and liquidity, they also come with several risks, including credit risk in commercial mortgages, interest rate risk, market volatility, and legal and regulatory risks. The CMBS market has undergone significant changes and developments following the 2008 financial crisis, including new regulations and improved underwriting standards. As a result, the future of the CMBS market will likely be shaped by the continued evolution and adaptation to a changing financial landscape. If you are considering investing in CMBS or any other types of investment. In that case, it is crucial to work with a wealth management professional who can help you navigate the complexities of the market and make informed decisions that align with your financial goals. Contact a wealth management professional today to learn more about how they can help you achieve financial success.What Are Commercial Mortgage-Backed Securities (CMBS)?

CMBS Issuance Process

Origination of Commercial Mortgages

Pooling of Mortgages

Securitization Process

CMBS Tranches

Senior Tranches

Mezzanine Tranches

Equity Tranches

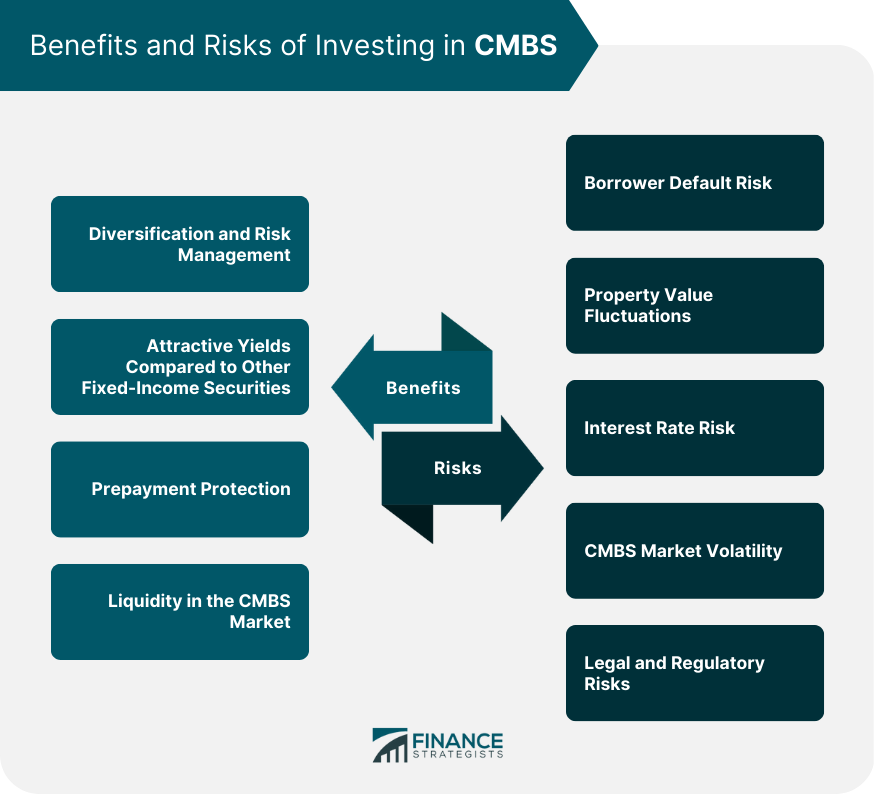

Benefits of Investing in CMBS

Diversification and Risk Management

Attractive Yields Compared to Other Fixed-Income Securities

Prepayment Protection

Liquidity in the CMBS Market

Risks Associated With CMBS Investments

Borrower Default Risk

Property Value Fluctuations

Interest Rate Risk

CMBS Market Volatility

Legal and Regulatory Risks

CMBS Market Participants and Their Roles

Commercial Mortgage Lenders

CMBS Issuers

CMBS Investors

Institutional Investors

Retail Investors

Rating Agencies

Servicers and Trustees

The Role of CMBS in the 2008 Financial Crisis

Growth of the CMBS Market Pre-Crisis

Impact of CMBS on the Real Estate Bubble

CMBS Market Collapse and Its Effects on the Global Economy

Post-Crisis CMBS Market Developments and Regulations

New Regulations Impacting CMBS Issuance

Dodd-Frank Wall Street Reform and Consumer Protection Act

Risk Retention Rules

Evolution of Underwriting Standards in the CMBS Market

Current State of the CMBS Market and Future Outlook

Takeaway

Commercial Mortgage-Backed Securities (CMBS) FAQs

Commercial Mortgage-Backed Securities (CMBS) are a type of mortgage-backed security that is secured by commercial mortgages, such as loans issued to businesses for the purchase or refinancing of commercial properties like office buildings, shopping centers, hotels, and multifamily housing.

CMBS provide diversification for investors by pooling together a diverse group of commercial mortgages with varying credit qualities, property types, and geographic locations. This diversification helps mitigate the risks associated with concentrating investments in a single asset class or sector.

The primary risks associated with investing in CMBS include borrower default risk, property value fluctuations, interest rate risk, market volatility, and legal and regulatory risks. Investors should carefully assess these risks before investing in CMBS.

The CMBS market contributed to the 2008 financial crisis by providing easy access to financing for commercial properties, often with lax underwriting standards, which led to inflated property values and increased leverage. When the real estate bubble burst, the CMBS market experienced a sharp decline, causing significant losses for investors and financial institutions.

Post-crisis regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act and risk retention rules, have impacted the CMBS market by requiring issuers to retain a portion of the credit risk associated with the securities they issue, leading to more conservative underwriting practices and improved overall credit quality of CMBS.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.