Commodity Market Hours Overview

Commodity market hours refer to the specific times during which commodities can be bought and sold on various exchanges around the world. The exact hours vary depending on the exchange and the commodity in question.

For instance, in the U.S., the Chicago Mercantile Exchange (CME) and the New York Mercantile Exchange (NYMEX) have different operating hours for various commodities.

Similarly, other key global markets like the LME in Europe and the Shanghai Futures Exchange (SHFE) in Asia have their specific trading hours.

Understanding these hours is essential for traders as they influence market volatility, commodity prices, and trading strategies.

Additionally, the advent of electronic trading platforms has enabled almost 24/7 trading in some markets, further emphasizing the need for traders to stay aware of commodity market hours.

Global Commodity Markets and Trading Hours

Commodity markets are spread across the globe, each having specific operating hours. These hours are critical as they impact global commodity prices and trading strategies.

United States Commodity Market Hours

In the United States, the primary commodity markets are the Chicago Mercantile Exchange and the New York Mercantile Exchange. Both have different operating hours for floor trading and electronic trading.

For example, the CME's open outcry trading hours for agricultural commodities are usually from 8:30 AM to 1:20 PM Central Time, while electronic trading runs nearly 24 hours from Sunday to Friday.

Europe Commodity Market Hours

In Europe, key commodity markets include the LME and Euronext. The LME provides for trading of metal commodities, with the main trading session operating between 11:40 AM and 5:00 PM local time.

Euronext, trading a variety of commodities, typically operates between 8:00 AM and 6:30 PM Central European Time.

Asia Commodity Market Hours

Asia's prominent commodity markets include the SHFE and the Tokyo Commodity Exchange (TOCOM).

The SHFE typically operates from 9:00 AM to 11:30 AM and 1:30 PM to 3:00 PM China Standard Time, with an additional night session. TOCOM operates from 9:00 AM to 3:30 PM Japan Standard Time with some additional trading periods.

However, please note that these hours may be subject to change due to factors such as daylight saving time, holidays, or market disruptions.

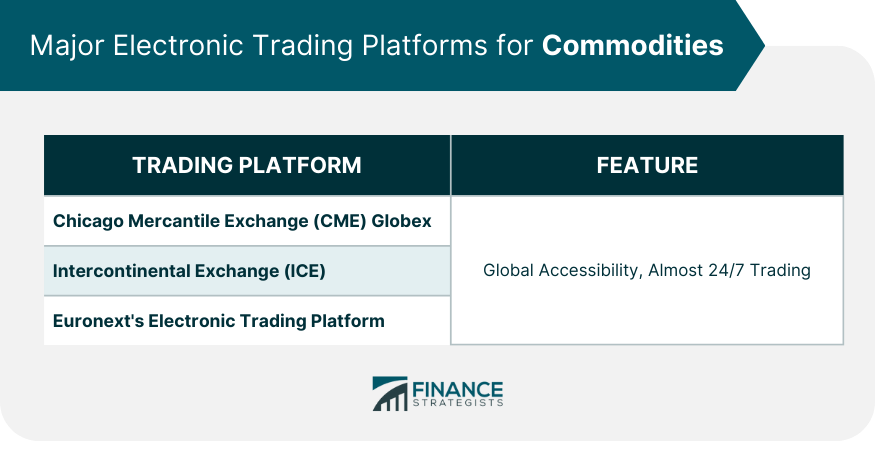

Major Electronic Trading Platforms for Commodities

CME Globex

The electronic trading platform of the CME is one of the most significant platforms for commodities.

It offers around-the-clock trading, thereby ensuring that commodity prices can react almost immediately to geopolitical events or economic data releases, regardless of traditional market hours.

The platform facilitates the trade of a broad range of assets, including commodities such as metals, agricultural products, and energy resources.

Intercontinental Exchange (ICE)

Another major player in the electronic trading arena. ICE provides a robust platform for trading commodity futures and options, and it encompasses a wide range of commodities like energy, agricultural goods, and metals.

The platform's global accessibility and extensive operating hours allow traders to respond promptly to changes in the commodity markets.

Euronext's Electronic Trading Platform

Operates one of Europe's leading commodity trading platforms. It offers a wide array of commodities for trade, including agricultural goods and metals.

The platform provides advanced trading tools, extended trading hours, and a vast network of traders and brokers, making it a top choice for commodity traders in Europe and around the world.

Pros of Electronic Trading

Accessibility and Flexibility

One of the primary advantages of electronic trading is global accessibility. Traders can participate in the markets from anywhere in the world, given they have an internet connection.

Furthermore, electronic trading often allows for almost 24/7 trading, offering flexibility to trade outside traditional market hours.

Speed of Execution

Electronic trading platforms offer near-instant execution of trades, reducing the lag between order placement and execution. This speed is crucial in fast-paced markets where prices can change rapidly.

Immediate Reaction to Global Events

In today's interconnected world, events across the globe can impact financial markets. Electronic trading enables traders to react almost immediately to these events, capitalizing on potential opportunities.

Cons of Electronic Trading

Risk of Overtrading

The convenience and ease of access that electronic trading provides can lead to overtrading, a scenario where traders execute more trades than necessary, often driven by emotions rather than rational investment strategies. This behavior can increase transaction costs and potential losses.

Technical Glitches

While technology can streamline processes, it can also present challenges. Technical glitches, internet connectivity issues, or platform downtimes can disrupt trading activities. These disruptions can lead to missed opportunities or unexpected losses.

Impersonal Nature of Trading

Electronic trading eliminates human interaction, which was a staple in traditional floor trading. This impersonal nature can make it harder for traders to gauge market sentiment or develop relationships with other traders.

Impact of Market Hours on Commodity Trading

Market hours significantly affect commodity trading, influencing market volatility and commodity prices and presenting implications for traders in different time zones.

Effect of Trading Hours on Market Volatility

Market hours can greatly influence market volatility. Typically, market opening and closing times experience higher volatility due to increased trading activity. Traders need to be cautious during these periods, as price movements can be erratic and unpredictable.

Impact of Global Market Hours on Commodity Prices

Global market hours affect commodity prices. When a major market opens or closes, it can lead to significant price movements due to shifts in supply and demand.

For instance, if a major news event occurs when the U.S. market is closed, it could result in significant price movements when the market opens.

Implications for Traders in Different Time Zones

Traders in different time zones need to consider the operating hours of various global commodity markets. Those trading commodities listed on foreign exchanges must adjust their schedules to align with those markets' operating hours.

This requirement can present challenges due to time zone differences but also opportunities to trade in markets when others are closed.

Trading Strategies Based on Commodity Market Hours

Understanding commodity market hours can help traders develop effective trading strategies, identify opportunities, and manage risks associated with different trading sessions.

Develop Trading Strategies

Trading strategies need to account for commodity market hours. Some strategies might work better at the opening of the market, while others might perform well during the market's closing.

Day trading strategies, for instance, require the trader to complete all transactions within the market hours of a single trading day.

Opportunities and Risks in Different Trading Sessions

Different trading sessions offer distinct opportunities and risks. For example, the market's opening hours often see a rush of activity, potentially offering lucrative opportunities.

However, this period can also be risky due to the high volatility. Similarly, overnight trading can provide opportunities when significant news events occur, but it can also pose risks due to lower liquidity.

Overnight Trading in Commodity Markets

Overnight trading refers to trades that are placed after an exchange's official operating hours. With the advent of electronic trading platforms, traders can now execute trades almost 24/7 in some markets.

However, overnight trading can be risky due to less trading activity and higher volatility.

Role in Commodity Markets

Electronic trading platforms have revolutionized commodity markets, extending trading hours and bringing greater accessibility and speed to commodity trading.

Impact on Commodity Market Hours

Electronic trading platforms allow for extended hours, often enabling nearly 24-hour trading. This extended access means that commodity prices can react almost immediately to geopolitical events or economic data releases, regardless of traditional market hours.

Major Electronic Trading Platforms

Some major electronic trading platforms for commodities include CME Globex, Intercontinental Exchange (ICE), and Euronext's electronic trading platform. These platforms provide global accessibility, allowing traders to participate in commodity markets from anywhere in the world.

Pros and Cons of Electronic Trading

While electronic trading brings convenience and extended market hours, it also comes with drawbacks. Pros include accessibility, speed of execution, and the ability to react quickly to global events.

However, the downsides include the risk of overtrading due to easy access, technical glitches, and the impersonal nature of trading without human interaction.

Regulatory Considerations Regarding Commodity Market Hours

Commodity market hours are also influenced by regulations imposed by governing bodies. Traders need to stay updated with these regulations to navigate the markets effectively.

Role of Regulatory Bodies

Regulatory bodies like the Commodity Futures Trading Commission (CFTC) in the U.S., the Financial Conduct Authority (FCA) in the U.K., and the Securities and Exchange Board of India (SEBI) set rules and regulations for commodity markets, including trading hours.

Regulations Pertaining to Commodity Market Hours

Regulatory bodies define trading hours to ensure orderly trading and protect market participants. These trading hours can be changed due to various factors, such as market conditions, technological advancements, and regulatory developments.

Impact of Regulatory Changes

Regulatory changes can significantly impact commodity market hours and trading strategies. For example, in response to the growing popularity of electronic trading, regulators have extended trading hours, allowing for more trading opportunities.

However, these changes can also increase the risk for traders due to potential increased volatility during extended hours.

Conclusion

Understanding the dynamics of commodity market hours is vital for traders across the globe. With these markets operating in different time zones, strategies need to account for changes in volatility, commodity prices, and unique opportunities that each trading session presents.

Electronic trading platforms have revolutionized these markets, providing nearly 24/7 accessibility and instant reaction to global events. However, these platforms also introduce risks like overtrading and technical issues.

Regulatory bodies play a crucial role in defining market hours and implementing changes based on market conditions and technological advancements.

Comprehending these elements enables traders to navigate the commodity markets more efficiently, manage risks, and seize trading opportunities regardless of their geographical location.

Commodity Market Hours FAQs

Commodity market hours refer to the operating hours during which commodities can be traded on different exchanges worldwide. The exact hours depend on the specific exchange and the commodity being traded.

Commodity market hours can significantly influence trading, affecting market volatility, commodity prices, and the trading strategies used by traders. The opening and closing of markets often see increased activity and volatility, while overnight trading may present unique opportunities and risks.

Electronic trading platforms have greatly extended commodity market hours. Some markets now operate nearly 24/7, allowing traders to respond to global events and economic data releases almost immediately, irrespective of traditional market hours.

Regulatory bodies like the Commodity Futures Trading Commission (CFTC) in the U.S., the Financial Conduct Authority (FCA) in the U.K., and the Securities and Exchange Board of India (SEBI) set the rules and regulations for commodity markets, including defining trading hours. These hours can be adjusted based on various factors, such as market conditions and technological advancements.

Different commodity market hours present various opportunities and risks. Market opening hours, for instance, typically see a surge in trading activity, offering potentially lucrative opportunities but also increased risk due to high volatility. Similarly, overnight trading can provide opportunities when significant news events occur but also comes with risks due to potentially lower liquidity and greater volatility.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.