Commodity prices are the market prices for raw materials that are traded on national and international commodity exchanges. These are often the basic building blocks of the economy, the components used to create other goods. From wheat used to make bread to crude oil refined into gasoline, commodities permeate nearly every aspect of our lives. Setting commodity prices involves a complex dance of supply and demand. Factors such as weather, geopolitical tensions, economic indicators, and even investor sentiment can cause these prices to fluctuate. The resulting cost dynamics impact industries, economies, and everyday consumers worldwide, thus making the understanding of commodity prices pivotal for various stakeholders. Energy commodities include crude oil, natural gas, heating oil, ethanol, and purified terephthalic acid. These commodities are crucial as they power our homes, fuel our vehicles, and are the backbone of many industrial processes. The prices of energy commodities fluctuate based on a variety of factors including geopolitical tensions, natural disasters, technological advancements, and changes in market dynamics. For instance, political instability in an oil-rich region may disrupt production and supply, leading to an increase in crude oil prices. On the other hand, the development of renewable energy technologies may reduce demand for traditional energy commodities, potentially leading to a decrease in their prices. Agricultural commodities include a wide array of products such as grains (wheat, corn, soybeans), dairy, fruits, vegetables, and fibers (cotton). The prices of these commodities are significantly influenced by factors such as weather patterns, pests and diseases, technological advancements, and shifts in dietary preferences. For example, an unseasonably cold spring might damage wheat crops, leading to a reduced supply and an increase in prices. Conversely, advancements in agricultural technology could boost crop yields, potentially leading to a decrease in prices. Metals and minerals are crucial for many sectors of the economy, including construction, technology, and automotive industries. This category includes commodities like gold, silver, copper, iron ore, and more. The prices of these commodities are subject to various influencing factors such as global economic health, demand from key industries, mining challenges, and geopolitical factors. For instance, during times of economic uncertainty, investors often flock to gold as a 'safe haven' investment, which can drive up its price. Conversely, a decrease in demand from a significant consumer like the construction industry could lead to a drop in the price of metals like steel. Livestock and meat commodities include cattle, hogs, and poultry. Prices for these commodities can be impacted by factors such as feed prices, weather conditions, animal diseases, and consumer demand. For example, an outbreak of a disease like bird flu could lead to a decrease in poultry supply, resulting in higher prices. On the other hand, shifts in consumer dietary preferences towards plant-based foods could decrease demand for meat, leading to lower prices. Supply and demand dynamics play a crucial role in determining commodity prices. If demand exceeds supply, prices rise, while if supply surpasses demand, prices drop. Various factors influence these dynamics, including weather, natural disasters, technology, and consumer preferences. For example, unfavorable weather conditions might damage crops, leading to a shortage in supply and a rise in prices. On the demand side, if a new technology reduces the need for a particular commodity, its price could drop. Geopolitical events, such as conflicts, political instability, policy changes, and trade disputes, can impact commodity prices. These events can disrupt the supply chain, affect demand, or change market sentiment. For instance, conflicts in oil-producing regions can disrupt oil production, leading to supply shortages and increased prices. On the other hand, trade disputes might lead to reduced demand for certain commodities, pushing their prices down. Economic indicators, including GDP growth rates, employment levels, and interest rates, can significantly influence commodity prices. High GDP growth rates may lead to increased demand for commodities, pushing prices up. Conversely, low GDP growth rates may cause a drop in demand, resulting in lower prices. Furthermore, employment levels affect consumers' purchasing power. High employment rates often lead to increased demand for goods, which can push commodity prices up. Conversely, high unemployment rates can reduce demand for goods, leading to lower commodity prices. Currency fluctuations can also impact commodity prices. Commodities are often priced in U.S. dollars on international markets. When the dollar is strong, commodities become more expensive for buyers using other currencies, which can reduce demand and lead to lower prices. On the contrary, when the dollar weakens, commodities become cheaper for buyers using other currencies. This can increase demand and lead to higher commodity prices. These include fundamental analysis, which considers factors such as supply and demand dynamics, and technical analysis, which looks at past price trends and patterns. In addition, econometric models that incorporate macroeconomic variables, and machine learning algorithms that can process large datasets to find hidden patterns and relationships, are also used. Expert analysis and predictions also play a significant role in commodity price forecasting. Analysts with deep industry knowledge provide insights into how various factors might impact commodity prices. These insights can help investors, policymakers, and businesses make informed decisions. However, despite their expertise, these predictions are not always accurate due to the inherent uncertainty and complexity of commodity markets. Commodity price fluctuations have direct and indirect impacts on consumers. An increase in commodity prices often translates into higher prices for goods and services, leading to an increase in living costs. For example, a rise in the price of crude oil can lead to higher gasoline prices, making it more expensive to fuel vehicles. Similarly, an increase in the price of wheat can lead to higher bread prices, raising grocery bills for consumers. For producers, commodity price fluctuations can impact revenues, costs, and profitability. An increase in commodity prices can lead to higher revenues for producers of these commodities. However, for producers who use these commodities as inputs, higher prices can increase production costs and squeeze profit margins. For instance, when the price of corn increases, it can benefit corn farmers but can hurt ethanol producers, who use corn as a raw material. Commodity prices have a significant influence on inflation and interest rates. An increase in commodity prices can lead to higher inflation as the cost of goods and services rise. Central banks often respond to higher inflation by raising interest rates to curb excessive price growth. On the other hand, a decrease in commodity prices can lead to lower inflation or even deflation. In response to lower inflation, central banks may lower interest rates to stimulate economic activity. Commodity prices are market prices for raw materials traded on national and international commodity exchanges, serving as the fundamental building blocks of the economy. They encompass a diverse range of products, from energy commodities like crude oil and natural gas to agricultural products like wheat and soybeans, as well as metals like gold and copper. Livestock and meat, including cattle, hogs, and poultry, also form part of the commodity market. The determination of commodity prices involves a complex dance of supply and demand dynamics, influenced by various factors such as weather patterns, geopolitical events, economic indicators, and currency fluctuations. As such, accurate commodity price forecasting becomes crucial for stakeholders, employing analytical methods, econometric models, and expert analysis to anticipate market trends. Commodity price fluctuations impact consumers, producers' revenues and costs, and central bank decisions on inflation and interest rates. A comprehensive understanding of commodity prices becomes essential for informed decision-making and effective management of resources in a rapidly changing world.What Are Commodity Prices?

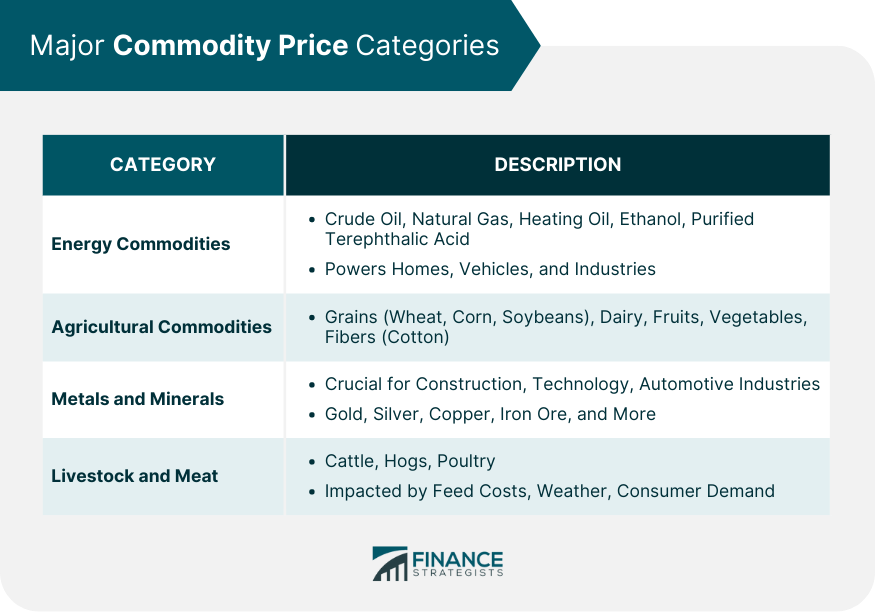

Major Commodity Price Categories

Energy Commodities

Agricultural Commodities

Metals and Minerals

Livestock and Meat

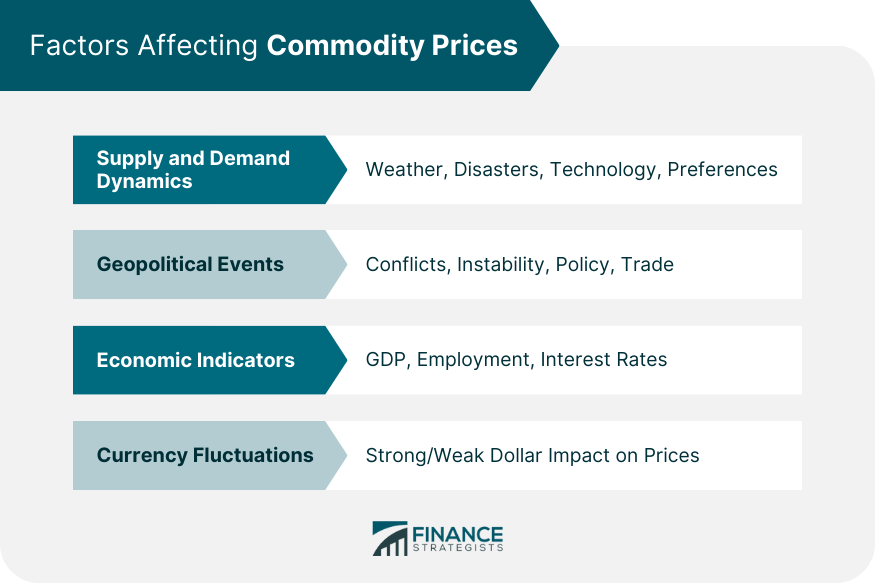

Factors Affecting Commodity Prices

Supply and Demand Dynamics

Geopolitical Events

Economic Indicators

Currency Fluctuations

Commodity Price Forecasting

Analytical Methods and Models

Expert Analysis and Predictions

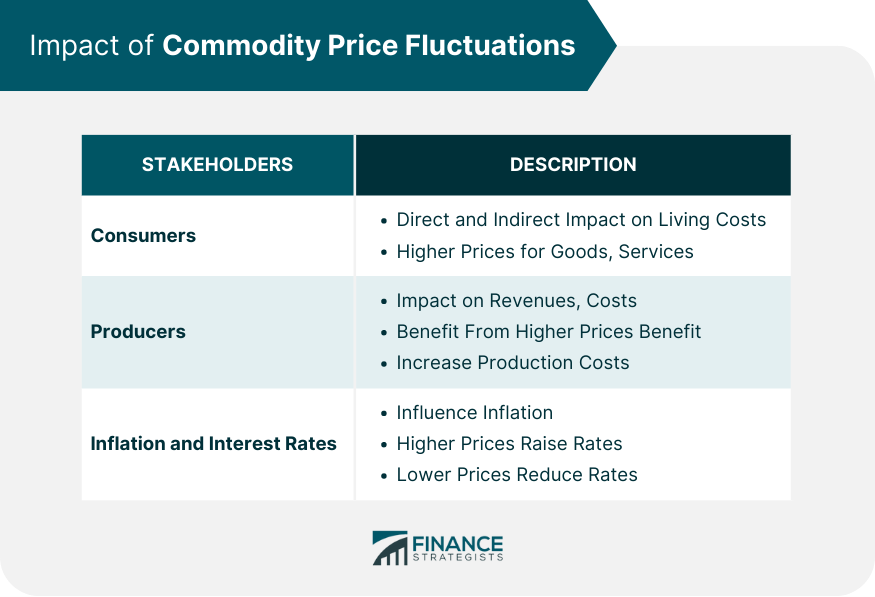

Impact of Commodity Price Fluctuations

Consumers

Producers

Inflation and Interest Rates

Conclusion

Commodity Prices FAQs

Commodity prices are the market prices for raw materials traded on national and international commodity exchanges.

Commodity prices are influenced by a range of factors including supply and demand dynamics, weather patterns, geopolitical tensions, technological advancements, and market sentiments.

Price fluctuations directly impact consumers and producers. For consumers, higher commodity prices can mean higher prices for goods and services. For producers, price increases can lead to higher revenues, but they can also increase production costs if the commodities are used as inputs.

Various methods including fundamental analysis, technical analysis, econometric models, and machine learning algorithms are used for commodity price forecasting.

Commodity prices have a significant influence on inflation and interest rates. An increase in commodity prices can lead to higher inflation, which may prompt central banks to raise interest rates. Conversely, a decrease in commodity prices can lead to lower inflation, potentially leading central banks to lower interest rates.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.