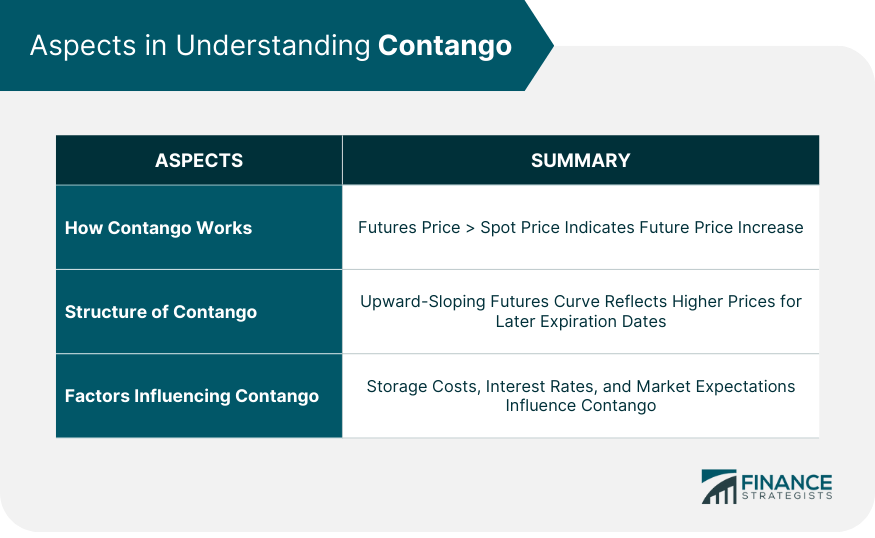

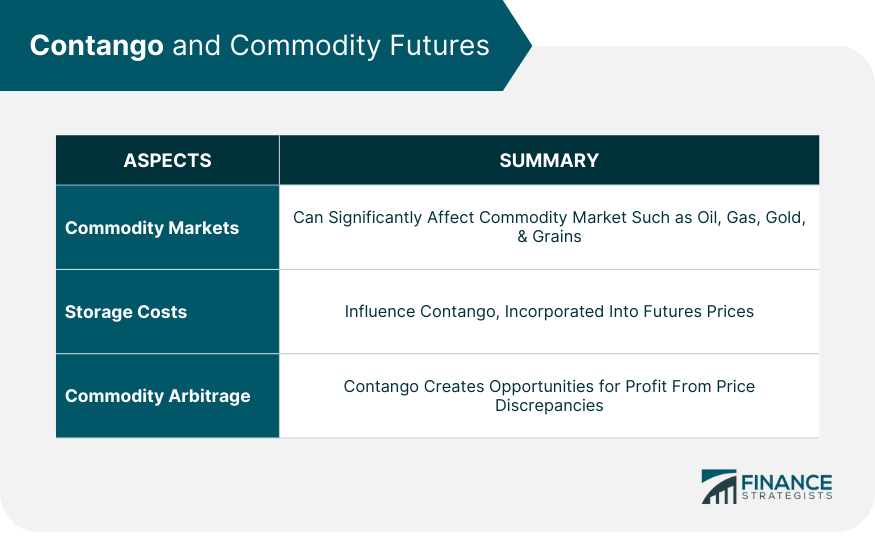

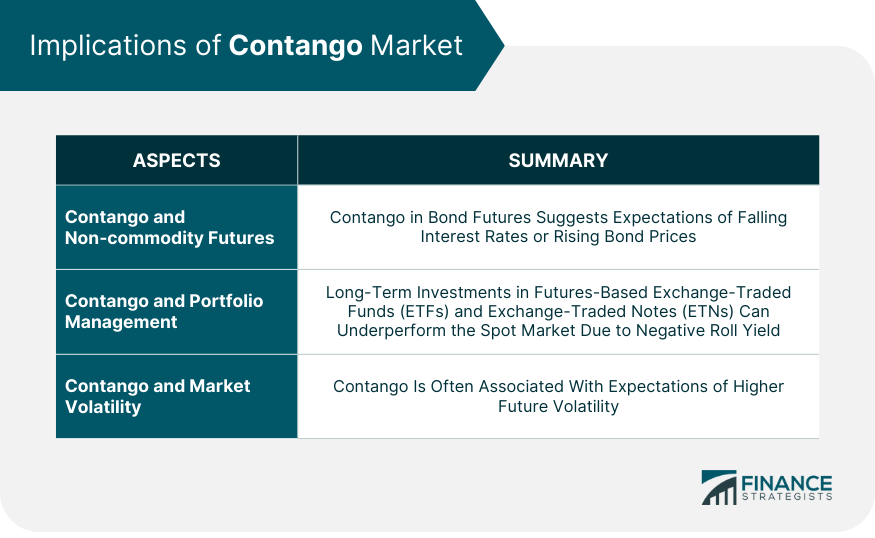

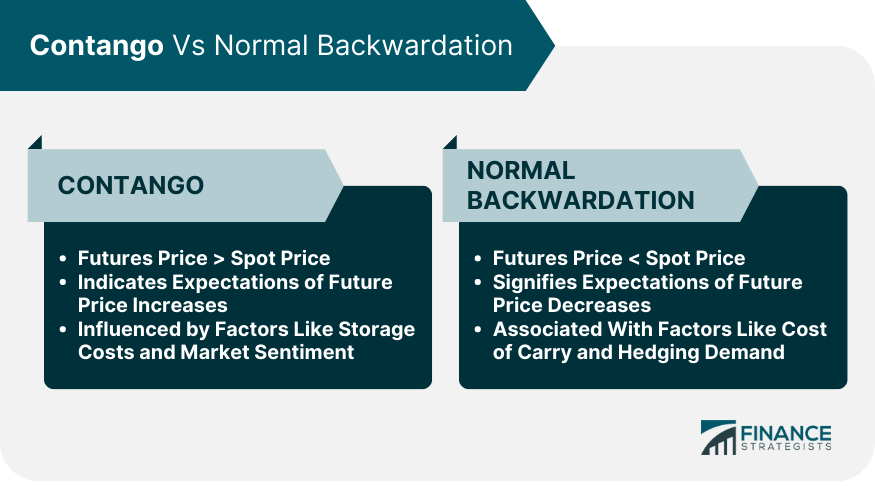

Contango is a term used in financial markets to describe a situation where the future price of a commodity or financial instrument is higher than the spot price. It occurs when there is an upward-sloping futures curve, indicating an expectation of higher prices in the future. In contango, market participants are willing to pay a premium for the convenience of buying the asset at a later date. This phenomenon is often seen in commodities markets and is influenced by factors such as storage costs, interest rates, and market supply and demand dynamics. Contango comes into play in the futures market, where buyers and sellers trade contracts for assets to be delivered at a future date. In a contango situation, the futures price of an asset is higher than the current spot price. This price structure is due to factors such as storage costs, interest charges, and market expectations about future price movements. The structure of a contango can be visualized through a futures curve, which plots the prices of futures contracts against their expiration dates. In a contango market, this curve slopes upward, indicating higher futures prices for contracts with later expiration dates. The degree of contango can vary based on market conditions and the specific asset involved. Several factors can influence the contango, including storage costs, interest rates, and market expectations. Storage costs, for example, can cause contango because the asset holder incurs costs over time, which are incorporated into the futures price. Similarly, interest rates can affect contango as higher rates increase the cost of carrying an asset, pushing futures prices up. Market expectations also play a key role: if the market anticipates a future increase in the asset's price, this expectation can result in contango. Contango can significantly affect various commodity markets, including oil, gas, gold, and grains. For instance, in the oil market, contango can occur when the market expects future oil prices to rise, potentially due to anticipated geopolitical events, changes in production levels, or shifts in global demand. Similarly, in the gold market, contango may arise due to storage costs and interest rates, combined with expectations of future price movements. Storage costs is a critical factor contributing to contango in commodity markets. When these costs are high, they can push up futures prices, resulting in a contango situation. For example, commodities like oil and gas require expensive storage solutions, and these costs are factored into futures prices. When a market is in contango, it might incentivize producers to increase storage, assuming they expect to sell their commodities at higher prices. Contango can create opportunities for commodity arbitrage, a strategy where traders aim to profit from price discrepancies in different markets. In a contango market, an arbitrageur could potentially buy the commodity at the lower spot price, store it, and simultaneously sell a futures contract. If the futures price at the contract's expiration is higher than the spot price plus storage costs, the arbitrageur can make a profit. While contango is often discussed in the context of commodity markets, it's equally relevant in financial futures markets, such as those for bonds, interest rates, or currencies. For instance, in a bond futures market, contango could occur if the market expects interest rates to fall in the future, as this would increase the value of the bonds to be delivered. Contango can also have implications for interest rates. High-interest rates can contribute to a contango market because they increase the cost of carrying an asset, pushing up futures prices. Additionally, expectations of falling interest rates can lead to contango in bond futures as market participants anticipate higher bond prices. In bond futures, contango can have several implications. It could suggest market expectations of falling interest rates or rising bond prices. Contango in bond futures could also affect the yields on these instruments. Furthermore, it can influence hedging strategies, as the price relationships between different futures contracts could affect the effectiveness of a hedge. Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs) that track futures-based indices can be significantly affected by contango. These funds typically roll their futures contracts forward each month to avoid taking delivery of the underlying asset. If the market is in contango, the new contract is more expensive than the expiring one. This process, known as "roll yield," can erode returns over time, particularly in steep contango markets. Contango can pose challenges for long-term investors, particularly those invested in futures-based ETFs or ETNs. Due to the negative roll yield in a contango market, these investments can underperform the spot market over the long term, even if the price of the underlying asset increases. Therefore, investors need to be mindful of the potential impact of contango on their investment returns. Investors and portfolio managers can employ several strategies to manage the risk associated with contango. These include diversifying their portfolio to include assets that aren't affected by contango, using options strategies to hedge against potential losses, or investing in inverse or short futures ETFs during contango markets. Additionally, some ETFs employ contango-mitigating strategies, such as shifting their investments to contracts further out in the future when the contango is high. Contango can be linked with market volatility. In the volatility futures market, for example, contango often occurs because market participants expect future volatility to be higher than current volatility. However, during periods of market stress, volatility futures can shift into backwardation as market participants expect volatility to decrease over time. During economic downturns, contango can become more pronounced. This is often due to heightened market volatility and increased uncertainty about future price movements. For instance, during the 2008 financial crisis, many commodity markets experienced significant contango due to expectations of future price increases amidst a volatile and uncertain market environment. Contango plays a critical role in volatility index futures, such as those based on the VIX index. These futures often trade in contango because market participants generally expect volatility to rise in the future. However, the degree of contango can vary based on market conditions and shift to backwardation during periods of heightened market stress. Contango and normal backwardation are two contrasting concepts in futures markets. Contango refers to a situation where the futures price of an asset is higher than the spot price, indicating expectations of future price increases. It is influenced by factors like storage costs and market sentiment. On the other hand, normal backwardation occurs when futures prices are lower than spot prices, signaling expectations of future price decreases. Normal backwardation is associated with factors like the cost of carry and hedging demand. Understanding the dynamics between contango and normal backwardation is crucial for investors and traders, as they provide insights into market expectations and can influence trading strategies. Contango is a futures market phenomenon where futures prices exceed spot prices, signaling expectations of future price increases. It impacts commodity futures, storage costs, and ETFs/ETNs tied to futures-based indices. Long-term investors face challenges due to contango, necessitating risk mitigation strategies like diversification and hedging. Contango is linked to market volatility, particularly in volatility index futures. During economic downturns, contango intensifies, reflecting increased market uncertainty. Understanding contango is vital for investors, influencing investment decisions, risk management, and market predictions. It involves factors like storage costs, interest rates, and market sentiment. Awareness of contango's implications in diverse market conditions and its association with volatility is crucial for navigating the complexities of futures trading.Definition of Contango

Understanding Contango in Detail

How Contango Works

Structure of Contango in the Futures Market

Factors Influencing Contango

Contango and Commodity Futures

Contango in Different Commodity Markets

Contango’s Effect on Storage Costs

Role of Contango in Commodity Arbitrage

Contango and Non-commodity Futures

Contango in Financial Futures

Impact of Contango on Interest Rates

Implications of Contango in Bond Futures

Contango in Portfolio Management

How Contango Affects ETFs and ETNs

Impact of Contango on Long-Term Investments

Strategies for Managing Contango Risk

Contango and Market Volatility

Correlation Between Contango and Volatility

Contango During Economic Downturns

Role of Contango in Volatility Index Futures

Contango vs Backwardation

Final Thoughts

Contango FAQs

Contango is a situation in the futures market where futures prices are higher than the current spot prices of the underlying asset. It generally indicates that the market expects the asset's price to increase over time. Contango is visualized through a futures curve that slopes upward, indicating higher futures prices for contracts with later expiration dates.

Contango can significantly affect Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs) that track futures-based indices. These funds typically roll their futures contracts forward each month to avoid taking delivery of the underlying asset. In a contango situation, the new contract is more expensive than the expiring one, a process known as "roll yield," which can erode returns over time.

Contango and normal backwardation are two different market situations in the futures market. While contango refers to a situation where futures prices are higher than the spot price, normal backwardation is a condition where futures prices are lower than the spot price. Normal backwardation generally indicates the market's expectation that the asset price will decrease over time.

Yes, contango can impact the global economy. For example, a contango situation in the oil market can lead to a sharp decrease in oil prices, affecting oil-producing nations' revenues while benefiting consumers and industries that rely heavily on oil. Additionally, contango can shape market structures and drive innovation in financial products, impacting various sectors of the global economy.

Investors can manage contango risk by diversifying their portfolio to include assets not affected by contango, using options strategies to hedge against potential losses, or investing in inverse or short futures ETFs during contango markets. Additionally, some ETFs employ contango-mitigating strategies, such as shifting their investments to contracts further out in the future when the contango is high.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.