The covered call strategy is an options trading technique in which an investor simultaneously holds a long position in an underlying asset, such as stocks, and sells call options on the same asset. The call option gives the buyer the right, but not the obligation, to buy the underlying asset at a predetermined price, known as the strike price, before the option's expiration date. The basic components of such a strategy are owning the underlying asset and selling a call option on that asset. The investor receives a premium from selling the call option, which provides income and downside protection in the event of a decrease in the underlying asset's value. One of the simplest methods to generate steady income in the stock market is to learn how to trade covered calls. Here are the steps to implementing a covered call strategy: The underlying asset can be a stock, ETF, or index. The investor should choose an asset that they are comfortable holding for the long term. This can be any of the above-mentioned assets that the investor believes will appreciate in value over time. It is important to choose an underlying asset that the investor understands well and is comfortable holding for the duration of the strategy. The investor must purchase the underlying asset before selling the call option. This ensures that the investor has a long position in the asset, which is necessary to sell a call option against it. The underlying asset purchase should be made carefully considering the investment goals and risk tolerance of the investor. The investor sells a call option on the underlying asset with a strike price and expiration date that they believe is appropriate. The investor must consider several factors when selecting the call option, including the strike price, expiration date, and premium. The strike price should be above the current market price of the underlying asset. If the stock price increases, the investor can still benefit from the price appreciation up to the strike price. Choosing a strike price that is too high may limit potential profits, while choosing one that is too low may not provide enough downside protection. The expiration date should be far enough in the future to provide ample time for the stock price to appreciate but not so far that the investor loses the ability to benefit from the premium received. Choosing an expiration date that is too short may not provide enough time for the underlying asset to appreciate, while choosing an expiration date that is too long may limit potential profits. The premium received should be high enough to provide a significant income stream, but not so high that it reduces the potential for profit. It is the price that the buyer pays for the right to buy the underlying asset at the strike price before the expiration date. The premium can be influenced by several factors, including the volatility of the underlying asset and the time to expiration. Maximizing profits is a critical consideration for investors implementing the covered call strategy. There are several tips that investors can follow to maximize their profits and make the most of their covered call strategy. Higher implied volatility can lead to higher premiums. Implied volatility is a measure of the expected volatility of the underlying asset, as reflected in the price of the call option. By selling call options with higher implied volatility, investors can potentially earn higher premiums and generate more income. Monitoring the price movement can help investors decide when to sell call options. For example, if the price of the underlying asset has recently increased, an investor may choose to sell a call option at a higher strike price to take advantage of the increase in value. Knowing when to close out positions can help prevent losses. By setting stop-loss orders or monitoring the price movement of the underlying asset, investors can make informed decisions about when to close out a position to prevent losses. Reducing risk is an important consideration for investors implementing the covered call strategy. There are several strategies that investors can use to reduce the risk of the strategy and help protect their investments. Diversification can help to spread risk across different assets, reducing the potential impact of losses from any single position. This can be particularly beneficial for investors using the covered call strategy, as it can help to mitigate the risks associated with a single underlying asset. Technical analysis can help investors identify potential trends and patterns in the underlying asset's price movement, informing decisions about when to buy or sell call options. By using technical analysis, investors can make more informed decisions about when to buy or sell call options, potentially reducing the risk of losses. Setting stop-loss orders can help investors minimize losses if the underlying asset's price falls below a predetermined level. This can be a useful tool for investors using the covered call strategy, as it can help to limit losses if the underlying asset experiences a sudden drop in value. There are several advantages of a covered call strategy, including: The premium received from selling the call option provides the investor with a steady income stream. This can be particularly attractive for investors who are looking to supplement their regular income or who want to generate additional cash flow. The premium received from selling the call option can offset some of the losses in the event of a decrease in the underlying asset's value. This provides downside protection that can be especially beneficial during volatile market conditions. The investor can still benefit from the price appreciation up to the strike price of the call option. This means that if the underlying asset's value increases, the investor can still benefit from the increase in value up to the strike price of the call option. While covered call strategies have advantages, there are also disadvantages, including: The investor's profit potential is limited to the premium from selling the call option. If the underlying asset's value increases above the strike price of the call option, the investor may miss out on additional gains. This can be particularly frustrating for investors who see the value of the underlying asset continue to increase after selling the call option. If the underlying asset decreases in value, the investor could lose money even with the premium received from selling the call option. This is because the premium may not be sufficient to offset the losses in the underlying asset's value. This risk can be particularly concerning for investors holding a significant position in the underlying asset. The investor may miss out on potential gains if the underlying asset increases in value beyond the strike price of the call option. If the underlying asset increases in value beyond the strike price of the call option, the investor may miss out on potential gains. This can be particularly frustrating for investors who are bullish on the underlying asset and believe it has significant upside potential. A covered call strategy can be a useful tool for investors looking to generate income while holding a long position in an underlying asset. While the strategy does have advantages, there are also risks involved, including the limited potential for profit and the risk of the underlying asset decreasing in value. To successfully implement a covered call strategy, investors should carefully consider the underlying asset, the call option's strike price and expiration date, and the premium received from selling the call option. Additionally, investors should follow best practices, such as diversifying their portfolio, using technical analysis to inform decisions, and setting stop-loss orders to minimize losses. Ultimately, a covered call strategy can be an effective way to generate income and manage risk, but investors should carefully consider their investment goals and risk tolerance before implementing the strategy. As with any investment strategy, risks are involved, and investors should be prepared to manage those risks accordingly. Overall, implementing a covered call strategy can be a valuable tool in a well-rounded wealth management plan, providing income generation, downside protection, and potential for capital appreciation while carefully managing risk.What Is a Covered Call?

Steps to Implementing a Covered Call Strategy

Identify an Underlying Asset

Buy the Underlying Asset

Sell a Call Option on the Underlying Asset

Choosing the Right Call Option

Strike Price Selection

Expiration Date Selection

Premium Collection

Tips for Maximizing Profits

Sell Calls With High Implied Volatility

Monitor the Underlying Asset’s Price Movement

Close Out Positions When Necessary

Strategies for Reducing Risks

Diversify Your Portfolio

Use Technical Analysis to Inform Decisions

Set Stop-Loss Orders to Minimize Losses

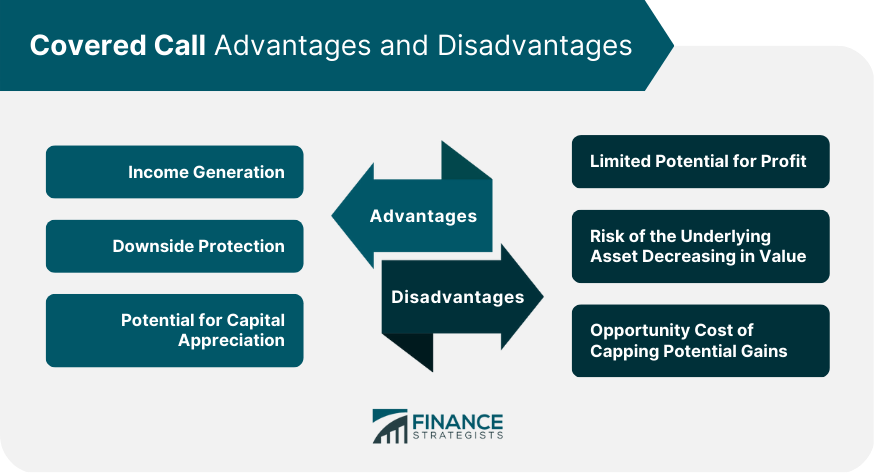

Advantages of Covered Call Strategy

Income Generation

Downside Protection

Potential for Capital Appreciation

Disadvantages of Covered Call Strategy

Limited Potential for Profit

Risk of the Underlying Asset Decreasing in Value

Opportunity Cost of Capping Potential Gains

Final Thoughts

Covered Call FAQs

A covered call strategy is an options trading strategy where an investor holds a long position in an underlying asset, such as stocks. It simultaneously sells call options on the same asset.

The benefits of a covered call strategy include generating income, providing some downside protection, and having the potential for capital appreciation.

The risks of a covered call strategy include the limited potential for profit, the risk of the underlying asset decreasing in value, and the opportunity cost of capping potential gains.

To implement a covered call strategy, an investor needs to follow three steps: identify an underlying asset, buy the underlying asset, and sell a call option on the underlying asset.

Best practices for implementing a covered call strategy include diversifying your portfolio, using technical analysis to inform decisions, and setting stop-loss orders to minimize losses. Additionally, investors should sell calls with high implied volatility, monitor the underlying asset's price movement, and close out positions when necessary.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.