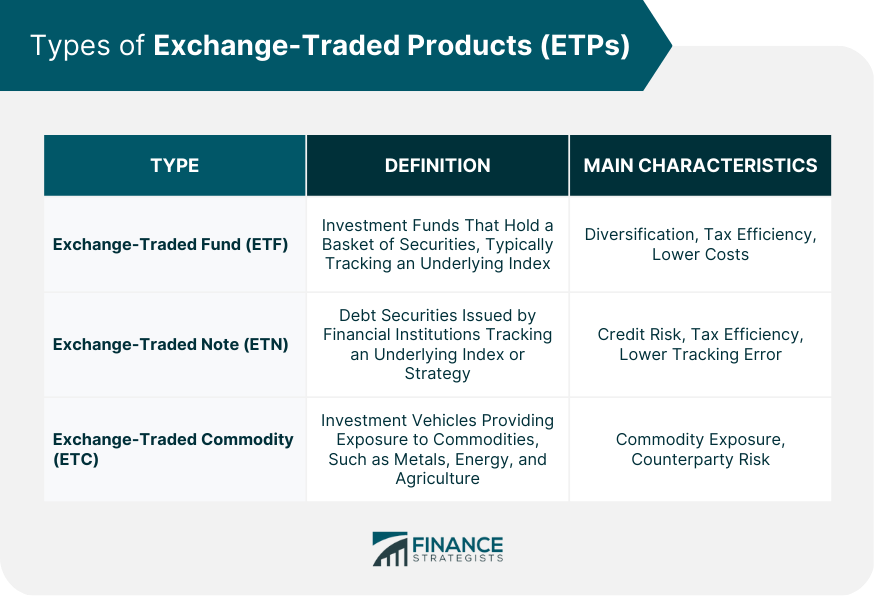

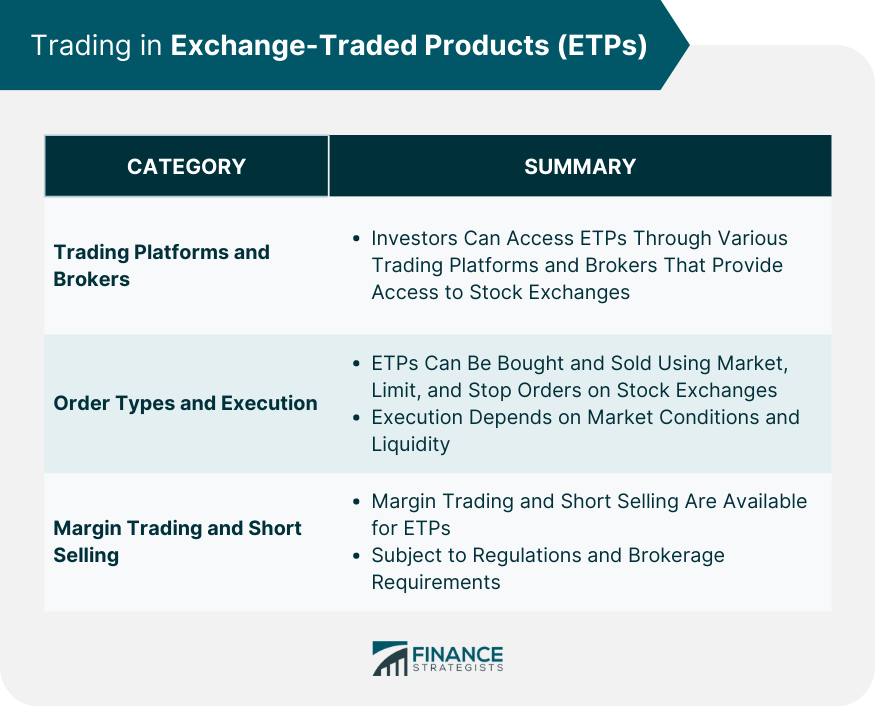

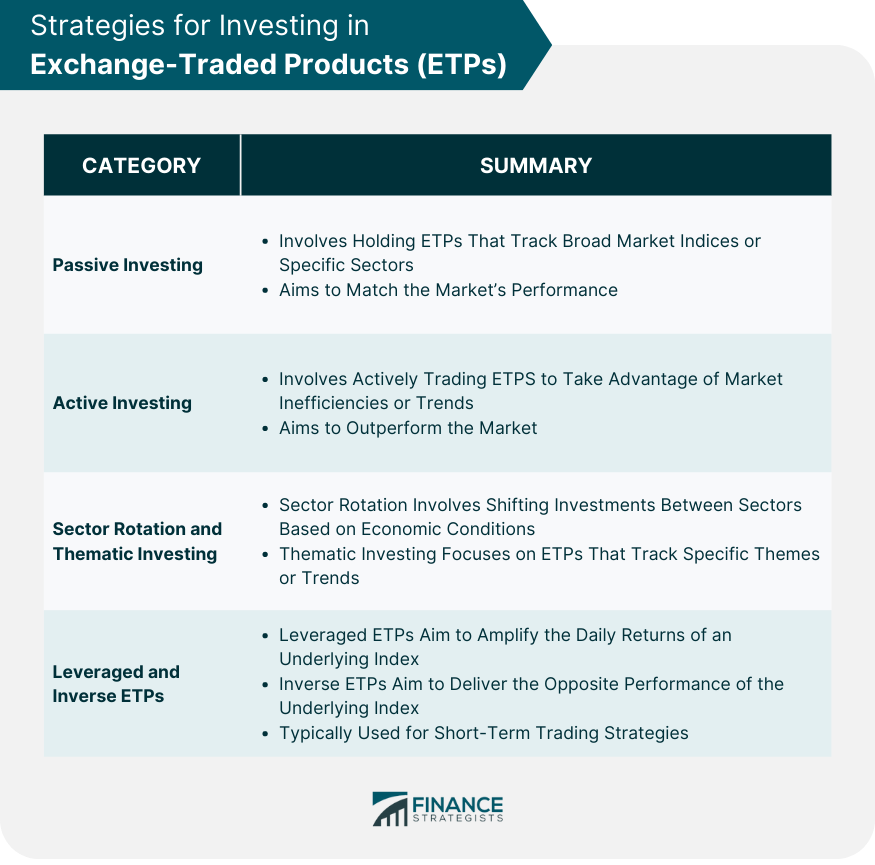

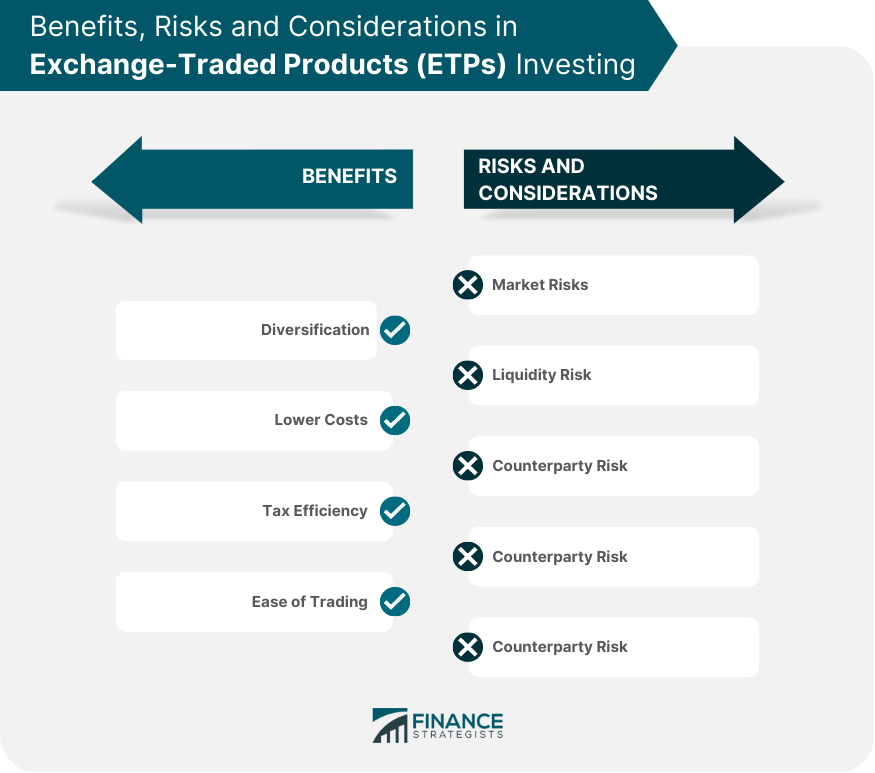

ETPs are a type of investment vehicle that trade on stock exchanges and track the performance of an underlying asset, index, or strategy. ETPs provide investors with the opportunity to gain exposure to a variety of asset classes, sectors, and strategies through a single tradable instrument. There are several types of ETPs, including Exchange-Traded Funds (ETFs), Exchange-Traded Notes (ETNs), and Exchange-Traded Commodities (ETCs). Each type of ETP has its own unique structure and characteristics. Exchange-traded funds (ETFs) are a type of ETP that hold a basket of securities, typically designed to track the performance of an underlying index. ETFs can be structured as open-end funds or unit investment trusts. There are various types of ETFs, including equity, fixed income, commodity, currency, and alternative strategy ETFs. ETFs offer several advantages, such as diversification, tax efficiency, and lower costs. However, they also have potential drawbacks, such as tracking errors and liquidity risks. Exchange-traded notes (ETNs) are debt securities issued by financial institutions that track the performance of an underlying index or strategy. ETNs do not hold any assets, and their returns are based on the performance of the underlying asset. ETNs can track various asset classes, including equities, commodities, currencies, and alternative strategies. ETNs offer potential advantages, such as tax efficiency and lower tracking errors. However, they also carry credit risk, as the investor's return depends on the issuer's ability to meet its obligations. Exchange-traded commodities (ETCs) are a type of ETP that provide exposure to commodities, such as metals, energy, and agricultural products. ETCs can be structured as debt securities or grantor trusts. ETCs can track single commodities, baskets of commodities, or commodity indices. ETCs offer investors a convenient way to gain exposure to commodities, but they also carry risks, such as commodity price volatility and counterparty risk. The following table summarizes the trading options available for trading ETPs. The following table summarizes the strategies for investing in ETPs. Investing in ETPs offers numerous benefits, such as diversification, lower costs, tax efficiency, and ease of trading. Compared to mutual funds, ETPs generally have lower expense ratios and can be traded throughout the day like stocks. ETPs also offer a more transparent investment process, as their holdings are disclosed daily. Investors in ETPs are exposed to market risk, as the value of their investments may fluctuate due to market conditions. Liquidity risk arises when an ETP's trading volume is low, which can lead to wider bid-ask spreads and difficulty executing trades at desirable prices. ETNs and certain ETCs carry counterparty risk, as investors rely on the issuer's creditworthiness to receive their returns. Tracking error refers to the difference between an ETP's performance and the performance of its underlying index or asset. This can result from management fees, trading costs, or other factors. ETPs may have different tax implications, depending on their structure and the investor's jurisdiction. Investors should consult a tax professional for guidance. ETPs are regulated by various regulatory bodies, depending on the jurisdiction in which they are traded. In the United States, the Securities and Exchange Commission (SEC) oversees ETPs. ETP issuers must meet listing and reporting requirements to maintain their listings on stock exchanges and ensure transparency for investors. Regulators enforce compliance with applicable laws and regulations, aiming to protect investors and maintain market integrity. Exchange-traded products have become an important component of modern investing, offering investors a range of benefits and investment options. Investors can employ various trading strategies, including passive and active investing, sector rotation, thematic investing, and the use of leveraged and inverse ETPs. However, ETP investing also entails risks, such as market, liquidity, counterparty, and tracking errors. Regulatory bodies like the SEC oversee ETPs to ensure compliance, transparency, and investor protection. As the ETP market continues to evolve, trends such as new ETP structures, growth in thematic and niche ETPs, and the impact of technology are expected to shape the future landscape, presenting both challenges and opportunities for the industry.Definition of Exchange-Traded Products (ETPs)

Types of ETPs

Exchange-Traded Funds (ETFs)

Definition and Structure

Types of ETFs

Pros and Cons

Exchange-Traded Notes (ETNs)

Definition and Structure

Types of ETNs

Pros and Cons

Exchange-Traded Commodities (ETCs)

Definition and Structure

Types of ETCs

Pros and Cons

Trading and Investing in ETPs

How to Trade ETPs

Strategies for Investing in ETPs

Benefits of Investing in ETPs

Risks and Considerations in ETP Investing

Market Risk

Liquidity Risk

Counterparty Risk

Tracking Error

Tax Implications

Regulation and Compliance

Regulatory Bodies Overseeing ETPs

Listing and Reporting Requirements

Compliance and Investor Protection

Conclusion

Exchange-Traded Products (ETPs) FAQs

The main types of ETPs include exchange-traded funds (ETFs), exchange-traded notes (ETNs), and exchange-traded commodities (ETCs). Each type has its own unique structure and characteristics.

ETPs trade on stock exchanges like individual stocks, allowing for intraday trading, while mutual funds are traded only at the end of the day at their net asset value (NAV). ETPs generally have lower expense ratios and offer more transparency, as their holdings are disclosed daily.

ETPs offer several benefits, such as diversification, lower costs, tax efficiency, and ease of trading. They provide exposure to a variety of asset classes, sectors, and strategies through a single tradable instrument.

Key risks associated with investing in ETPs include market risk, liquidity risk, counterparty risk (for ETNs and certain ETCs), and tracking error. Investors should carefully consider these risks when making investment decisions.

ETPs are regulated by various regulatory bodies, depending on the jurisdiction in which they are traded. In the United States, for example, the Securities and Exchange Commission (SEC) oversees ETPs. ETP issuers must meet listing and reporting requirements to maintain their listings on stock exchanges and ensure transparency for investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.