The forward price, in the realm of financial derivatives, is the agreed-upon price for the future delivery of an asset. It's crucial in a forward contract, which is a legal agreement between two parties to buy or sell an asset at a predetermined price and a specific future date. The purpose of the forward price is to provide certainty and risk management in a world of fluctuating market prices. By locking in a price today for a future transaction, both buyers and sellers can plan and budget with more confidence. Historically, forward contracts were common in agricultural markets to ensure farmers had a market for their produce and to protect against drastic price changes. Over time, this concept evolved and expanded into various financial markets, including equities, currencies, and interest rates. This evolution has led to the creation of standardized contracts traded on exchanges, known as futures contracts, which operate on similar principles to forward contracts. The significance of forward prices in the financial market is multifold. They allow participants to manage risk, inform pricing decisions, and provide signals about future expectations of asset prices. Further, they serve as a foundation for derivative pricing and form an integral part of the market's risk management toolkit. The calculation of the forward price involves considering the current spot price of the asset, the risk-free interest rate, storage costs (for physical commodities), dividends (for equities), and the time to maturity of the contract. The forward price generally equals the spot price compounded at the risk-free rate for the duration of the contract, adjusted for any payouts or costs associated with holding the asset. Several factors can influence the forward price. These include changes in the spot price, interest rates, storage costs, and the time to maturity. For instance, a rise in interest rates or storage costs will generally increase the forward price, while an approaching maturity date will cause the forward price to converge towards the spot price. The spot price is the current price at which an asset can be bought or sold for immediate delivery, while the forward price is the agreed price for future delivery. The difference between these two prices is often due to the cost of carry, which includes factors like interest costs and storage costs. However, in efficient markets, any significant price discrepancies can be quickly exploited for arbitrage, ensuring the forward price aligns with the theoretical price derived from the cost-of-carry model. Commodity forward contracts are agreements to buy or sell a specific quantity of a commodity at a predetermined price on a specified future date. These contracts are used by producers and consumers of commodities to hedge against price fluctuations. Equity forward contracts involve the future delivery of a specific number of shares of a certain stock at an agreed-upon price. These contracts are often used by large investors and institutions to hedge exposure to equity price risk. Currency forward contracts are agreements to exchange a certain amount of one currency for another at a predetermined exchange rate on a specific future date. These contracts are widely used by multinational corporations and investors to hedge against foreign exchange risk. Interest rate forward contracts, also known as Forward Rate Agreements (FRAs), are agreements between two parties to exchange interest payments on a notional principal for a specified period. These contracts are used by banks and other financial institutions to hedge against interest rate risk. In commodity markets, forward prices play an essential role in facilitating trade between producers and consumers. Producers can sell commodities forward to lock in a price for their future production, providing certainty and protecting against price drops. Conversely, consumers can buy commodities forward to secure a price for their future needs, protecting against price increases. Forward prices can impact commodity prices by signaling market expectations about future supply and demand conditions. If forward prices are higher than spot prices (a condition known as contango), it may indicate expectations of future supply shortages or increased demand. Conversely, if forward prices are lower than spot prices (backwardation), it may signal expected supply surpluses or decreased demand. The primary risk in commodity forward contracts is price risk: the risk that the spot price at the contract's maturity is different from the agreed-upon forward price. This can lead to losses for one party and gains for the other. To mitigate this risk, parties can use options or swap contracts, which provide more flexibility or allow the risk to be transferred to another party. In equity markets, forward contracts enable investors to lock in a purchase or sale price for a stock in the future. This can be useful for managing portfolio risk, implementing investment strategies, or fulfilling future cash flow needs. The relationship between forward prices and stock prices is complex. In theory, the forward price should reflect the market's expectations about the future price of the stock. However, other factors like interest rates, dividends, and market sentiment can also influence the forward price. As with commodities, the key risk in equity forward contracts is price risk. Investors can mitigate this risk by using equity options, which provide the right but not the obligation to buy or sell the stock in the future. Another strategy is to diversify the investment portfolio to spread the risk across different stocks or asset classes. Currency forward contracts are a common tool for managing foreign exchange risk. Companies with international operations often use these contracts to hedge their exposure to currency fluctuations. The forward price in currency markets, also known as the forward exchange rate, can impact spot exchange rates through arbitrage activities. If the forward price differs significantly from the spot price adjusted for interest rate differentials (a condition known as covered interest rate parity), arbitrageurs can profit from the discrepancy, bringing the prices back into alignment. Currency forward contracts carry foreign exchange risk: the risk that the exchange rate at the contract's maturity differs from the agreed-upon forward rate. Companies can manage this risk through options or currency swaps, which provide more flexibility or allow the risk to be transferred. Interest rate forward contracts, often referred to as Forward Rate Agreements (FRAs), play a critical role in managing interest rate risk. FRAs allow parties to hedge against potential changes in interest rates, which can impact the cost of borrowing or the returns on interest-bearing investments. The forward price in interest rate markets, known as the forward rate, can signal market expectations about future interest rates. If forward rates are higher than current rates, it may suggest that the market expects interest rates to rise, and vice versa. The primary risk associated with interest rate forward contracts is interest rate risk: the risk that the actual interest rate at the contract's maturity differs from the agreed-upon forward rate. Interest rate swaps, options, or futures contracts can help manage this risk by providing more flexibility or transferring the risk to another party. One of the primary uses of forward prices is for hedging risks. By locking in a forward price, a company or investor can protect against adverse movements in commodity prices, stock prices, exchange rates, or interest rates. This can help provide budget certainty and protect profit margins. Forward contracts can also be used for speculation. Traders with a particular view on future market conditions can enter into forward contracts to profit from their predictions. If they anticipate that the forward price is lower than the future spot price will be, they can agree to buy the asset forward, and vice versa. Differences between forward prices and future spot prices can create arbitrage opportunities. If the forward price is higher than the future spot price is expected to be (plus the cost of carry), an arbitrageur can sell the asset forward, while simultaneously buying the asset in the spot market and holding it until the forward contract matures. One criticism of forward pricing models is that they often rely on assumptions that may not hold in the real world. For example, they typically assume that markets are efficient, that there are no transaction costs, and that borrowing and lending rates are the same for all market participants. These assumptions can lead to discrepancies between theoretical and actual forward prices. Forward prices can be influenced by market imperfections and inefficiencies. Factors like liquidity constraints, market segmentation, and limits to arbitrage can cause forward prices to deviate from their theoretically fair values. There are concerns that forward prices can be manipulated, particularly in less liquid or less regulated markets. Market participants with significant influence may attempt to move forward prices for their benefit, potentially leading to market distortions and losses for other participants. A forward price, in essence, is the agreed-upon price for a future delivery of an asset in a forward contract, serving as a critical tool in managing financial risk and providing certainty in fluctuating markets. From its roots in agricultural markets, the concept of forward price has expanded into various financial markets, including commodities, equities, currencies, and interest rates. Its practical applications span from hedging risks, through speculation, to exploiting arbitrage opportunities. Although there are criticisms and limitations, like model assumptions and potential for manipulation, forward prices continue to play a crucial role in the financial markets. In today's globalized and interconnected financial landscape, the ability to manage risk and anticipate future price movements is more important than ever. As such, understanding forward prices and how they operate is essential for anyone involved in financial planning, investment management, or corporate finance. Given the complexity of forward contracts and the risks involved, it's often wise to seek professional advice before entering into these contracts. Financial advisors, risk management consultants, and legal professionals can provide valuable guidance and help navigate the intricacies of these financial instruments.What Is the Forward Price?

How the Forward Price Works

How Is It Calculated?

Factors Influencing the Calculation

Differences Between Spot Price and Forward Price

Types of Forward Contracts

Commodity Forwards

Equity Forwards

Currency Forwards

Interest Rate Forwards

Forward Price in Commodity Markets

Role in Commodity Trading

Impact on Commodity Prices

Risks and Mitigation Strategies

Forward Price in Equity Markets

Role in Equity Trading

Impact on Stock Prices

Risks and Mitigation Strategies

Forward Price in Currency Markets

Role in Currency Trading

Impact on Exchange Rates

Risks and Mitigation Strategies

Forward Price in Interest Rate Markets

Role in Interest Rate Trading

Impact on Interest Rates

Risks and Mitigation Strategies

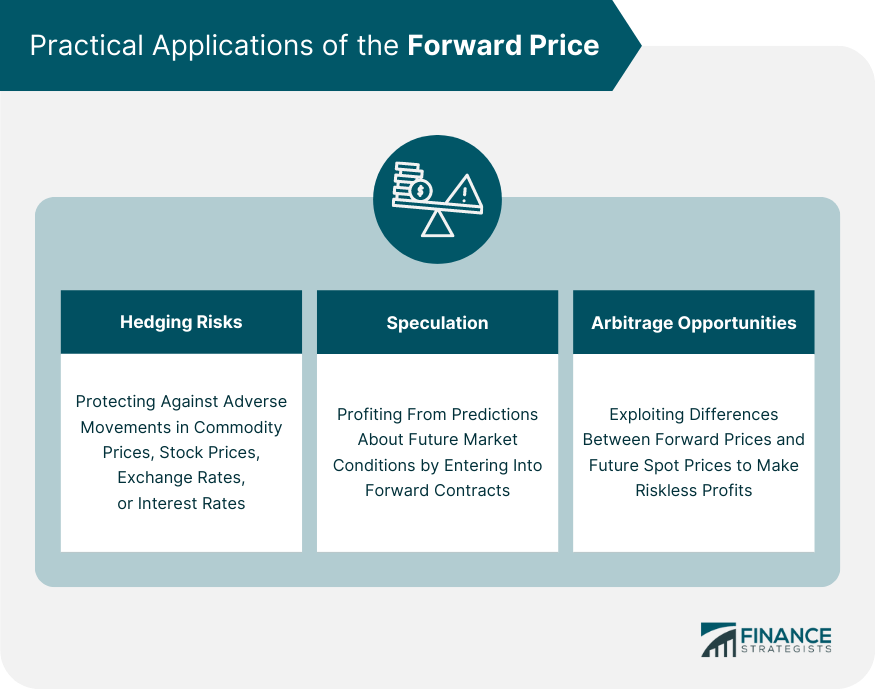

Practical Applications of Forward Price

Hedging Risks

Speculation

Arbitrage Opportunities

Criticisms and Limitations of the Forward Price

Pricing Model Assumptions

Market Imperfections and Inefficiencies

Potential for Manipulation

Final Thoughts

Forward Price FAQs

The forward price is the agreed-upon price for the future delivery of an asset in a forward contract.

The forward price is typically calculated based on the current spot price, the risk-free interest rate, the time to maturity of the contract, and any costs or payouts associated with holding the asset.

The spot price is the current price of an asset for immediate delivery, while the forward price is the agreed price for future delivery. The difference between the two is often due to the cost of carry, which includes factors like interest costs and storage costs.

Forward prices are used for hedging risks, speculating on future price movements, and exploiting arbitrage opportunities.

The limitations of forward price include pricing model assumptions, market imperfections, and the potential for manipulation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.