Fractional ownership refers to a method of investing where multiple investors pool their resources to acquire a shared ownership interest in a high-value asset. Each investor owns a fraction of the asset, enabling them to access and benefit from the asset without bearing the full cost of acquisition and maintenance. Compared to traditional investments such as stocks, bonds, and mutual funds, fractional ownership offers a unique opportunity to invest in alternative assets that may not be accessible to individual investors. It provides access to diversified investments and potential for capital appreciation, while mitigating risks associated with full ownership. Benefits of fractional ownership include lower entry costs, diversification, potential for capital appreciation, and access to assets that may be otherwise unaffordable. Risks include illiquidity, potential for disputes among co-owners, and reliance on the performance of the underlying asset. Fractional ownership is popular in the vacation home and resort market, allowing investors to enjoy the benefits of owning a luxury property for a fraction of the cost. Investors typically receive a fixed number of weeks to use the property annually and share the costs of maintenance and management. Investors can also participate in fractional ownership of commercial properties such as office buildings, retail spaces, and industrial properties. This offers a way to diversify one's real estate portfolio and potentially generate rental income and capital appreciation. Fractional ownership enables art enthusiasts and investors to own a share of valuable paintings, sculptures, and other collectibles. This allows them to participate in the potential appreciation of the artwork's value over time. Investors can also acquire fractional ownership in vintage cars, sports memorabilia, and other collectible items with historical or cultural significance. This offers an opportunity for capital appreciation and diversification beyond traditional investments. Fractional ownership of luxury assets like private jets and yachts provides investors with a more cost-effective way to access and enjoy these high-value items. Investors share the costs of acquisition, maintenance, and management while enjoying usage rights based on their ownership share. Investing in high-end jewelry and luxury watches through fractional ownership allows investors to benefit from the potential appreciation of these items. It also offers a unique form of diversification for an investment portfolio. Fractional ownership can be applied to intellectual property assets such as patents and trademarks. Investors can share in the potential revenue streams generated from licensing or enforcing these intellectual property rights. Investing in fractional ownership of royalties from creative works, such as music, movies, and books, can provide investors with a passive income stream and an opportunity to diversify their investment portfolios. Several online platforms facilitate fractional ownership investments in real estate, including Pacaso, RealtyMogul, and Fundrise. These platforms enable investors to browse properties, review due diligence materials, and invest in fractional ownership interests. Investors typically need to create an account on the chosen platform, verify their identity, and provide information about their financial situation. The platform may charge a one-time investment fee, ongoing management fees, or both. Investors should carefully review the fee structures before committing to an investment. Masterworks, Maecenas, and Otis are examples of platforms that facilitate fractional ownership investments in art and collectibles. These platforms allow investors to acquire shares in high-value artworks and other collectible items. Similar to real estate platforms, investors must create an account, verify their identity, and provide financial information. Platforms typically charge a one-time transaction fee and may also charge ongoing management or administration fees. Platforms such as Jet Token, Rally, and My Yacht provide fractional ownership opportunities in luxury assets like private jets, yachts, and high-end jewelry. These platforms allow investors to browse available assets and invest in shares of the desired items. The investment process on luxury asset platforms is similar to that of real estate and art platforms. Investors must create an account, verify their identity, and provide financial information. Fees may include one-time transaction fees and ongoing management fees. Royalty Exchange, License, and IPwe are platforms that facilitate fractional ownership investments in intellectual property assets such as patents, trademarks, and creative work royalties. Investors must create an account, verify their identity, and provide financial information before investing in intellectual property assets. The platforms may charge a one-time transaction fee, ongoing management fees, or both. In some cases, fractional ownership investors hold direct ownership interests in the underlying asset. This means that their names are recorded as co-owners, and they have a direct claim to their share of the asset. Alternatively, fractional ownership investments may be structured through legal entities such as limited liability companies (LLCs) or special purpose vehicles (SPVs). In this case, investors own shares in the entity, which in turn owns the underlying asset. Investors in fractional ownership assets may be subject to income tax on any income generated by the asset, such as rental income or royalty payments. The tax treatment will depend on the investor's jurisdiction and the nature of the income. When investors sell their fractional ownership interests, they may be subject to capital gains tax on any profits realized from the sale. The tax treatment will depend on the investor's jurisdiction and the nature of the asset. Fractional ownership interests may be considered securities, subject to regulation by securities authorities. In some cases, fractional ownership interests may be represented by security tokens or fractional shares, which are tradable on secondary markets. Platforms offering fractional ownership investments must comply with securities regulations, including registration, disclosure, and reporting requirements. Investors should ensure that they understand the regulatory framework applicable to their investments. Investing in fractional ownership assets allows investors to diversify their portfolios across different asset classes, reducing risk and potentially enhancing returns. Within a specific asset class, such as real estate or art, investors can further diversify by investing in different types of properties or artworks, different geographical locations, or various investment styles. A buy-and-hold strategy involves purchasing fractional ownership interests with the expectation that they will appreciate in value over time. This approach focuses on the long-term capital appreciation and may be more suitable for less liquid assets, such as real estate or art. Some investors may choose to trade fractional ownership interests more actively, seeking short-term profits through market fluctuations. This approach may be more appropriate for assets with greater liquidity or those that have secondary markets for trading, such as security tokens or fractional shares. Before investing in fractional ownership, investors should carefully assess the quality of the underlying asset. This may involve researching the asset's history, market demand, the potential for appreciation, and any potential risks or liabilities associated with the asset. Investors should consider the liquidity of fractional ownership investments and plan their exit strategies accordingly. This may involve identifying secondary markets for trading or determining a time horizon for holding the investment before selling. Investors in fractional ownership vacation homes have experienced successful investments by enjoying both the personal use of luxurious properties and the potential appreciation of the properties' value over time. Fractional ownership investments in commercial properties, such as office buildings or retail spaces, have generated rental income and capital appreciation for investors in some cases, contributing to their overall investment success. Investors in fractional ownership of paintings and sculptures have seen substantial returns on their investments in some instances, as the art market has experienced significant appreciation for certain works. Fractional ownership investments in vintage cars and sports memorabilia have proven successful for some investors, as the value of these assets has increased due to their rarity, historical significance, and cultural appeal. Investors in fractional ownership of private jets and yachts have enjoyed the benefits of luxury travel without bearing the full cost of ownership while also participating in the potential appreciation of these high-value assets. Fractional ownership investments in high-end jewelry and watches have generated returns for some investors as the value of these luxury items has appreciated over time. Investors in fractional ownership of patents and trademarks have benefited from licensing revenues and enforcement settlements in some cases, generating income and appreciation for their investments. Fractional ownership investments in royalties from creative works, such as music, movies, and books, have provided investors with passive income streams and diversification for their investment portfolios. Fractional Ownership Investments offer a unique and attractive opportunity for investors to diversify their portfolios and gain access to high-value assets that may otherwise be unattainable. These investments encompass a variety of asset classes such as real estate, art and collectibles, luxury assets, and intellectual property. By pooling resources and sharing ownership, investors can reap the benefits of potential capital appreciation while mitigating some risks associated with full ownership. As the fractional ownership investment landscape continues to expand and evolve, it is crucial for potential investors to consider the benefits and risks, perform thorough due diligence, and understand the legal and regulatory aspects of their investments. A well-planned investment strategy, focusing on diversification and risk management, can help investors achieve their financial goals. A wealth management advisor can help you navigate Fractional Ownership Investments successfully by evaluating opportunities, tailoring an investment strategy, and guiding you through taxation and regulatory compliance complexities.Definition of Fractional Ownership

Comparison With Traditional Investments

Benefits and Risks of Fractional Ownership Investments

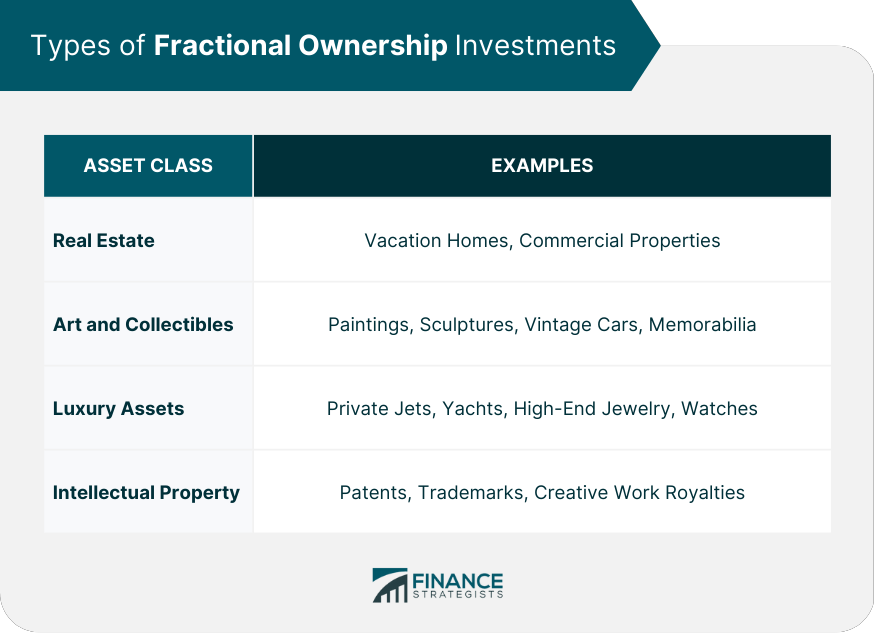

Types of Fractional Ownership Investments

Real Estate

Vacation Homes and Resorts

Commercial Properties

Art and Collectibles

Paintings and Sculptures

Vintage Cars and Memorabilia

Luxury Assets

Private Jets and Yachts

High-End Jewelry and Watches

Intellectual Property

Patents and Trademarks

Royalties from Creative Works

Platforms and Marketplaces for Fractional Ownership

Real Estate Platforms

Overview of Top Platforms

Investment Process and Fees

Art and Collectibles Platforms

Overview of Top Platforms

Investment Process and Fees

Luxury Assets Platforms

Overview of Top Platforms

Investment Process and Fees

Intellectual Property Platforms

Overview of Top Platforms

Investment Process and Fees

Legal and Regulatory Aspects

Ownership Structure

Direct Ownership

Ownership Through Legal Entities

Tax Implications

Income Tax

Capital Gains Tax

Securities Regulations

Security Tokens and Fractional Shares

Regulatory Compliance and Disclosures

Strategies for Investing in Fractional Ownership

Diversification

Across Asset Classes

Within a Specific Asset Class

Long-Term vs Short-Term Investing

Buy and Hold Strategy

Trading and Speculation

Risk Management

Assessing the Quality of the Underlying Asset

Liquidity and Exit Strategies

Case Studies of Successful Fractional Ownership Investments

Real Estate

Vacation Homes

Commercial Properties

Art and Collectibles

Paintings and Sculptures

Vintage Cars and Memorabilia

Luxury Assets

Private Jets and Yachts

High-End Jewelry and Watches

Intellectual Property

Patents and Trademarks

Royalties from Creative Works

The Bottom Line

Fractional Ownership FAQs

The benefits of Fractional Ownership Investments include lower entry costs, diversification, potential for capital appreciation, and access to high-value assets that may otherwise be unaffordable.

Fractional Ownership Investments can involve assets such as real estate, art and collectibles, luxury assets (e.g., private jets, yachts, high-end jewelry, and watches), and intellectual property (e.g., patents, trademarks, and creative work royalties).

To get started with Fractional Ownership Investments, research and choose a suitable platform or marketplace that offers the type of assets you're interested in. Create an account, verify your identity, and provide financial information before browsing and investing in available fractional ownership opportunities.

Yes, there may be tax implications associated with Fractional Ownership Investments, such as income tax on the income generated by the asset and capital gains tax on profits realized from selling fractional ownership interests. The exact tax treatment will depend on the investor's jurisdiction and the nature of the asset.

To manage risks when investing in Fractional Ownership Investments, focus on diversification across and within asset classes, assess the quality of the underlying asset, and consider liquidity and exit strategies. Additionally, ensure that you understand the legal and regulatory aspects of your investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.